Tax Relief On Medical Insurance Ireland If you have health insurance you can get tax relief on the premium you pay to an approved insurer You do not need to claim the relief it is given as a

Your employer might pay medical insurance to an authorised insurer for you or your dependents as a Benefit in Kind If so you can claim tax relief from You pay your employee s medical insurance policy of 800 1 000 less tax relief of 200 You must deduct Income Tax PRSI and USC on the gross amount

Tax Relief On Medical Insurance Ireland

Tax Relief On Medical Insurance Ireland

https://www.wealthandfinance-news.com/wp-content/uploads/2019/03/tax-relief.png

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/3-3-1024x1024.png

Tax Relief On Donations To Charity Part 1 YouTube

https://i.ytimg.com/vi/4xFqSodsok4/maxresdefault.jpg

Claim Medical Insurance Tax Relief if your employers pays your health insurnace on your behalf 200 tax back for each adult on the policy The good news is that yes tax relief is available on private health insurance premiums and has been for many years This relief is not related to whether you have

Discover how to claim tax relief on medical and dental expenses in Ireland Learn about eligible expenses procedures and benefits Don t miss out on potential tax refunds The tax relief available is at the standard rate of tax currently 20 If your employer paid 1 000 of Medical Insurance for you and your family Therefore you will be entitled to a

Download Tax Relief On Medical Insurance Ireland

More picture related to Tax Relief On Medical Insurance Ireland

Tax relief

https://renovateme.co.uk/blog/wp-content/uploads/tax-relief-1024x657.jpg

Malaysia Personal Income Tax Relief 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjM81nSzJ2QiCATWboDACN2BpfNmw-0Wf5BApuHi91cjON32r6XUxhruNbA8f0o3K_H_4oIf1B4xQE6D0tInpJ7fFjXuaqCtw3-786N9ouUQ8nKcW7kxtIy0bZOmw2wXtBmRb63A-pQjcxK9mCdSvqTGiUvUxaePn9JkzlCVQKv7Gj0EukB_pdXpC10/s1585/Individual_Tax_Relief_2021.jpg

Can I Get Tax Relief On Pension Contributions Financial Advisers

https://www.insightifa.com/wp-content/uploads/2022/12/Tax-Relief-On-Pensions.jpg

How can I claim tax relief in respect of Health Expenses You may claim the tax relief by claiming online via Revenue s PAYE anytime service by completing Form Med 1 TRS stands for Tax Relief at Source Since 2014 those who had private medical insurance had 20 tax deducted from their full Gross Premium by their private medical

You can claim tax relief on expenses related to your treatment including telephone electricity laundry and medical appliance costs Plus get tax relief for private car You may only claim for expenses that you have receipts for and you can claim relief on the last four year s health expenses You can download an Annual Tax Relief Statement of

Quick Guide To Tax Relief On Research And Development Interface Online

https://interface-online.org.uk/wp-content/uploads/2022/09/Quick-guide-to-tax-relief-on-research-and-development.png

Tax Relief On Replacement Of Domestic Items ECOVIS

https://www.ecovis.co.uk/wp-content/uploads/2022/07/e2252eab-bacc-49d2-9b7b-4427c298b473.jpg

https://www.citizensinformation.ie/en/money-and...

If you have health insurance you can get tax relief on the premium you pay to an approved insurer You do not need to claim the relief it is given as a

https://www.revenue.ie/.../illness-and-injury/medical-insurance.aspx

Your employer might pay medical insurance to an authorised insurer for you or your dependents as a Benefit in Kind If so you can claim tax relief from

Tax Relief In The UK

Quick Guide To Tax Relief On Research And Development Interface Online

Tax Relief On Private Treatment Orthodontic Society Of Ireland

Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical

How To Claim Tax Relief On Pension Contributions Ireland Retire Gen Z

Annual Multitrip Travel Insurance Ireland Compare Cheap Quotes

Annual Multitrip Travel Insurance Ireland Compare Cheap Quotes

How To Get Tax Relief On Bad Debt CHW Accounting

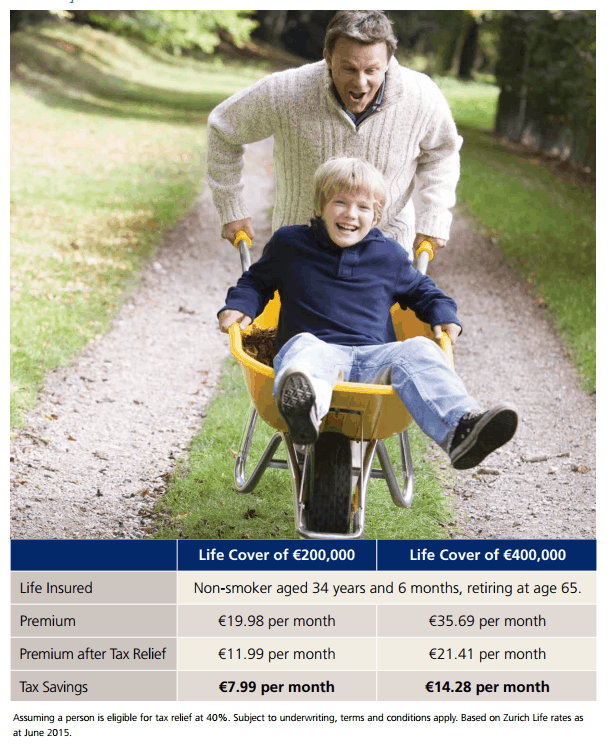

Tax Relief On Life Insurance Premiums OneLife Insurance

Tax Relief On Pension Contributions 20 40 Profit Right Away All

Tax Relief On Medical Insurance Ireland - Claim Medical Insurance Tax Relief if your employers pays your health insurnace on your behalf 200 tax back for each adult on the policy