Tax Relief Mortgage Interest Uk As per my understanding the finance cost mortgage interest expense can claim a tax relief It can be claim 20 of the financal cost e g 7 668 was the interest i paid in tax

Support for Mortgage Interest SMI helps homeowners on certain benefits pay interest on loans or mortgages what you ll get eligibility and how to claim Fundamentally if you borrow money to finance a trading or property business you should get tax relief on any interest incurred However borrowing to finance private expenditure is not

Tax Relief Mortgage Interest Uk

Tax Relief Mortgage Interest Uk

https://www.carterjonas.co.uk/-/media/images/news-images-t08/residential/2018-resi-mortgage-interest-tax-relief-petition.ashx

Buying An Ex council House In London Are They Good Value For Money

https://static.standard.co.uk/homesandproperty/s3fs-public/thumbnails/image/2017/11/21/14/exlocaltotterdownfieldscreditedwarddenison.jpg?width=900&auto=webp&quality=50&crop=968:645%2Csmart

Understanding The Mortgage Interest Deduction With TaxSlayer

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-8.jpg

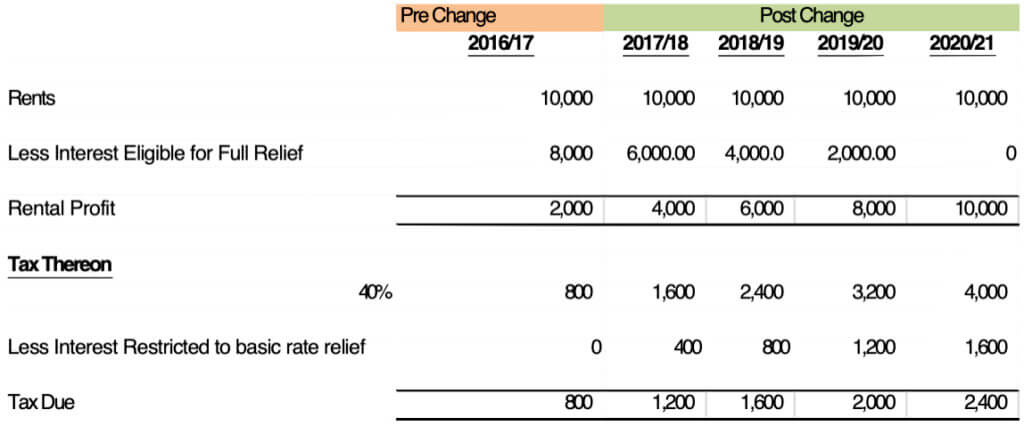

Mortgage interest tax relief is the ability for landlords to deduct their mortgage interest costs from their taxable profits Historically the interest you paid towards a mortgage payment could be deducted from your rental income To make the tax system fairer the government will restrict the amount of Income Tax relief landlords can get on residential property finance costs such as mortgage interest

Is your total income without allowable expenses and mortgage interest above 50 270 pushing you into the higher tax band Will you invest a significant amount into your buy to let property on things such as renovations Interest rates are at a 14 year high and landlords are paying a lot more on their buy to let mortgages so how can they get tax relief for the interest which is unrelievable in the current year

Download Tax Relief Mortgage Interest Uk

More picture related to Tax Relief Mortgage Interest Uk

Mortgage Interest Rate Calculator Ireland Moneysherpa

https://mlfxk9f4fh20.i.optimole.com/w:auto/h:auto/q:mauto/ig:avif/f:best/https://moneysherpa.ie/wp-content/uploads/2022/08/Untitled-design-17.png

Mortgage Tax Relief

https://www.pattersonhallaccountants.co.uk/wp-content/uploads/2018/06/Mortgage-Tax-Relief-830x436.jpg

Mortgage Interest Rates DROPPED Buy A Home NOW Or WAIT YouTube

https://i.ytimg.com/vi/sBQXhxDKM5E/maxresdefault.jpg

The tax relief that landlords can now benefit from comes in the form of a 20 tax credit on their mortgage interest payments To put this into perspective if a landlord pays 9 000 in interest they can claim a tax credit of As a result one of the most common questions we get asked is can I still claim mortgage interest The answer is if you are a basic rate taxpayer you still get full tax relief provided

A mortgage interest tax deduction in the UK was announced in 2021 meaning that you can earn a credit to your account based on what your mortgage may be Currently that From April 2020 landlords will no longer be able to deduct their mortgage costs from their rental income All of the rental income you earn will be taxable and you ll instead receive a 20 tax

Mortgage Interest And Tax Relief Accounting Firms

https://www.accountingfirms.co.uk/wp-content/uploads/2023/01/Mortgage-Interest-and-Tax-Relief.png

Current Mortgage Rates Dec 18 Rates Fall For Most Loans The

https://g.foolcdn.com/editorial/images/605365/todaysmortgagerate-graphics2.jpg

https://community.hmrc.gov.uk/customerforums/sa/...

As per my understanding the finance cost mortgage interest expense can claim a tax relief It can be claim 20 of the financal cost e g 7 668 was the interest i paid in tax

https://www.gov.uk/support-for-mortgage-interest

Support for Mortgage Interest SMI helps homeowners on certain benefits pay interest on loans or mortgages what you ll get eligibility and how to claim

Mortgage Interest Rates Mortgage Rates Mortgage Infographic Work

Mortgage Interest And Tax Relief Accounting Firms

Historic Mortgage Rates From 1981 To 2019 And Their Impact TheStreet

Tax Relief Of Mortgage Interest Sigma Chartered Accountants

The Telegraph Financial Services Logo Is Shown In Front Of A House

UK Mortgage Rates Rise At Fastest Pace In A Decade Finansdirekt24 se

UK Mortgage Rates Rise At Fastest Pace In A Decade Finansdirekt24 se

Mortgage Interest Rate As Of 05 16 2014 03 00 PM Eastern FHAFriday

Learn How To Generate Tax Debt Relief Leads At Broker Calls

Tax Relief Of Mortgage Interest Sigma Chartered Accountants

Tax Relief Mortgage Interest Uk - To make the tax system fairer the government will restrict the amount of Income Tax relief landlords can get on residential property finance costs such as mortgage interest