Tax Return Law File the tax return for forestry Form 2C by 28 February 2025 Remember also to file and pay VAT if you are registered for VAT Tax return for forestry

Resident taxpayers are required to file an annual tax return where they report their global income and claim any eligible deductions or credits Non residents are taxed only on their Finnish sourced income Under the Internal Revenue Code returns can be classified as either tax returns or information returns although the term tax return is sometimes used to describe both kinds of returns in a broad sense Tax returns in the more narrow sense are reports of tax liabilities and payments often including financial information used to compute the tax A very common federal tax form is IRS Form 1040

Tax Return Law

Tax Return Law

https://emfservices.azureedge.net/news/5564.jpg

Individual Income Tax Return Law Concept Scales Of Justice Criminal

https://thumbs.dreamstime.com/z/individual-income-tax-return-law-concept-scales-justice-criminal-liability-non-payment-taxes-one-hundred-dollars-bill-179457310.jpg

Why Choose A Tax Attorney For Your 2016 Tax Return France Law Firm

https://www.francelawfirm.com/wp-content/uploads/2016/01/Tax-Law.jpeg

In Finland you will receive a pre completed tax return from the Tax Administration in March April The tax return contains information on the income and deductions of the previous year Most people receive a tax decision and tax certificate with their tax return Explore potential tax law changes like TCJA extensions from the new Trump administration and some of the key IRS adjustments for 2025 accounting profession is bracing for the potential tax law changes that now lie ahead as President elect Donald Trump returns to the White House Meanwhile the IRS has outlined several of its planned

Federal and state tax returns are considered confidential and protected by federal law as is other information pertaining to an individual s taxes but there are disclosure laws that provide exceptions Learn about tax return This article aims to provide a clear guide on how the tax return process in Finland works It offers practical advice on preparing and submitting your tax return understanding

Download Tax Return Law

More picture related to Tax Return Law

Trump Tax Return Committee Releases Detailed Report Herald ng

https://int.nyt.com/data/documenttools/e5cb7acb35c3e3d9/1/output-1.png

Pay Your Personal Tax Return By The End Of January Alterledger

https://www.alterledger.com/wp-content/uploads/2022/01/Pay-your-tax-by-end-of-Jan.gif

I Amended My Tax Return Now What

https://optimataxrelief.com/wp-content/uploads/2023/03/2023-optima-amended-tax-return-now-what.jpg

Different sources provide the authority for tax rules and procedures Here are some sources that can be searched online for free Internal Revenue Code The Constitution gives Congress the power to tax Congress typically enacts Federal tax law in Basically the same tax rules apply for a full year of residency as for part of a year of residency Tax returns Spouses file separate returns joint filing or income splitting is not possible In most cases individuals receive pre completed tax returns in

Some taxpayers decide that the hassle and expense of putting together an income tax return is not worth the refund that they might receive at the end of the process Some people forget to file income tax returns and others make a conscious decision not to file a return In some cases those who fail to file income tax returns may face penalties Tax returns and payment of taxes limited liability companies A limited liability company must file a tax return within 4 months from the end of the last calendar month of its accounting period The tax return is recommended to be filed electronically which is easy to do in the MyTax online service Tax year

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

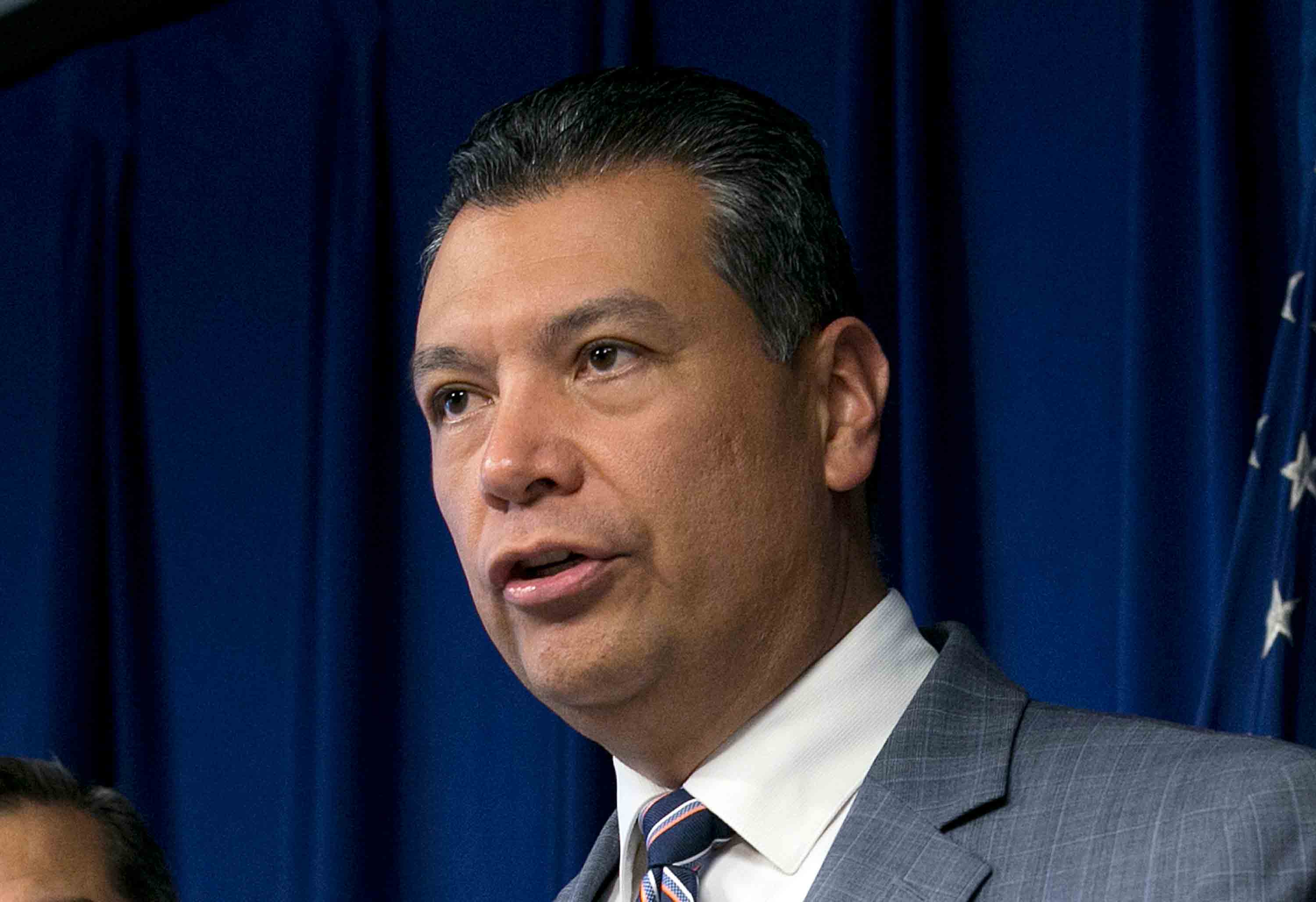

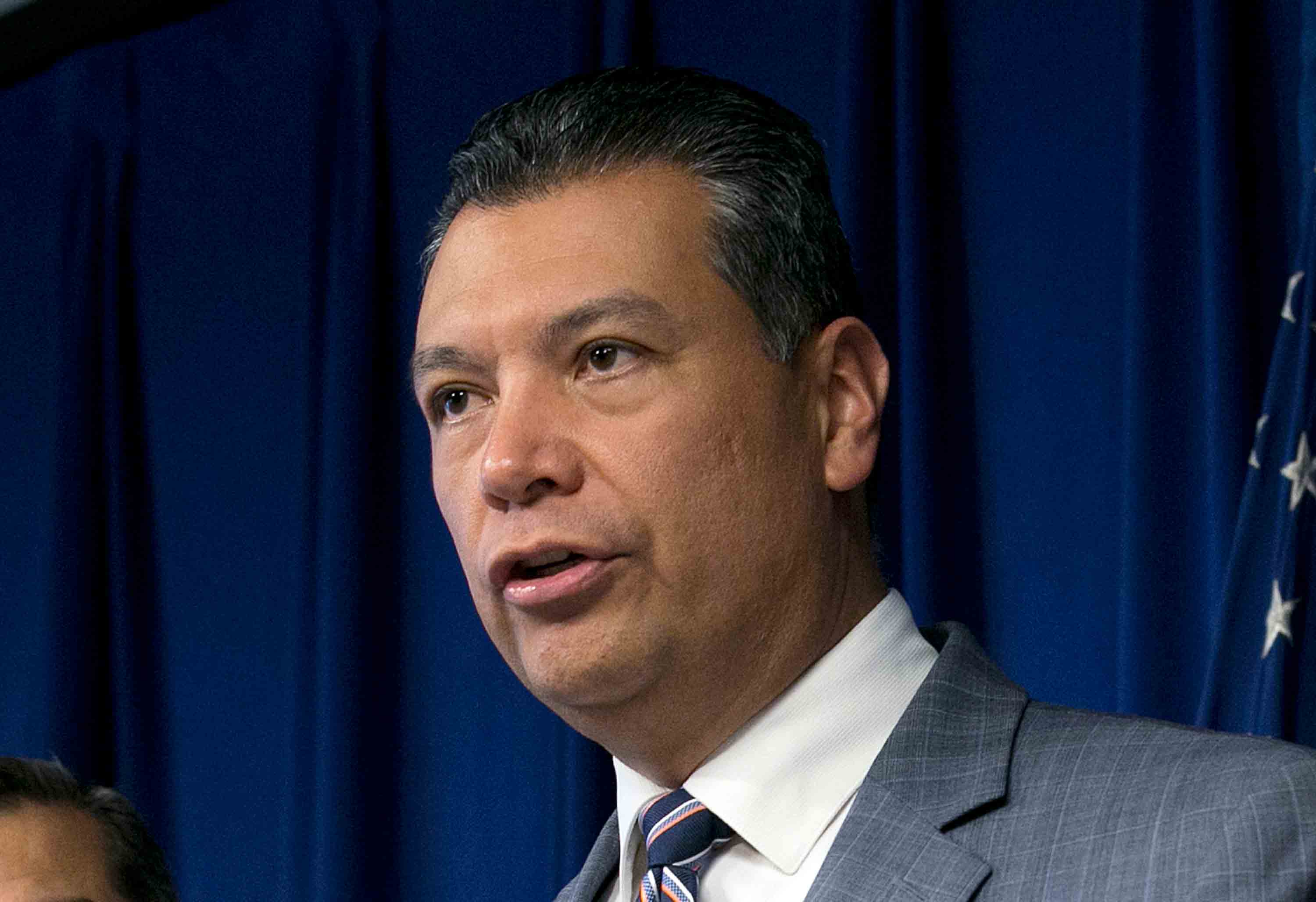

Federal Judge Blocks California s Trump Tax Return Law The Minnesota Sun

https://theminnesotasun.com/wp-content/uploads/2019/09/Trump-Tax-Returns-California_840x480.jpg

https://www.vero.fi › en

File the tax return for forestry Form 2C by 28 February 2025 Remember also to file and pay VAT if you are registered for VAT Tax return for forestry

https://finlandexpat.com › tax-in-finland

Resident taxpayers are required to file an annual tax return where they report their global income and claim any eligible deductions or credits Non residents are taxed only on their Finnish sourced income

4 Smart Investments Using Your Tax Return

Tax Accounting Services Lee s Tax Service

Tax Return Form 2011 A Tax Return Form From 2011 2012 I Am Flickr

Individual Income Tax Return Law Concept Scales Of Justice Criminal

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Draht Verantwortlicher F r Das Sportspiel Vermuten States Of Jersey

ITR Income Tax Return E verification To Complete Filing Process All

ITR Income Tax Return E verification To Complete Filing Process All

Tax Return Free Creative Commons Handwriting Image

Five Grown up Ways To Spend Your Tax Return

Tax Return Law - The new tax changes you should know about before filing your return From new state tax credits to free ways to file there s a lot to know about this tax season By PJ Randhawa Published 9