Tax Relief For Dependents Claim the child as a qualifying child for the child tax credit the credit for other dependents or the additional child tax credit

Part 1 of this publication explains the filing requirements and other tax information for individuals who can be claimed as a dependent on another person s tax return Part 2 explains how to report and figure the tax on The Child Tax Credit can reduce your taxes by up to 2 000 per qualifying child age 16 or younger If you do not owe taxes up to 1 600 of the Child Tax Credit may be refundable through the Additional

Tax Relief For Dependents

Tax Relief For Dependents

https://accoladeaccounting.com/wp-content/uploads/2021/07/tax-relief-scaled.jpg

Here s The Real Story On Tax Relief RateMuse

https://i0.wp.com/blog.ratemuse.com/wp-content/uploads/2019/10/tax_relief.png?fit=1200%2C978&ssl=1

R D Tax Relief In 2022 What You Need To Know

https://forrestbrown.co.uk/wp-content/uploads/2021/09/Stocksy_txp24f5e82ftaB300_Medium_3370983.jpg

Understand the IRS rules for claiming dependents on your taxes who qualifies and how it can save you thousands Get clarity maximize your tax benefits You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule

Overview of the Rules for Claiming a Dependent This table is only an overview of the rules For details see Publication 17 Your Federal Income Tax For Individuals You can t If you claim one or more dependents on your tax return you may be eligible for certain tax credits The amount of the Child Tax Credit is 2 000 per qualifying child and it is partially

Download Tax Relief For Dependents

More picture related to Tax Relief For Dependents

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

Optima Tax Relief Reviews What Taxpayers Should Be Aware Of When

https://viralrang.com/wp-content/uploads/2021/04/Optima-Tax-Relief-Reviews.jpg

Tax Relief Overview Cumberland Law Group

https://cumberlandlawatlanta.com/wp-content/uploads/2023/06/Tax-Relief-Overview-min.jpeg

A tax dependent is a qualifying child or relative who can be claimed on a tax return Dependents must meet certain criteria including residency and relation in order to qualify You can claim a child spouse relative and even a friend as a tax dependent to lower your taxes This is how the IRS determines who can qualify

Relief due You can receive a tax credit of 245 with effect from 1 January 2021 70 for previous years You will not receive a tax credit if your dependent relative s income In this tax tutorial you will learn about dependents and dependent exemptions You will learn Dependents are either a qualifying child or a qualifying relative of the taxpayer

Balanced Measured Approach Needed For Tax Relief Texas School Coalition

https://www.txsc.org/wp-content/uploads/2022/05/Property-Tax-Relief.png

Tax Relief 101 Exploring Different Forms Of Tax Relief

https://lirp.cdn-website.com/739b5f09/dms3rep/multi/opt/Tax+relief+with+tax+on+top-1920w.jpg

https://www.irs.gov/publications/p501

Claim the child as a qualifying child for the child tax credit the credit for other dependents or the additional child tax credit

https://www.irs.gov/publications/p929

Part 1 of this publication explains the filing requirements and other tax information for individuals who can be claimed as a dependent on another person s tax return Part 2 explains how to report and figure the tax on

Tax Tip How To Know If You Qualify For A Tax Relief Program Tax Help

Balanced Measured Approach Needed For Tax Relief Texas School Coalition

Window To Enjoy Tax Reliefs Closing CN Advisory

Tax Relief Prompts Easier Bank Rates Namibian Sun

Company Income Tax Malaysia Jacob Berry

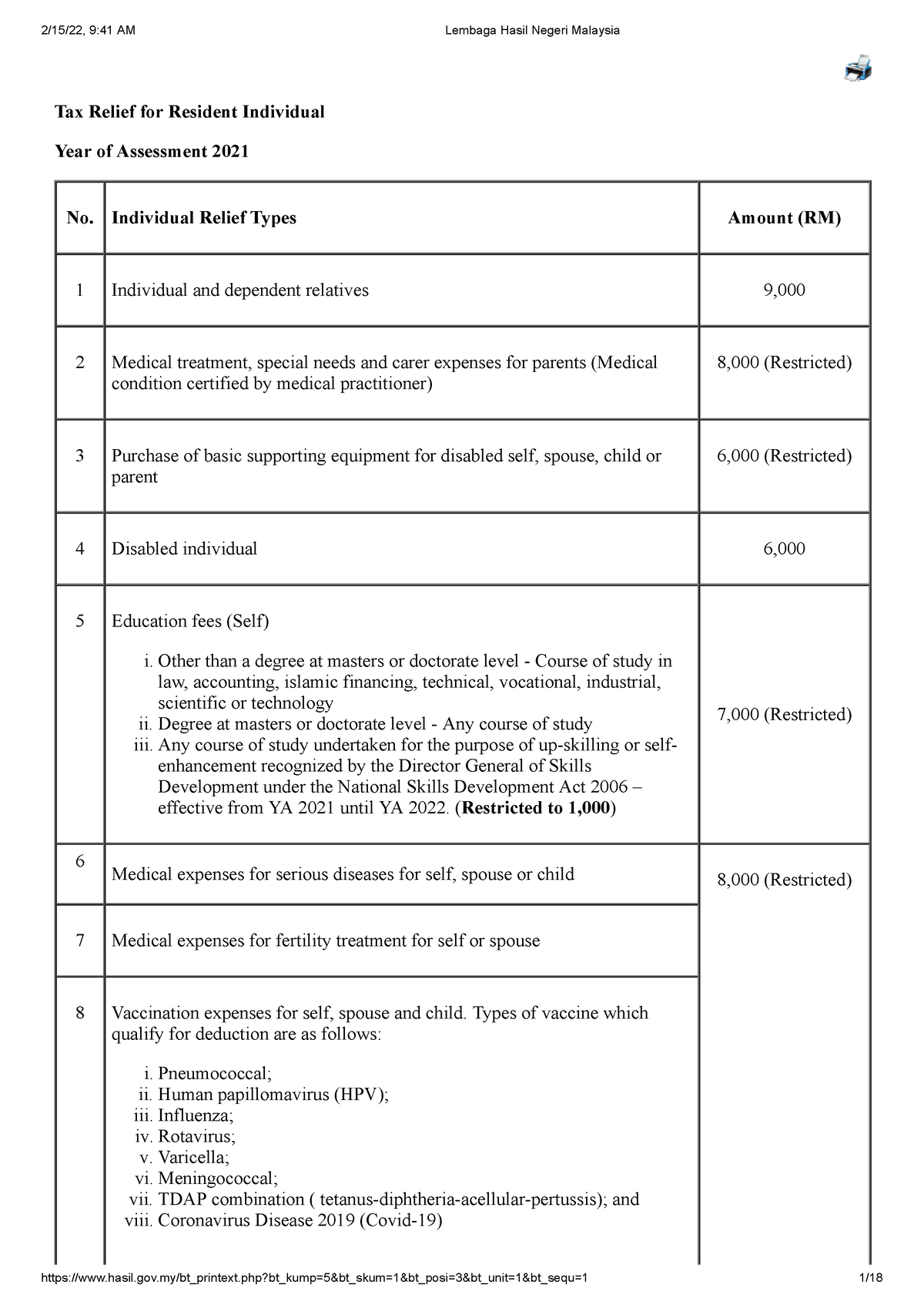

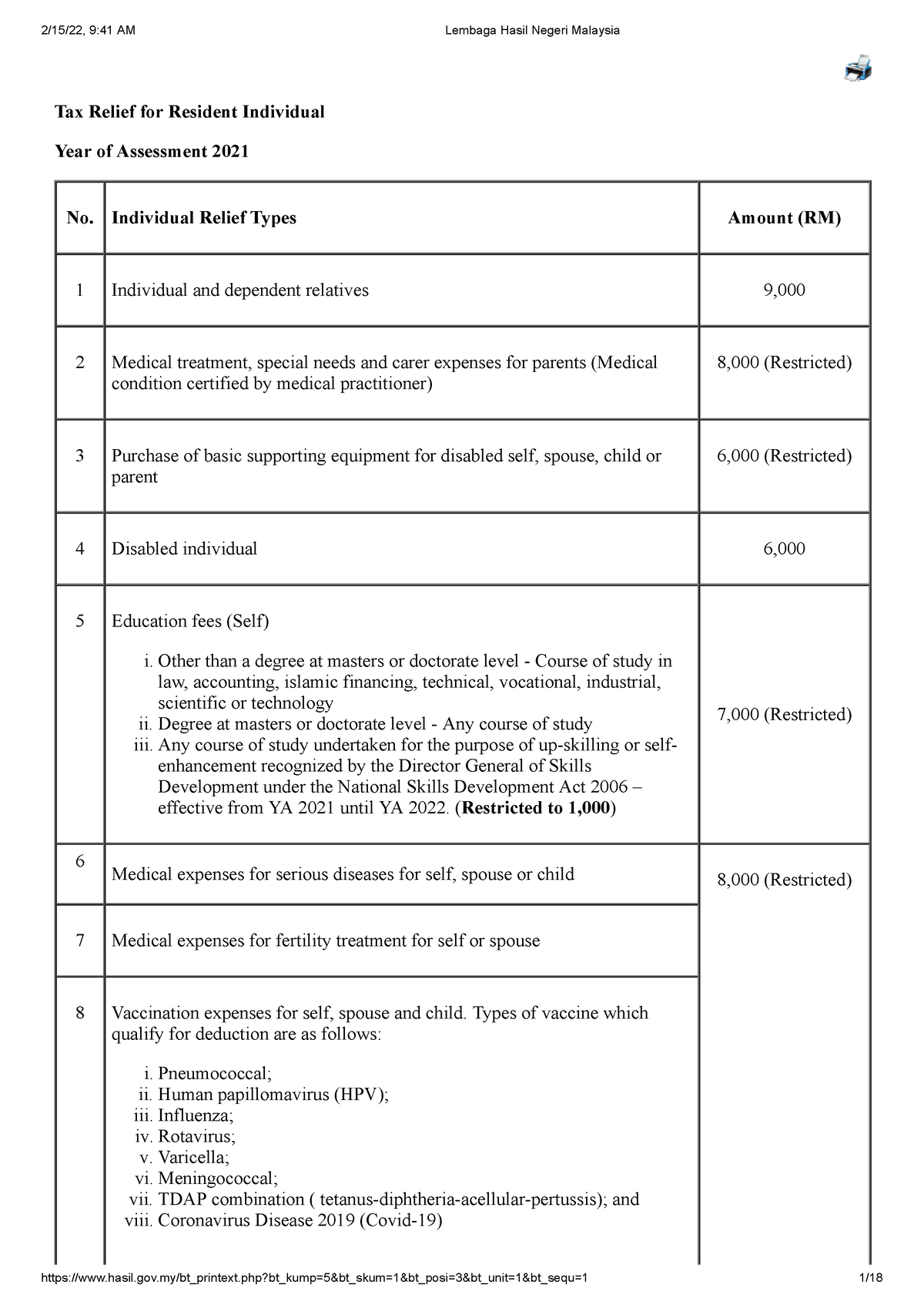

Tax Relief 2021 Taxation Tax Relief For Resident Individual Year Of

Tax Relief 2021 Taxation Tax Relief For Resident Individual Year Of

Reimagining Fundraising Generic Submission Automating Tax Benefits

Oregon W 4 Allowances

Real Tax Relief For Families Congressman Dan Newhouse

Tax Relief For Dependents - Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your