Tax Relief For Social Work Registration You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to approved professional bodies or learned

If you re eligible you ll usually be able to claim tax relief on your job expenses online If you cannot claim online there are other ways you can claim You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to approved professional bodies

Tax Relief For Social Work Registration

Tax Relief For Social Work Registration

https://homecarematters.ie/wp-content/uploads/2021/01/t2-600x600.png

Tax Relief For Domestic Companies Amendments Made To Incom Flickr

https://live.staticflickr.com/65535/48780569303_2f7ef8375f_b.jpg

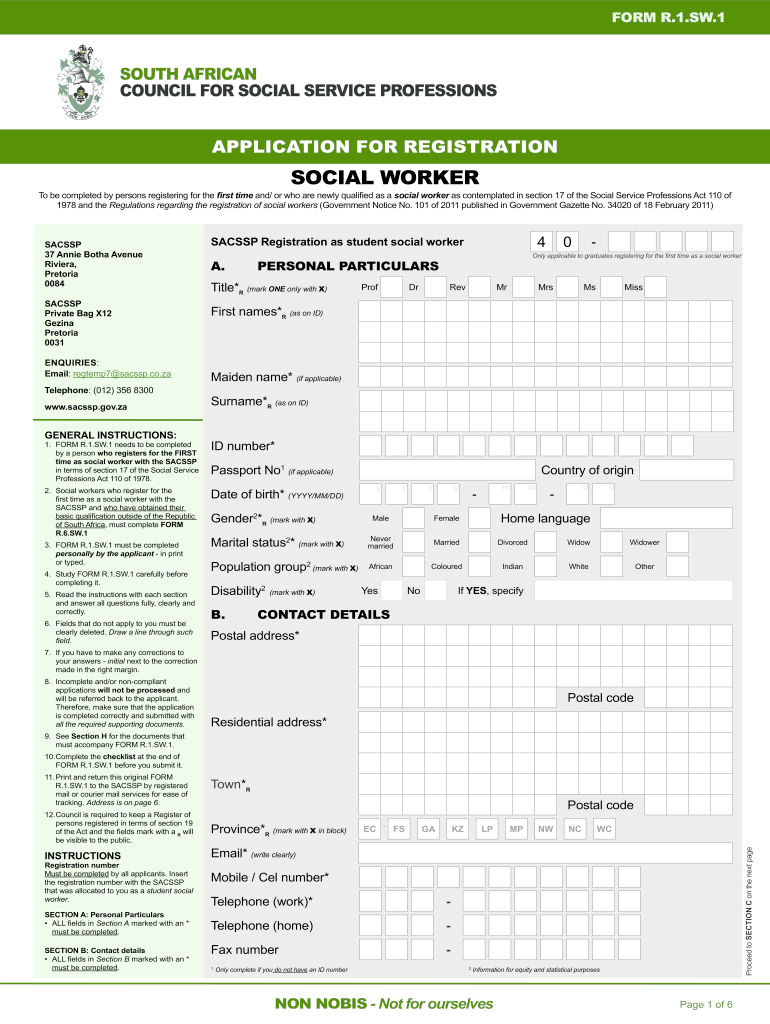

Sacssp Online Registration 2023 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/505/602/505602404/large.png

HM Revenue and Customs has agreed that the registrant fee payable to the Social Care Council is tax deductible and may be claimed by Registrants on their tax return or by application to Paying your renewal fees How to pay the renewal fee to maintain your HCPC registration Read more Why we charge fees Why we request fees and how we use them Read more Claiming

To renew your registration for the 2024 25 registration year you also must pay the annual registration fee of 90 Tax relief If you re a UK taxpayer you may be able to claim back If you re not a UK national and your social work qualification is from outside the UK you ll need to pay a scrutiny fee when you submit your application to join the Social Work England

Download Tax Relief For Social Work Registration

More picture related to Tax Relief For Social Work Registration

Tax Advisor For SEIS And EIS Tax Relief Gatwick Accountant

https://www.gatwickaccountant.com/wp-content/uploads/2022/07/accountant-for-tax-return-near-me.png

Tax Relief For Home Workers

https://www.kateunderwoodhr.co.uk/wp-content/uploads/2022/03/KUHR-Blog-image-template-34-min-1080x675.png

Tax Relief For Non discriminatory Companies

https://image.luminews.my/zojelx493f4fssojxoj8kce4ni1w

There are three different ways of claiming tax relief on your registration fees 1 If you complete a self assessment tax return you can claim tax relief from your registration fees on the There are three different ways of claiming tax relief on your registration fees If you do not file a tax return you can claim tax relief using form P87 Tax relief for expenses of employment

You can claim tax relief for all the payments that have been made to the main social worker organisations the care councils and other professional associations for the last 4 years normally worth between 150 and 250 Tax relief Graduated relief Small businesses whose yearly turnover is below a certain threshold may be able to benefit from graduated relief If you are eligible for the

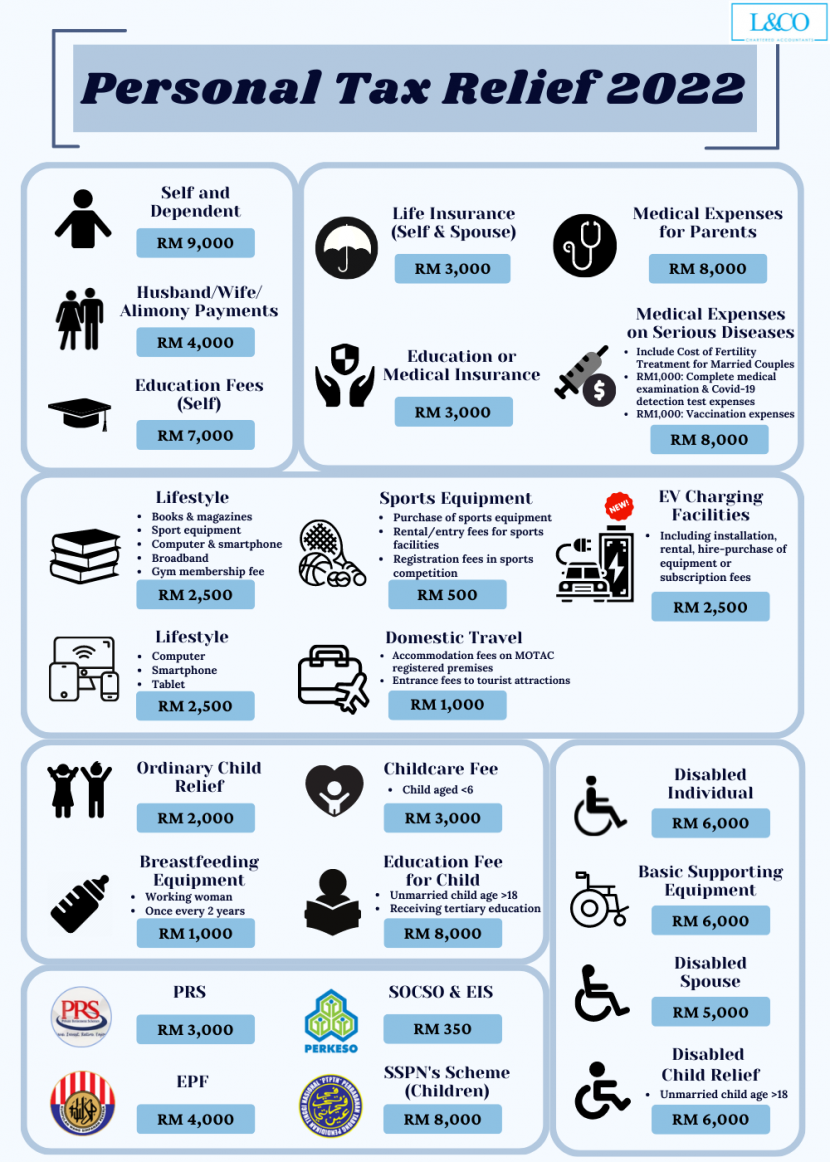

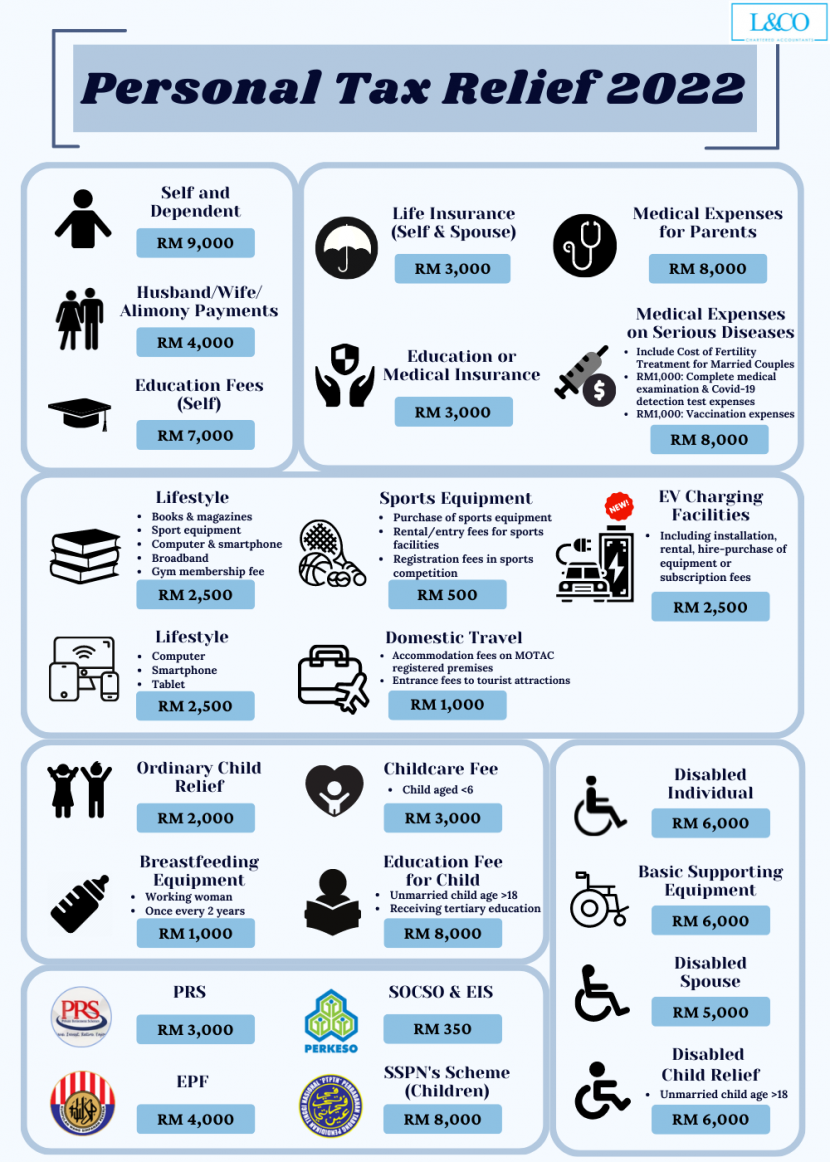

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/Personal-Tax-Relief-2022-1-830x1162.png

Tax Relief For Children 2021 Fill In The Declaration Now

https://sb-bg.com/app/uploads/2021/10/Tax-relief_tumb_en.png

https://www.gov.uk/tax-relief-for-employees/...

You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to approved professional bodies or learned

https://www.gov.uk/tax-relief-for-employees

If you re eligible you ll usually be able to claim tax relief on your job expenses online If you cannot claim online there are other ways you can claim

Budget 2016 Senior Citizens Need Tax Relief

Personal Tax Relief 2022 L Co Accountants

Tax Relief For Working From Home During The Pandemic Here s How To

Tax Relief For Individuals With Disabilities

Go Direct To Get Tax Relief On Work Expenses

Tax Relief In 2020 21 For Working From Home Beech Business Services

Tax Relief In 2020 21 For Working From Home Beech Business Services

Malaysia Personal Income Tax Relief 2022

TCSS Votes To Provide Tax Relief For Some Seniors LaGrange Daily News

2021 Stimulus Tax Relief For This Year s Taxes TheStreet

Tax Relief For Social Work Registration - Paying your renewal fees How to pay the renewal fee to maintain your HCPC registration Read more Why we charge fees Why we request fees and how we use them Read more Claiming