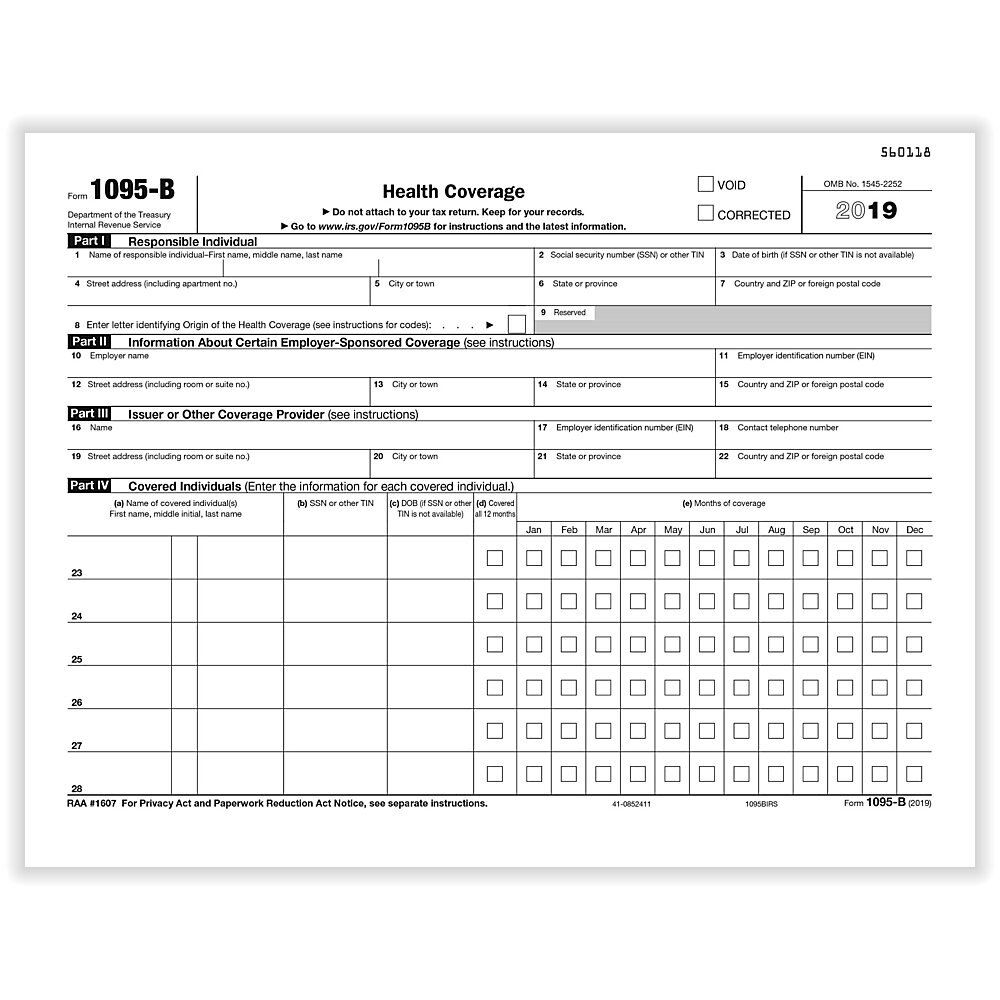

Tax Return Health Insurance Proof You will use the information on Forms 1095 B to verify that you had health coverage for each month during the year and will check the full year coverage box on your tax return

Taxpayers who are preparing to file their tax returns may receive multiple health care information forms that they can use to complete their return The forms are Form 1095 A Health Insurance Marketplace Statement Form 1095 B Health Coverage Form 1095 C Employer Provided Health Insurance Offer and Coverage Using the 1095 A as proof you have health insurance you can then complete Form 8962 to file with your tax returns This will calculate the final amount in premium tax credits you re eligible for to see if you can qualify for more money back

Tax Return Health Insurance Proof

Tax Return Health Insurance Proof

https://i.pinimg.com/originals/39/9c/59/399c59057a9c8a5f1a9a32e6bbd37371.jpg

How To Restore Workers Compensation Insurance

https://lh3.googleusercontent.com/2lyQgrkIVgbebEIMgXRRmyTfjkUZ7N0xDZfCYN3F6OUYduN_46HPHktqUQBifcIaAaRgXO0GTtJVQ25JaJ6go8Hmf3ma9Mpxef4Rn2ZEEg4mg4ujZM_YwsYcRz3WNjkHVUf8ny86

The Spanish NIE Number Filing Taxes Income Tax Return Tax

https://i.pinimg.com/originals/35/81/3d/35813dbfda5ef7a99b67ea8f1d1632f3.jpg

You must file a tax return if enrolled in Health Insurance Marketplace plan Get details on tax forms you need to file This form is used to verify on your tax return that you and your dependents have at least minimum qualifying health insurance coverage Still need to file An expert can help or do taxes for you with 100 accuracy

Get 2023 federal tax info for Medicare Medicaid Children s Health Insurance Program CHIP other coverage Form 1095 B 1095 C more If you don t expect your income to change for the year you re seeking coverage You can provide your most recent tax return or W 2s If you have a different job than you had last year but expect the same income don t send documents that show income from your old

Download Tax Return Health Insurance Proof

More picture related to Tax Return Health Insurance Proof

IRS Requires Proof Of Health Insurance In 2018

https://cdn.aarp.net/content/dam/aarp/money/taxes/2017/10/1140-irs-requires-health-insurance-for-e-file.imgcache.rev9dcefc7719018b480be64cc15b8a1310.jpg

Sample Auto Insurance Policy Declaration Page Check More At Https

https://i.pinimg.com/originals/ea/59/7d/ea597d270ea10fc3214542b842498176.jpg

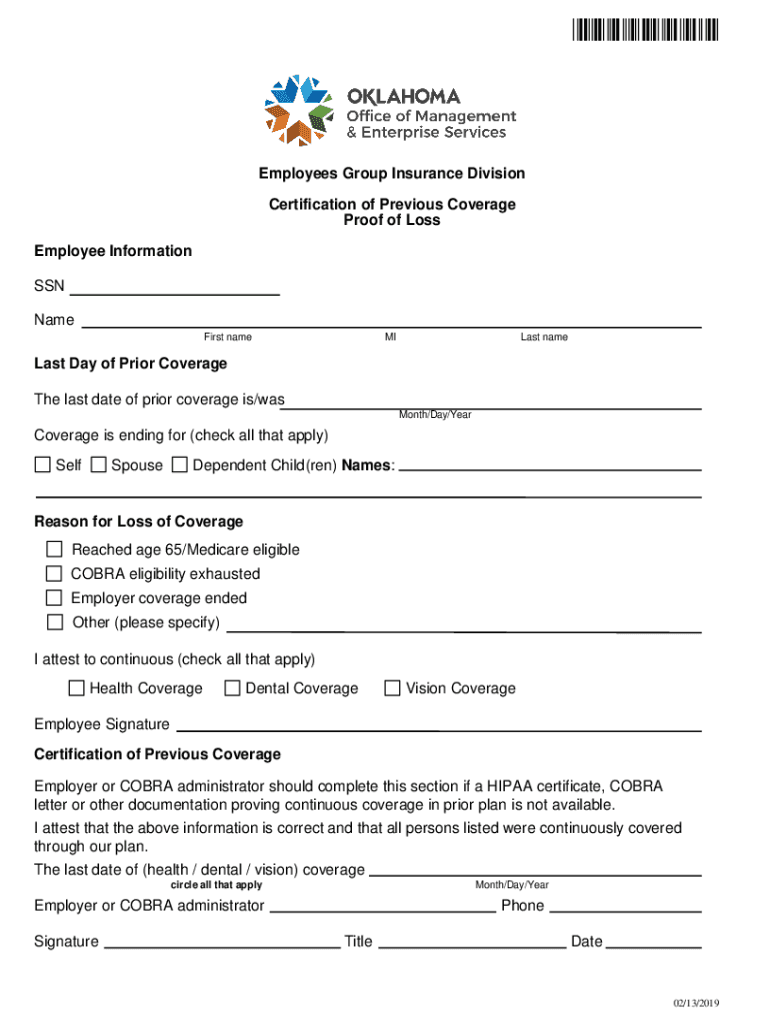

2019 Form OK Certification Of Previous Healthcare Coverage Proof Of

https://www.pdffiller.com/preview/551/364/551364678/large.png

You may need your form to show proof of health plan coverage when filing your tax returns with a tax preparer You don t need to submit it with your return For more information please visit the IRS page on health care information forms Kaiser Permanente mails the 1095 B form only If you received health insurance coverage you should receive forms 1095 A 1095 B or 1095 C You can use the information from Form 1095 A to claim the premium tax credit but Form 1095 B and Form 1095 C do not need to be filed with your tax return

Information about Form 1095 B Health Coverage including recent updates related forms and instructions on how to file Form 1095 B is used by providers of minimum essential health coverage to file returns reporting information for each individual for whom they provide coverage Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on medical care and how you get heath

Do I Need Form 1095 To File A Tax Return Health Insurance Health

https://i.pinimg.com/736x/44/a9/2c/44a92c8a7a961e9f4444d0d47b2f857f--received-by-information-about.jpg

Tax Benefits On Health Insurance Under Section 80D Income Tax Income

https://i.pinimg.com/originals/be/3b/b4/be3bb4dbf8cbf1e522eab2033f926ce7.jpg

https://www.irs.gov/affordable-care-act/questions...

You will use the information on Forms 1095 B to verify that you had health coverage for each month during the year and will check the full year coverage box on your tax return

https://www.irs.gov/affordable-care-act/...

Taxpayers who are preparing to file their tax returns may receive multiple health care information forms that they can use to complete their return The forms are Form 1095 A Health Insurance Marketplace Statement Form 1095 B Health Coverage Form 1095 C Employer Provided Health Insurance Offer and Coverage

What Tax Forms Do I Need For Employee Health Insurance 2023

Do I Need Form 1095 To File A Tax Return Health Insurance Health

How To Avoid Insurance Claim Rejection SAVE TAX SAVE MONEY

Individual Insurance Plan Premiums Double For Some Of Alabama s Insured

Proof Of Insurance Well Expert

Simple Proof Of Insurance Letter Template Riteforyouwellness

Simple Proof Of Insurance Letter Template Riteforyouwellness

Benefits Proof Of Insurance Coverage Letter Customizable Template For

You Can Save Tax Through Health Insurance Infographic

Proof Of Insurance Cards PDF Automobiles Insurance

Tax Return Health Insurance Proof - If you don t expect your income to change for the year you re seeking coverage You can provide your most recent tax return or W 2s If you have a different job than you had last year but expect the same income don t send documents that show income from your old