Tax Return Laundry Uniform If your laundry expenses pass the wholly exclusively and necessarily test you can claim self employed expenses You do this when you do your Self Assessment tax return In the 2024 25 tax year the flat

Key Takeaways Certain job related expenses such as theatrical costumes hard hats and other safety gear may be deductible Items that can be worn outside of work including overalls white dress Learn how to claim uniform expenses on your taxes with our comprehensive guide covering criteria types calculations and IRS guidelines

Tax Return Laundry Uniform

Tax Return Laundry Uniform

http://www.picpedia.org/handwriting/images/tax-return.jpg

Corporate Income Tax Annual Tax Return Form Excel Template And Google

https://image.slidesdocs.com/responsive-images/sheets/corporate-income-tax-annual-tax-return-form-excel-template_d9bd2fc9f4__max.jpg

Bookkeeper For Tax Return Prep OnlineJobs ph

https://media.onlinejobs.ph/employer_logos/420270/ecdb860546c46880bbbebd9f62239d7a.jpg

We pre fill your tax return with work related clothing laundry and dry cleaning expense information you uploaded from myDeductions Check them and add All you need to do is to fill in a form for HMRC to claim back your tax on your Uniform Laundry Expenses for the last four tax years

We pre fill your tax return with work related clothing laundry and dry cleaning expense information you uploaded from myDeductions Check them and add The ATO allows certain taxpayers to claim a deduction for the cost of buying and cleaning occupation specific clothing items of protective wear and for certain

Download Tax Return Laundry Uniform

More picture related to Tax Return Laundry Uniform

Laundry Setup PH Manila

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=421172890031682

Royal Laundry Manorville NY

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100063921760522

Porter Laundry Home

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=2115798298649667

Yes you can deduct the expenses of cleaning and laundering business use uniforms You would be able to expense detergent and appliances but be very careful If you re planning to claim back tax with regard to laundry costs it must be the case that wearing your uniform in the first place is a necessity If you re employed

If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 100s of tax for up to five years of expenses You can reclaim whether Deducting the Laundry Bill There are essentially two 2 options that may allow you to deduct your laundry expenses 1 If the clothing qualifies as deductible

KingsMen Laundry And Cleaning Service

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100063877396558

4 Smart Investments Using Your Tax Return

https://blog.usccreditunion.org/hubfs/tax-return-money.jpg

https://taxscouts.com/expenses/how-much …

If your laundry expenses pass the wholly exclusively and necessarily test you can claim self employed expenses You do this when you do your Self Assessment tax return In the 2024 25 tax year the flat

https://turbotax.intuit.com/tax-tips/jobs-an…

Key Takeaways Certain job related expenses such as theatrical costumes hard hats and other safety gear may be deductible Items that can be worn outside of work including overalls white dress

NRIs How To File Your Income Tax Return On Rental Income From Indian

KingsMen Laundry And Cleaning Service

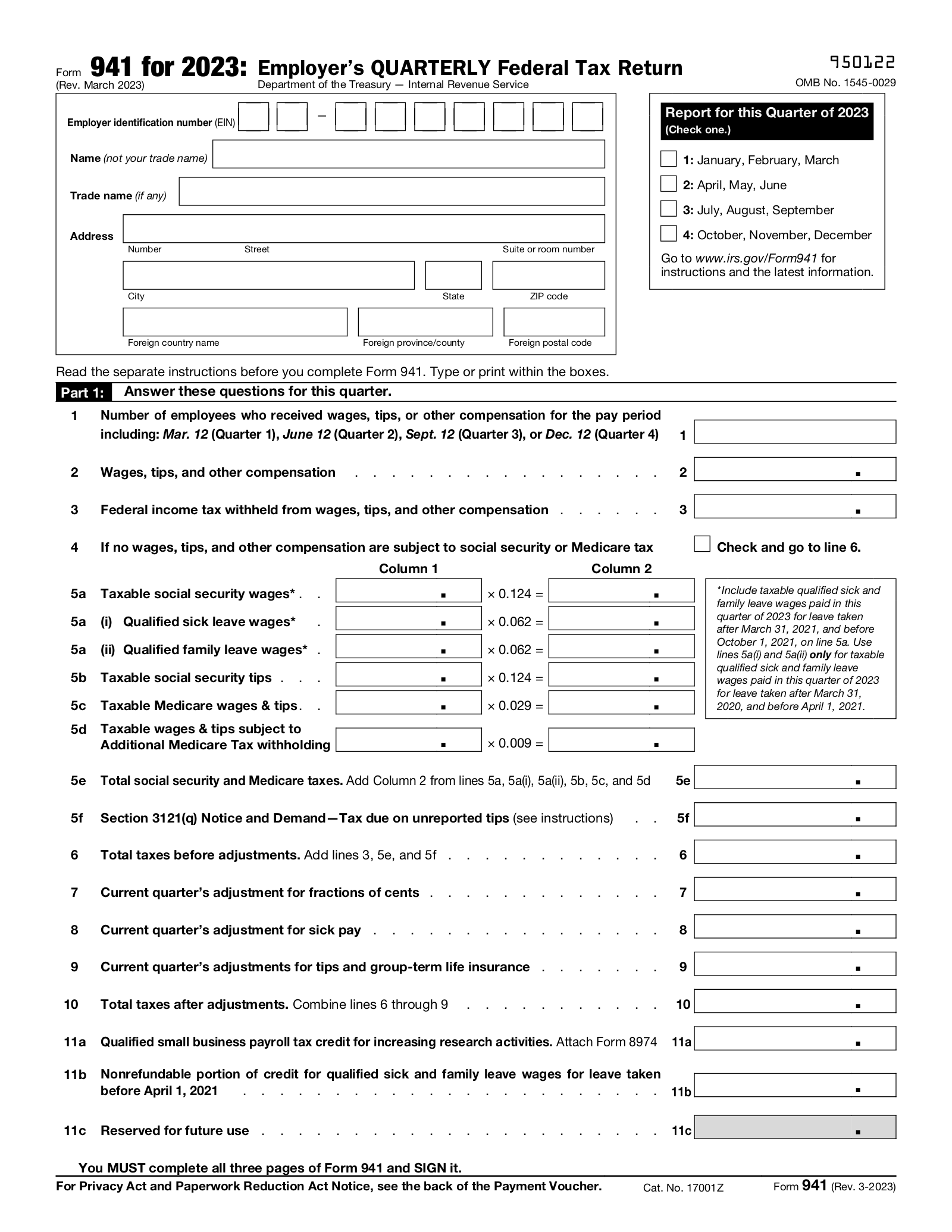

Form 941 Employer s Quarterly Federal Tax Return EForms

Tax Return Deadline Extension

IRS Commissioner Says Tax Return Backlog Will Clear By End Of 2022

Tax Return Employment Self Employment Dividend Rental Property

Tax Return Employment Self Employment Dividend Rental Property

Laundry Detergent Sheets

How To Read And Understand A Tax Return C2P Central

Jev Anne Laundry Shop Cainta

Tax Return Laundry Uniform - 1 Home office deduction The home office deduction may be the largest deduction available if you re self employed If you work 100 remotely as a W 2