Tax Return Donations Without Receipts Tax Deductions on Donations Donation is another deduction you can claim on the what can I claim on tax without receipts list if you donated 2 or more to bucket collections by an

If you made one or more small cash donations each of 2 or more to bucket collections for example to collections conducted by a DGR for natural disaster victims you can claim a total You should keep records of all tax deductible gifts donations and contributions you make However if you made one or more small cash donations each of 2 or more to bucket

Tax Return Donations Without Receipts

Tax Return Donations Without Receipts

http://www.sampletemplatess.com/wp-content/uploads/2018/02/tax-donation-receipt-template-8enhh-luxury-related-keywords-suggestions-for-non-profit-donation-receipt-template-of-tax-donation-receipt-template-betwq.jpg

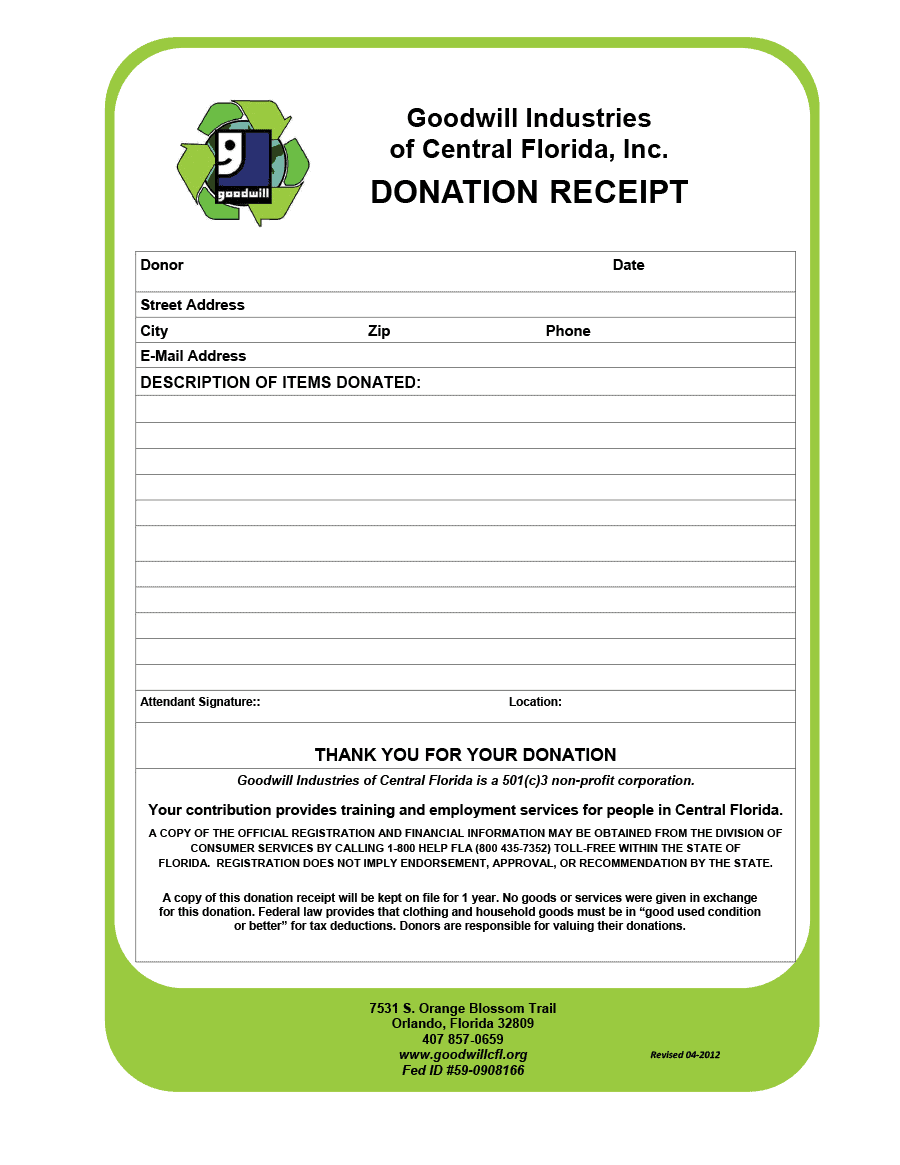

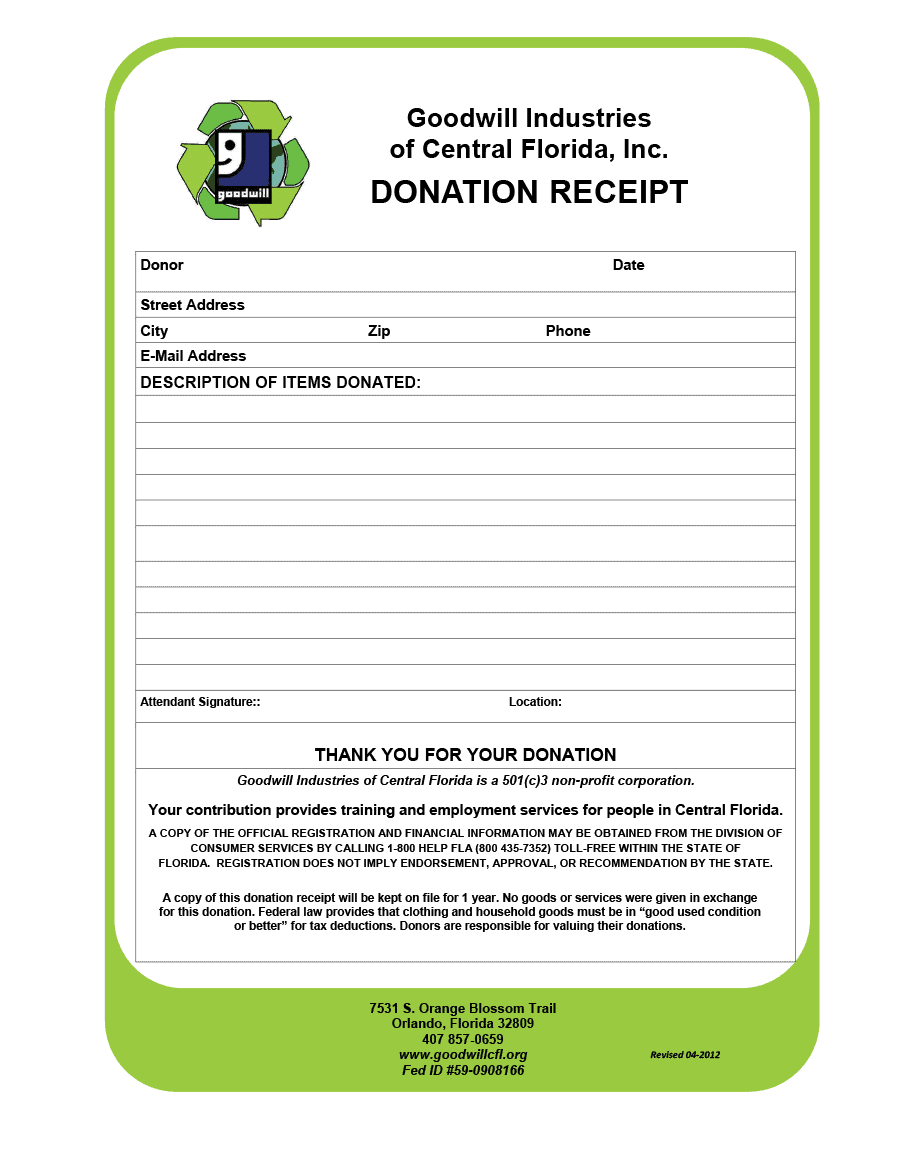

6 Free Donation Receipt Templates

https://www.dailylifedocs.com/wp-content/uploads/2017/02/donation-receipt-template-AAAA.png

6 Free Donation Receipt Templates

https://www.dailylifedocs.com/wp-content/uploads/2017/02/donation-receipt-template-DDDD-791x1024.png

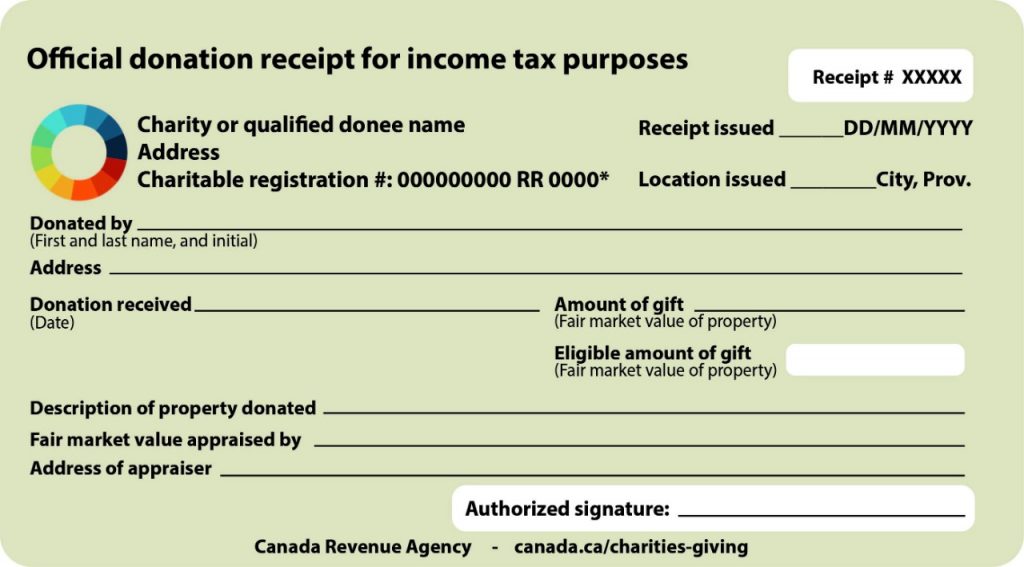

You can only claim a tax deduction for gifts or donations to organisations which are deductible gift recipients DGRs When you make a gift you do not receive a material benefit in return Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your

You can save deductions and receipts right in your Etax account year round so they are ready for your next tax return Snap a photo of your receipt as soon as you buy something you re Charitable donations or contributions are potentially a tax saving opportunity Not only does the charity benefit but taxpayers enjoy tax savings by deducting part or all of their

Download Tax Return Donations Without Receipts

More picture related to Tax Return Donations Without Receipts

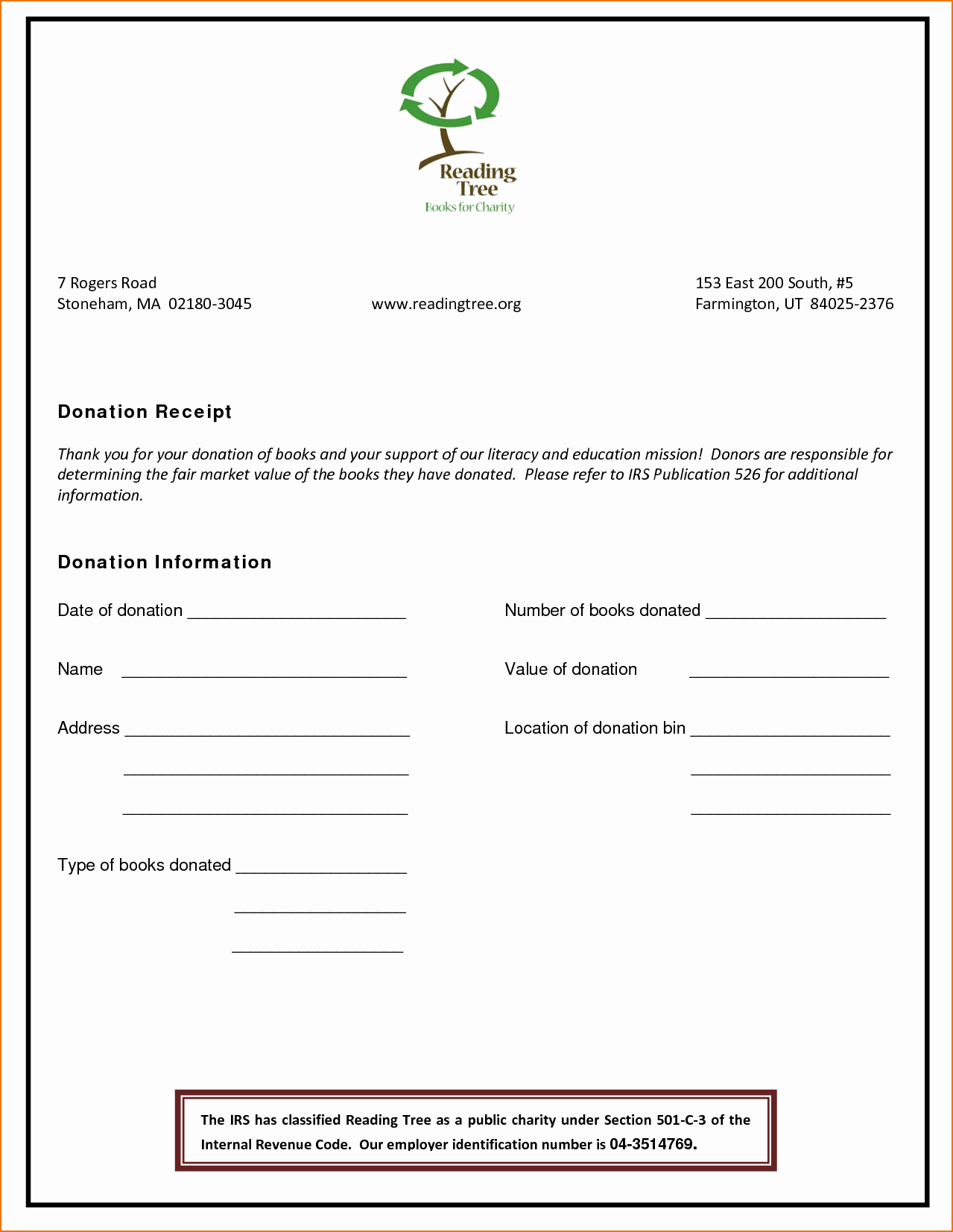

FREE 9 Donation Receipt Templates In Google Docs Google Sheets

https://images.sampletemplates.com/wp-content/uploads/2015/09/Donation-Receipt-Tax-Deduction-Form.jpg

Non Profit Donation Receipt Template Excel Templates

https://ufreeonline.net/wp-content/uploads/2019/04/non-profit-donation-receipt-form-beautiful-4-non-profit-donation-receipt-template-of-non-profit-donation-receipt-form.png

Donation Receipt Donation Receipt Forms Donation Receipt Template Etsy

https://i.etsystatic.com/25866327/r/il/6706a4/4010228136/il_fullxfull.4010228136_mvak.jpg

These individuals including married individuals filing separate returns can claim a deduction of up to 300 for cash contributions made to qualifying charities during 2021 The Learn about the rules and regulations regarding tax deductible donations in Australia including whether donations can be claimed as tax deductions without a receipt Read this guide to

Deductions you can take without receipts include home office expenses such as rent and utilities self employment taxes self employed health insurance premiums and certain vehicle By IRS definition charitable contributions represent gifts given without reciprocity Supporting a charitable organization by buying merchandise or attending an event puts you into the got

How Much Can You Claim In Charitable Donations Without Receipts Help

https://irs-taxes.org/wp-content/uploads/2021/06/Signing-charitable-donation-check-768x481.jpg

4 Smart Investments Using Your Tax Return

https://blog.usccreditunion.org/hubfs/tax-return-money.jpg

https://taxaccountinghouse.com.au/individual-tax...

Tax Deductions on Donations Donation is another deduction you can claim on the what can I claim on tax without receipts list if you donated 2 or more to bucket collections by an

https://www.ato.gov.au/.../gifts-and-donations

If you made one or more small cash donations each of 2 or more to bucket collections for example to collections conducted by a DGR for natural disaster victims you can claim a total

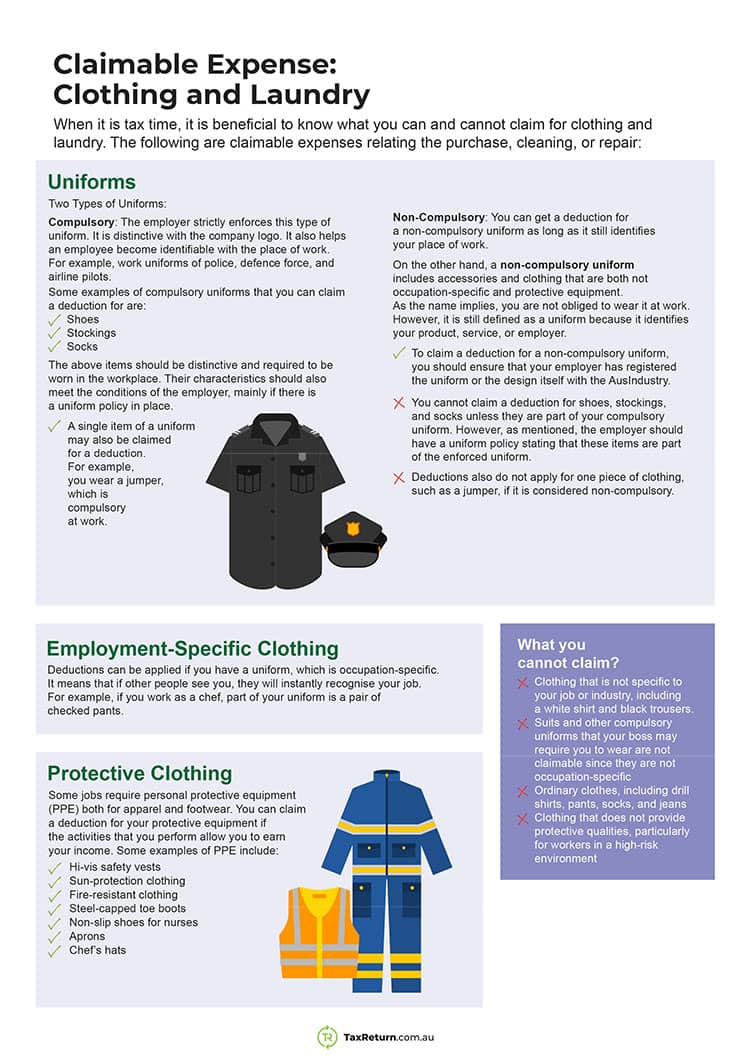

Claimable Expenses What You Can Claim On Your Tax Return

How Much Can You Claim In Charitable Donations Without Receipts Help

Non Profit Donation Receipt Templates At Allbusinesstemplates

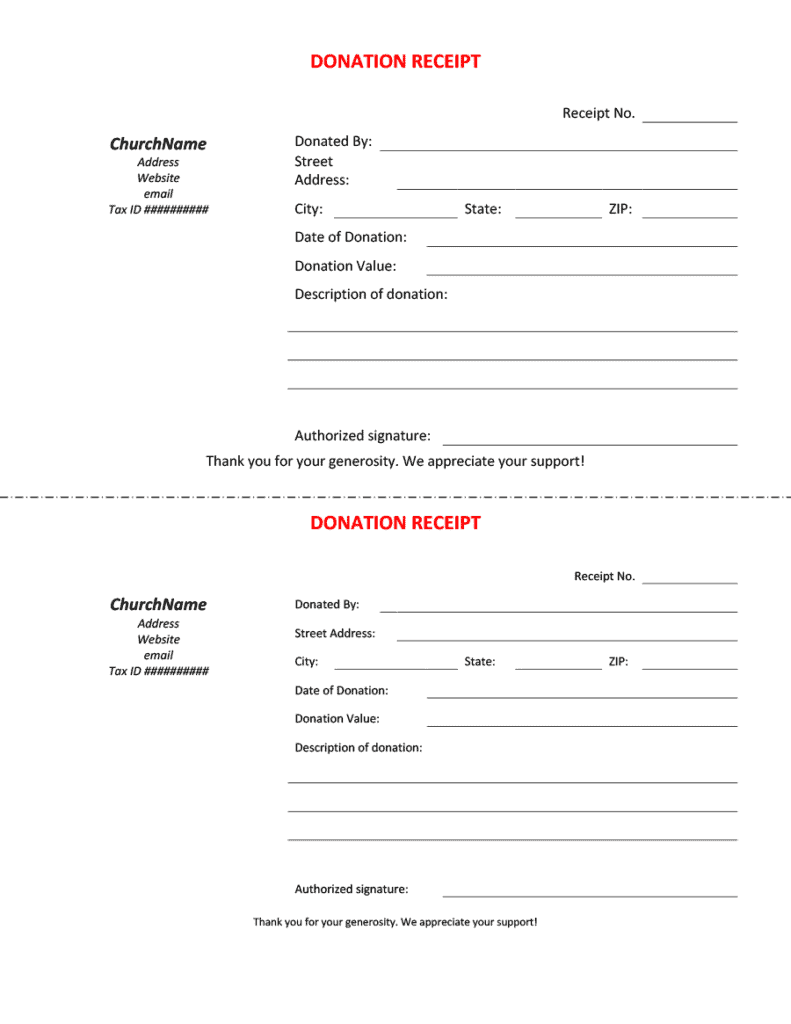

Free Church Donation Receipt PDF Word EForms

Donation Receipt Template In Microsoft Word Template

Learn Which Donations You Can Deduct From Your Tax Return Handmade

Learn Which Donations You Can Deduct From Your Tax Return Handmade

Donation Receipts For Providing Services Smith Neufeld Jodoin LLP

File Your Income Tax Return By 31st July Ebizfiling

Non Profit Letter For Donations Database Letter Template Collection

Tax Return Donations Without Receipts - Charitable donations or contributions are potentially a tax saving opportunity Not only does the charity benefit but taxpayers enjoy tax savings by deducting part or all of their