Tax Relief For Mortgage Loan Mortgage interest relief at source or MIRAS was a housing tax relief scheme in the United Kingdom from 1983 to 2000 which was introduced as a way of reducing the amount of tax relief granted to mortgage borrowers As its name suggests it allowed borrowers to make mortgage repayments that already included tax relief on interest instead of the traditional method of reclaiming the tax from the Inland Revenue

Verkko 22 syysk 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can Verkko Claiming Tax Relief On Your Main Residence Whilst tax relief on loans for private purposes is basically forbidden by the tax rules there are ways to secure a deduction

Tax Relief For Mortgage Loan

Tax Relief For Mortgage Loan

https://www.fortunebuilders.com/wp-content/uploads/2018/10/mortgage-loan-options.jpg

How Does Debt Relief Work Types Of Debt Relief

https://www.debt.org/wp-content/uploads/2018/09/debt-relief-course.jpg

Tax Relief For Domestic Companies Amendments Made To Incom Flickr

https://live.staticflickr.com/65535/48780569303_2f7ef8375f_b.jpg

Verkko Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on Verkko 22 hein 228 k 2021 nbsp 0183 32 Mortgage interest tax relief is the ability for landlords to deduct their mortgage interest costs from their taxable profits Historically the interest you paid towards a mortgage payment could

Verkko 16 kes 228 k 2023 nbsp 0183 32 Reintroduce tax relief on mortgage payments More than 25 000 people have signed a petition calling on the government to let people make mortgage repayments from their salary before it is Verkko 21 elok 2023 nbsp 0183 32 You could apply for initial mortgage relief if your loan is backed by the U S Department of Housing and Urban Development HUD the Federal Housing

Download Tax Relief For Mortgage Loan

More picture related to Tax Relief For Mortgage Loan

Tax Relief Loan

https://www.macuonline.org/media/k2/items/cache/68b62085e41e8f225811766f8d5eb2bb_M.jpg

Tax Relief For Home Workers

https://www.kateunderwoodhr.co.uk/wp-content/uploads/2022/03/KUHR-Blog-image-template-34-min.png

Tax Advisor For SEIS And EIS Tax Relief Gatwick Accountant

https://www.gatwickaccountant.com/wp-content/uploads/2022/07/accountant-for-tax-return-near-me.png

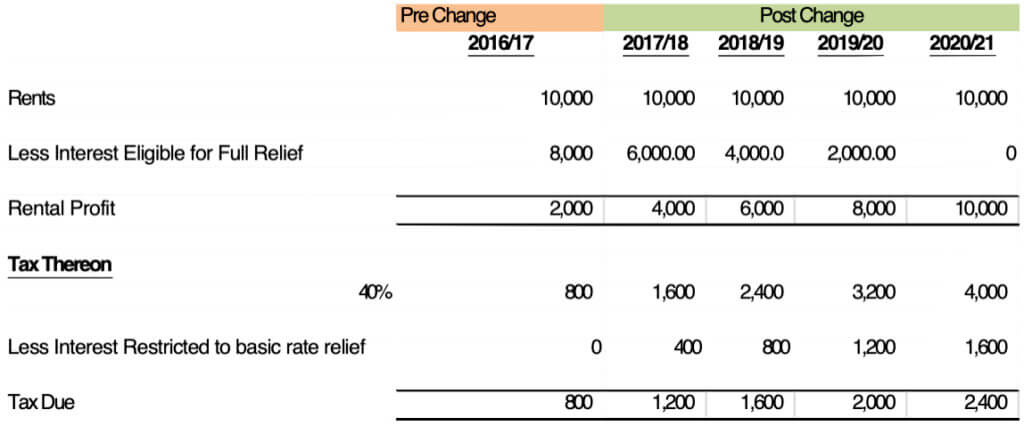

Verkko 4 tammik 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who Verkko 9 tammik 2023 nbsp 0183 32 75 2020 2021 100 The reduction is the basic rate value of 20 of the lowest of Finance costs like mortgage interest loads to buy furnishings

Verkko In the 2018 19 tax year you can claim 50 of your mortgage tax relief In the 2019 20 tax year you can claim 25 of your mortgage tax relief The table below shows how Verkko Mortgage Interest Relief is a tax relief on the interest you pay in a tax year on a qualifying mortgage loan You can claim Mortgage Interest Relief on interest paid by

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/3-3-1024x1024.png

What To Know Before Getting Your First Mortgage

https://realtybiznews.com/wp-content/uploads/2017/01/mortgage.jpg

https://en.wikipedia.org/wiki/Mortgage_Interest_Relief_At_Source

Mortgage interest relief at source or MIRAS was a housing tax relief scheme in the United Kingdom from 1983 to 2000 which was introduced as a way of reducing the amount of tax relief granted to mortgage borrowers As its name suggests it allowed borrowers to make mortgage repayments that already included tax relief on interest instead of the traditional method of reclaiming the tax from the Inland Revenue

https://www.nerdwallet.com/article/taxes/mort…

Verkko 22 syysk 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can

Mortgage Tax Relief

Personal Tax Relief 2022 L Co Accountants

Tax Relief For Children 2021 Fill In The Declaration Now

Interest Deductions Should I Buy Property Personally Or Via A Company

Tax Relief For Working From Home During The Pandemic Here s How To

Go Direct To Get Tax Relief On Work Expenses

Go Direct To Get Tax Relief On Work Expenses

Tax Relief For Individuals With Disabilities

Tax Relief Of Mortgage Interest Sigma Chartered Accountants

Learn How To Generate Tax Debt Relief Leads At Broker Calls

Tax Relief For Mortgage Loan - Verkko 19 tammik 2023 nbsp 0183 32 Landlord mortgage interest tax relief in 2022 23 Since April 2020 you ve no longer been able to deduct any of your mortgage expenses from your rental