Tax Relief On Medical Insurance Paid By Employer Ireland Verkko Your employer might pay medical insurance to an authorised insurer for you or your dependents as a Benefit in Kind If so you can claim tax relief from Revenue for the

Verkko Since the employee has not benefited from the TRS on the medical insurance premium paid by his or her employer he or she is entitled to tax relief as follows PAYE Verkko 28 huhtik 2015 nbsp 0183 32 Medical insurance providers calculate the amount of medical insurance eligible for tax relief paid by the employer based on the number of

Tax Relief On Medical Insurance Paid By Employer Ireland

Tax Relief On Medical Insurance Paid By Employer Ireland

https://www.tax-refunds.co.uk/wp-content/uploads/2021/06/Flat-Rate-Expenses-1536x1030.jpg

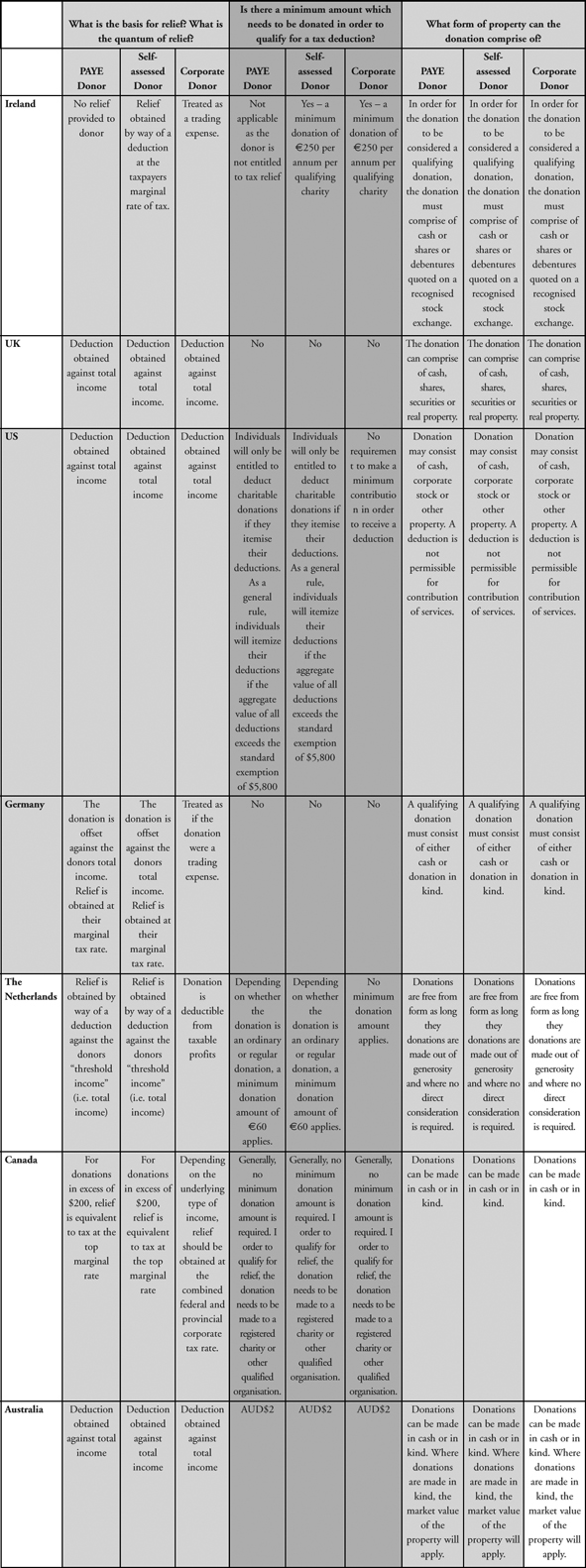

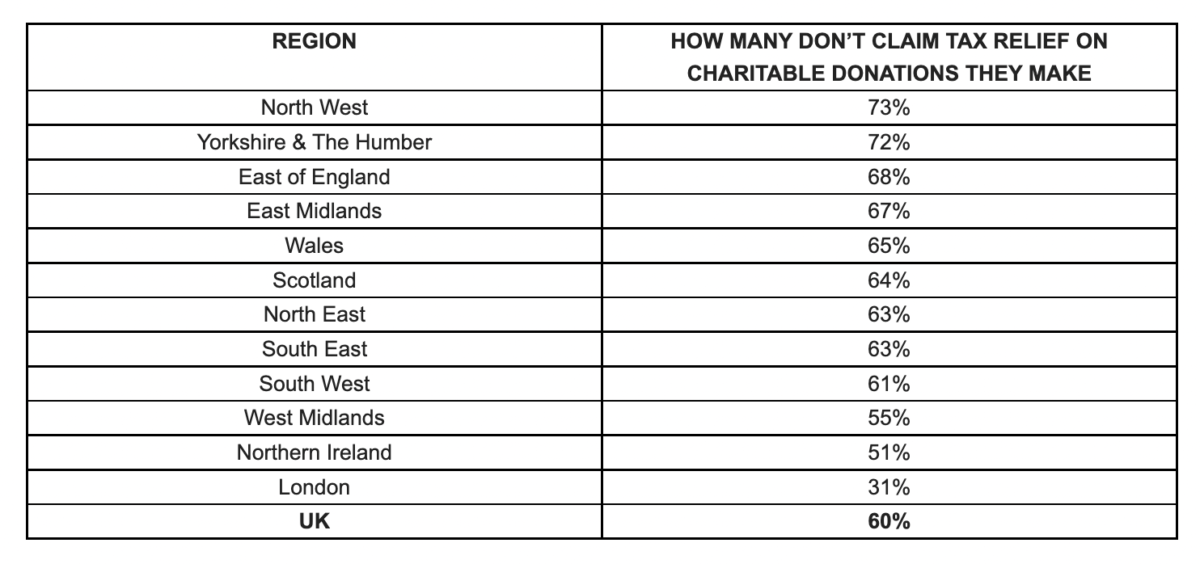

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

Verkko Medical insurance Employers can pay medical insurance to an approved insurer on behalf of employees and their family The employee is subject to tax as a BIK on the Verkko Tax relief continues to be granted at 20 on the amount eligible for tax relief Medical Insurance Premiums paid by Employer Where an employer pays medical

Verkko Employers are free to grant additional leave days above the statutory requirements Maternity leave pay the salary received is fully taxable Sick leave pay the pay Verkko Where the employer is paying medical insurance on behalf of the employee this is treated as a Benefit In Kind The value of the BIK is equal to the gross premium payable for the employee Employees are

Download Tax Relief On Medical Insurance Paid By Employer Ireland

More picture related to Tax Relief On Medical Insurance Paid By Employer Ireland

Medical Insurance Paid By Employer Sanepo

https://sanepo.com/en/wp-content/uploads/2023/03/medical-insurance-paid-by-employer_075558ab3.jpg

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

https://stedswm.co.uk/wp-content/uploads/2022/05/image001.png

Tax Advisor For SEIS And EIS Tax Relief Gatwick Accountant

https://www.gatwickaccountant.com/wp-content/uploads/2022/07/accounting-and-record-keeping-for-small-business.png

Verkko 22 toukok 2023 nbsp 0183 32 employee individual policy holder who has personally paid for the policy Tax Relief at Source TRS was ignored for the purposes of the below The Verkko 16 toukok 2023 nbsp 0183 32 For health insurance paid for by the employer the Bik value is calculated as 2 of the cost of the health insurance policy to the employer This

Verkko Portion of premium paid by employer 75 2 250 Tax relief granted to employer 2 600 x 75 x 20 390 Net payment made by employer 1 860 Employer Verkko You must claim tax relief within the 4 years following the year in which you paid for the healthcare Tax relief is also available for premiums paid for health insurance This

How To Get Tax Relief On Your Pension Contribution YouTube

https://i.ytimg.com/vi/899ustNwhCQ/maxresdefault.jpg

Tax Relief On Charitable Donations

https://www.charteredaccountants.ie/taxsourcetotal/taxpoint/images/images_TAXP042012_F0001.jpg

https://www.revenue.ie/.../illness-and-injury/medical-insurance.aspx

Verkko Your employer might pay medical insurance to an authorised insurer for you or your dependents as a Benefit in Kind If so you can claim tax relief from Revenue for the

https://www.revenue.ie/en/tax-professionals/tdm/income-ta…

Verkko Since the employee has not benefited from the TRS on the medical insurance premium paid by his or her employer he or she is entitled to tax relief as follows PAYE

Time To End Pension Tax Relief Inequality Business In The News

How To Get Tax Relief On Your Pension Contribution YouTube

How To Claim Higher Rate Tax Relief On Pension Contributions

Malaysia Income Tax Here Are The Tax Reliefs To Claim For YA 2022

Hoeveel Betaalt Een Werkgever Aan Loonbelasting Loonbelasting UAC Blog

Personal Tax Relief 2021 L Co Accountants

Personal Tax Relief 2021 L Co Accountants

Tax Relief On Home Help Comfort Keepers

Do You Get Tax Relief On A Salary Sacrifice Pension Husky Finance

Tax Relief For Working From Home Bell Tindle Williamson

Tax Relief On Medical Insurance Paid By Employer Ireland - Verkko Employers are free to grant additional leave days above the statutory requirements Maternity leave pay the salary received is fully taxable Sick leave pay the pay