Tax Relief On House Rent If you increase your mortgage loan on your buy to let property you may be able to treat interest on the additional loan as a revenue expense or get relief against

Rent paid minus 10 of salary Rs 1 47 600 Therefore the entire rent amount of Rs 1 80 000 paid by Mr Anwar is not directly What should I do if I forgot to submit the rent receipts to my employer The good news is that HRA can be claimed directly on your income tax returns If you didn t submit rent

Tax Relief On House Rent

Tax Relief On House Rent

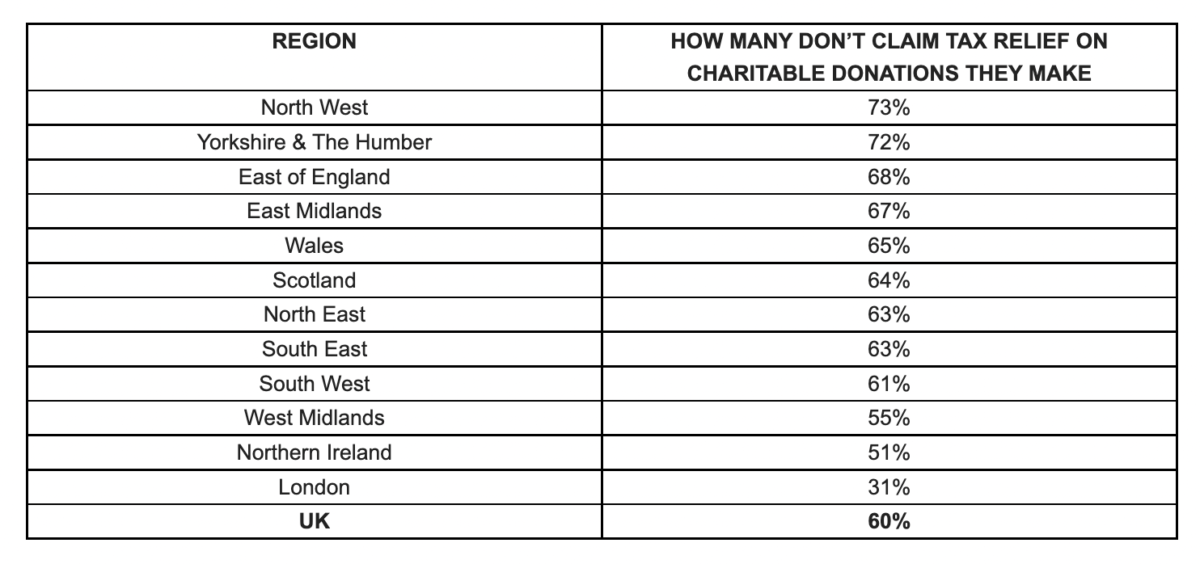

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

Income Tax Relief Programs Services USA Tax Settlement

http://usataxsettlement.com/wp-content/uploads/2021/01/Tax-Relief.jpeg

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

Click Review your Tax 2020 2023 and select year Click Request under the Statement of Liability section Click on Complete Your Income Tax Return In the Tax Credits Alternatively you can claim rent a room relief even if you re trading providing you let furnished accommodation within your own home Completing a tax return for rental income If you don t already receive a

A Rent Tax Credit was introduced in December 2022 for people who pay for private rented accommodation The credit will be available for 2022 until 2025 You can claim the tax Further this tax benefit can be claimed only if they have the HRA component as part of their salary structure and is staying in a rented accommodation Self employed

Download Tax Relief On House Rent

More picture related to Tax Relief On House Rent

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

https://stedswm.co.uk/wp-content/uploads/2022/05/image001.png

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/3-3-1024x1024.png

How To Get Tax Relief On Loan Interest For Residential Rental Property

https://i.ytimg.com/vi/jKCrZMd5qkc/maxresdefault.jpg

HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting If it s an official tenancy then your landlord should be registered but if it s the case that you re renting a room in somebody s house they re not necessarily going to be

The expenses Bill could claim against the rent come to about 2 500 for the year When deducted from the total rent received this would leave him with a profit of The new system means higher or additional rate taxpayers can no longer claim the tax back on their mortgage repayments as the credit only refunds tax at the

Can I Get Tax Relief On Pension Contributions Financial Advisers

https://www.insightifa.com/wp-content/uploads/2022/12/Tax-Relief-On-Pensions.jpg

How To Claim Higher Rate Tax Relief On Pension Contributions

https://images.prismic.io/penfold/b814df70-55e3-4dbe-ba29-7e5e1b617b34_Claim+higher+rate+tax+relief+-+Penfold+Pension+Blog.png?auto=compress,format&rect=462,0,4075,2292&w=1536&h=864

https://www.gov.uk/guidance/income-tax-when-you...

If you increase your mortgage loan on your buy to let property you may be able to treat interest on the additional loan as a revenue expense or get relief against

https://cleartax.in/s/hra-house-rent-allowance

Rent paid minus 10 of salary Rs 1 47 600 Therefore the entire rent amount of Rs 1 80 000 paid by Mr Anwar is not directly

Rule 21AAA Tax Relief On Income Arising From Foreign Retirement Funds

Can I Get Tax Relief On Pension Contributions Financial Advisers

Tax Preparation Specialist Issues Tax Relief Guidance For Employees Who

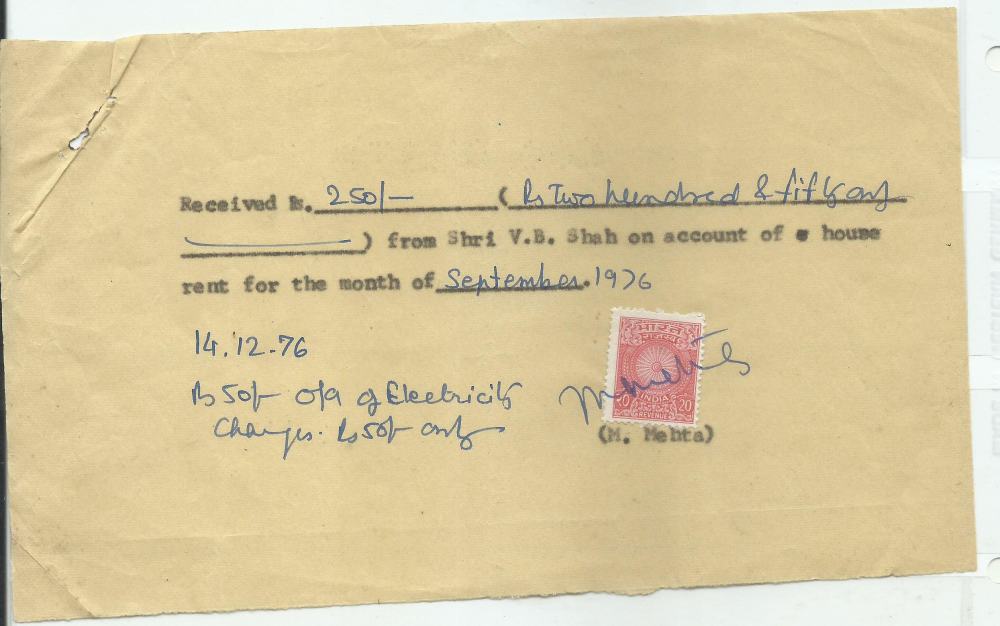

Rent Receipts With Revenue Stamps Its Role In Claiming HRA Tax Benefits

Tax Relief For Working From Home Bell Tindle Williamson

Ways You Can Get Business Tax Reliefs Vdio Magazine 2023

Ways You Can Get Business Tax Reliefs Vdio Magazine 2023

Basic Income Tax Reliefs Elver Consultancy Chartered Accountants Wigan

UK Pension Tax Relief Explained 2022 23 Lomond Wealth

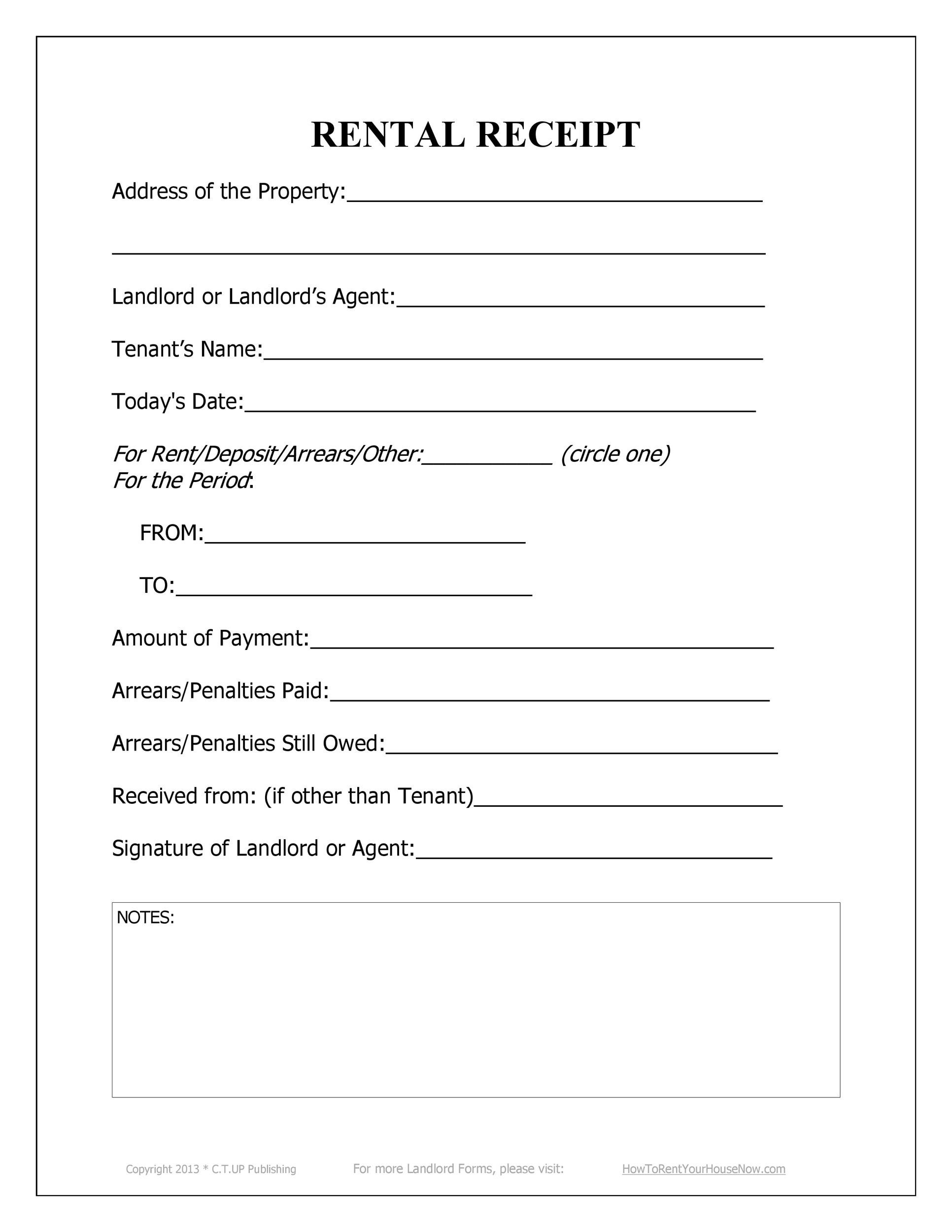

Free Printable Rent Receipt Free Printable 49 Printable Rent Receipts

Tax Relief On House Rent - To lower your taxable income you re allowed to deduct your expenses from your rental income so you only pay tax on your profits What if I m a live in landlord If you only rent