Tax Relief For Interest On Rental Property If you increase your mortgage loan on your buy to let property you may be able to treat interest on the additional loan as a revenue expense or get relief against

The tax relief landlords get on a buy to let mortgage interest has ended Instead you ll receive a tax credit based on 20 of your mortgage interest payments We help you calculate its impact on your tax bill Landlords will no longer be able to deduct all of their finance costs from their property income to arrive at their property profits They will instead receive a basic rate

Tax Relief For Interest On Rental Property

Tax Relief For Interest On Rental Property

https://live.staticflickr.com/65535/48780569303_2f7ef8375f_b.jpg

Changes To The Tax Exemption Regime Of Savings Accounts On The Horizon

https://de-langhe.be/wp-content/uploads/2023/01/iStock-1201269168-1.jpg

What Is The SEIS Tax Relief Scheme Exporaise

https://exporaise.com/wp-content/uploads/2022/11/Tax.jpg

The tax relief that landlords can now benefit from comes in the form of a 20 tax credit on their mortgage interest payments To put this into perspective if a landlord pays 9 000 in interest they can claim The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30 up to

Since 2020 21 individual landlords cannot deduct finance costs including interest from their residential property rental income for tax purposes Tax relief is You may be allowed claim Mortgage Interest Relief against your rental income The interest must be from a mortgage that is used to purchase improve or

Download Tax Relief For Interest On Rental Property

More picture related to Tax Relief For Interest On Rental Property

Tax Help Today Colonial Tax Relief Trusted Tax Relief For Families

https://colonialtaxrelief.com/wp-content/uploads/2024/01/AdobeStock_562351608-scaled.jpeg

TAX RELIEF FOR SALARY ARREARS OR ADVANCE Tax Planning For Salary

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/05/A-1-6.jpg

Corporate Tax Relief For Small Businesses Spectrum Auditing YouTube

https://i.ytimg.com/vi/KuBnNhAgei0/maxresdefault.jpg

FL 2024 08 Oct 1 2024 The IRS announced today tax relief for individuals and businesses in parts of Florida that were affected by Hurricane Helene Mortgage Interest Tax Relief was announced in last year s Budget and provided relief for mortgage holders who experienced increased interest rates in 2023

Under the new rules landlords pay tax on all of their rental earnings less allowable expenses and then claim back a tax credit equivalent to 20 of annual mortgage interest For example A landlord From April 2020 landlords will no longer be able to deduct their mortgage costs from their rental income All of the rental income you earn will be taxable and you ll instead receive

Potential Tax Relief For Volunteer First Responders In NY Is One Step

https://images-cf.news12static.com/3kqcuzntcg31/5t1PNAQ8eNx3gt8WOZYFlA/fec765396edf959ceb70d97dc244008e/96e0efc2-3d50-4f60-9d8b-8fc074d2f1fc.jpg?fit=thumb&w=1920&h=1080&q=80

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

https://www.gov.uk/guidance/income-tax-when-you...

If you increase your mortgage loan on your buy to let property you may be able to treat interest on the additional loan as a revenue expense or get relief against

https://www.which.co.uk/money/tax/income …

The tax relief landlords get on a buy to let mortgage interest has ended Instead you ll receive a tax credit based on 20 of your mortgage interest payments We help you calculate its impact on your tax bill

Tax Relief For Living Walls

Potential Tax Relief For Volunteer First Responders In NY Is One Step

Tax Relief For Individuals With Disabilities

Tax Relief For Financial Institutions In Disposal Of Non performing

Can I Claim Tax Relief For Failed R D Projects

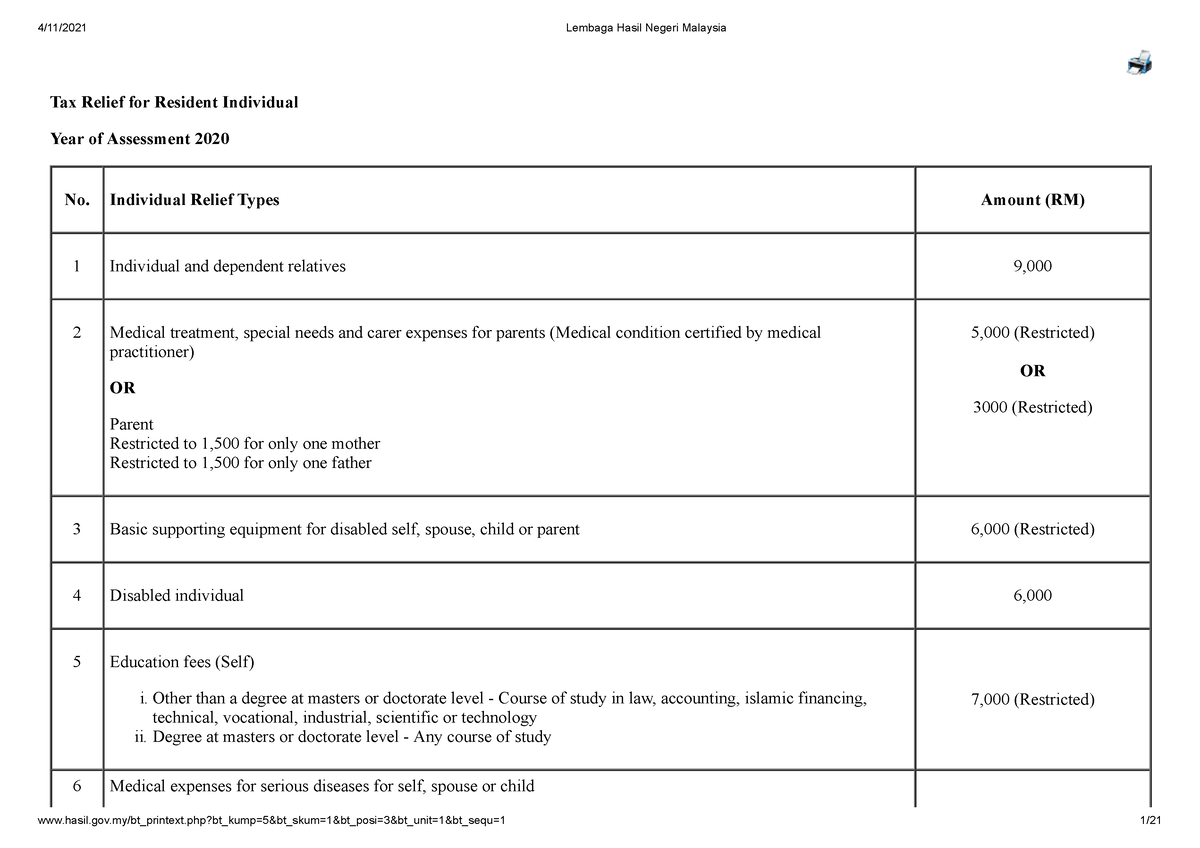

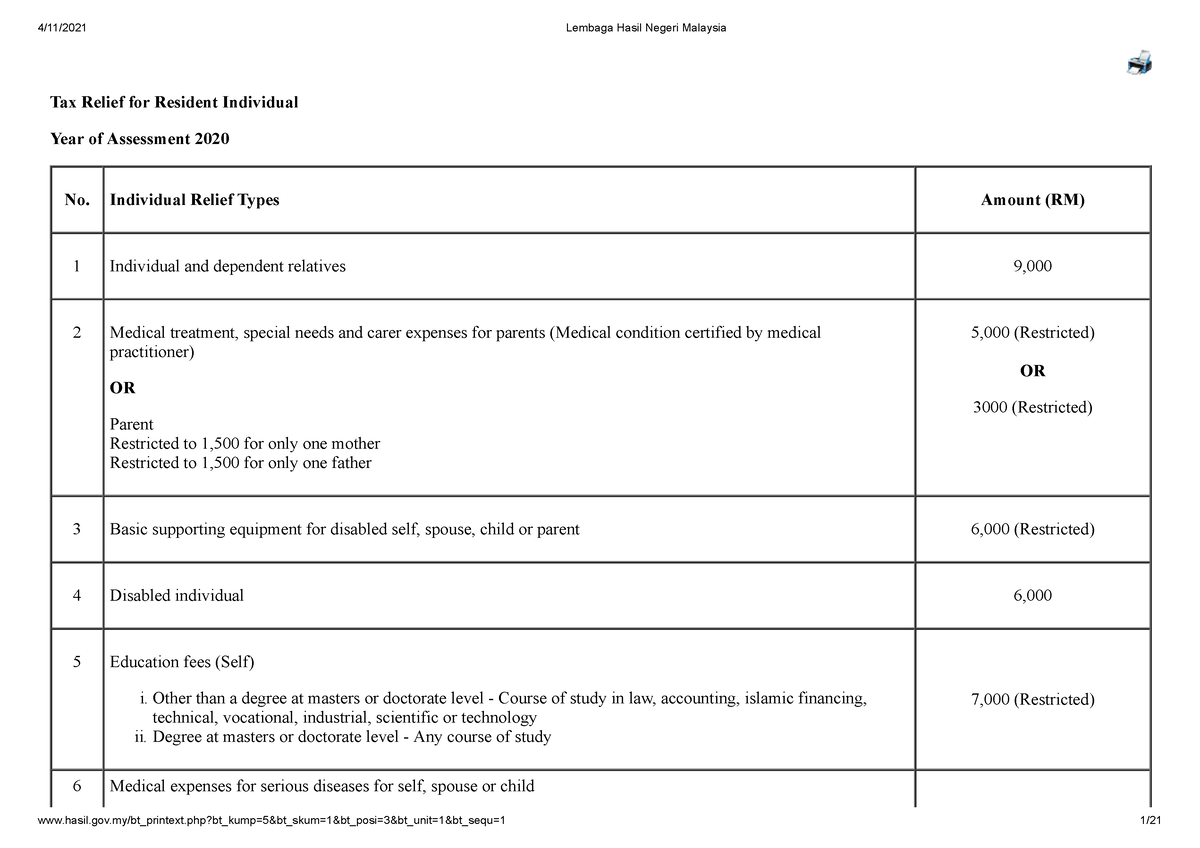

Tax Assesment 2009 2020 Tax Relief For Resident Individual Year Of

Tax Assesment 2009 2020 Tax Relief For Resident Individual Year Of

Tax Relief For Non discriminatory Companies

Tax Relief For Property Rental Losses Tax Tips Galley Tindle

Tax Relief For Children 2021 Fill In The Declaration Now

Tax Relief For Interest On Rental Property - You may be allowed claim Mortgage Interest Relief against your rental income The interest must be from a mortgage that is used to purchase improve or