Tax Return Eligibility Australia Your tax return is a form you can complete online or by paper get help from a tax agent or our Tax Help program Before you prepare your tax return Find out what s new or is changing this

When you lodge a tax return you include how much money you earn income and any expenses you can claim as a deduction If you need to lodge a tax return you can choose from of the Work out the income you need to include in your tax return such as employment government payments and investment income What expenses you can claim as income tax

Tax Return Eligibility Australia

Tax Return Eligibility Australia

https://www.alterledger.com/wp-content/uploads/2022/01/Pay-your-tax-by-end-of-Jan.gif

https://c.pxhere.com/photos/c2/d6/tax_return_control_tax_office_form_finance_money_income_tax_billing-1038566.jpg!d

Tax Return Checklist TaxAssist Accountants

https://assets.taxassist.ie/articles/1560956375_Tax Return Checklist 2019 A5.jpg

In Australia individual taxpayers are required to lodge a personal tax return each financial year 1 July to 30 June to declare their income and claim eligible tax deductions or credits from the previous year All Australian residents are required to pay income tax on annual earnings above 18 200 anything below this falls into the tax free threshold The income tax rate starts at 19 but the more you earn the higher your tax

Based on your taxable income the Australian Taxation Office ATO applies the relevant tax rates and calculations to determine your tax liability If you have paid more tax than required throughout the year you may Before you start claiming your tax return you need to determine if you are eligible Generally if you have paid taxes during the financial year and your income is below the tax

Download Tax Return Eligibility Australia

More picture related to Tax Return Eligibility Australia

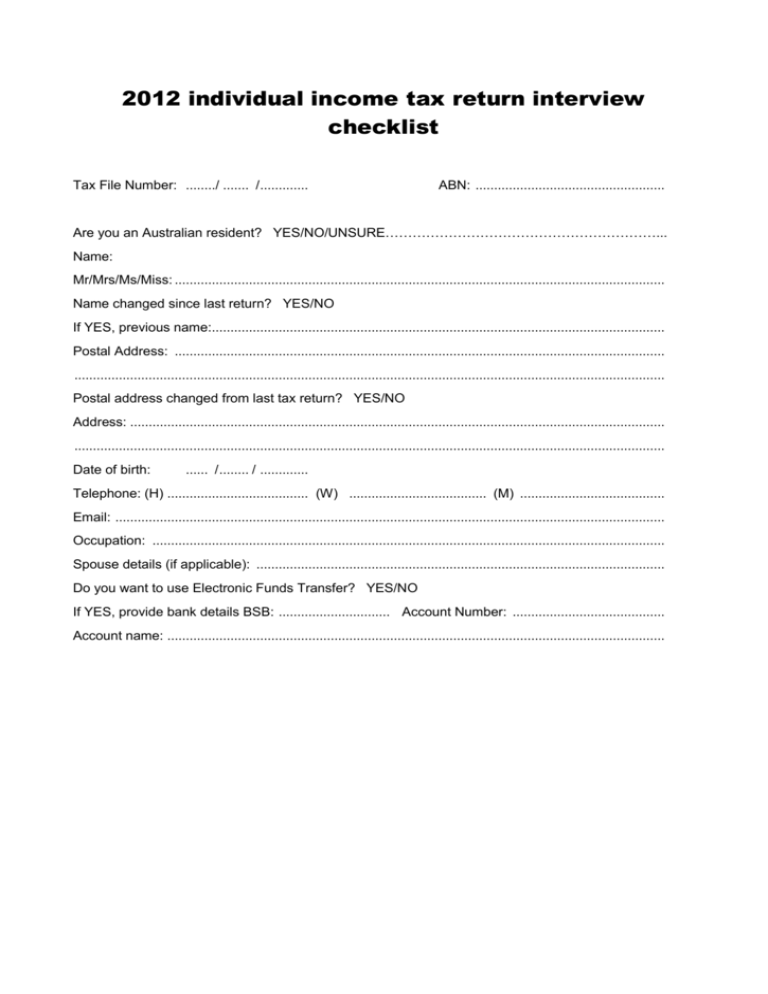

2012 Individual Tax Return Checklist

https://s3.studylib.net/store/data/008486155_1-43e1469b80c29c2f29cbdcf95e0e77a7-768x994.png

Australia Resident Return Eligibility Test The Visas Of OZ

https://www.thevisasofoz.com/wp-content/uploads/Australia_Resident_Return_Eligibility.jpg

4 Smart Investments Using Your Tax Return

https://blog.usccreditunion.org/hubfs/tax-return-money.jpg

It is free to get a TFN You need a TFN for your employer to pay tax on your behalf A TFN also helps the ATO and superannuation funds identify who you are If you re a Each income year you need to assess your personal circumstances to work out if you need to lodge a tax return Reasons you need to lodge a tax return may include if you

As an Australian resident you can earn up to 18 200 in a financial year and not pay tax You can also claim certain deductions that are subtracted from your assessable income If you re Chances are that if you ve been studying in Australia for more than 6 months you ll be a resident in Australia for tax purposes Do you need to lodge tax return If so when and how Find

8 Points To Check Eligibility For Income Tax Return Filing

https://blog.saginfotech.com/wp-content/uploads/2022/05/eligibility-income-tax-return-filing.jpg

Tax Return Employment Self Employment Dividend Rental Property

https://i.pinimg.com/originals/d3/7f/83/d37f830fdf0e55518f62e71ed96aa8bd.png

https://www.ato.gov.au › individuals-and-families › your-tax-return

Your tax return is a form you can complete online or by paper get help from a tax agent or our Tax Help program Before you prepare your tax return Find out what s new or is changing this

https://www.ato.gov.au › individuals-and-families › ...

When you lodge a tax return you include how much money you earn income and any expenses you can claim as a deduction If you need to lodge a tax return you can choose from of the

Income Tax Return Last Date Direct Link To File Itr Other Details Riset

8 Points To Check Eligibility For Income Tax Return Filing

Withholding Tax Return

Eligibility Verification Prevent Denials Ebook RCM Solution

Tax Return And Tax Investigators Stock Photo Alamy

ITR Income Tax Return E verification To Complete Filing Process All

ITR Income Tax Return E verification To Complete Filing Process All

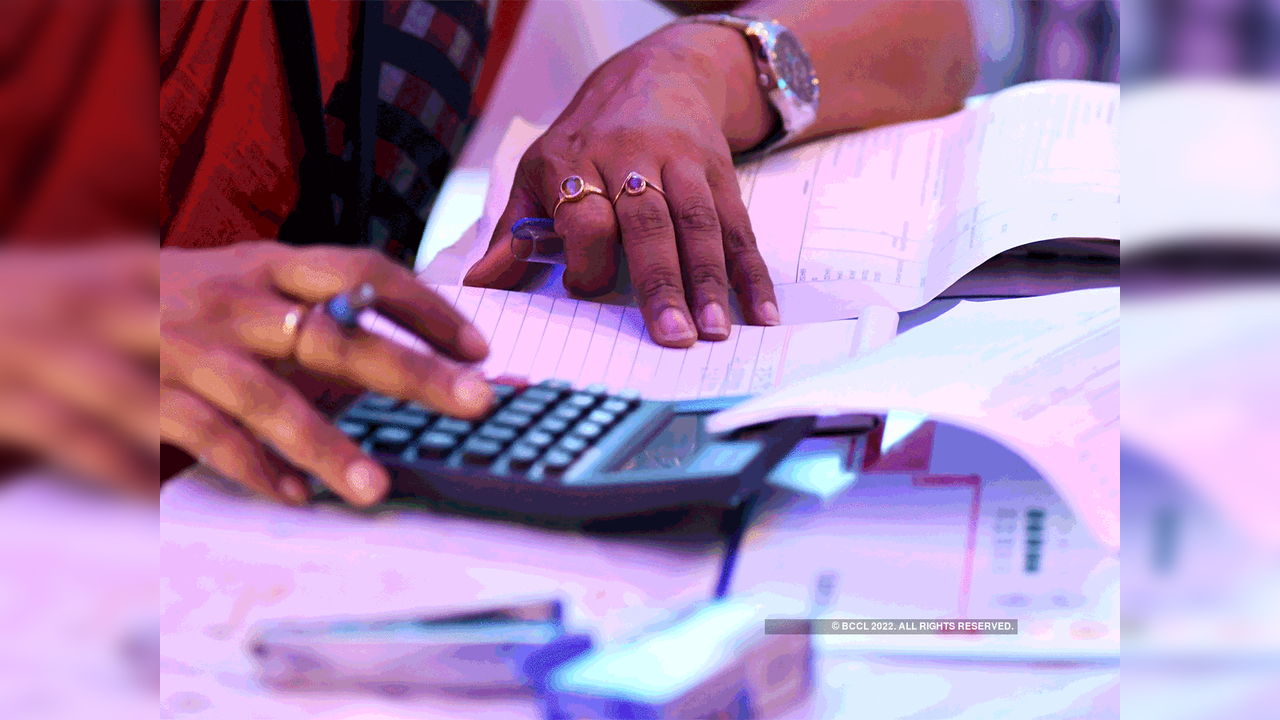

Income Eligibility National CACFP Sponsors Association

How To File Income Tax Return For The Deceased Person By Legal Heir

Extension Of Timelines For Filing Of Income tax Returns And Various

Tax Return Eligibility Australia - In Australia individual taxpayers are required to lodge a personal tax return each financial year 1 July to 30 June to declare their income and claim eligible tax deductions or credits from the previous year