Tax Relief On Interest Income Tax exempt interest is interest income that is not subject to federal income tax In some cases the amount of tax exempt interest a

Key Takeaways Various types of tax relief can help you lower your tax bill or settle tax related debts Tax deductions let you deduct certain expenses such as home mortgage interest The limit on Income Tax reliefs restricts the total amount of qualifying loan interest relief and certain other reliefs in each year to the greater of 50 000 and 25 of adjusted total

Tax Relief On Interest Income

Tax Relief On Interest Income

https://nepc.gov.ng/cms/wp-content/uploads/2022/05/tax-interest.jpg

Are You Entitled To Claim Flat Rate Expenses DSR Tax Refunds Ltd

https://www.tax-refunds.co.uk/wp-content/uploads/2021/06/Flat-Rate-Expenses-1536x1030.jpg

Income Tax Relief Programs Services USA Tax Settlement

http://usataxsettlement.com/wp-content/uploads/2021/01/Tax-Relief.jpeg

Tax treatment of interest income and interest expense Back to Advanced Taxation ATX How to approach Advanced Taxation Relevant to ATX MYS This article is relevant to You pay tax on any interest over your allowances at your usual rate of income tax 20 40 or 45 Scottish income tax rates do not apply to savings and dividend income When HMRC calculates the tax you owe

JW Josh Wilson Senior researcher writer In this article What is tax relief Tax relief for job expenses Tax relief on pension contributions Tax relief on charitable donations Tax relief that Home Tax on savings and investments From 6 January 2024 the main rate of class 1 National Insurance contributions NIC deducted from employees wages is

Download Tax Relief On Interest Income

More picture related to Tax Relief On Interest Income

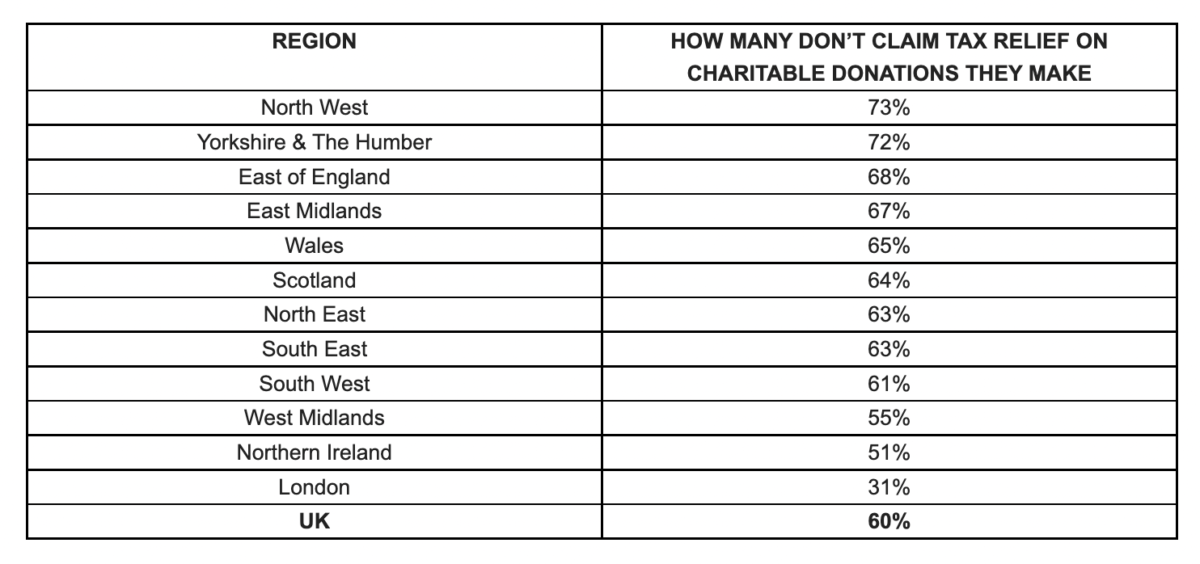

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

https://stedswm.co.uk/wp-content/uploads/2022/05/image001.png

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

If you earned interest income from money held at a bank or other financial institution you should expect to receive a 1099 INT from anyone who paid you that With most savings accounts you pay tax on interest over 1 000 if you are a basic rate taxpayer earning more than 12 570 and 500 if you re a higher rate payer i e if you earn

You can claim tax relief on loan interest payments for the purchase or extension of your main residence purchase or extension of a commercially let property purchase of Tax free savings the starting savings rate Helen Saxon Updated 4 May 2023 If you earn less than 18 570 a year from income and savings interest then all your savings

Income Tax Relief 4 Things You Must Do Now Before Year End

https://www.sgmoneymatters.com/wp-content/uploads/2015/12/tips-for-more-income-tax-relief.jpg

Landlords Restriction Of Tax Relief On Interest GBM Accounts

https://gbmaccounts.co.uk/wp-content/uploads/2016/12/buy-to-let-landlords-tax-relief-on-interest.jpg

https://www.investopedia.com/.../taxex…

Tax exempt interest is interest income that is not subject to federal income tax In some cases the amount of tax exempt interest a

https://www.investopedia.com/terms/t/t…

Key Takeaways Various types of tax relief can help you lower your tax bill or settle tax related debts Tax deductions let you deduct certain expenses such as home mortgage interest

Malaysia Income Tax Here Are The Tax Reliefs To Claim For YA 2022

Income Tax Relief 4 Things You Must Do Now Before Year End

Time To End Pension Tax Relief Inequality Business In The News

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Company Income Tax Malaysia Jacob Berry

Learn How To Generate Tax Debt Relief Leads At Broker Calls

Learn How To Generate Tax Debt Relief Leads At Broker Calls

How To Claim Higher Rate Tax Relief On Pension Contributions

Tax relief RateMuse

Tax Relief On Pension Contributions TN Accountancy Accountants

Tax Relief On Interest Income - You pay tax on any interest over your allowances at your usual rate of income tax 20 40 or 45 Scottish income tax rates do not apply to savings and dividend income When HMRC calculates the tax you owe