Tax Relief Redundancy Payments If you receive a lump sum in compensation for the loss of employment part of it may be tax free The following payments are tax free The statutory redundancy lump sum A

When receiving redundancy payments tax can have a big impact on the amount you actually take home Learn how to reduce tax on a redundancy payment You may receive a lump sum payment on redundancy or retirement from your employer A lump sum payment on termination of employment may be exempt from tax or

Tax Relief Redundancy Payments

Tax Relief Redundancy Payments

https://s.yimg.com/uu/api/res/1.2/rZicfk33qd2AbvQtuxo4wA--~B/aD0xMDgwO3c9MTkyMDtzbT0xO2FwcGlkPXl0YWNoeW9u/https://media-mbst-pub-ue1.s3.amazonaws.com/creatr-uploaded-images/2020-08/ca6904c0-d77f-11ea-bfb3-3160aa51c6da

REDUNDANCY UK Tax Planning With Your Redundancy Payment YouTube

https://i.ytimg.com/vi/JDsHD1IDX6g/maxresdefault.jpg

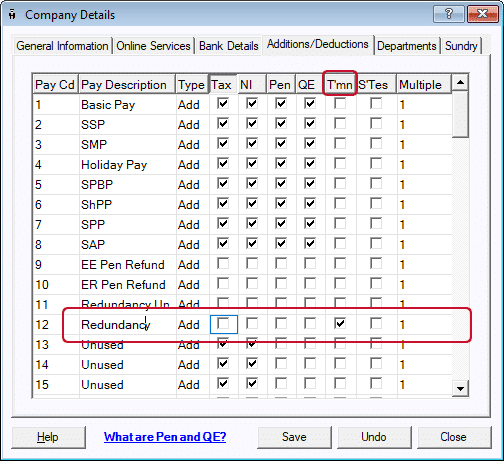

How To Process Redundancy Pay IRIS

https://www.iris.co.uk/wp-content/uploads/2020/03/PM-TermPym-1.png

Statutory redundancy pay under 30 000 is not taxable What you ll pay tax and National Insurance on depends on what s included in your termination payment Being made redundant Certain payments made to you on retirement or redundancy may attract beneficial tax treatment These payments include the following Statutory redundancy payments Pension lump sums Pension scheme refunds Ex gratia severance

A statutory redundancy payment is due where an employee is made redundant with at least 2 years service This includes an employee working under a fixed term contract agreed The first 30000 00 of the redundancy payment is tax free Anything over this sum is shown in box 5 of SA101 page Ai2 The guidance advises This includes redundancy

Download Tax Relief Redundancy Payments

More picture related to Tax Relief Redundancy Payments

Calculate An Employee s Redundancy Pay Business Law Donut

https://www.lawdonut.co.uk/sites/default/files/calculate-an-employees-redundancy-pay-431687821.jpg

How Redundancy Payments Will Be Affected By Tax FTAdviser

https://www.ft.com/__origami/service/image/v2/images/raw/https://s3-eu-west-1.amazonaws.com/fta-ez-prod/ez/images/7/5/4/7/2197457-5-eng-GB/employee+pallet.jpg%3Fv1?source=ftadviser

Tax And Redundancy Payments Financial Architects

https://financialarchitects.ie/wp-content/uploads/2022/10/tax-red-img-1024x645.png

Lump sum payments on a redundancy or retirement are eligible for special tax treatment and may be partially or totally exempt from income tax PRSI and USC Note A lump sum paid under Most payments from employers to employees are taxable but there is a special tax treatment for lump sum payments on a redundancy or retirement Statutory redundancy payments are exempt from tax There is

Tax relief on individual contributions is restricted to the higher of 3 600 or 100 of relevant UK earnings Can an individual pay the whole redundancy payment into their pension Tax relief on redundancy or retirement payments On a redundancy or retirement payment an employee may be entitled to the higher of Standard Capital Superannuation Benefit SCSB

Tax On Redundancy Payments TaxAssist Accountants

https://ta-support.nyc3.cdn.digitaloceanspaces.com/file-uploads/public/RtI9LLdS9gDKmkiFirEerg8YimQbcWIjeTscfC1s.jpg

Redundancy Payment Tips Should You Use Payments To Cover Debt Or Tax

https://cdn.images.express.co.uk/img/dynamic/23/590x/redundancies-commonplace-months-2020-1331803.jpg?r=1599316347956

https://www.citizensinformation.ie/en/employment/...

If you receive a lump sum in compensation for the loss of employment part of it may be tax free The following payments are tax free The statutory redundancy lump sum A

https://moneytothemasses.com/tax/tax-miti…

When receiving redundancy payments tax can have a big impact on the amount you actually take home Learn how to reduce tax on a redundancy payment

The Week In Tax Extra Relief For The Newly Unemployed Are Redundancy

Tax On Redundancy Payments TaxAssist Accountants

How Are Redundancy Payments Taxed Money Magazine

Redundancy And Tax Relief Aspire Wealth Management

Tax On Redundancy Payments TaxAssist Accountants

Redundancy Payments And Tax Simmons Livingstone Associates

Redundancy Payments And Tax Simmons Livingstone Associates

Redundancy Payments Deduction For Tax Institute Of Financial

What Tax Is Due On Redundancy Payments Paish Tooth

Redundancy Payments The Sneaky Tax You ll Face If You Lose Your Job

Tax Relief Redundancy Payments - A statutory redundancy payment is due where an employee is made redundant with at least 2 years service This includes an employee working under a fixed term contract agreed