Tax Relief On Home Office Equipment The temporary tax exemption covering home office equipment purchased by employees and reimbursed by employers as a result of COVID 19 which allowed employees to receive the full reimbursement free from income tax and NICs only applied from 16 th March 2020 until 5 April 2022

Home Office Tax Deduction Rules for 2023 Kiplinger When you purchase through links on our site we may earn an affiliate commission Here s how it works Home taxes tax deductions It s just 50 Learn more Advertiser disclosure Home Office Tax Deduction 2023 2024 Rules Who Qualifies The home office deduction is a tax break for self employed people who use

Tax Relief On Home Office Equipment

Tax Relief On Home Office Equipment

https://www.caremark.ie/wp-content/uploads/2023/01/caremark-client-image-25-1-980x652.jpeg

Claiming For Working From Home Expenses In 2021 22

https://rfm-more.co.uk/wp-content/uploads/2021/09/Working-from-home-expenses.jpg

Budget 2023 R D Tax Relief Changes News YesTax

https://yes.tax/storage/news/1678966611-Mark Wood 1366x911px.jpg

This temporary income tax and NIC exemption is intended to ensure that no tax liability arises where employers reimburse employees personal expenditure on home office equipment arising from arrangements to work from home during the Covid 19 outbreak The following two conditions must be satisfied Reimbursing expenses for office equipment your employee has bought If your employee needs to purchase home office equipment to enable them to work from home they will need to discuss this with you in advance If you reimburse your employee the actual costs of the purchase then this is non taxable provided there is no significant

Tax Tip 2022 10 January 19 2022 The home office deduction allows qualified taxpayers to deduct certain home expenses when they file taxes To claim the home office deduction on their 2021 tax return taxpayers generally must exclusively and regularly use part of their home or a separate structure on their property as their primary place The new exemption is introduced under ITEPA 2003 s 210 power to exempt minor benefits and equivalent NICs provisions to ensure employer reimbursements for the cost of home office equipment expenses are exempt from tax and NICs and is contained in The Income Tax Exemption for Coronavirus Related Home Office Expenses

Download Tax Relief On Home Office Equipment

More picture related to Tax Relief On Home Office Equipment

Claiming For Working From Home Expenses In 2021 22

https://rfm-more.co.uk/wp-content/uploads/2021/09/Working-from-home-expenses-S.jpg

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

Tax Relief On Job Expenses For Employees YouTube

https://i.ytimg.com/vi/yv3gOJ2997A/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGHIgRSg9MA8=&rs=AOn4CLC7Bimq3lrQQXKwLa2uk_pg_o_djg

Individuals Credits and Deductions Home Office Deduction at a Glance If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as mortgage interest insurance utilities repairs and depreciation for that area Step 2 Find out the square footage of your home For our example let s say your home has a total area of 1 600 square feet Step 3 Now divide the area of your office by the area of your house

An existing tax exemption under section 316 of the Income Tax Earnings and Pensions Act 2003 ITEPA03 applies where an employer provides supplies such as home office equipment directly to The tax treatment where employers provide or pay for home office equipment for employees varies depending on how this is done An income tax exemption applies where the employer provides

How To Claim Tax Relief For Your Home Office Bright Ideas Accountancy

https://biaccountancy.com/wp-content/uploads/2017/03/454.jpg

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/3-3-1024x1024.png

https://brodies.com/.../what-tax-relief-is-available-to-homeworkers

The temporary tax exemption covering home office equipment purchased by employees and reimbursed by employers as a result of COVID 19 which allowed employees to receive the full reimbursement free from income tax and NICs only applied from 16 th March 2020 until 5 April 2022

https://www.kiplinger.com/taxes/tax-deductions/...

Home Office Tax Deduction Rules for 2023 Kiplinger When you purchase through links on our site we may earn an affiliate commission Here s how it works Home taxes tax deductions

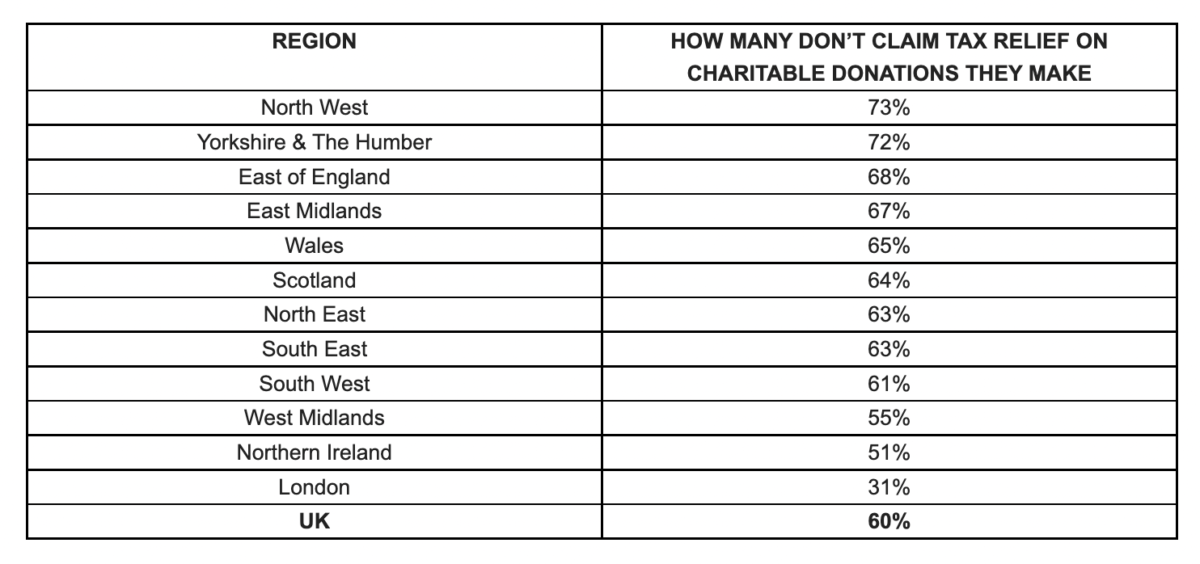

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

How To Claim Tax Relief For Your Home Office Bright Ideas Accountancy

Tax Relief Working From Home Get YourMoneyBack

Tax Relief On Home Help Comfort Keepers

Home Care Tax Relief Right At Home Ireland

Remote Workers Get Average Of Just 26 Tax Relief On Costs Business Post

Remote Workers Get Average Of Just 26 Tax Relief On Costs Business Post

What Is Tax Relief Can You Claim It Taxoo

Computer Tax Relief Fresh Mango Technologies UK

How To Claim Higher Rate Tax Relief On Pension Contributions

Tax Relief On Home Office Equipment - This temporary income tax and NIC exemption is intended to ensure that no tax liability arises where employers reimburse employees personal expenditure on home office equipment arising from arrangements to work from home during the Covid 19 outbreak The following two conditions must be satisfied