Tax Relief On Interest Payments Buy To Let Learn how the basic rate tax reduction for finance costs is calculated and applied to your rental income from 2017 to 2021 See examples of how the restriction

Letting Relief can greatly reduce the amount of Capital Gains Tax you pay when you sell a buy to let You can make up to 40 000 in tax free gains To qualify for Letting Relief currently you must share Landlords with buy to let properties can breathe a sigh of relief albeit a small one as they are entitled to a 20 tax credit on their mortgage payments This means that for every 9 000 spent on interest

Tax Relief On Interest Payments Buy To Let

Tax Relief On Interest Payments Buy To Let

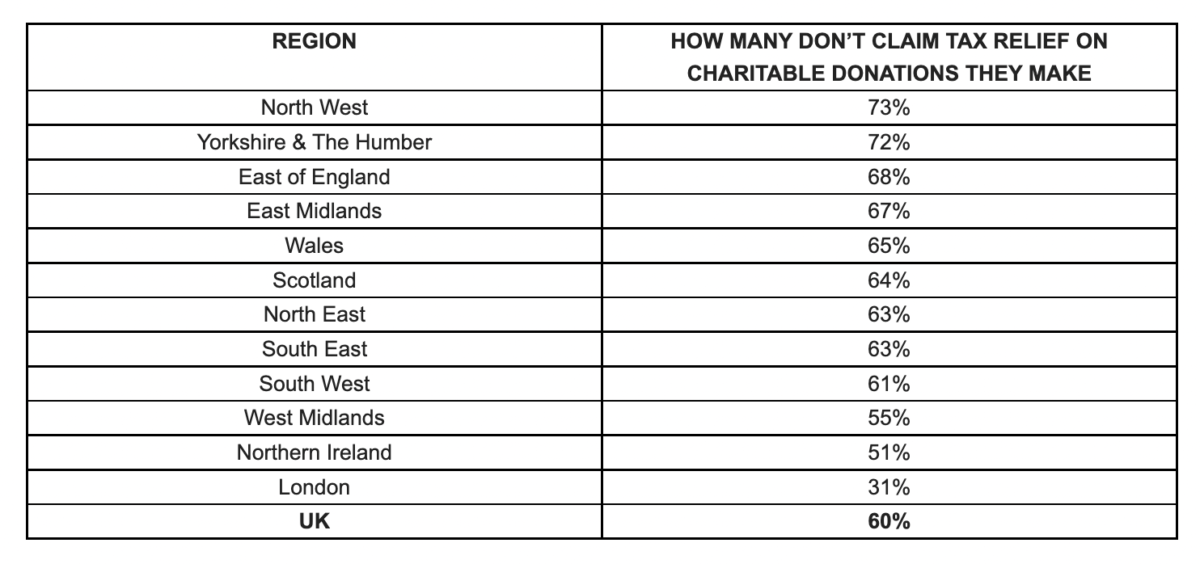

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

Everything You Need To Know About IRS Tax Help Services Hardluckcastle

https://anthemtaxservices.com/wp-content/uploads/2019/08/tax-debt-relief-1.jpg

Major Debt Relief Options To Cushion Debt Tricky Finance

https://www.trickyfinance.com/wp-content/uploads/2021/01/debt-relief.jpg

Learn how to work out your rental income and taxable profits if you let property in the UK Find out about allowable expenses changes to tax relief for One key benefit is full tax relief on mortgage interest payments Unlike owning a buy to let property personally a limited company can claim the entire amount

Announced in 2015 and coming into full force in April 2020 Section 24 of the Finance Act 2015 restricts all income tax relief on property finance costs to the basic rate of 20 This represents a drastic Learn about the taxes that apply to buy to let property including stamp duty capital gains mortgage interest relief and more Find out how to declare rental income claim allowable expenses and

Download Tax Relief On Interest Payments Buy To Let

More picture related to Tax Relief On Interest Payments Buy To Let

How Do I Qualify For Relief On Past Due Taxes

https://ayarlaw.com/new-site/wp-content/uploads/2020/11/tax-debt-relief.jpg

NEPC Staff Mentorship And Development Programme NEPC

https://nepc.gov.ng/cms/wp-content/uploads/2022/05/tax-interest.jpg

Can I Get Tax Relief On Pension Contributions Financial Advisers

https://www.insightifa.com/wp-content/uploads/2022/12/Tax-Relief-On-Pensions.jpg

Learn how the tax system for buy to let landlords changed in 2020 and how it affects your income and profit Compare the old interim and new rules and find out how to lower The tax relief that landlords of residential properties get for finance costs will be restricted to the basic rate of Income Tax this will be phased in from April 2017

Many landlords are now paying increased mortgage interest payments and a higher tax bill due to the changes in buy to let tax relief The changes in tax relief also Learn how the tax rules for buy to let mortgages have changed since 2017 and how they will affect your tax bill Find out how to calculate your tax credit compare different

Tax Debt Relief Your Options Keep Asking

https://cdn.keepasking.com/keepasking/wp-content/uploads/2021/01/tax-debt-relief-your-options-scaled.jpg

Tax Relief On Interest Costs

https://media.licdn.com/dms/image/C4E12AQGFLSJD5vEFIA/article-cover_image-shrink_600_2000/0/1520176684448?e=2147483647&v=beta&t=mesmXYMMsasI4bfUPjcaScPBlxHLG4zDxeXx31loq78

https://www.gov.uk/guidance/changes-to-tax-relief...

Learn how the basic rate tax reduction for finance costs is calculated and applied to your rental income from 2017 to 2021 See examples of how the restriction

https://www.charcol.co.uk/guides/buy-to-le…

Letting Relief can greatly reduce the amount of Capital Gains Tax you pay when you sell a buy to let You can make up to 40 000 in tax free gains To qualify for Letting Relief currently you must share

State specific Disaster Relief Payments May Not Need To Be Claimed On

Tax Debt Relief Your Options Keep Asking

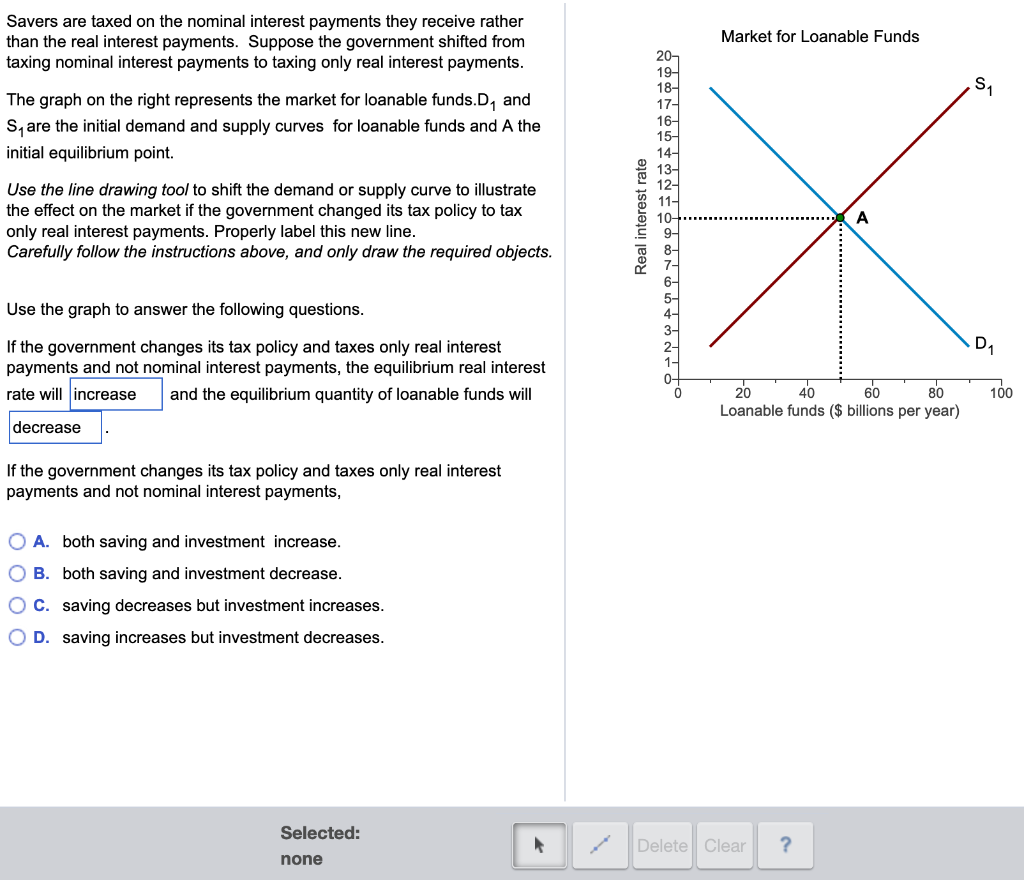

Solved Savers Are Taxed On The Nominal Interest Payments Chegg

Buy to let Rates Set To Rise CJ Hole

12 Reasons To Speak To A Tax Relief Specialist About Your Back Taxes

IRS Tax Debt Relief 9 Ways To Settle Your Tax Debts Tax Relief

IRS Tax Debt Relief 9 Ways To Settle Your Tax Debts Tax Relief

Take Over Payments Contract PDF Form Fill Out And Sign Printable PDF

Interest Only Tax Relief On Interest Only Buy To Let

Compare Home Mortgage Interest Rates By Decade INFOGRAPHIC Denver

Tax Relief On Interest Payments Buy To Let - From 6 th April 2020 interest will not be an allowable expense in computing the profits of the rental business but will instead attract tax relief at 20 Basic rate