Tax Relief On Insurance Policies Life insurance payouts are made tax free to beneficiaries But there are times when money from a policy is taxable especially if you re accessing cash value in your own policy Here s how

Life insurance premiums are not usually tax deductible You may however be able to deduct them as a business expense if you are not directly or indirectly a beneficiary of the policy Life insurance policies offer maturity death benefits and tax deductions under Section 80C and Section 10 10D of the Income Tax Act of 1961 The tax deductions provided under both the sections for life insurance policy are provided below

Tax Relief On Insurance Policies

Tax Relief On Insurance Policies

https://hosttools.com/wp-content/uploads/insurance-policy-2021-04-06-04-10-11-utc.jpg

Claiming Tax Relief On Personal Contributions

https://s3.studylib.net/store/data/008863819_1-2f6094913014d745c3da18091a1e8c10-768x994.png

Life And Accident Insurance Transit Employees Health And Welfare

https://tehw.org/wp-content/uploads/2022/09/Insurance-Policy.jpg

This guide explains gains on foreign life insurance policies It covers the types of policies whose gain it is how to make entries on your tax return how to calculate the gain Life insurance payouts are usually tax free If your policy s payout causes your estate s worth to exceed 13 61 million your heirs might be charged estate taxes Your beneficiaries might pay

Life Insurance Relief is given to individuals who paid annual insurance premiums on their own life insurance policies On this page Qualifying for relief Amount of relief How to claim FAQs Qualifying for relief To claim Life Insurance Relief for the Year of Assessment YA 2024 you must satisfy all these conditions The profits from the surrender of certain life insurance policies are treated as savings income rather than capital gains and taxed last after all other income ie top sliced in the income tax computation

Download Tax Relief On Insurance Policies

More picture related to Tax Relief On Insurance Policies

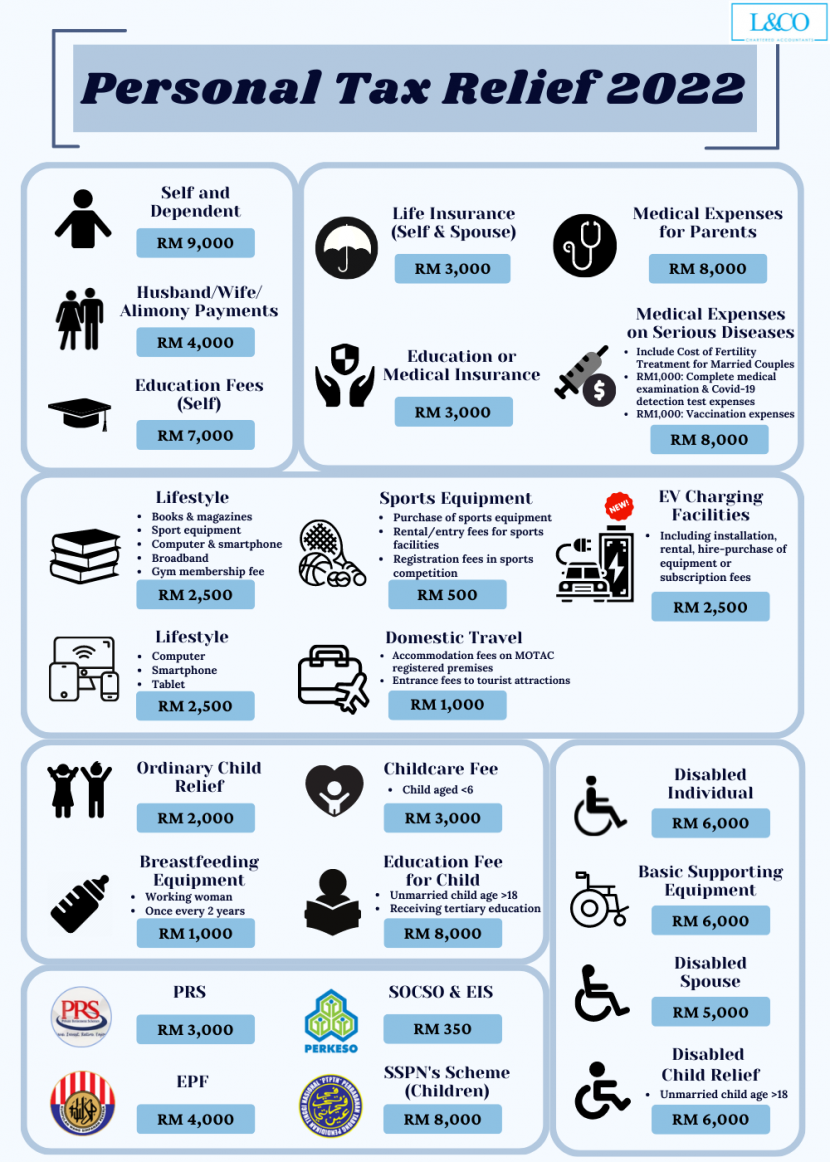

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/3-3-1024x1024.png

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

Direct Tax Relief On LinkedIn Direct Tax Relief Confidential

https://media.licdn.com/dms/image/D5618AQGLEC5iEoohYg/companyUpdate-article-image-shrink_1280/0/1657839917937/IRSProblemsjpg?e=2147483647&v=beta&t=0y3ohXTeQR5SlirhQ6oD3DVi6QNW7yu_4i6zH1r_Ngw

Typically speaking if you re the beneficiary of a life insurance policy you probably won t owe any taxes on the death benefit aka payout But there are a few times when taxes creep in We ll explain each scenario for both taxable and untaxable cases in detail below Life Insurance Tax Types You Need to Know Personal and insurance reliefs form part of tax reliefs in Kenya These incentives reduce the amount of tax one has to pay and are granted on a monthly basis Personal relief is the amount deducted by a resident person from tax payable by him It acts as a credit against a tax liability

This interview will help you determine if the life insurance proceeds received are taxable or nontaxable Information you ll need If you are the policy holder who surrendered the life insurance policy for cash if the amount you received is more than the cost of the policy If you are the beneficiary This gist summarizes guidelines issued by CBDT on tax exemption for high premium life insurance policies other than ULIPs pursuant to Budget 2023 amendments

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

Tax Relief Matters Abacus Advice

https://www.aaltd.co.uk/blog/wp-content/uploads/2023/07/taxre.jpg

https://www.forbes.com/advisor/life-insurance/is...

Life insurance payouts are made tax free to beneficiaries But there are times when money from a policy is taxable especially if you re accessing cash value in your own policy Here s how

https://www.investopedia.com/articles/personal...

Life insurance premiums are not usually tax deductible You may however be able to deduct them as a business expense if you are not directly or indirectly a beneficiary of the policy

Remote Workers Get Average Of Just 26 Tax Relief On Costs Business Post

Tax Relief For Working From Home During The Pandemic Here s How To

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

Computer Tax Relief Fresh Mango Technologies UK

Can I Get Tax Relief On Pension Contributions Financial Advisers

Personal Tax Relief 2022 L Co Accountants

Personal Tax Relief 2022 L Co Accountants

Will I Lose Pension Tax Relief When I Turn 75 I Still Run A Business

Claiming Tax Relief On Pension Contributions Thompson Taraz Rand

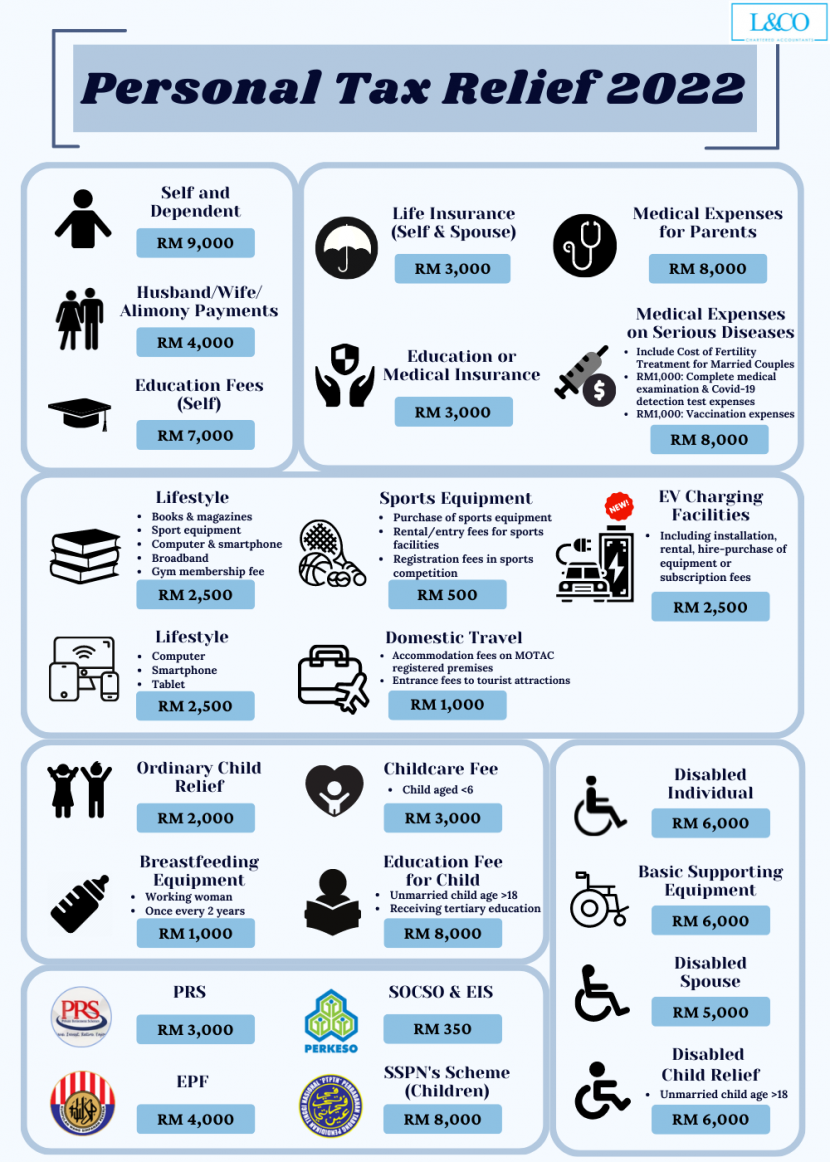

What Is Excess Liability Insurance Embroker

Tax Relief On Insurance Policies - This guide explains gains on foreign life insurance policies It covers the types of policies whose gain it is how to make entries on your tax return how to calculate the gain