Tax Reporting For Commission Rebates Web 2 juin 2019 nbsp 0183 32 A common question many brokers and buyers have is whether such rebates are taxable income that must be reported to the IRS on Form 1099 MISC The answer

Web 6 avr 2022 nbsp 0183 32 1 What is a Rebate 2 What are Supplier Rebates 3 What are the Types of Rebates 4 What is an Example of a Rebate 5 How to Account for Customer Web 8 mars 2023 nbsp 0183 32 The percentage method is a flat percentage deduction on commissions in the amount of 22 However if the commission is more than 1 million the amount is

Tax Reporting For Commission Rebates

Tax Reporting For Commission Rebates

https://docs.isatech.eu/en-us/apps/REB/img/reb-setup-8.en-us.png

Rebate Form Fill And Sign Printable Template Online US Legal Forms

https://www.pdffiller.com/preview/485/448/485448276/large.png

Profits Tax Payment Of Commissions Rebates And Discounts To Be

https://mexus.com.hk/wp-content/uploads/2023/07/253.Profits-Tax-–-Payment-Of-Commissions-Rebates-And-Discounts-To-Be-Assessed-By-An-Agent-1024x576.jpg

Web 29 mars 2018 nbsp 0183 32 Rebates of fund management charges paid by an investment platform to investors were not annual payments for tax purposes and so were not subject to Web If the buyers purchase a house for 1 million the agent receives 25 000 HST commission from the vendors and then pays 20 or 5 000 to her clients To

Web 5 f 233 vr 2023 nbsp 0183 32 Accounting for a Commission Under the accrual basis of accounting you should record an expense and an offsetting liability for a commission in the same Web Tax Tax Accounting EXECUTIVE SUMMARY The IRS has attempted for many years to categorize rebates as deductions rather than exclusions so that the restrictions of IRC 167

Download Tax Reporting For Commission Rebates

More picture related to Tax Reporting For Commission Rebates

Report On Regional Rebates Utah Public Service Commission

https://s3.studylib.net/store/data/007604466_2-fc0722c021f4300929c0b601839c256b-768x994.png

Getting A Realtor Commission Rebate In NY Hauseit New York

https://www.hauseit.com/wp-content/uploads/2019/04/NY-Getting-a-Realtor-Commission-Rebate-1024x779.jpg

Top Mass Save Rebate Form Templates Free To Download In PDF Format

https://i0.wp.com/www.masssaverebate.net/wp-content/uploads/2022/10/top-mass-save-rebate-form-templates-free-to-download-in-pdf-format-101.png?fit=530%2C749&ssl=1

Web The IRS may be taxing rebates points and rewards and sending out 1099s How the IRS interprets taxing rebates points and rewards can be confusing at best For example Web 6 mai 2011 nbsp 0183 32 Tax reporting for commission rebates In today s difficult housing market it has become commonplace for brokers to offer buyers a cash rebate of a portion of their

Web Commission is now seeking to phase out free allocations A new carbon border adjustment mechanism CBAM will also be introduced requiring EU importers as of 2026 to Web How rebates are taxed and reported depends on the type of mutual fund investment Mutual fund trust Investors in mutual fund trusts must report the rebates as income in the

MS EXCEL Commission Invoice Template Invoice Template Microsoft Word

https://i.pinimg.com/originals/b0/4f/0f/b04f0f8aa089a9568fd6ae2765b7e712.png

Commission Payment Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/497/328/497328486/large.png

https://ttlc.intuit.com/community/taxes/discussion/is-a-commission...

Web 2 juin 2019 nbsp 0183 32 A common question many brokers and buyers have is whether such rebates are taxable income that must be reported to the IRS on Form 1099 MISC The answer

https://www.solvexia.com/blog/rebate-accounting-procedures-challenges...

Web 6 avr 2022 nbsp 0183 32 1 What is a Rebate 2 What are Supplier Rebates 3 What are the Types of Rebates 4 What is an Example of a Rebate 5 How to Account for Customer

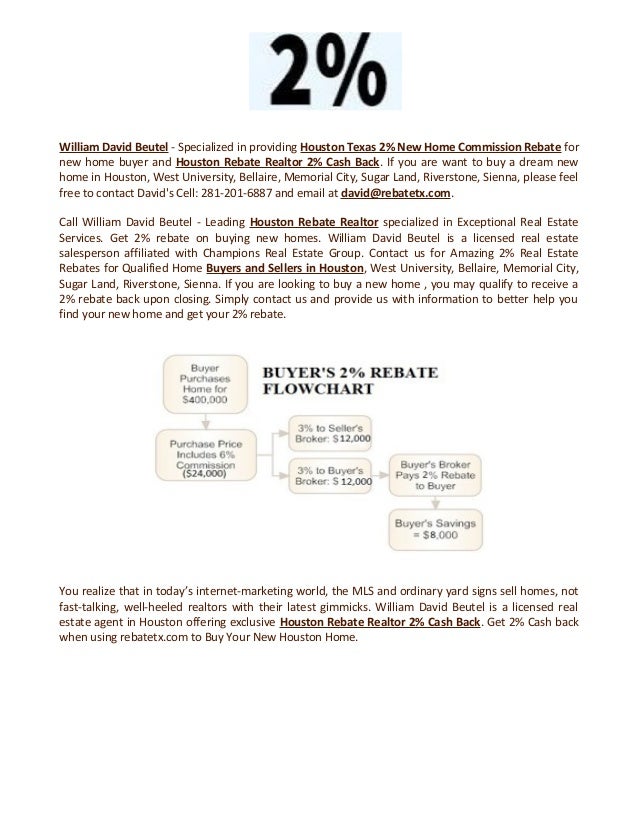

Houston Texas 2 New Home Buyer Rebate

MS EXCEL Commission Invoice Template Invoice Template Microsoft Word

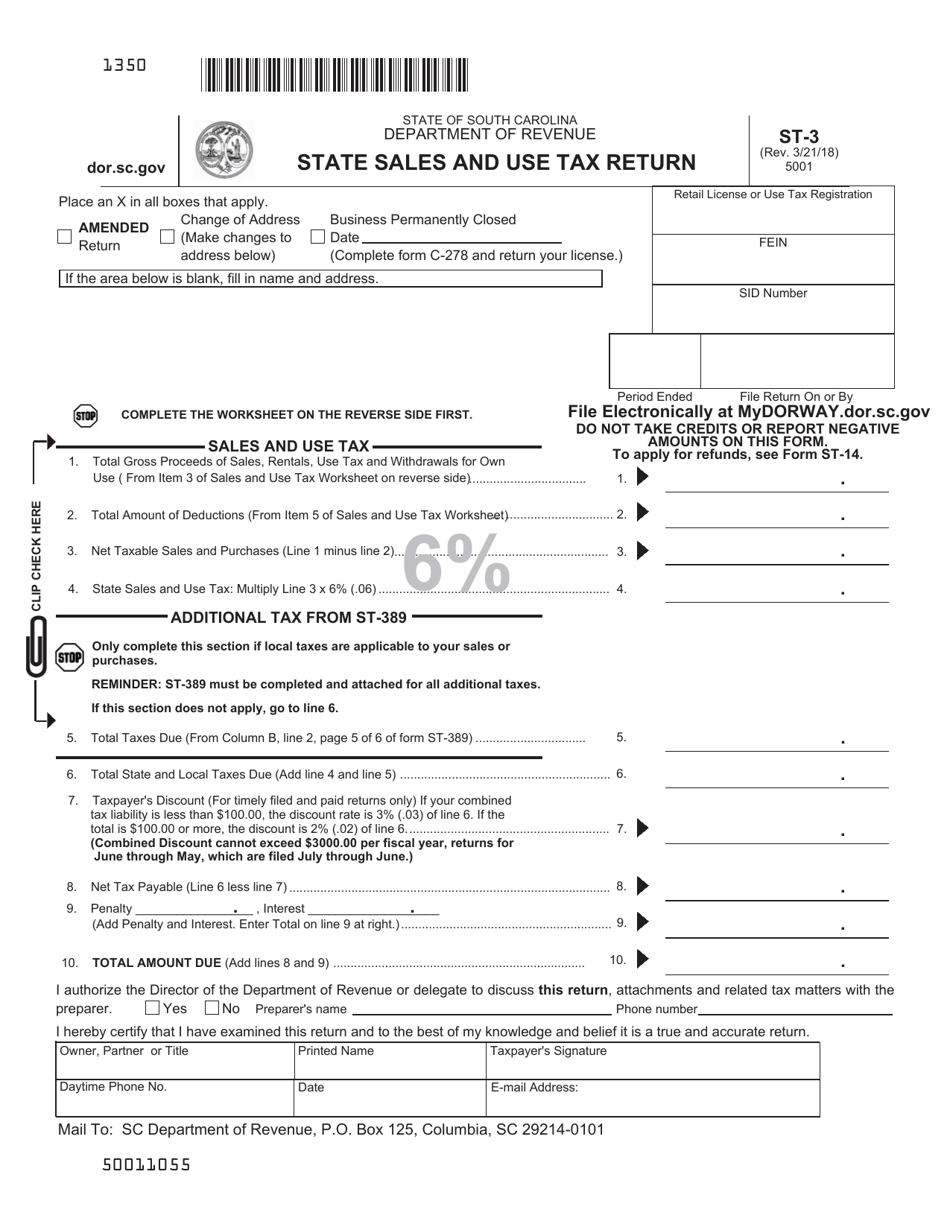

Sales And Use Tax Return Form St John The Baptist Parish Printable

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

Real Estate Commission Rebate Calculator

Buyer Commission Rebate NYC Infographic Portal Nyc Infographic

Buyer Commission Rebate NYC Infographic Portal Nyc Infographic

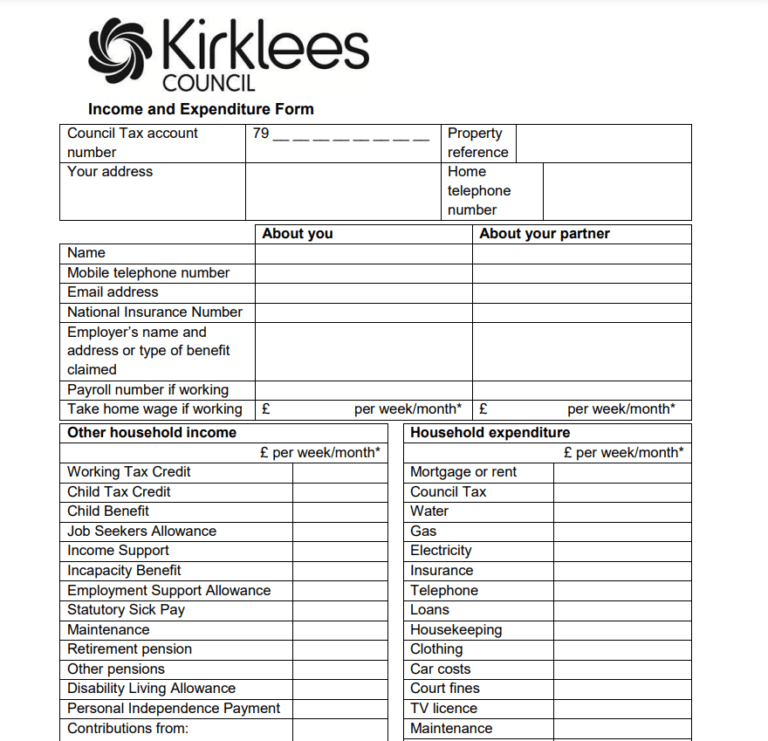

Council Tax Rebate Form Kirklees By Touch Printable Rebate Form

High Profitable IB Commission Rebate EA 99 Safe Secure Autoforexrobo

Are Buyer Broker Commission Rebates Taxable In NYC FAQ On IRS Tax And

Tax Reporting For Commission Rebates - Web Learn how SolveXia has helped companies improve their rebate calculations as well as manage complex vendor and customer rebates and commission reporting Product