Tax Relief Summary If you ve paid foreign tax on income received or capital gains made that are also taxable in the UK you may be able to claim relief for the foreign tax paid This helpsheet will

Chapter by chapter from Albania to Zimbabwe we summarize corporate tax systems in more than 150 jurisdictions The content is current as of 1 March 2024 with exceptions noted Keep up to date on significant tax developments As announced at Autumn Budget 2024 the government will introduce legislation in Finance Bill 2024 25 to increase the main rates of Capital Gains Tax CGT from 10 and

Tax Relief Summary

Tax Relief Summary

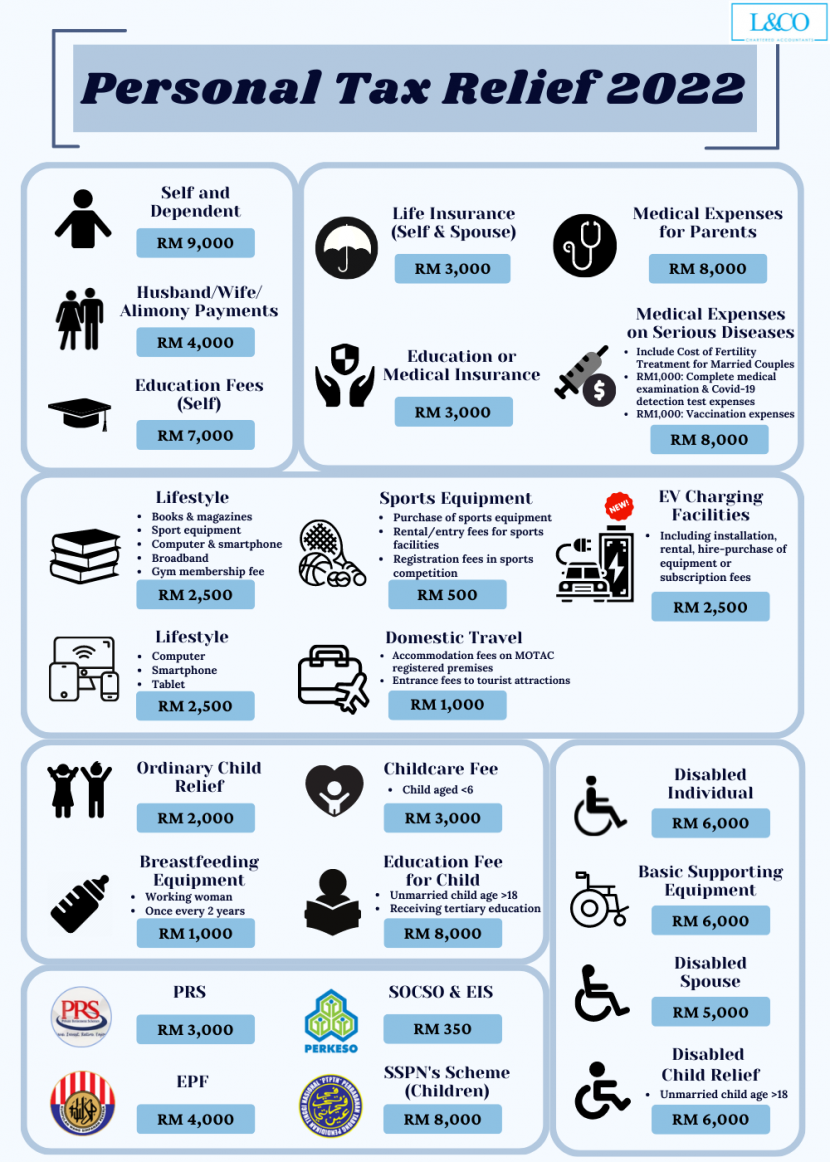

https://landco.my/wp-content/uploads/2023/07/Personal-Tax-Relief-2023-731x1024.png

COVID 19 Tax Relief Summary The Comic Accountant

https://thecomicaccountant.com/wp-content/uploads/2020/04/IRD-relief-1024x843.png

Tax Relief Overview Cumberland Law Group

https://cumberlandlawatlanta.com/wp-content/uploads/2023/06/Tax-Relief-Overview-min.jpeg

The double taxation treaty provides to direct investor companies an entitlement to a tax credit equal to half the tax credit to which a UK resident individual would be entitled and for UK residents are usually able to claim a credit for foreign taxes suffered on overseas income or gains that are taxable in the United Kingdom This is either under an

10 rowsThe treaty rate is the maximum rate at which the UK and Switzerland are permitted to tax income in the relevant categories under the treaty Rates chargeable under the domestic Summary of personal tax relief 2024 is here for you to do earlier preparation for your tax saving Quickly jot down and share to your friends Any changes is subjected to LHDN s announcement i Ordinary Child Relief ii

Download Tax Relief Summary

More picture related to Tax Relief Summary

Here s The Real Story On Tax Relief RateMuse

https://i0.wp.com/blog.ratemuse.com/wp-content/uploads/2019/10/tax_relief.png?fit=1200%2C978&ssl=1

Company Tax Relief 2023 Malaysia Printable Forms Free Online

https://ringgitplus.com/en/blog/wp-content/uploads/2022/03/income-tax_everything-you-should-claim_ya2021.jpg

R D Tax Relief In 2022 What You Need To Know

https://forrestbrown.co.uk/wp-content/uploads/2021/09/Stocksy_txp24f5e82ftaB300_Medium_3370983.jpg

Income tax relief is again given at 30 of the investment made and gains made on the investment are tax free In addition dividends from ordinary shares in VCTs are income Tax reliefs reduce the amount of tax payable by a person or company if they meet certain conditions There are over 1 000 tax reliefs in force in the UK tax system These reliefs

There are more than 1 000 tax reliefs in the UK Reliefs can help maintain the competitiveness of tax systems and governments can use tax reliefs as a mechanism to redistribute wealth This document is a short summary of the main changes in taxation once off payments cost of living supports supports for energy costs social welfare health housing

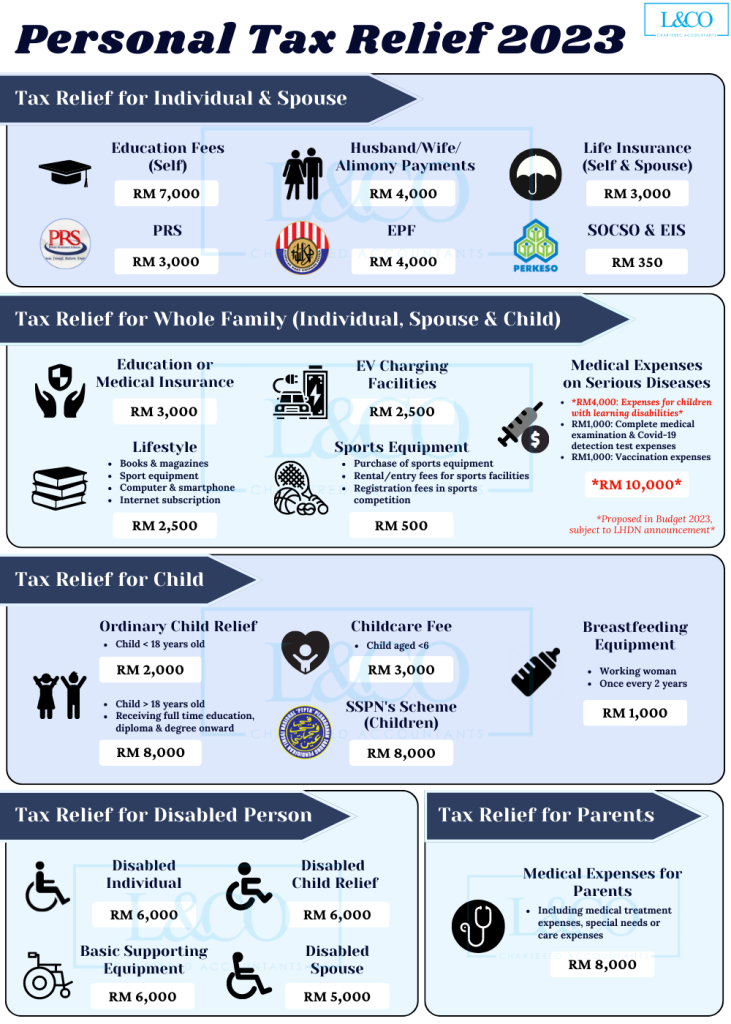

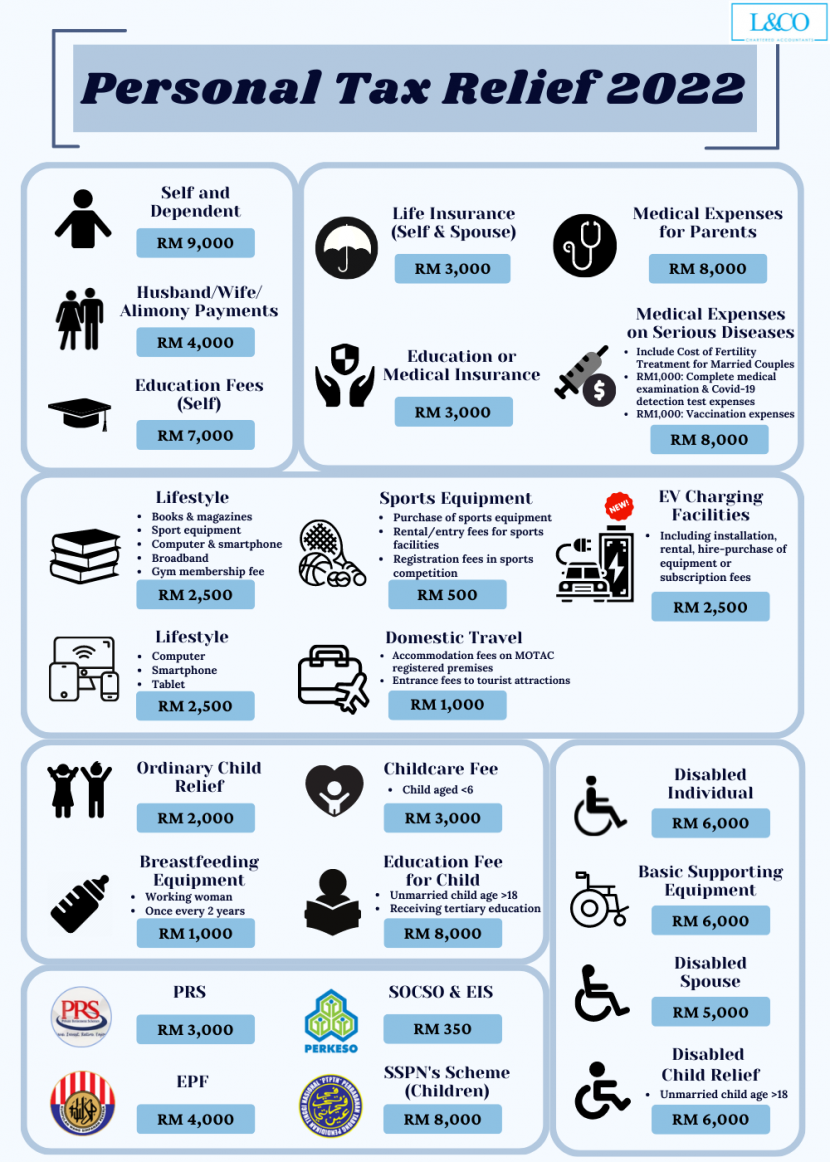

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/Personal-Tax-Relief-2022-1-830x1162.png

The IRS Expands Tax Relief Again Fennemore

https://www.fennemorelaw.com/wp-content/uploads/2021/08/tax_relief_1920x988.jpg

https://www.gov.uk › government › publications › ...

If you ve paid foreign tax on income received or capital gains made that are also taxable in the UK you may be able to claim relief for the foreign tax paid This helpsheet will

https://www.ey.com › en_gl › technical › ta…

Chapter by chapter from Albania to Zimbabwe we summarize corporate tax systems in more than 150 jurisdictions The content is current as of 1 March 2024 with exceptions noted Keep up to date on significant tax developments

Tax Relief Special Installment Plans And Deadline Extensions Crowe

Personal Tax Relief 2022 L Co Accountants

All State Tax Relief ESEOspace

Income Tax Relief For Deployed Canadian Armed Forces Members

Tax Relief Vancouver WA What s Happenin Blog

Balanced Measured Approach Needed For Tax Relief Texas School Coalition

Balanced Measured Approach Needed For Tax Relief Texas School Coalition

Tax Tip How To Know If You Qualify For A Tax Relief Program Tax Help

Tax Lien Removal Tax Relief Boxelder Consulting

Income Tax Relief Under Section 89 1 Read With Rule 21A With

Tax Relief Summary - 10 rowsThe treaty rate is the maximum rate at which the UK and Switzerland are permitted to tax income in the relevant categories under the treaty Rates chargeable under the domestic