Tax Return Mortgage Interest Uk To make the tax system fairer the government will restrict the amount of Income Tax relief landlords can get on residential property finance costs such as mortgage interest

If you increase your mortgage loan on your buy to let property you may be able to treat interest on the additional loan as a revenue expense or get relief against Income Tax as Mortgage interest tax relief is the ability for landlords to deduct their mortgage interest costs from their taxable profits Historically the interest you paid towards a mortgage payment could be deducted from your rental income

Tax Return Mortgage Interest Uk

Tax Return Mortgage Interest Uk

https://i.ytimg.com/vi/aillCkzA3KI/maxresdefault.jpg

Mortgage Without Tax Returns Mortgage Tax Return Mortgage Tips

https://i.pinimg.com/736x/b7/0d/78/b70d7834a4f52155bde75b06ac19cfc7.jpg

No Tax Return Mortgage Top 4 Ways To Get Approved In 2023

https://i0.wp.com/balanceprocess.com/wp-content/uploads/2021/10/no-tax-return-mortgage.jpg?w=640&ssl=1

You might benefit from carrying forward unused finance costs see a detailed calculation of the changes in the mortgage interest tax relief here Read our guide to paying tax on rental income here for more information Interest rates are at a 14 year high and landlords are paying a lot more on their buy to let mortgages so how can they get tax relief for the interest which is unrelievable in the current year 3rd Feb 2023

The tax relief that landlords can now benefit from comes in the form of a 20 tax credit on their mortgage interest payments To put this into perspective if a landlord pays 9 000 in interest they can claim a tax credit From April 2020 landlords will no longer be able to deduct their mortgage costs from their rental income All of the rental income you earn will be taxable and you ll instead receive a 20 tax credit for your mortgage interest This means

Download Tax Return Mortgage Interest Uk

More picture related to Tax Return Mortgage Interest Uk

Mortgage Interest Tax Deduction What Is It How Is It Used

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Mortgage Interest Tax Changes How Will They Affect You

https://www.telegraph.co.uk/content/dam/property/Spark/directline/mortgage-interest-tax-relief-changes-xlarge.jpg?imwidth=1200

Understanding The Mortgage Interest Deduction With TaxSlayer

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-8.jpg

The new mortgage interest tax relief rules mean landlords have to pay more tax on buy to let income Here are 3 calculations so you know what to expect Mortgage interest tax relief by tax year The tax relief that residential landlords could previously claim on their mortgage interest payments was gradually phased out over a period of four tax

From 2020 21 landlords will only be able to offset 20 of their mortgage interest payments when filing their tax returns The change marks the final chapter in the government s Calculate your mortgage interest tax relief Mortgage interest tax relief is probably the last thing landlords want to hear about given the controversial changes to the system that

Mortgage Without Tax Returns 2023 Guide

https://homeabroadinc.com/wp-content/uploads/2023/08/No-Tax-Return-Mortgage.jpg

Mortgages With No Tax Returns No Tax Return Mortgage Dream Flickr

https://live.staticflickr.com/65535/49028798177_6047f32636_b.jpg

https://www.gov.uk/government/publications/...

To make the tax system fairer the government will restrict the amount of Income Tax relief landlords can get on residential property finance costs such as mortgage interest

https://www.gov.uk/guidance/income-tax-when-you...

If you increase your mortgage loan on your buy to let property you may be able to treat interest on the additional loan as a revenue expense or get relief against Income Tax as

Mortgage Without Tax Returns Required Options For 2024 Dream Home

Mortgage Without Tax Returns 2023 Guide

New Year New Home Whip Your Financial Resume Into Shape To Improve

Current Mortgage Rates Dec 18 Rates Fall For Most Loans The

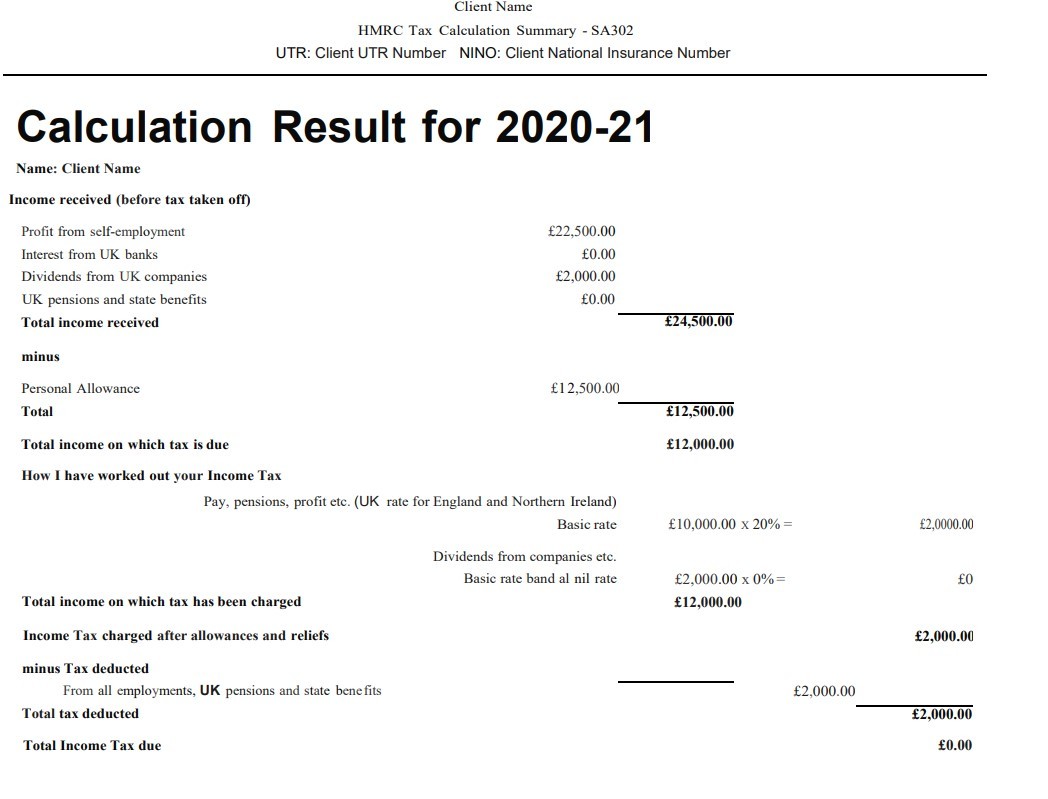

How To Access Your SA302 s And Tax Year Overviews As Income Proof For

UK Mortgage Rates Rise At Fastest Pace In A Decade Finansdirekt24 se

UK Mortgage Rates Rise At Fastest Pace In A Decade Finansdirekt24 se

Mortgage Interest Relief On A Personal Income Tax Return Form Stock

Tax Deductions For Homeowners NerdWallet Tax Deductions Mortgage

Statement Of Information Fillable Form Mortgage Printable Forms Free

Tax Return Mortgage Interest Uk - Interest rates are at a 14 year high and landlords are paying a lot more on their buy to let mortgages so how can they get tax relief for the interest which is unrelievable in the current year 3rd Feb 2023