Tax Return Ltd Verkko 17 helmik 2023 nbsp 0183 32 Instructions for completing the income tax return limited companies and cooperatives This guide explains the requirements regarding the information on

Verkko Learn how to prepare and file full statutory annual accounts and a Company Tax Return for your private limited company Find out the deadlines requirements and Verkko Learn how to file a Company Tax Return if you get a notice from HMRC even if you make a loss or have no Corporation Tax to pay Find out the deadlines penalties and

Tax Return Ltd

Tax Return Ltd

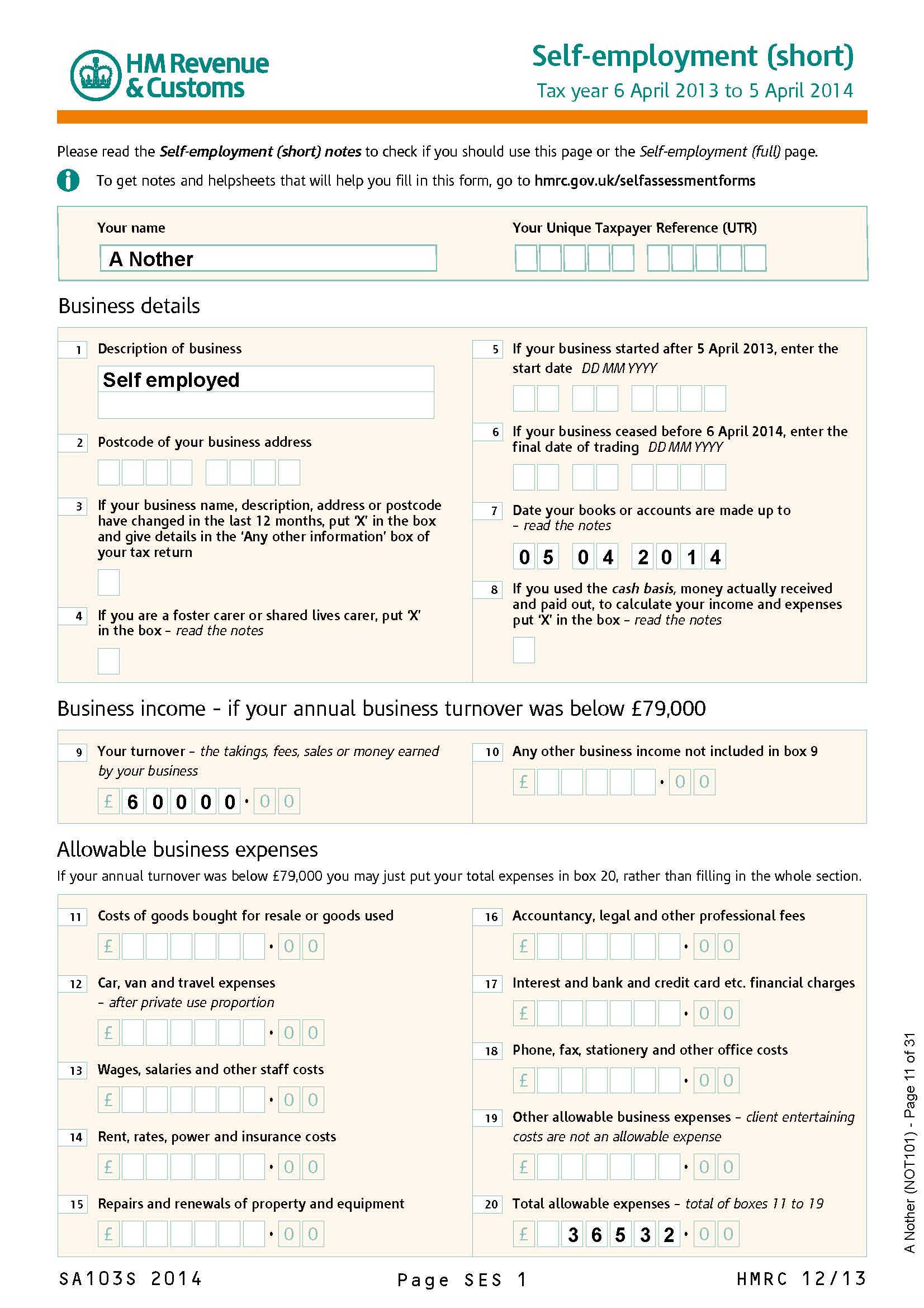

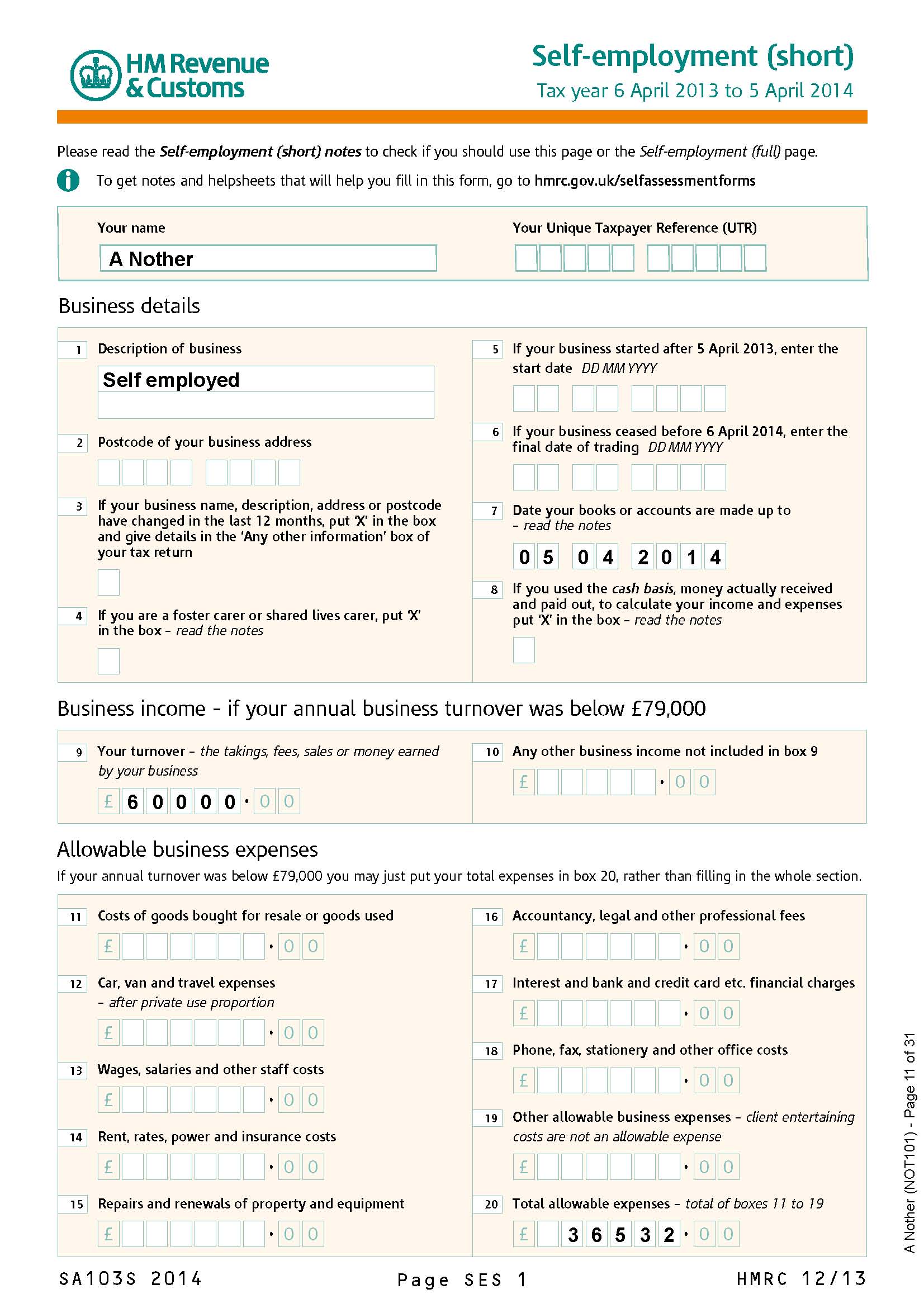

https://ltdaccountancy.co.uk/wp-content/uploads/2020/07/how-to-complete-self-assessment-tax-return-scaled-e1595192725435.jpg

Product Detail

http://www.real-price.co.uk/images/product-images/SPI1001_Page_11_8.jpg

Tax Return Free Creative Commons Handwriting Image

http://www.picpedia.org/handwriting/images/tax-return.jpg

Verkko The amount for income tax is 20 of the profits your limited liability company or co operative makes To determine your company s financial result subtract deductible Verkko Tax Returned Limited PO Box 68031 London NW4 9JB info taxreturned co uk www getyourtaxreturned co uk Business Hours Weekday 9am to 5pm Weekends

Verkko TAX RETURNED LIMITED Free company information from Companies House including registered office address filing history accounts annual return officers charges Verkko 25 elok 2020 nbsp 0183 32 Tax Returned Limited I just wanted to warn people of a company called Tax Returned Limited I asked them to help me with a tax uniform refund They sent

Download Tax Return Ltd

More picture related to Tax Return Ltd

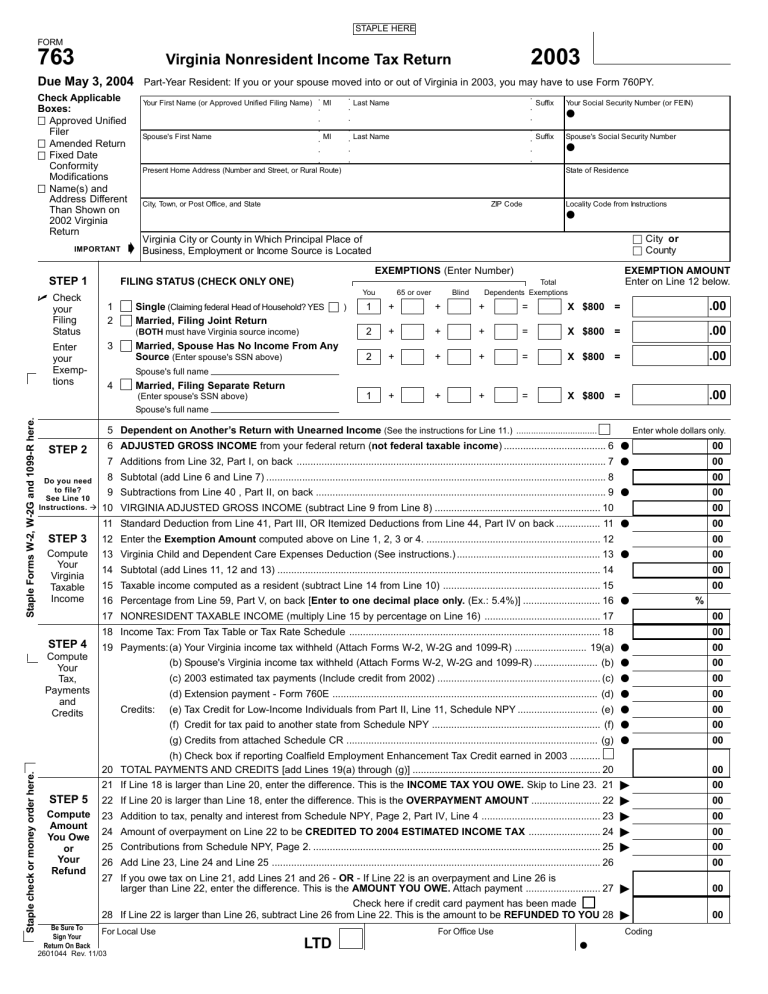

Virginia Nonresident Income Tax Return LTD

https://s3.studylib.net/store/data/008136183_1-11da48d4cca48ef3374adb55471f8bfd-768x994.png

Tax Return Highway Sign Image

http://www.picpedia.org/highway-signs/images/tax-return.jpg

Tax Return Free Of Charge Creative Commons Tablet 1 Image

https://pix4free.org/assets/library/2021-08-07/originals/tax-return.jpg

Verkko Tax Returned Limited is an English limited company incorporated under The Companies Act 2006 number 08828062 169 2024 All rights reserved Privacy Policy Verkko 29 marrask 2023 nbsp 0183 32 Maximum Refund Guarantee Maximum Tax Savings Guarantee or Your Money Back Individual Returns If you get a larger refund or smaller tax due

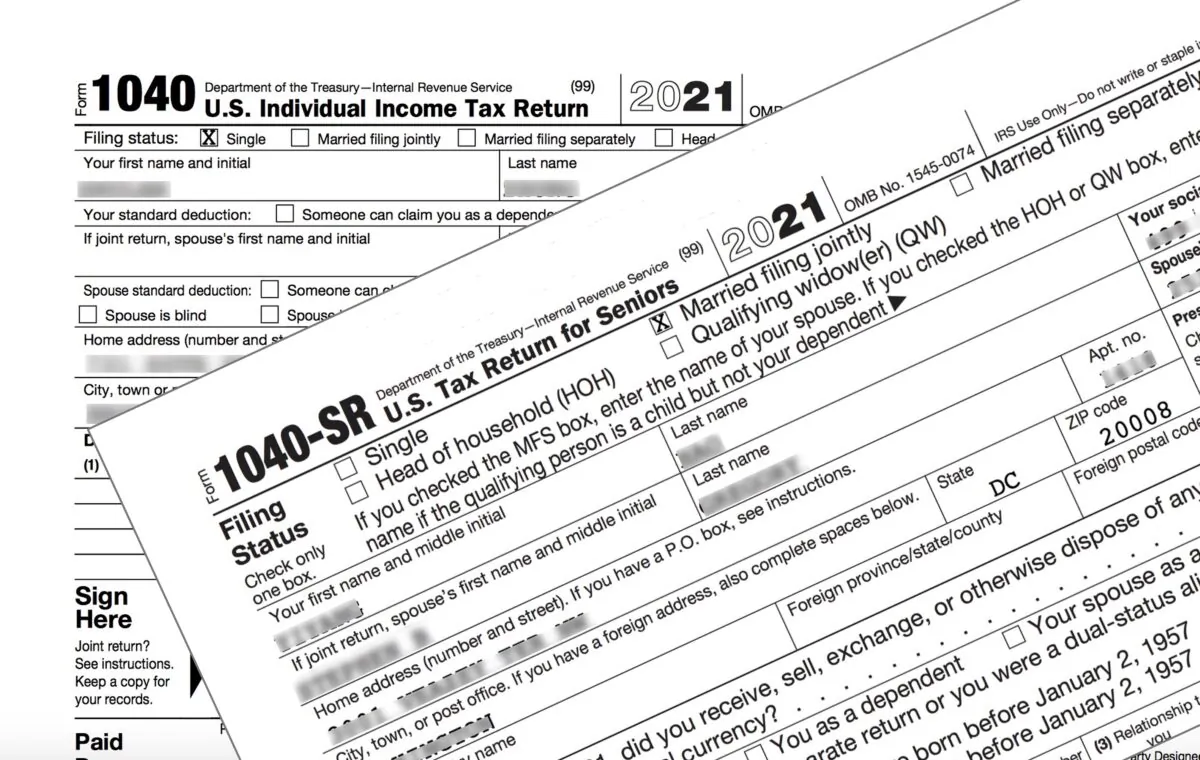

Verkko 2 tammik 2024 nbsp 0183 32 This guide will help you prepare your Company Tax Return It explains how to complete the Company Tax Return form CT600 what other information you Verkko 5 huhtik 2023 nbsp 0183 32 Learn how limited companies are taxed on Corporation Tax VAT National Insurance income tax dividend tax and other types of tax Find out the

4 Smart Investments Using Your Tax Return

https://blog.usccreditunion.org/hubfs/tax-return-money.jpg

Five Grown up Ways To Spend Your Tax Return

https://apexadvice.com.au/wp-content/uploads/sites/137/2023/09/202309-5-ways-to-spend-tax-return-copy.jpeg

https://www.vero.fi/.../instructions_for_completing_the_income_tax_ret…

Verkko 17 helmik 2023 nbsp 0183 32 Instructions for completing the income tax return limited companies and cooperatives This guide explains the requirements regarding the information on

https://www.gov.uk/prepare-file-annual-accounts-for-limited-company

Verkko Learn how to prepare and file full statutory annual accounts and a Company Tax Return for your private limited company Find out the deadlines requirements and

Tax Return Clipboard Image

4 Smart Investments Using Your Tax Return

Income Tax Return Free Of Charge Creative Commons Green Highway Sign

Small Business Tax Preparation Checklist How To Prepare For Tax Season

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Do It Yourself Online Tax Return Prepare Taxes On The Internet And E

Prepare And File Form 2290 E File Tax 2290

Prepare And File Form 2290 E File Tax 2290

Tax Return Employment Self Employment Dividend Rental Property

H R BLOCK TAX RETURN PROGRAM FOR AT HOME On Mercari Tax Software Hr

How To Keep Your Tax Return From Getting Hung Up

Tax Return Ltd - Verkko 1 tammik 2024 nbsp 0183 32 Taxation of general and limited partnerships This page contains guidance about your taxes if you operate business through a general partnership or a