Tax Relief On Loan Interest Buy To Let Tax relief is available for interest on loans where the borrowed money is used for certain specific purposes You can also claim relief for alternative finance payments paid on a

Landlords with buy to let properties can breathe a sigh of relief albeit a small one as they are entitled to a 20 tax credit on their mortgage payments This means that for every 9 000 spent on interest a landlord can Letting Relief can greatly reduce the amount of Capital Gains Tax you pay when you sell a buy to let You can make up to 40 000 in tax free gains To qualify for Letting Relief currently you must share an occupancy

Tax Relief On Loan Interest Buy To Let

Tax Relief On Loan Interest Buy To Let

https://asianjournal.ca/wp-content/uploads/2022/10/selina_robinson_large-scaled.jpg

How To Get Tax Relief On Loan Interest For Residential Rental Property

https://i.ytimg.com/vi/jKCrZMd5qkc/maxresdefault.jpg

Home Loan Interest Double Tax Deduction Benefit Removed In Budget 2023

https://freefincal.com/wp-content/uploads/2023/02/Home-Loan-interest-double-tax-deduction-benefit-removed-in-budget-2023.jpg

Interest rates are at a 14 year high and landlords are paying a lot more on their buy to let mortgages so how can they get tax relief for the interest which is unrelievable in the current year Since 2020 21 individual landlords The buy to let mortgage interest tax relief often referred to as mortgage interest tax relief is a tax credit available to landlords This relief allows landlords to reduce their tax liability based on a specified amount

If you increase your mortgage loan on your buy to let property you may be able to treat interest on the additional loan as a revenue expense or get relief against Income Tax as long Landlords with buy to let mortgages can now no longer deduct mortgage interest from rental income to lower their tax bill at the end of the year Instead they now have to pay full tax on any money earned this way

Download Tax Relief On Loan Interest Buy To Let

More picture related to Tax Relief On Loan Interest Buy To Let

Understanding Buy to Let MORTGAGES In Simple Terms YouTube

https://i.ytimg.com/vi/ZvasGXP8QIw/maxresdefault.jpg

Budget 2023 R D Tax Relief Changes News YesTax

https://yes.tax/storage/news/1678966611-Mark Wood 1366x911px.jpg

Tax Relief On Job Expenses For Employees YouTube

https://i.ytimg.com/vi/yv3gOJ2997A/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGHIgRSg9MA8=&rs=AOn4CLC7Bimq3lrQQXKwLa2uk_pg_o_djg

From April 2020 relief for mortgage interest and other finance costs on residential property is restricted to the basic rate of Income Tax 20 This change was phased in over three years from April 2017 It means that For tax years 2017 18 to 2019 20 there are restrictions on the extent to which interest and other finance costs payable on loans to buy residential let properties may be deducted in

What is buy to let mortgage interest tax relief The way landlords must declare their rental income has changed resulting in many facing higher tax bills While borrowing money through a buy to let mortgage was once a major tax advantage it s no longer the case What is buy to let mortgage interest tax relief The way landlords must declare their rental income has changed resulting in many facing higher tax bills While borrowing money through a buy to let mortgage was once a major tax advantage it s no longer the case

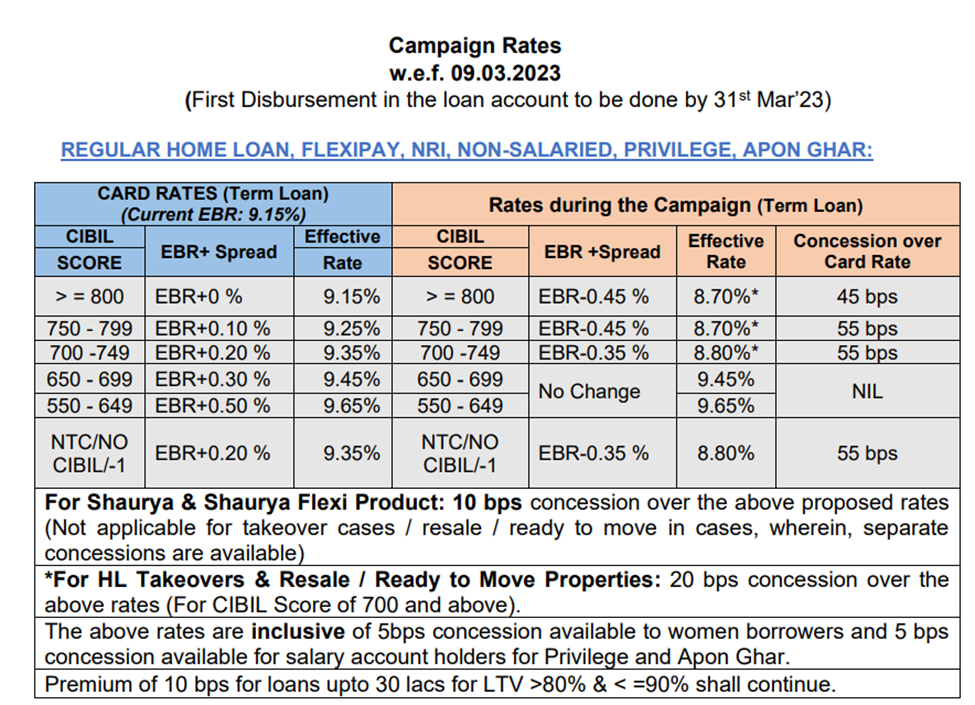

SBI Reduces Home Loan Interest Rates For Those With Good CIBIL Scores

https://emicalculator.net/wp-content/uploads/sbi-home-loan-interest-rates.png?x70551

How Good Is The Tax Relief On Pensions YouTube

https://i.ytimg.com/vi/tWo2CmhQjIU/maxresdefault.jpg

https://www.gov.uk › government › publications › interest...

Tax relief is available for interest on loans where the borrowed money is used for certain specific purposes You can also claim relief for alternative finance payments paid on a

https://www.moneysupermarket.com › lan…

Landlords with buy to let properties can breathe a sigh of relief albeit a small one as they are entitled to a 20 tax credit on their mortgage payments This means that for every 9 000 spent on interest a landlord can

Personal Tax Relief 2022 L Co Accountants

SBI Reduces Home Loan Interest Rates For Those With Good CIBIL Scores

Direct Tax Relief On LinkedIn Direct Tax Relief Confidential

5 Steps To Create A Budget Carl Summers Financial Services

Tax Relief On The Way For About 1 8 Million New Yorkers YouTube

Tax Relief Matters Abacus Advice

Tax Relief Matters Abacus Advice

How To Maximise Tax Relief When Completing A Refurbishment

Build To Rent Vs Buy To Let Could One Replace The Other

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Tax Relief On Loan Interest Buy To Let - The buy to let mortgage interest tax relief often referred to as mortgage interest tax relief is a tax credit available to landlords This relief allows landlords to reduce their tax liability based on a specified amount