Tax Relief For Parents Medical Expenses Under a multiple support agreement you treat your parent as your dependent You paid all of your parent s medical expenses Your siblings repaid you for three fourths of these expenses In figuring your medical expense

Here s a breakdown of each medical tax relief so you can understand what exactly are the expenses that you can claim for tax relief and what you can t Medical treatment special needs and carer expenses for parents Many caregivers and their aging loved ones rack up thousands of dollars every year in medical expenses Depending on the total amount you ve spent on a loved one s care in tax year 2021 you might be able to deduct some of those

Tax Relief For Parents Medical Expenses

Tax Relief For Parents Medical Expenses

https://cnadvisory.my/wp-content/uploads/2023/03/personal-tax-relief-2022-scaled.jpg

Tax Relief For Domestic Companies Amendments Made To Incom Flickr

https://live.staticflickr.com/65535/48780569303_2f7ef8375f_b.jpg

How To Get The Most Out Of Your Medical Expenses Elite Tax

http://elitetax.ca/wp-content/uploads/2016/12/AdobeStock_117273938.jpeg

Caregivers spend a whopping 7 200 out of pocket New bill would provide tax relief More than 48 million Americans are caregivers providing more than 600 billion in Vaccination expenses for self spouse and child Types of vaccine which qualify for deduction are as follows i Complete medical examination for self spouse child as defined by the

You may be able to offset a parent s tax liability by deducting medical expenses if they paid them out of their income The most important thing to do is to check whether your parent needs to file a tax return since in You can claim tax relief on medical expenses you pay for yourself or for any other person You must claim tax relief within the 4 years following the year in which you paid for the healthcare

Download Tax Relief For Parents Medical Expenses

More picture related to Tax Relief For Parents Medical Expenses

Tax Advisor For SEIS And EIS Tax Relief Gatwick Accountant

https://www.gatwickaccountant.com/wp-content/uploads/2022/07/accountant-for-tax-return-near-me.png

Tax Relief For Pre trading Expenses Accounting Firms

https://www.accountingfirms.co.uk/wp-content/uploads/2022/01/Tax-Relief-For-Pre-Trading-Expenses.png

Claim Tax Relief Of Employing A Carer Home Care Matters

https://homecarematters.ie/wp-content/uploads/2021/01/t2.png

Medical care expenses include payments for the diagnosis cure mitigation treatment or prevention of disease or payments for treatments affecting any structure or function of the Though a dependency exemption can t be deducted under current law a taxpayer who can claim someone as a dependent can deduct medical expenses the taxpayer paid for

You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40 This section The Tax Administration Framework Review New ways to tackle non compliance The Tax Administration Framework Review enquiry and assessment powers penalties

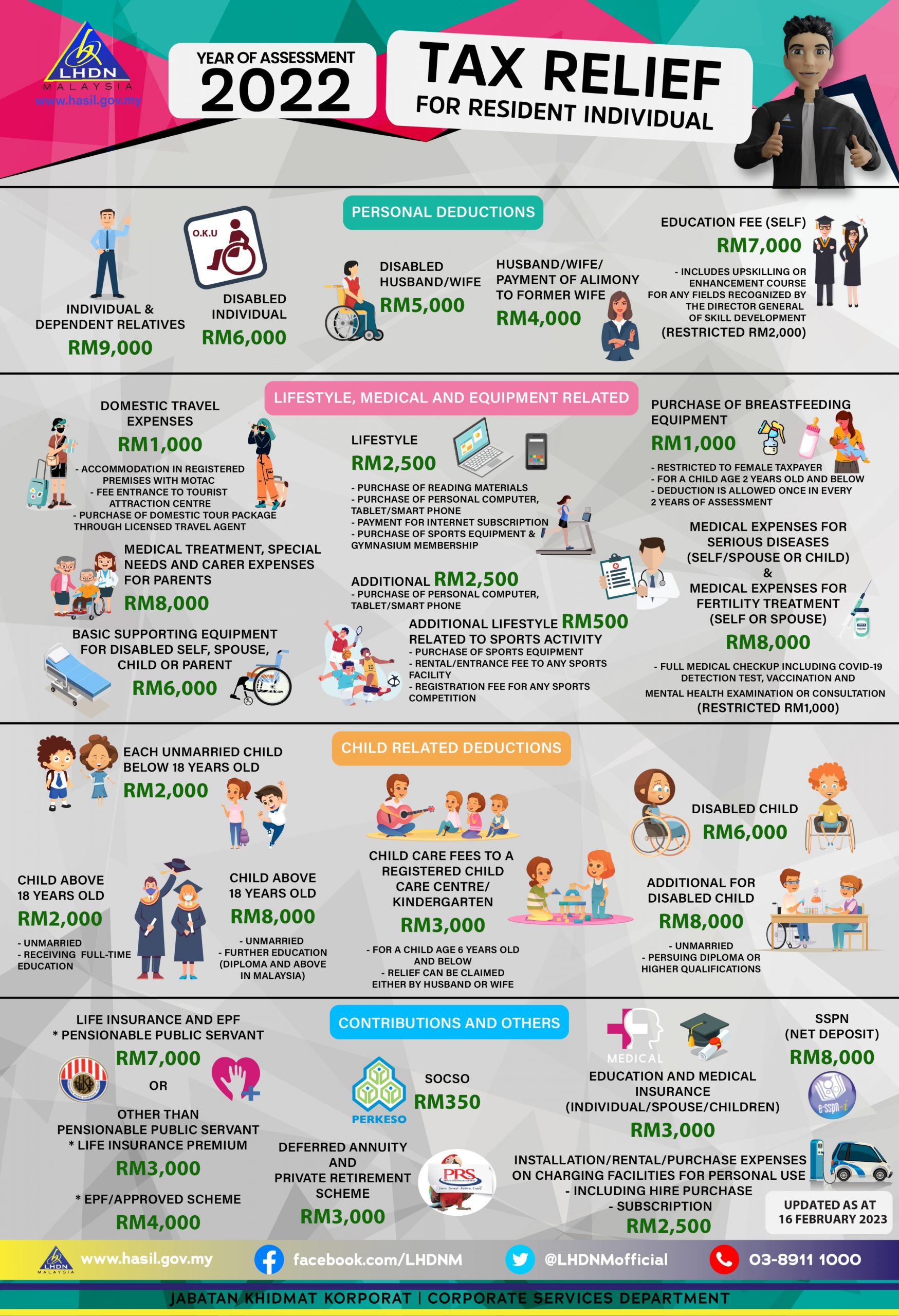

Malaysia Personal Income Tax Relief 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjM81nSzJ2QiCATWboDACN2BpfNmw-0Wf5BApuHi91cjON32r6XUxhruNbA8f0o3K_H_4oIf1B4xQE6D0tInpJ7fFjXuaqCtw3-786N9ouUQ8nKcW7kxtIy0bZOmw2wXtBmRb63A-pQjcxK9mCdSvqTGiUvUxaePn9JkzlCVQKv7Gj0EukB_pdXpC10/s1585/Individual_Tax_Relief_2021.jpg

Tax Relief For Home Workers

https://www.kateunderwoodhr.co.uk/wp-content/uploads/2022/03/KUHR-Blog-image-template-34-min-1080x675.png

https://www.irs.gov/publications/p502

Under a multiple support agreement you treat your parent as your dependent You paid all of your parent s medical expenses Your siblings repaid you for three fourths of these expenses In figuring your medical expense

https://www.imoney.my/articles/what-ca…

Here s a breakdown of each medical tax relief so you can understand what exactly are the expenses that you can claim for tax relief and what you can t Medical treatment special needs and carer expenses for parents

List Of Personal Tax Relief And Incentives In Malaysia 2023

Malaysia Personal Income Tax Relief 2022

Tax Preparation Specialist Issues Tax Relief Guidance For Employees Who

Tax Relief For Working From Home During The Pandemic Here s How To

Tax Relief For Individuals With Disabilities

List Of Personal Tax Relief And Incentives In Malaysia 2023

List Of Personal Tax Relief And Incentives In Malaysia 2023

Personal Tax Relief 2021 L Co Accountants

CT Tax Exemption For Retirees

What Can You Claim For Tax Relief Under Medical Expenses

Tax Relief For Parents Medical Expenses - Vaccination expenses for self spouse and child Types of vaccine which qualify for deduction are as follows i Complete medical examination for self spouse child as defined by the