Tax Return Mortgage Interest Rental Property See how to work out the tax relief for individual landlords and assess the impact of the finance cost restriction from 6 April 2017 The tax relief that landlords of residential

You may be allowed claim Mortgage Interest Relief against your rental income The interest must be from a mortgage that is used to purchase improve or repair your rental The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30 up to 30 000 and it rises

Tax Return Mortgage Interest Rental Property

Tax Return Mortgage Interest Rental Property

https://i.ytimg.com/vi/aillCkzA3KI/maxresdefault.jpg

Understanding The Mortgage Interest Deduction With TaxSlayer

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-8.jpg

No Tax Return Mortgage Top 4 Ways To Get Approved In 2023

https://i0.wp.com/balanceprocess.com/wp-content/uploads/2021/10/no-tax-return-mortgage.jpg?w=640&ssl=1

You can deduct mortgage interest you pay on your rental property When you refinance a rental property for more than the previous outstanding balance the portion of the interest allocable to loan proceeds not related to rental use If you increase your mortgage loan on your buy to let property you may be able to treat interest on the additional loan as a revenue expense or get relief against Income Tax

If you receive rental income for the use of a dwelling unit such as a house or an apartment you may deduct certain expenses These expenses which may include mortgage To make the tax system fairer the government will restrict the amount of Income Tax relief landlords can get on residential property finance costs such as mortgage interest

Download Tax Return Mortgage Interest Rental Property

More picture related to Tax Return Mortgage Interest Rental Property

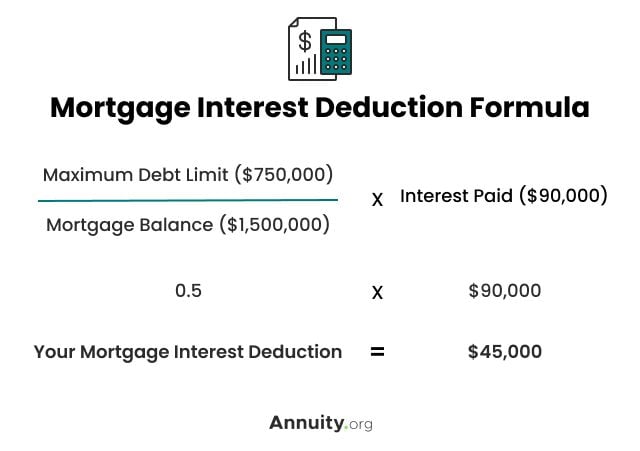

Mortgage Interest Tax Relief Calculator DermotHilary

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Mortgage Without Tax Returns Mortgage Tax Return Mortgage Tips

https://i.pinimg.com/736x/b7/0d/78/b70d7834a4f52155bde75b06ac19cfc7.jpg

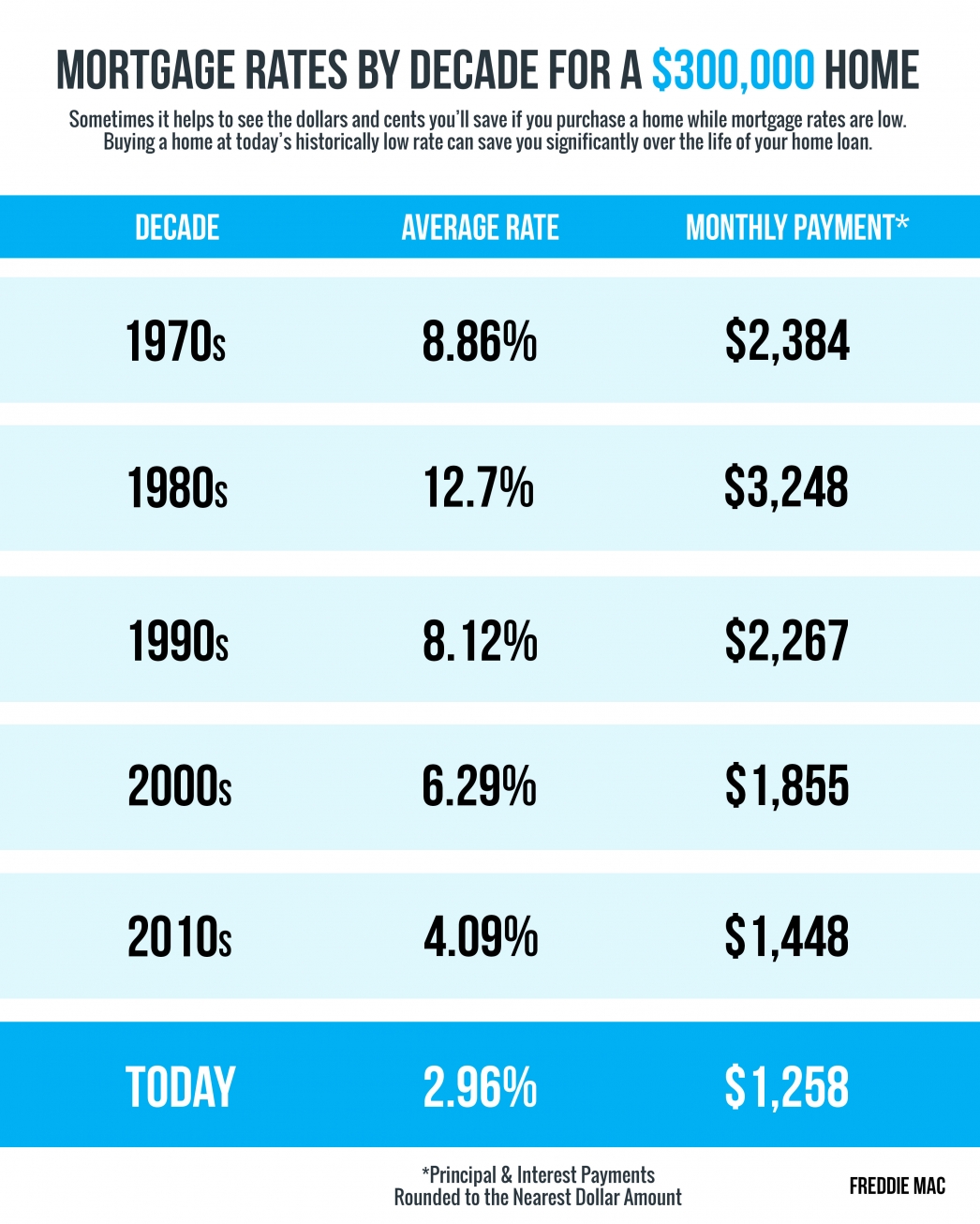

Mortgage Rates Payments By Decade INFOGRAPHIC Blog WestMark

https://www.westmarkrealtors.com/blog/wp-content/uploads/sites/152/2020/08/Mortgage-Rates-Payments-by-Decade-INFOGRAPHIC.jpg

Use this calculator for each loan to help you work out how much interest is deductible Property interest phasing calculator If you borrowed funds on or after 27 March 2021 for your Owning a rental property can return cash and tax advantages You should have rental income after direct expenses insurance and property taxes and you can take a depreciation deduction to offset the taxes on that

If you own rental property and borrow against it to buy a home the interest does not qualify as mortgage interest because the loan is not secured by the home itself Interest mortgage points and real estate taxes can be deducted the year they are incurred Other real estate closing costs such as recording fees transfer taxes and title insurance must

Mortgage Without Tax Returns 2023 Guide

https://homeabroadinc.com/wp-content/uploads/2023/08/No-Tax-Return-Mortgage.jpg

4 Tax Advantages Of Rental Property Investment CF Capital

https://images.squarespace-cdn.com/content/v1/5e71d7603d691d5631ea4b98/1681314320693-T4WCE03AYE06H9444LF7/20230412_CFC_TaxAdvantagesOfRentalProperty.jpg?format=1000w

https://www.gov.uk › guidance › changes-to-tax-relief...

See how to work out the tax relief for individual landlords and assess the impact of the finance cost restriction from 6 April 2017 The tax relief that landlords of residential

https://www.revenue.ie › en › property › rental-income › ...

You may be allowed claim Mortgage Interest Relief against your rental income The interest must be from a mortgage that is used to purchase improve or repair your rental

Mortgages With No Tax Returns No Tax Return Mortgage Dream Flickr

Mortgage Without Tax Returns 2023 Guide

Figuring Out Depreciation On Rental Property EamonMunira

Best Tax Deductions For Homeowners In Essex County

Mortgage Without Tax Returns Required Options For 2024 Dream Home

Tax Requirements For Non Residents Of Canada Earning Rental Income

Tax Requirements For Non Residents Of Canada Earning Rental Income

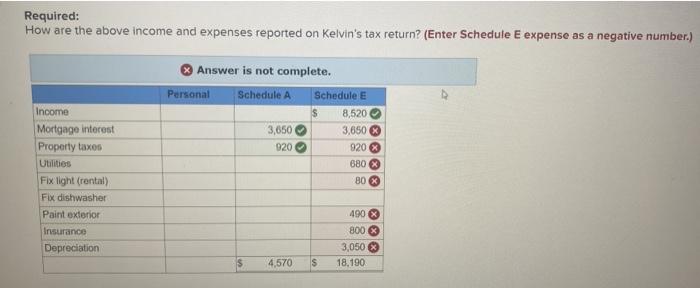

Solved 5 Kelvin Owns And Lives In A Duplex He Rents The Other Unit

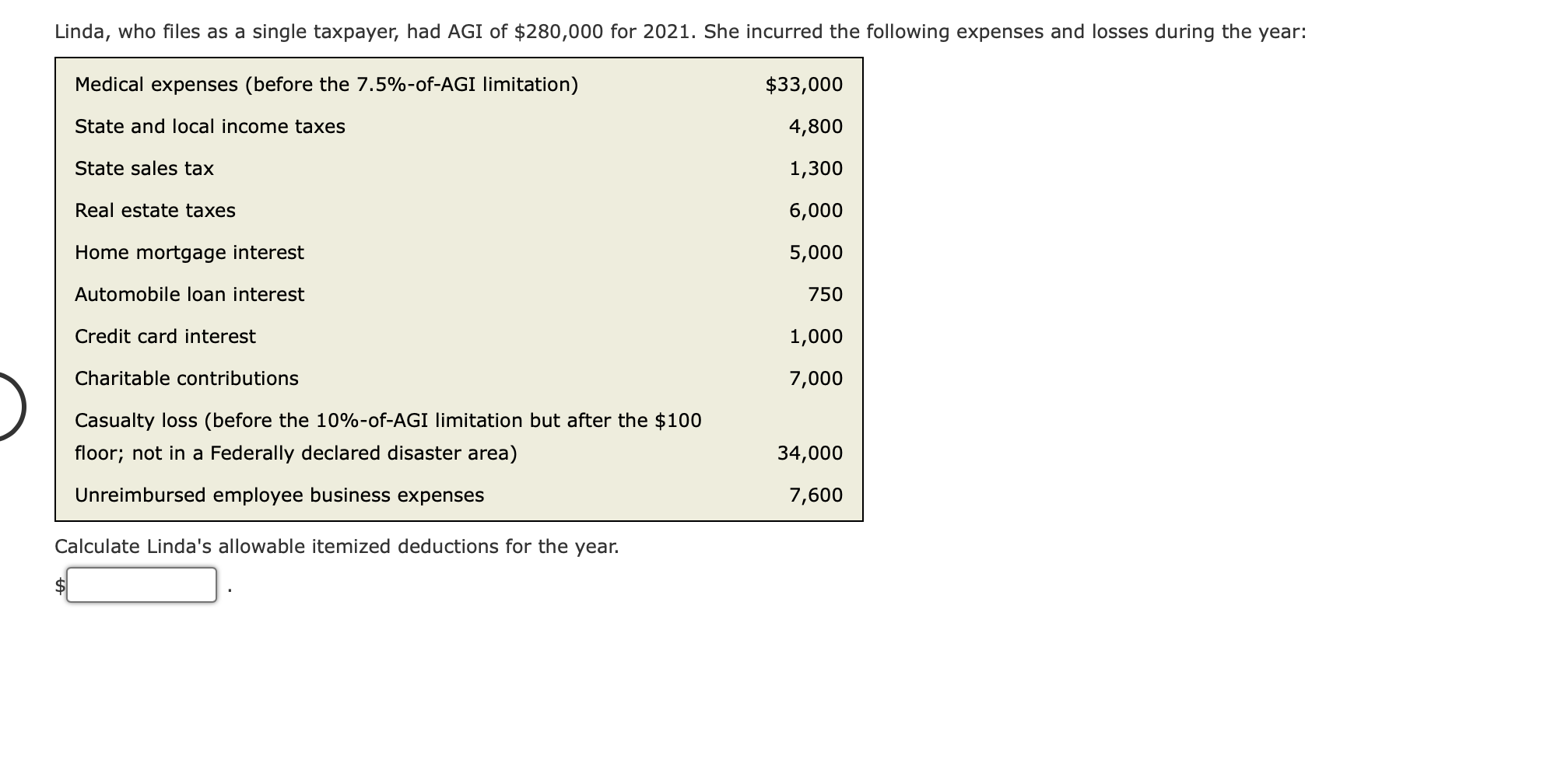

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

Solved Kelvin Owns And Lives In A Duplex He Rents The Other Chegg

Tax Return Mortgage Interest Rental Property - Owning a rental property can generate some extra income but it can also generate some great tax deductions Here are five big ones that tax pros say should be on