Tax Relief On Electric Vehicles For the first year allowance for electric vehicle charge points this measure will have effect for expenditure incurred on or after 1 April 2025 for Corporation Tax purposes and on or

From 1 April 2025 drivers of electric and low emission cars vans and motorcycles will need to pay vehicle tax in the same way as drivers of petrol and diesel vehicles 10 year exemption for BEVs and FCEVs registered until 31 December 2025 Exemption granted until 31 December 2030 at the latest Reduction of the taxable amount for BEVs and PHEVs from 1 to 0 5 of the gross catalogue

Tax Relief On Electric Vehicles

Tax Relief On Electric Vehicles

https://i3.wp.com/image.cnbcfm.com/api/v1/image/107112106-16619676952022-08-31t100604z_1011545743_rc26er9nfhj9_rtrmadp_0_autos-toyota-batteries.jpeg

Insurance For All Types Of Vehicles Electric Included Markham Brokers

https://markhambrokers.com/wp-content/uploads/2020/12/shutterstock_1095424064-1.jpg

MEC Free Electric Car Charging 212 Brooksbank Ave North Vancouver

https://i.pinimg.com/originals/68/fe/a7/68fea71c44fc5179043fc8c09da5975c.png

Under the plans laid out today electric cars registered from April 2025 will pay the lowest rate of 10 in the first year then move to the standard rate which is currently 165 The standard A new federal tax credit of 4 000 for used EVs priced below 25k Subject to other requirements like lower annual income see below Revised credit applies to battery

Finance Minister Nirmala Sitharaman announced measures in the Union Budget 2023 to make electric vehicles more affordable in India through battery subsidies Section If you buy a new all electric plug in hybrid or fuel cell electric vehicle in 2023 or after you can claim a clean vehicle tax credit of up to 7 500 The tax credit is available to both

Download Tax Relief On Electric Vehicles

More picture related to Tax Relief On Electric Vehicles

Proposed Guidance Released For Electric Vehicle Point of Sale Discounts

https://www.motormoutharabia.com/wp-content/uploads/2023/07/mfrack_realistic_photo_of_future_Electric_Vehicle_d6fe61a9-2302-4e41-bcf1-b8c74c475c39.jpeg

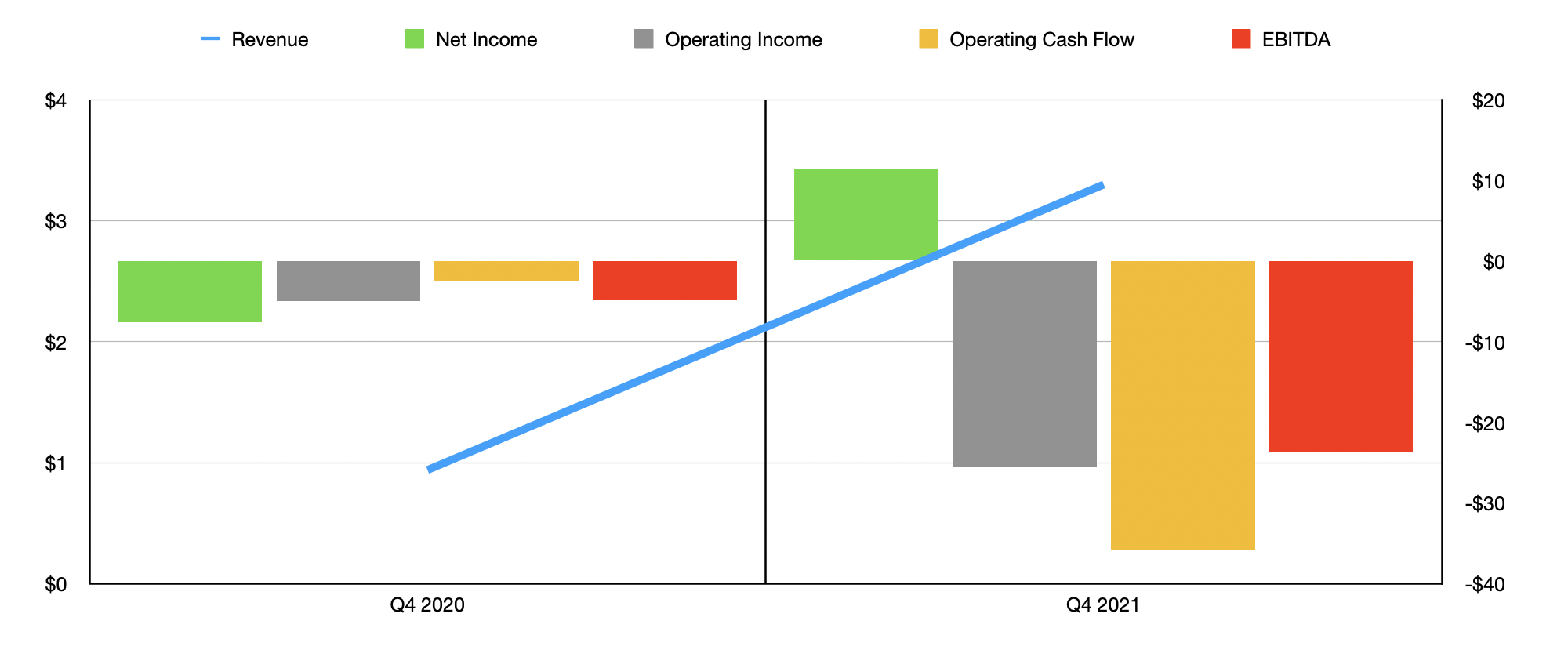

Xos Stock A Binary Play On Electric Vehicles NASDAQ XOS Seeking Alpha

https://static.seekingalpha.com/uploads/2022/4/1/9866571-16487894343208208_origin.png

Australia Is Failing On Electric Vehicles Architecture Design

https://images.theconversation.com/files/483873/original/file-20220912-68830-ej88qo.jpeg?ixlib=rb-1.1.0&q=15&auto=format&w=600&h=380&fit=crop&dpr=3

If you purchase EV charging equipment for a business fleet or tax exempt entity you may be eligible for a tax credit Starting on Jan 1 2023 the value of this credit is 6 of the cost of In a bid to promote the adoption of electric vehicles EVs and combat climate change the Indian government introduced Section 80EEB in the 2019 budget This initiative incentivizes individuals by offering tax deductions

Explore 2024 s tax relief options for UK self employed individuals buying electric cars including benefits and eligibility details Electric cars with zero emissions fall into the lowest benefit in kind tax band resulting in lower tax liabilities for employees This makes electric vehicles very attractive for

UP Govt Grants Road Tax Registration Fee Exemption On Electric

https://newsroompost.com/wp-content/uploads/2023/03/up-govt-EV-tax-exemption-1-1000x600.jpg

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

https://www.gov.uk › government › publications › capital...

For the first year allowance for electric vehicle charge points this measure will have effect for expenditure incurred on or after 1 April 2025 for Corporation Tax purposes and on or

https://www.gov.uk › guidance › vehicle-tax-for...

From 1 April 2025 drivers of electric and low emission cars vans and motorcycles will need to pay vehicle tax in the same way as drivers of petrol and diesel vehicles

Direct Tax Relief On LinkedIn Direct Tax Relief Confidential

UP Govt Grants Road Tax Registration Fee Exemption On Electric

Personal Tax Relief 2022 L Co Accountants

Income Tax And Sales Tax Relief On Construction Industry For Builders

Income Tax And Sales Tax Relief On Construction Industry For Builders

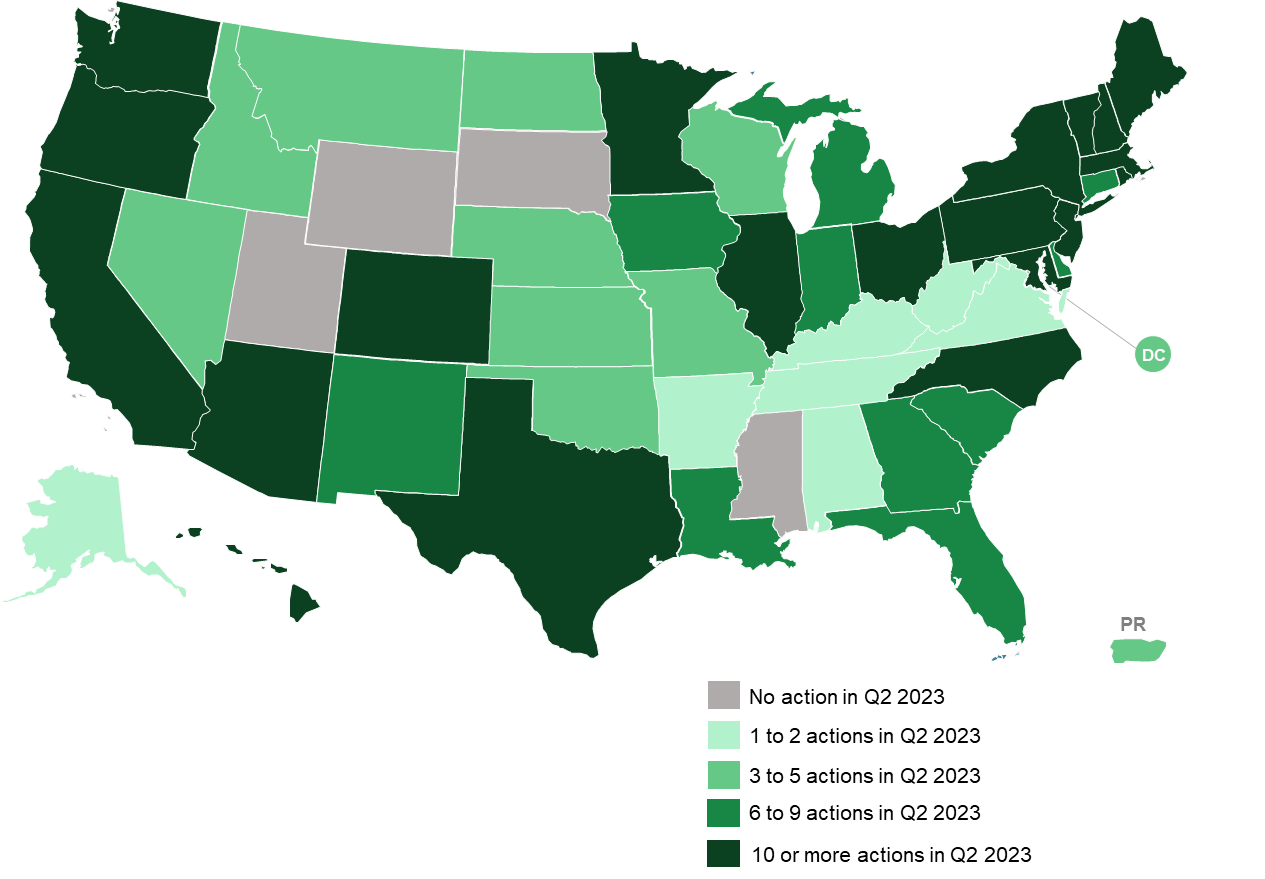

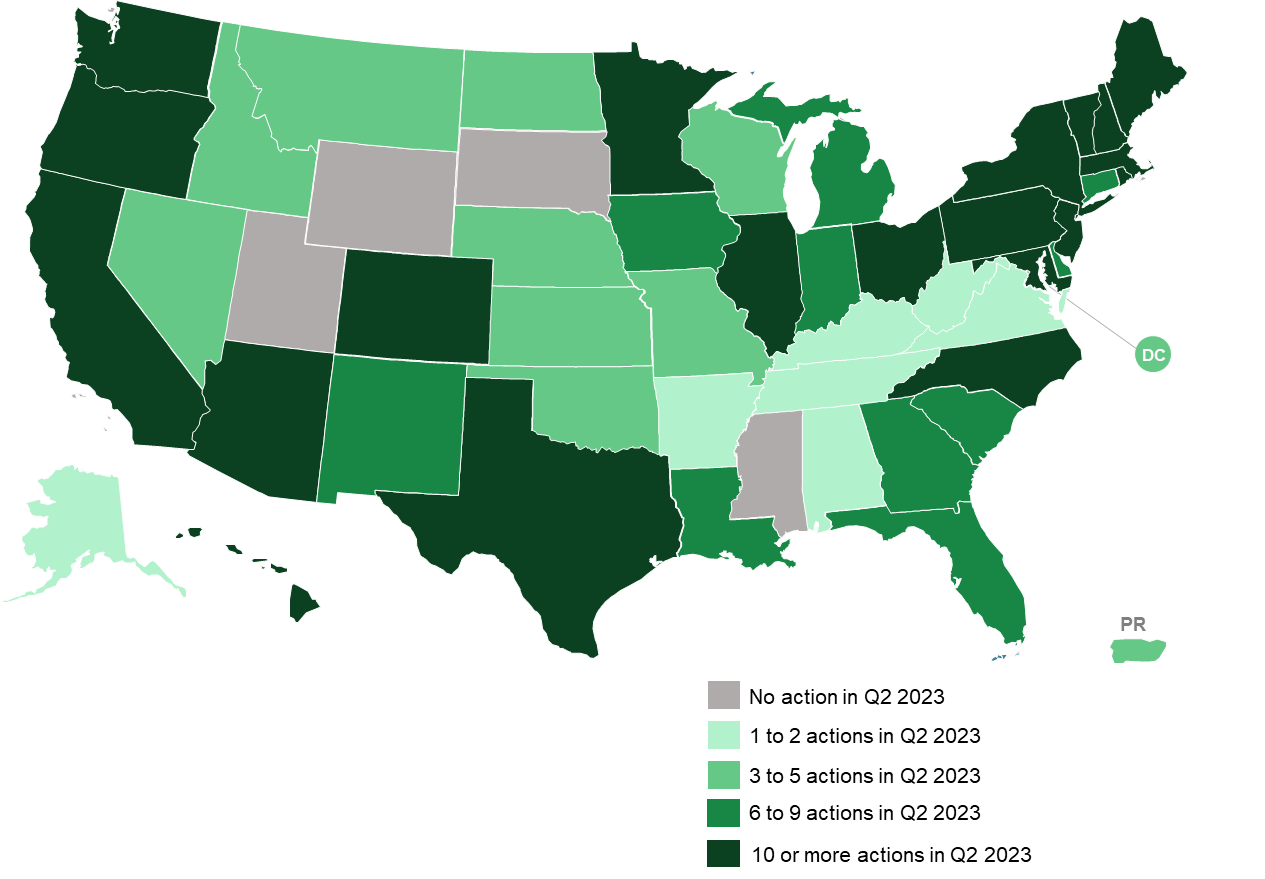

The 50 States Of Electric Vehicles States Consider LMI Incentives EV

The 50 States Of Electric Vehicles States Consider LMI Incentives EV

How To Claim Higher Rate Tax Relief On Pension Contributions

Electric Car Credit Income Limit How The Electric Car Tax Credit Works

ACCC s Sloppy Logic On Electric Vehicles Fails To Consider Health Costs

Tax Relief On Electric Vehicles - A new federal tax credit of 4 000 for used EVs priced below 25k Subject to other requirements like lower annual income see below Revised credit applies to battery