Tax Relief On Used Electric Cars Uk For Self Employed From 1 April 2025 drivers of electric and low emission cars vans and motorcycles will need to pay vehicle tax in the same way as drivers of petrol and diesel vehicles

Explore 2024 s tax relief options for UK self employed individuals buying electric cars including benefits and eligibility details Check whether you need to pay tax on an electric car used by your employee and find out if your employee is eligible for tax relief

Tax Relief On Used Electric Cars Uk For Self Employed

Tax Relief On Used Electric Cars Uk For Self Employed

https://i0.wp.com/www.employementform.com/wp-content/uploads/2022/10/self-employed-canada-tax-form.png

Learning Insurance Options For The Self Employed

https://www.inshura.com/wp-content/uploads/2022/10/self-employed.jpg

Electric Cars Used Cars Cars For Sale Derby Vans Sold Vehicles

https://i.pinimg.com/originals/33/5e/4f/335e4fc9e71cbba900497b2921064ff9.jpg

Businesses that invest in electric vehicles with zero emissions benefit from enhanced capital allowances From 1st April 2021 businesses purchasing new cars with 0g km CO2 emissions can claim 100 First Year Allowance FYA The purchase of a used electric car won t be eligible for FYA The HMRC Her Majesty s Revenue and Customs provides several allowances for electric cars The ECA scheme allows businesses to claim 100 capital allowances on new electric cars while the Annual Investment Allowance AIA allows tax relief on the cost of used electric cars over a longer period

Tax relief on electric cars in the UK for the self employed can offer significant benefits However it is essential to understand what cars qualify For new and unused electric cars or those with zero CO2 emissions the entire cost can be deducted from your taxable profits in the year you make the purchase With fully electric cars there is full tax relief up front but some of this is clawed back on sale For tax relief to be available The new electric car must be unused brand new The car must be fully electric 0g km CO2 Where these apply Tax relief is given as a 100 first year allowance at the business use percentage in year 1

Download Tax Relief On Used Electric Cars Uk For Self Employed

More picture related to Tax Relief On Used Electric Cars Uk For Self Employed

6 Best Accounting Software For Self Employed My Top Picks 2023

https://stewartgauld.com/wp-content/uploads/2023/05/6-Best-Accounting-Software-for-Self-Employed-in-2023.jpg

Mortgages For Self Employed The Mortgage Stop

https://themortgagestop.co.uk/wp-content/uploads/2022/06/The-Mortgage-Stop-Mortgages-for-Self-Employed_1000.jpg

9 Best Accounting Software For Self Employed In 2023

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg0CEBldalqY7FCdTEdVOOXwCJwbaHIWETPVZRYjPqO0ws-7VJQP2q5xVOI2doEaSxzHb_J0TV3Ik6y91T3AxZ4yB4bhIEGiSXnbviBJkTUASjLhMsZPGbkbs9AfRnIwIx_zQUhlKrxk3rtweJmXxrIsnBbU7olEZCVF9ChE15HcNqXz2gIU2HGvb5yQg/s899/9 Best Accounting Software for Self-Employed.jpg

What is a self employed capital allowance What can be claimed under the capital allowance What can t you claim for How much is the self employed annual investment allowance Self employed writing down capital allowances Using capital allowances for business cars Need help with your tax return You can get tax relief up to 100 of the cost of the vehicle in the year you buy it After that you continue to get a benefit in kind charge of only around 2 per year compared to up to 37 for non electric vehicles

When your employer reimburses you for the cost of electricity used to charge a company vehicle at home this is treated as taxable earnings However you can claim tax relief for business miles travelled Self Employed Tax Relief for Capital Allowances excluding charging point in the first year for higher rate taxpayer with 20 Private use 7 120 income tax saving and 578 50 Class 4 NIC saved

Life Insurance For The Self Employed Daniel Wealth Management

https://static.fmgsuite.com/media/ContentFMG/variantSize/72eb1151-0a01-42a7-ad73-22598db316d0.png?v=1

Understanding Vehicle Expenses For Self employed LMC Bookkeeping

https://www.lmcbookkeeping.co.uk/wp-content/uploads/2021/09/Understanding-vehicle-expenses-for-self-employed.png

https://www.gov.uk/guidance/vehicle-tax-for...

From 1 April 2025 drivers of electric and low emission cars vans and motorcycles will need to pay vehicle tax in the same way as drivers of petrol and diesel vehicles

https://www.mytaxaccountant.co.uk/post/tax-relief-electric-cars

Explore 2024 s tax relief options for UK self employed individuals buying electric cars including benefits and eligibility details

Guide To File Taxes For Self Employed Forbes Advisor

Life Insurance For The Self Employed Daniel Wealth Management

Electric Cars More Popular Than Petrol And Diesel Cars Following Post

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

Personal Tax Relief 2022 L Co Accountants

Best Health Insurance For Self Employed Top Options HealthNews

Best Health Insurance For Self Employed Top Options HealthNews

Remote Workers Get Average Of Just 26 Tax Relief On Costs Business Post

Self Employed Blank Invoice Template Free Template

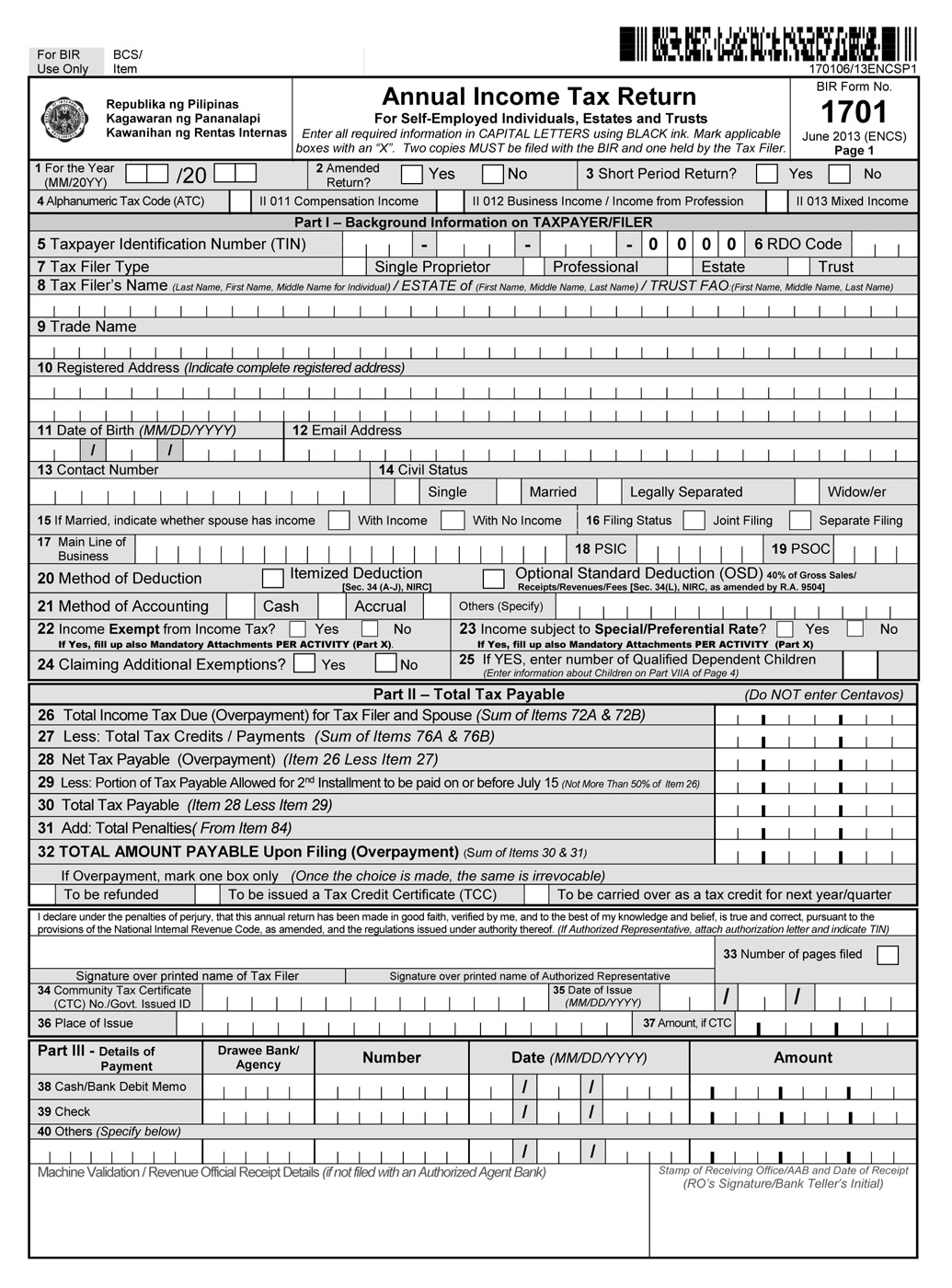

Itr Form For Self Employed Employment Form

Tax Relief On Used Electric Cars Uk For Self Employed - Tax relief on electric cars in the UK for the self employed can offer significant benefits However it is essential to understand what cars qualify For new and unused electric cars or those with zero CO2 emissions the entire cost can be deducted from your taxable profits in the year you make the purchase