Tax Relief For Buying Tools Tools bought through a credit system like Snap on tools do indeed qualify for tool tax relief In fact you can even claim the interest accrued as a necessary business expense

A tool tax rebate can be claimed by employees who buy their own tools to use for work It is often referred to as a mechanics tool rebate but it applies to other industries too As well as tools you can also claim tax for A tool tax rebate is a form of tax relief provided by HM Revenue and Customs HMRC for employees who purchase repair or replace tools that are essential for their job If your employer does not reimburse you for these costs you may

Tax Relief For Buying Tools

Tax Relief For Buying Tools

https://getassist.net/wp-content/uploads/2022/03/tax.jpg

Tax Relief For Domestic Companies Amendments Made To Incom Flickr

https://live.staticflickr.com/65535/48780569303_2f7ef8375f_b.jpg

Tax Advisor For SEIS And EIS Tax Relief Gatwick Accountant

https://www.gatwickaccountant.com/wp-content/uploads/2022/07/accountant-for-tax-return-near-me.png

Yes you can claim the tax back on tools you have bought for work But why Because they are considered an essential work expense by HMRC This means that the Tax Office recognises If you have to purchase tools for work use and are not reimbursed by your employer you should be eligible to claim tax relief on your purchases This is known as a tool tax allowance and is

Thankfully buying tools equipment or a vehicle for your business can be claimed as a tax expense which reduces your taxable income and tax bill Which type of tax expense you claim depends upon what you re buying and Employees who need to buy equipment to use as part of their employment may be able to claim tax relief based on the cost of the equipment acquired In most cases you can claim tax relief on the full cost of this type of equipment as it

Download Tax Relief For Buying Tools

More picture related to Tax Relief For Buying Tools

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

Tax Relief For Pre trading Expenses Accounting Firms

https://www.accountingfirms.co.uk/wp-content/uploads/2022/01/Tax-Relief-For-Pre-Trading-Expenses.png

Claim Tax Relief Of Employing A Carer Home Care Matters

https://homecarematters.ie/wp-content/uploads/2021/01/t2.png

A tax rebate is money that is returned to you by the government after purchasing something like tools This article aims to learn how the tax rebate tool works Type of people You may be able to claim tax relief on the cost of repairing or replacing small tools you need to do your job for example scissors or an electric drill

Claiming tax relief on tools and uniforms not only reduces your tax burden but also improves your financial health By understanding the claiming process utilizing strategic Flat rate expenses sometimes known as a flat rate deduction allow you to claim tax relief for an agreed fixed amount each tax year to cover what you spend on the clothing

Tax Relief For Home Workers YouTube

https://i.ytimg.com/vi/WxSWkYBU9ok/maxresdefault.jpg

Tax Relief How To Get It Start To Finish Tax Resolution Professionals

https://trp.tax/wp-content/uploads/2019/05/tax-relief-1.jpg

https://blog.pleo.io › en › tax-rebate-tools

Tools bought through a credit system like Snap on tools do indeed qualify for tool tax relief In fact you can even claim the interest accrued as a necessary business expense

https://www.safeworkers.co.uk › finance › tool-tax-rebate

A tool tax rebate can be claimed by employees who buy their own tools to use for work It is often referred to as a mechanics tool rebate but it applies to other industries too As well as tools you can also claim tax for

Tax Relief For Non discriminatory Companies

Tax Relief For Home Workers YouTube

Tax Relief For Home Workers

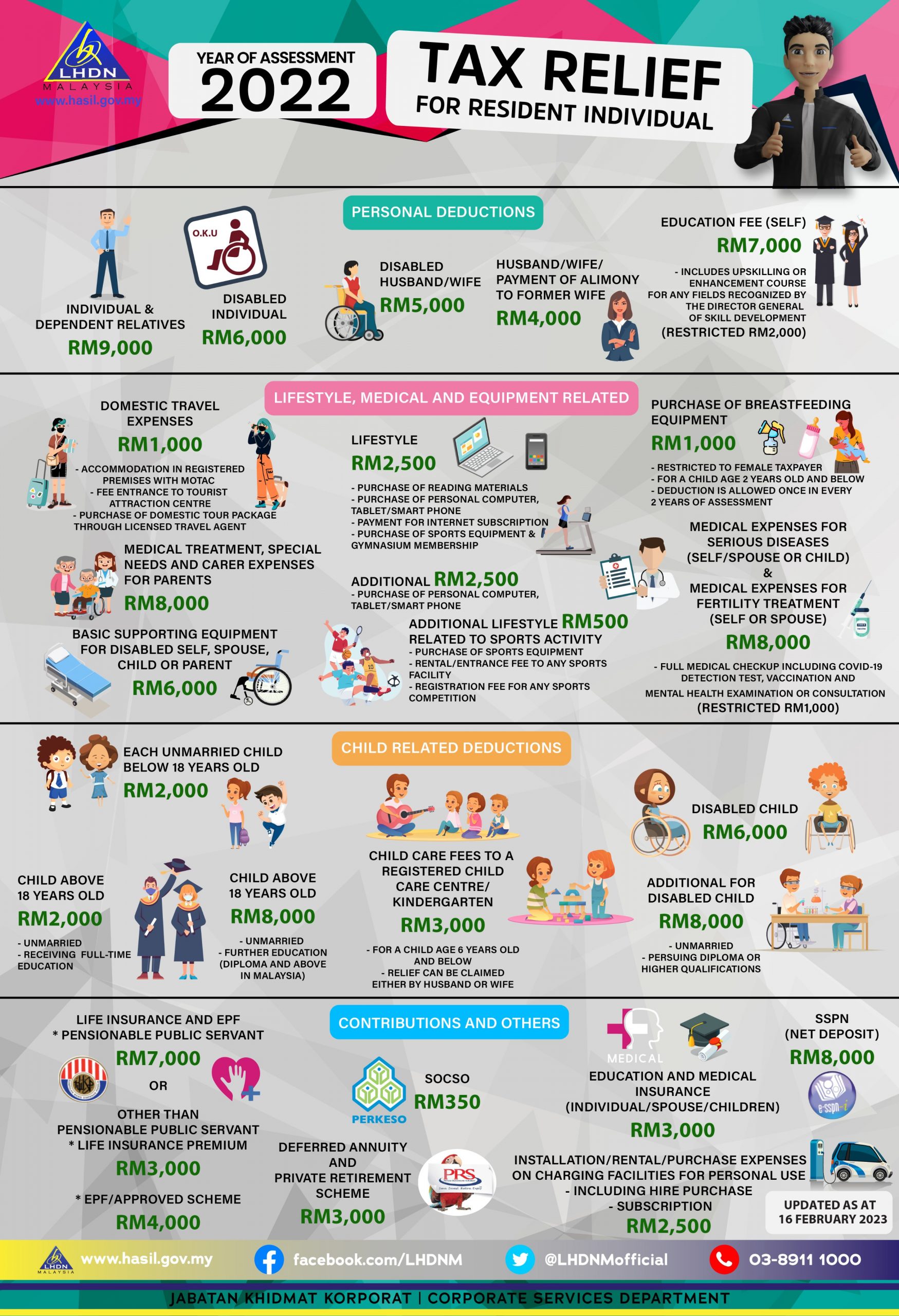

Personal Tax Relief 2022 Latest CN Advisory

Tax Relief For Individuals With Disabilities

Tax Preparation Specialist Issues Tax Relief Guidance For Employees Who

Tax Preparation Specialist Issues Tax Relief Guidance For Employees Who

List Of Personal Tax Relief And Incentives In Malaysia 2023

Business Tax Relief For South Australia SBS News

Company Income Tax Malaysia Jacob Berry

Tax Relief For Buying Tools - Yes you can claim the tax back on tools you have bought for work But why Because they are considered an essential work expense by HMRC This means that the Tax Office recognises