Tax Return Budget 2023 The total for the budget for 2023 is EUR 81 3 billion Most of the appropriations will be used for healthcare and social security Revenue will mainly come from taxes based on turnover such as value added tax and income taxes including earned income and capital gains tax The central government on budget deficit is predicted to amount to

The final sum of the budget proposal for 2023 is eur 80 5 billion Most of the appropriations will be used for healthcare and social security revenue will mainly come from taxes based on turnover such as value added tax and income taxes including earned income and capital gains tax the central government on budget deficit is Taxation changes 2023 News 12 13 2022 This is a summary of the changes becoming effective in 2023 Some of them are legislative changes proposed by the Government but not yet debated in the parliament Updates to this page are being made during December as we receive confirmation that the new rules enter into force

Tax Return Budget 2023

Tax Return Budget 2023

https://images.news18.com/ibnlive/uploads/2023/02/income-tax-nirmala-sitharaman-budget-2023-2-16752389263x2.png

Features Of Budget 2023 2024 Tax Parley

https://i0.wp.com/taxparley.com/wp-content/uploads/2023/02/Features-of-Budget-2023-2024.png?resize=1536%2C864&ssl=1

Budget 2023 New Income Tax Rule You Need To Know

https://i0.wp.com/tejimandi.com/wp-content/uploads/2023/02/income-tax-rule-changes-announced-in-Budget-2023-Blog-Banner-copy-12.png?fit=1024%2C539&ssl=1

The Finnish general value added tax VAT is expected to be raised to 25 5 percent from the current 24 percent by the end of 2024 Important Tax Changes in Finland in 2024 The State budget revenue for 2024 is estimated at EUR 76 3 billion of which tax revenue will account for EUR 66 8 billion 3 6 compared to the year 2023 Federal budget 2023 How the end of the low and middle income tax offset and start of stage three tax cuts will affect you Explained News National What the end of the lamington offset and start of stage three tax cuts will mean for you By Daniel Jeffrey 7 07am May 6 2023

Here are 12 IRS changes for tax year 2023 for returns filed in 2024 that could save retirees and pre retirees money and offset the financial hit of higher consumer prices 1 Tax brackets 2023 24 Budget Tax Measures In his 2023 24 Budget the Financial Secretary proposed the following measures Reducing profits tax salaries tax and tax under personal assessment for the year of assessment 2022 23 The relevant legislation for the tax reduction was passed by the Legislative Council and gazetted on 28 April 2023

Download Tax Return Budget 2023

More picture related to Tax Return Budget 2023

Deloitte Malaysia Expects Global Minimum Tax To Be Implemented In

https://assets.theedgemarkets.com/budget_tax-4_2023_theedgemarkets_0.jpg?Kh0tgZjlEdtDltQfnM3IoMVL0DSgb3io

What Expenses Can Reduce My Tax Bill 2023 Tax Return

https://primary.jwwb.nl/public/y/s/l/temp-oobwvzbbupdhbdflmfmh/untitleddesign1.gif?enable-io=true&enable=upscale&fit=bounds&width=1200

Does The Budget 2023 Signal The Return Of Angel Tax

https://global-uploads.webflow.com/6270b5fa14586801e66bb81e/63dff3ea4c15c8863ba8cd5a_Does The Budget 2023 Signal The Return Of Angel Tax.gif

IRS Tax Tip 2023 09 January 26 2023 The IRS is now accepting tax returns for the 2023 filing season and IRS Free File a program that makes brand name tax software and electronic filing available to most taxpayers for free The Open Budget Survey 2023 assessed 125 countries which are home to 95 of the world s population and include budgets totalling more than 33 5 trillion in spending in Fiscal Year 2022 This locally led process was conducted with in country researchers peer reviewers and government reviewers who completed 30 000 indicators across all

1 Tax brackets got wider When comparing tax year 2022 to 2023 there was a big adjustment to the federal income tax brackets according to experts While the rates didn t change there was 1 46 Landfill Tax rates for 2023 to 2024 As announced at Autumn Budget 2021 the government will legislate in Spring Finance Bill 2023 to increase the standard and lower rates of Landfill Tax in

Budget 2023 Funding Support Liberal Tax Regime And Other Things

https://www.businessinsider.in/photo/97373905/budget-2023-funding-support-liberal-tax-regime-and-other-things-fintechs-expect-from-the-government.jpg?imgsize=42088

Mu Budget Analysis 2023

https://www2.deloitte.com/content/dam/Deloitte/mu/Images/promo_images/mu-tax-promo-image-budget-analysis-2023-2024-noexp.png

https://julkaisut.valtioneuvosto.fi/bitstream/...

The total for the budget for 2023 is EUR 81 3 billion Most of the appropriations will be used for healthcare and social security Revenue will mainly come from taxes based on turnover such as value added tax and income taxes including earned income and capital gains tax The central government on budget deficit is predicted to amount to

https://julkaisut.valtioneuvosto.fi/bitstream/...

The final sum of the budget proposal for 2023 is eur 80 5 billion Most of the appropriations will be used for healthcare and social security revenue will mainly come from taxes based on turnover such as value added tax and income taxes including earned income and capital gains tax the central government on budget deficit is

Budget Choice Mktg Inc Digos

Budget 2023 Funding Support Liberal Tax Regime And Other Things

Budget 2023 Live Updates New Income Tax Regime Made attractive With

Budget 2023 New Income Tax Rules Capex Increase FM s Speech Had It

Tax On Luxury Items To Remain Unchanged In Federal Budget 2023 2024

Income Tax Budget For The Fiscal Year 2023 24

Income Tax Budget For The Fiscal Year 2023 24

Ontario Budget Commentary 2023 Welch LLP

Budget 2023 NEW Release Date Synergy TAS

Budget 2023 Income Tax Blocks Rate Changes Live New Income Tax

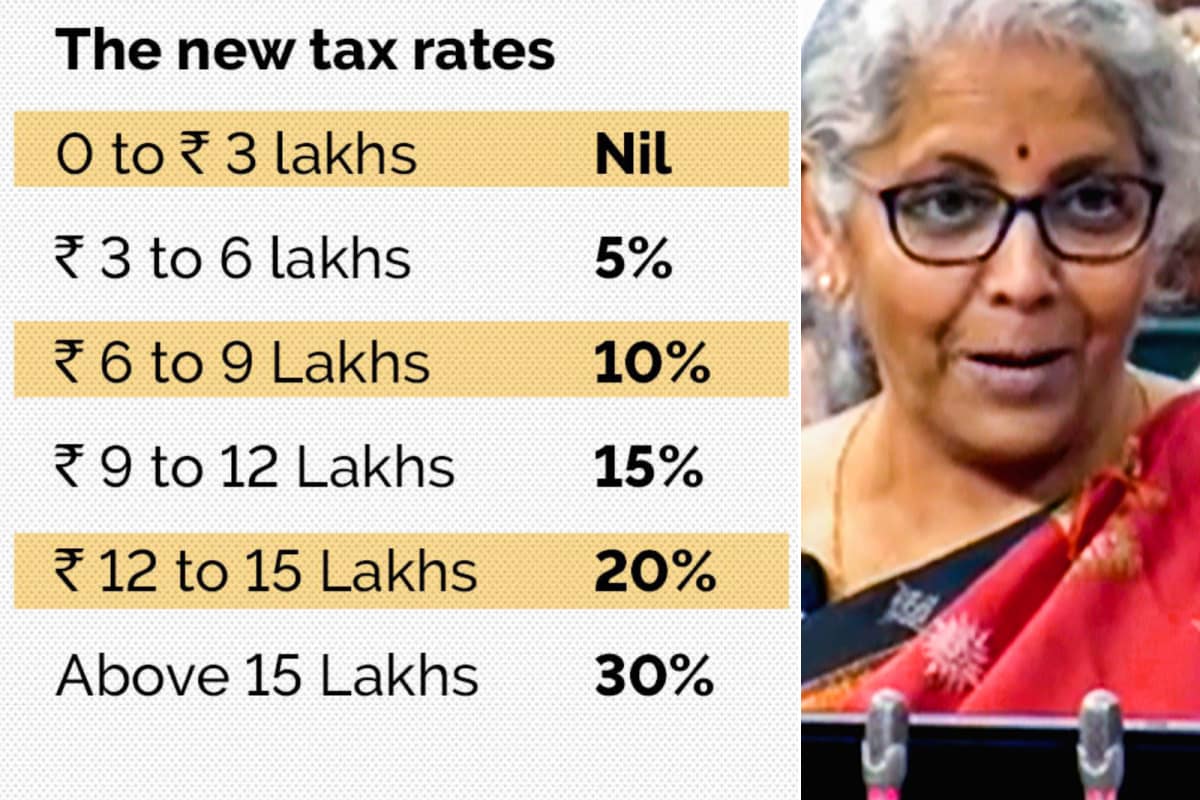

Tax Return Budget 2023 - The Union Budget 2023 focused on tax reforms including tax breaks for salaried taxpayers under the new regime increased duty on cigarettes and changes in presumptive taxation limits It also highlighted various measures to boost the economy ease compliance benefit MSMEs and simplify the tax system