Tax Return Limited Company Director Overview After the end of its financial year your private limited company must prepare full statutory annual accounts a Company Tax Return You need your accounts and

Company directors will need to register for Self Assessment if they receive taxable income and haven t yet paid any tax on it For instance if you re both a director and a shareholder in the company you As a director of a limited company you must follow the company s rules shown in its articles of association keep company records and report changes file your accounts

Tax Return Limited Company Director

Tax Return Limited Company Director

http://accountantsetc.com/wp-content/uploads/2018/09/guide-to-company-director-duties-accountants-etc.png

Pay Your Personal Tax Return By The End Of January Alterledger

https://www.alterledger.com/wp-content/uploads/2022/01/Pay-your-tax-by-end-of-Jan.gif

How To Complete A Self Assessment Tax Return FreeAgent

https://freeagent-res.cloudinary.com/image/upload/c_limit,w_1000/dpr_auto,f_auto/website-images/netlify/FA_Guide_How-to-complete-Self-Assessment-tax-return_1200x600.png

Remember as a director of a Limited Company you may still need to do a self assessment for the 21 22 tax year by 31st January 2023 Your self assessment is This guidance sets out HMRC s approach to applying legislation on expenses payments and benefits received by directors and employees

What is a Company Tax Return and who needs to deliver one When you must deliver a Company Tax Return The return declaration About this guide This guide will help you Limited company directors are classed as employees for tax purposes Therefore they receive their salary payments through PAYE They will be liable to pay Income Tax and National Insurance on any

Download Tax Return Limited Company Director

More picture related to Tax Return Limited Company Director

8 Reasons To Hire Someone To Help With Your Income Tax Planning Black

https://blackdiamondfs.com/wp-content/uploads/2021/08/taxfilingstatus.jpeg

Company And Personal Tax Services Aspreys Accountants Aspreys UK

https://aspreysuk.com/wp-content/uploads/2022/10/Header-4.png

Tax Efficient Limited Company Director Mortgage

https://media.licdn.com/dms/image/C4D12AQEvfHobWUqnzA/article-cover_image-shrink_720_1280/0/1521198895099?e=2147483647&v=beta&t=nABjXl0OBLBkUGCJYAKaMyCuWVxa_3h3RssRmumZUGA

In this video I m walking through the 21 22 self assessment tax return as a limited company director and shareholder declaring a directors salary and dividend income in a simple In this guide we will provide an overview of self assessment tax for limited company owners and directors including how to register for self assessment and file a

As a director you are responsible for your company s tax affairs You need to Understand how companies are taxed Register your company for all applicable The good news is that HMRC has finally changed their position on directors tax returns Their new advice is that a director will not be required to file an SA return

Does A Limited Company Director Need To File A Tax Return YouTube

https://i.ytimg.com/vi/2YQQMfdypk0/maxresdefault.jpg

What Is A Consolidated Tax Return with Picture

https://images.wisegeek.com/tax-return-form.jpg

https://www.gov.uk/prepare-file-annual-accounts...

Overview After the end of its financial year your private limited company must prepare full statutory annual accounts a Company Tax Return You need your accounts and

https://www.theaccountancy.co.uk/self-a…

Company directors will need to register for Self Assessment if they receive taxable income and haven t yet paid any tax on it For instance if you re both a director and a shareholder in the company you

Alert Why You Need To File Your Taxes Early

Does A Limited Company Director Need To File A Tax Return YouTube

Online Accountants From Just 32 Per Month

File Income Tax Return For Private Limited Company Provenience

Tax Return Clipboard Image

Private Limited Company And Director Are Different Persons ITAT

Private Limited Company And Director Are Different Persons ITAT

How To File Your LLC Tax Return The Tech Savvy CPA

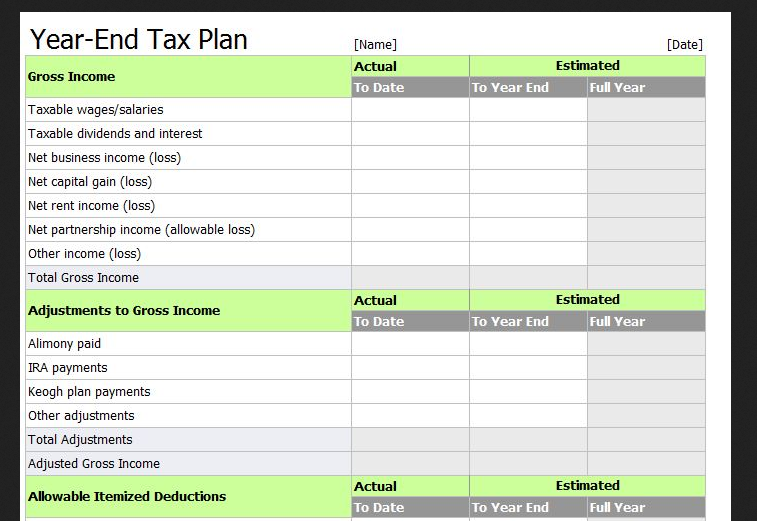

Tax Return Spreadsheet Template Uk Db excel

COMPANY TAX RETURN GUIDE

Tax Return Limited Company Director - Overview Your company or association must file a Company Tax Return if you get a notice to deliver a Company Tax Return from HM Revenue and Customs HMRC