Tax Return Due Web The tax return is used by the tax office to balance out the amount of income tax you have paid with other financial aspects such as Your spouse s income Any additional income you might have Tax deductions for instance statutory insurance contributions expenses for daycare or charitable donations Do I need to do a German tax return

Web 23 Feb 2023 nbsp 0183 32 The filing deadline for the 2022 tax period has been postponed by two months but since September 30th falls on a Saturday taxpayers now have until October 2nd 2023 to submit their tax returns Web 8 M 228 rz 2023 nbsp 0183 32 Key Tax Dates and Deadlines for Germany 2023 Published 8th Mar 2023 at 09 11 Last update 20th Nov 2023 at 06 30 TaxTipsGermany The tax year in Germany is the same as the calendar year Returns are filed for each calendar year and reflect the financial statements for the business year ending in that calendar year

Tax Return Due

Tax Return Due

http://www.muacllp.com/wp-content/uploads/2016/04/new_tax_return_due_dates_1.png

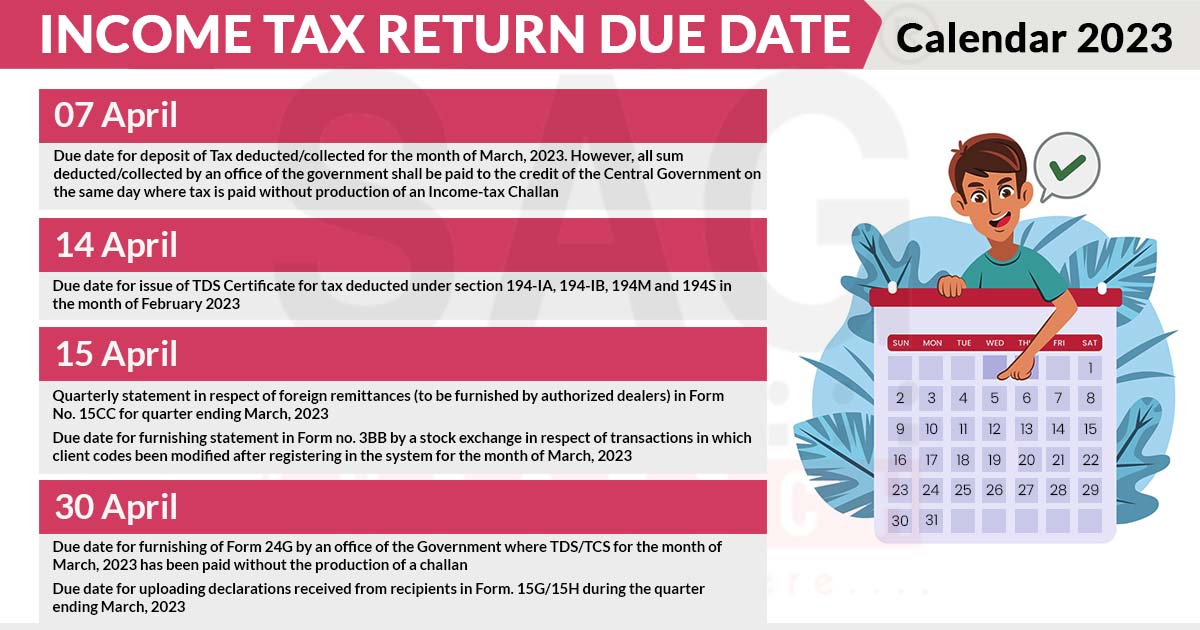

Due Date To File Income Tax Return For AY 2023 24 Is 31st Of July 2023

https://taxguru.in/wp-content/uploads/2023/06/Income-tax-return-filing-1.jpg

Five Options To Pay An IRS Debt

https://www.irsmind.com/wp-content/uploads/2018/11/Depositphotos_2339387_m-2015.jpg

Web If you re required to submit a tax return for the 2022 calendar year you have until October 2 2023 You can submit your tax return electronically via the official Elster portal If you don t have an account yet register for one as soon as possible because registration codes come via post for security reasons Web 27 Mai 2021 nbsp 0183 32 If you are someone who is required to file tax returns you now have until October 31st 2021 to get your paper work off to the tax office The deadline for filing taxes is usually July

Web 1 Juli 2023 nbsp 0183 32 Deadline September 30 2023 If you have to file a tax return this year you should note 30th September 2023 instead of 31st July 2023 for the submission Until then you have time to submit your documents for the tax return 2022 to your relevant tax office Web 11 Nov 2023 nbsp 0183 32 According to 167 152 of the German Fiscal Code overdue tax returns are penalized with a penalty fee for each month that they are overdue The tax office is obliged to charge you with a penalty fee if you don t file your tax return within 14 months of the end of the tax year in question

Download Tax Return Due

More picture related to Tax Return Due

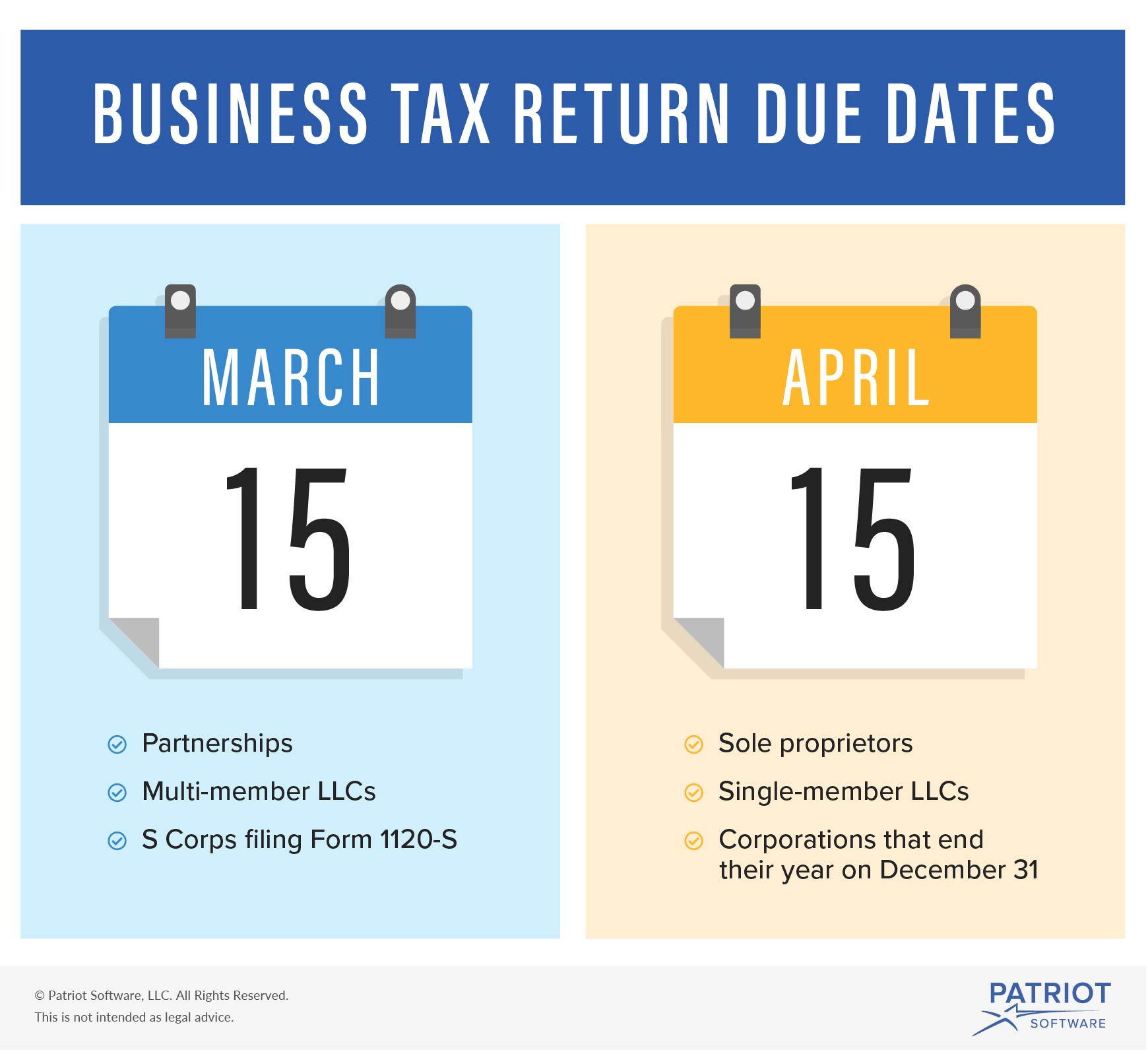

Small Business Tax Preparation Checklist How To Prepare For Tax Season

https://www.patriotsoftware.com/wp-content/uploads/2019/12/business-tax-return-due-date-visual.jpg

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

https://academy.tax4wealth.com/public/storage/uploads/1681121464-last-date-to-file-income-tax-return-itr-for-fy-2022-23-ay-2023-24.jpg

What Happens If You Don t Pay Your Taxes EveryBuckCounts

https://www.everybuckcounts.com/wp-content/uploads/2019/01/shutterstock_164415176-1024x653.jpg

Web 30 M 228 rz 2022 nbsp 0183 32 Here are the key things you need to know about filing your tax return for 2021 There have been a huge number of changes to German tax law recently which could see some taxpayers netting an even Web 15 Feb 2022 nbsp 0183 32 If you re well informed you can get a large tax refund and save tons in taxes In this article we ll summarize the important changes to the 2021 tax year Deadlines If you are required to file a tax return you must file it by July 31st of the following year or you will receive a lateness penalty fee Versp 228 tungszuschlag

Web 19 Aug 2019 nbsp 0183 32 Deadline for taxpayers Those who are required to file their taxes have until July 31st of the following year For example you must have your 2018 taxes filed by July 31 2019 Should the deadline fall on a weekend then it is automatically extended to the next business day Web 15 Juni 2023 nbsp 0183 32 Taxpayers who submit their income tax return without a tax advisor have been extended the deadline for submitting the return for the accounting year 2021 by three months for the accounting year 2022 by two months and

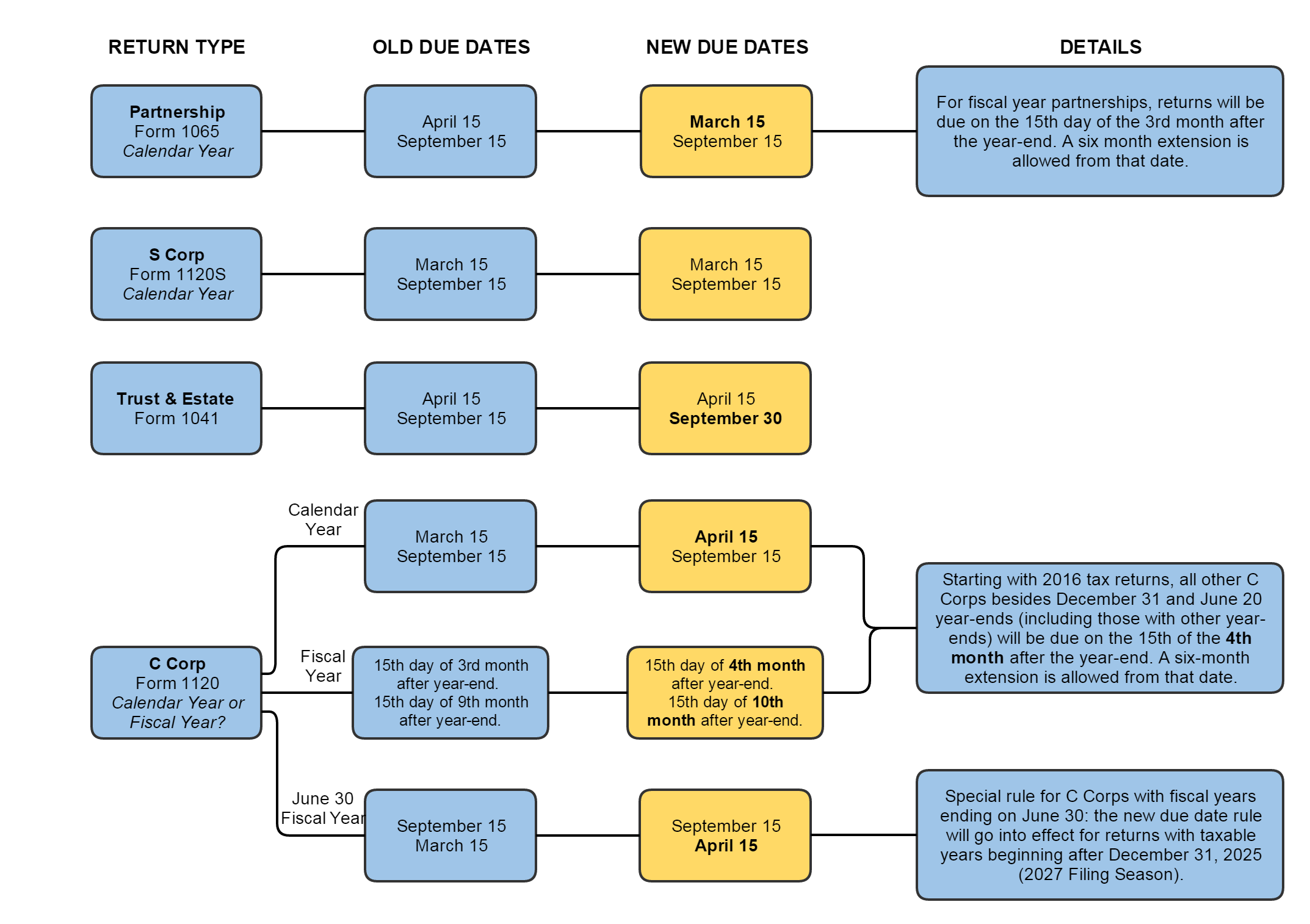

SLT Adapting To New Federal Tax Returns Due Dates In New York The

https://www.nysscpa.org/cpaj-images/CPA.2017.87.4.072.t001.jpg

Income Tax Return Due Date Last Date 2021 ITR Filing Online Payment

https://static.india.com/wp-content/uploads/2021/12/Income-Tax-Return-ITR-Filing-News.jpg

https://www.iamexpat.de/.../taxation-germany/annual-german-tax-return

Web The tax return is used by the tax office to balance out the amount of income tax you have paid with other financial aspects such as Your spouse s income Any additional income you might have Tax deductions for instance statutory insurance contributions expenses for daycare or charitable donations Do I need to do a German tax return

https://www.thelocal.de/20230223/what-you-need-to-know-about-germany…

Web 23 Feb 2023 nbsp 0183 32 The filing deadline for the 2022 tax period has been postponed by two months but since September 30th falls on a Saturday taxpayers now have until October 2nd 2023 to submit their tax returns

What Is The Due Date For C Corporate Tax Returns QATAX

SLT Adapting To New Federal Tax Returns Due Dates In New York The

Tax Return Due What To Do

When Are Taxes Due In 2021 Areatiklo

Revised Income Tax Return And Tax Audit Due Date For Financial Year

Company Tax Return Due Date 2023 Australia Pay Period Calendars 2023

Company Tax Return Due Date 2023 Australia Pay Period Calendars 2023

Tax Return Due Dates Pierce Firm PLLC

Income Tax Return E Filing Due Date Extended UpTo Dec 31st 2020

Coronavirus Last Date To File IT Returns Extended Ummid

Tax Return Due - Web 31 Okt 2022 nbsp 0183 32 Tax returns prepared by taxpayers who are not tax advisors Declaration for the calendar year 2021 submission deadline until 31 10 2022 Declaration for the 2022 calendar year submission deadline by 02 10 2023 Declaration for the 2023 calendar year submission deadline by 02 09 2024