Tax Relief Germany 2023 Verkko 1 tammik 2022 nbsp 0183 32 BERLIN Jan 2 Reuters The new German government will offer tax relief to individuals and companies worth at least 30 billion euros 34 1 billion in

Verkko August 29 2023 at 7 05 AM PDT Listen 2 43 Germany s ruling coalition agreed on an expanded package of tax relief measures for companies worth about 7 billion 7 6 Verkko This income is taxed using a special procedure the tax withholding procedure defined in Section 50a ITA Foreign artists athletes license grantors and directors

Tax Relief Germany 2023

Tax Relief Germany 2023

https://forrestbrown.co.uk/wp-content/uploads/2021/09/Stocksy_txp24f5e82ftaB300_Medium_3370983-1536x1024.jpg

Raised Relief Map Of Germany In 2022 Map Germany Map Country Maps

https://i.pinimg.com/originals/3c/3a/92/3c3a92b012840cefc41e830409740821.jpg

Anfahrt Bundesbezirksmusikfest 2023

https://www.bbmf2023.de/fileadmin/logo/logo.png

Verkko 17 marrask 2023 nbsp 0183 32 BERLIN Nov 17 Reuters Germany s lower house of parliament on Friday passed a multibillion dollar tax relief package for small and medium sized Verkko 12 hein 228 k 2023 nbsp 0183 32 BERLIN July 12 Reuters Germany s finance ministry plans to offer companies a tax relief package of around 6 billion euros 6 61 billion per year

Verkko 24 lokak 2023 nbsp 0183 32 BERLIN Oct 24 Reuters Germany s economy ministry is planning 50 billion euros 53 billion in tax breaks over the next four years to help industry and Verkko 1 helmik 2022 nbsp 0183 32 BERLIN The new German government will offer tax relief to individuals and companies worth at least 30 billion euros 34 1 billion in this

Download Tax Relief Germany 2023

More picture related to Tax Relief Germany 2023

Dossier 2023

https://www.bloom.be/uploads/images/Jaarhoroscoop.gif

Ten Ways To Protect Property Tax Relief In 2023

https://www.texaspolicy.com/wp-content/uploads/2023/02/Property-Tax-Relief-1350x759.jpg

Here s The Real Story On Tax Relief RateMuse

https://i0.wp.com/blog.ratemuse.com/wp-content/uploads/2019/10/tax_relief.png?fit=1200%2C978&ssl=1

Verkko 29 jouluk 2022 nbsp 0183 32 The German Ministry of Finance Dec 23 announced various tax changes for 2023 The announcement includes measures to 1 increase the basic tax Verkko 15 elok 2023 nbsp 0183 32 BERLIN Aug 15 Reuters The German government is planning to raise the amount of tax relief it will give to companies in a new draft law that could go to

Verkko 25 helmik 2022 nbsp 0183 32 Extending expanded loss offsetting The Third Coronavirus Tax Assistance Act raised the maximum amount of the loss carryback to 10 million and Verkko 27 jouluk 2022 nbsp 0183 32 In 2023 people who are earning in Germany will be able to make more without having to pay tax The basic tax free allowance Grundfreibetrag will rise to

Germany 2023 Philatelic Pursuits

https://live.staticflickr.com/65535/52828997799_a0b3023437_o.png

Lodging Workshop 2023

https://workshop.njsba.org/wp-content/uploads/ws2023-logo_big.svg

https://www.reuters.com/markets/europe/german-finance-minister-pledges...

Verkko 1 tammik 2022 nbsp 0183 32 BERLIN Jan 2 Reuters The new German government will offer tax relief to individuals and companies worth at least 30 billion euros 34 1 billion in

https://www.bloomberg.com/news/articles/2023-08-29/germany-agrees-on...

Verkko August 29 2023 at 7 05 AM PDT Listen 2 43 Germany s ruling coalition agreed on an expanded package of tax relief measures for companies worth about 7 billion 7 6

Forms 3520 3520 A RESP Tax Relief Effisca

Germany 2023 Philatelic Pursuits

CCC GM IM Norm Invitational Fall 2023 GM IM Norm Chess Tournament

Company Tax Relief 2023 Malaysia Printable Forms Free Online

Tax Tip How To Know If You Qualify For A Tax Relief Program Tax Help

Germany 2023 Philatelic Pursuits

Germany 2023 Philatelic Pursuits

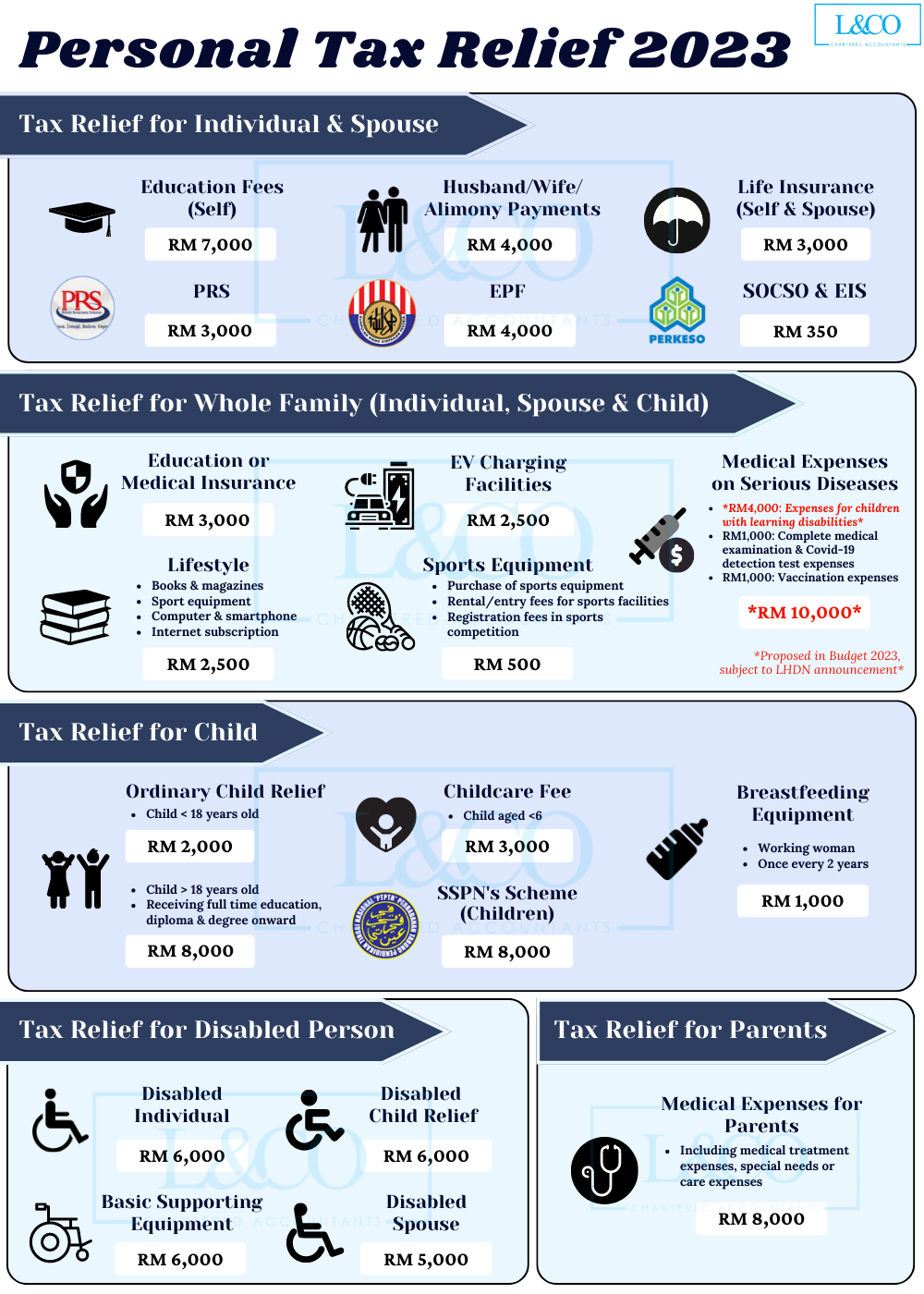

Personal Tax Relief Y A 2023 L Co Accountants

Download Template Kalender 2023 Lengkap Template Kalender 2023 Desain

2023 Calendar Planner Vector Hd Images 2023 Digital Calendar 2023

Tax Relief Germany 2023 - Verkko 24 lokak 2023 nbsp 0183 32 BERLIN Oct 24 Reuters Germany s economy ministry is planning 50 billion euros 53 billion in tax breaks over the next four years to help industry and