Tax Return Due Date For Corporate Assessee Due date for filing of audit report under section 44AB for the assessment year 2023 24 in the case of a corporate assessee or non corporate assessee who is required to submit his its return of income on October 31

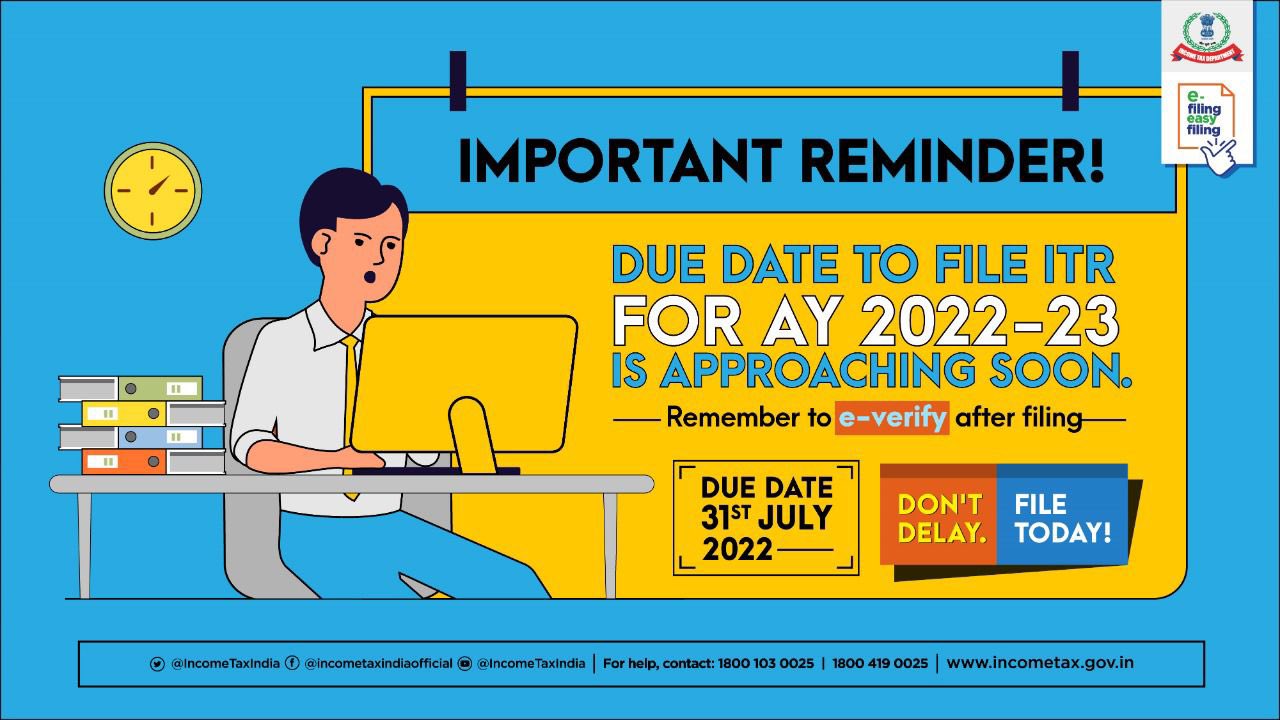

Due date The due date for filing of returns for non audit non corporate assessee s is 31 st July of the assessment year and for assessee s under audit u s 44AB and 291 rowsThe due date for the CIT return is the end of February or if filled electronically 15

Tax Return Due Date For Corporate Assessee

Tax Return Due Date For Corporate Assessee

https://pbs.twimg.com/media/FXhKfnhUUAAxG68.jpg:large

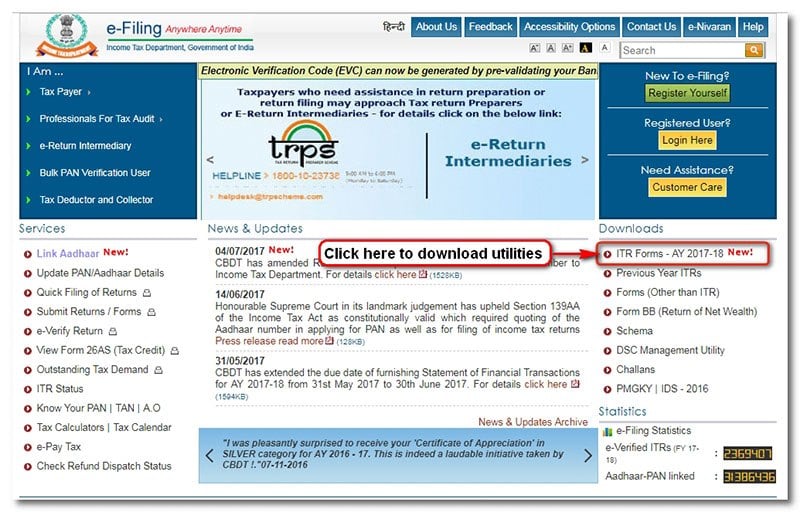

Income Tax Return Filing Due Date Extended To 31st October 2017

https://studycafe.in/wp-content/uploads/2017/07/income-tax-return-filing-due-date-extended.jpg

I T Return Filing Interest Penalties On The Cards If Failed To File

https://images.moneycontrol.com/static-mcnews/2022/07/Penalties-2-belate-returns-ITR-.jpg

Due date of furnishing return of income in case of a non working partner shall be 31st July of the assessment year whether the accounts of the firm are required to be audited or not Filing of audit report under Section 44AB for the Assessment Year 2024 25 in case of corporate or non corporate assessees whose return is due by October 31 2024 Extended from 30

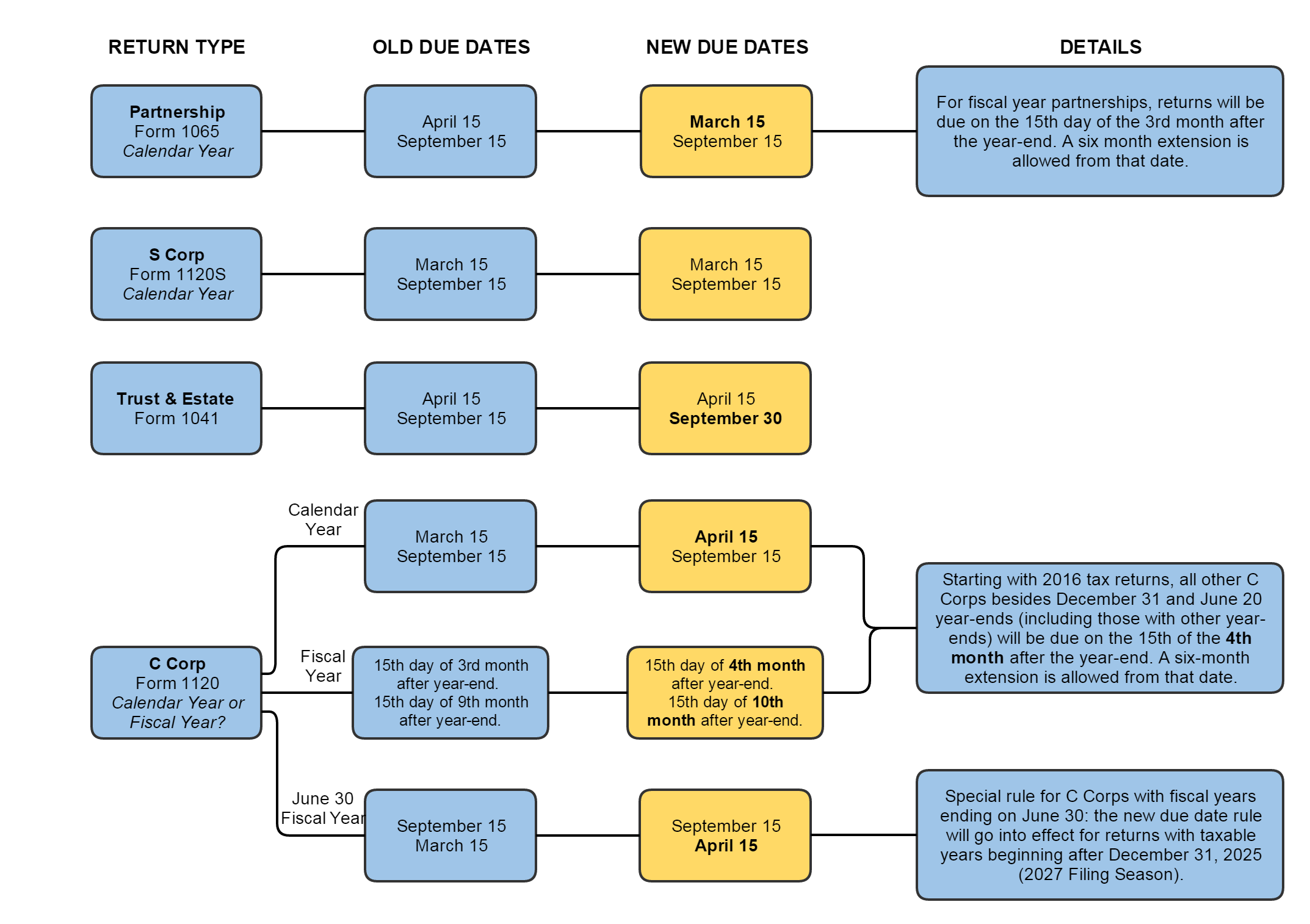

The due date for filing income tax return for corporate assessees and other assessees who are required to get their accounts audited under Income Tax Act 1961 or Income Tax Return Due Date for Assessees under Section 92E ITR Filing Deadline 30th November 2025 Report from Accountant Deadline under Section 92E At least one month before the due date for filing the

Download Tax Return Due Date For Corporate Assessee

More picture related to Tax Return Due Date For Corporate Assessee

Due Date To File Income Tax Return For AY 2023 24 Is 31st Of July 2023

https://taxguru.in/wp-content/uploads/2023/06/Income-tax-return-filing-1.jpg

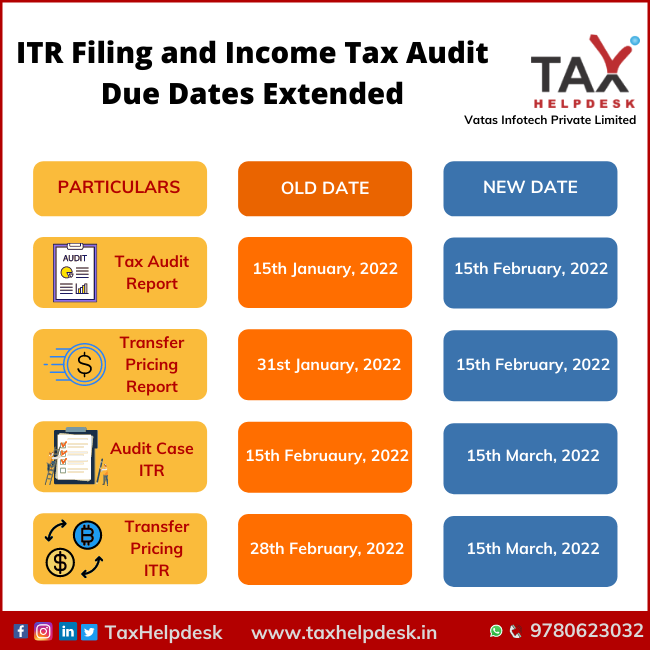

ITR Filing Income Tax Audit Due Dates Extended FY 2020 21 TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/01/ITR-Filing-and-Income-Tax-Audit-Due-Dates-Extended.png

New Tax Return Due Dates Meadows Urquhart Acree And Cook LLP

http://www.muacllp.com/wp-content/uploads/2016/04/new_tax_return_due_dates_1.png

Usually the due date to file an income tax return is 31st July for individuals and non audit cases and 31st October for audit cases of the relevant assessment year You can Corporate assessee and Non corporate assessee with audit 30th September Annual return of income for the assessment year 2018 19 in the case of an assessee if he it is required to

The statutory due date for filing of income tax return for the assessment year 2024 25 if the assessee not having any international or specified domestic transaction is a corporate assessee or b non corporate Discover the key due dates for filing Income tax Returns for the Assessment Year 2024 25 including deadlines for assessees requiring transfer pricing audits audited accounts

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

https://academy.tax4wealth.com/public/storage/uploads/1686567553-file-income-tax-return-for-ay-2023-24-by-july-31st-2023.jpg

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

https://academy.tax4wealth.com/public/storage/uploads/1681121464-last-date-to-file-income-tax-return-itr-for-fy-2022-23-ay-2023-24.jpg

https://taxguru.in › income-tax › income-ta…

Due date for filing of audit report under section 44AB for the assessment year 2023 24 in the case of a corporate assessee or non corporate assessee who is required to submit his its return of income on October 31

https://taxguru.in › income-tax › income-tax-return...

Due date The due date for filing of returns for non audit non corporate assessee s is 31 st July of the assessment year and for assessee s under audit u s 44AB and

Due Date For Filing Income Tax Return ITR Delay Penalty Wealth Baba

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

Corporate Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

Simple Way To E file Tax Rectification Request U S 154 On Portal

File Your Income Tax Return By 31st July Ebizfiling

When Are 2019 Tax Returns Due Every Date You Need To File Business

When Are 2019 Tax Returns Due Every Date You Need To File Business

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

Income Tax Returns Filing Due Dates Extended Ebizfiling

Income Tax Return Filing For AY 2021 22 Essential Things Individuals

Tax Return Due Date For Corporate Assessee - Due date of furnishing return of income in case of a non working partner shall be 31st July of the assessment year whether the accounts of the firm are required to be audited or not