Tax Return Policy In Australia Your tax return covers the income year from 1 July to 30 June If you need to complete a tax return you must lodge it or engage with a tax agent by 31 October

Your tax return must be lodged or you must engage a tax agent by 31 October When you lodge online with myTax or use a tax agent we pre fill your tax Tax return in Australia learn what information to include when and how to submit and the potential benefits of filing a tax return

Tax Return Policy In Australia

Tax Return Policy In Australia

https://i0.wp.com/www.thecoldwire.com/wp-content/uploads/2021/11/Best-Buy.jpeg

How Can I Find My Tax File Number

https://whitsondawson.com.au/wp-content/uploads/2022/08/Australian-Tax-Return-Form.jpg

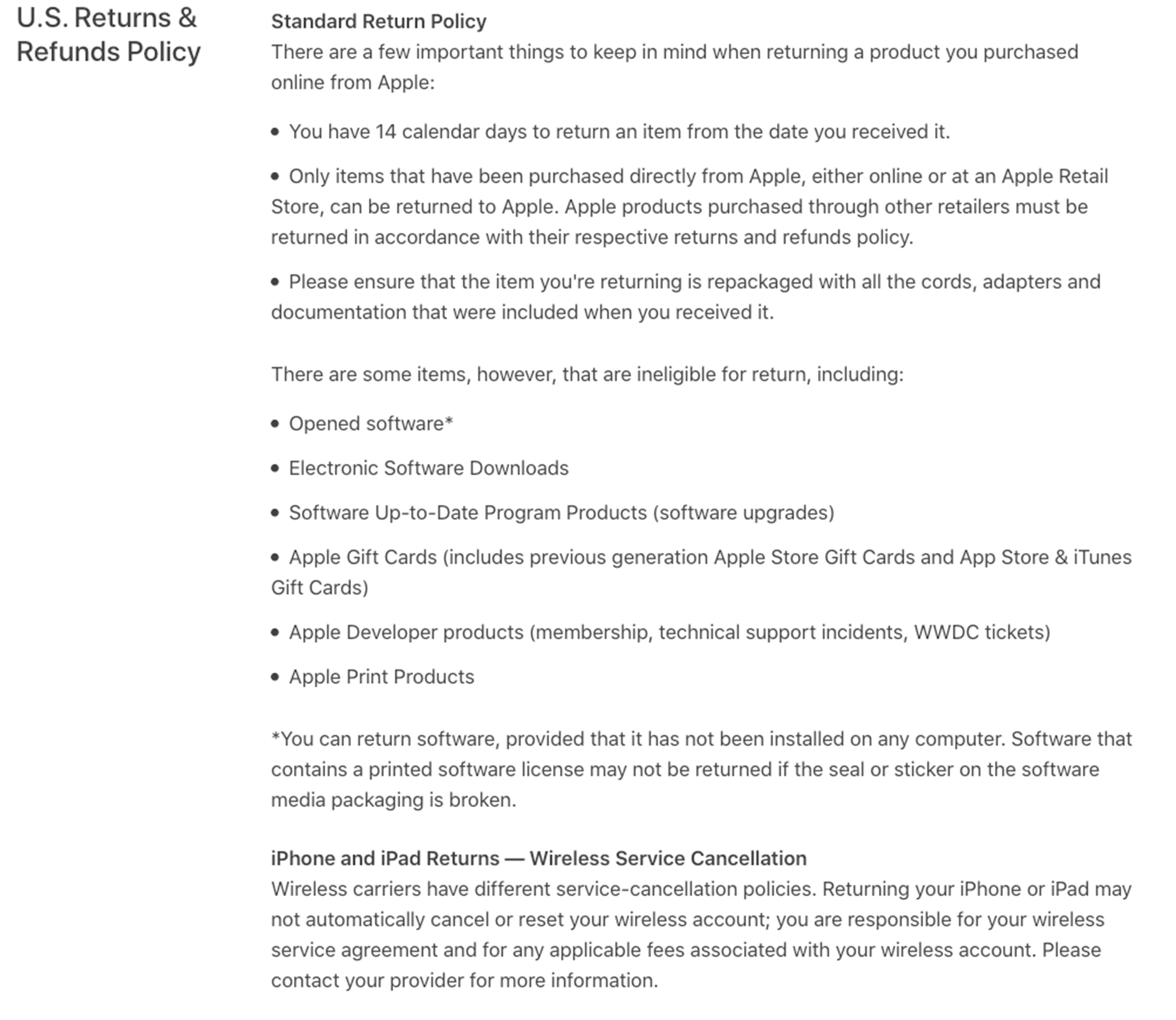

EA s New Refund Policy In Australia Implemented After Warnings From

https://techraptor.net/sites/default/files/styles/image_header/public/imports/2015/04/EA-australia-featured-image.jpg?itok=H1-Phe9y

Learn and understand how Australian income tax system works Includes taxation information on personal and business earnings capital gains current rates tax A resident individual is subject to Australian income tax on a worldwide basis i e income from both Australian and foreign sources except for certain foreign

Learn more about fulfilling your tax obligations in Australia Get to know the requirements tax calculation benefits of lodging your tax returns with H R Block The tax return guide discusses what you will need to do in preparation for completing your tax return as well as providing a step by step guide to the tax return process in Australia for 2024

Download Tax Return Policy In Australia

More picture related to Tax Return Policy In Australia

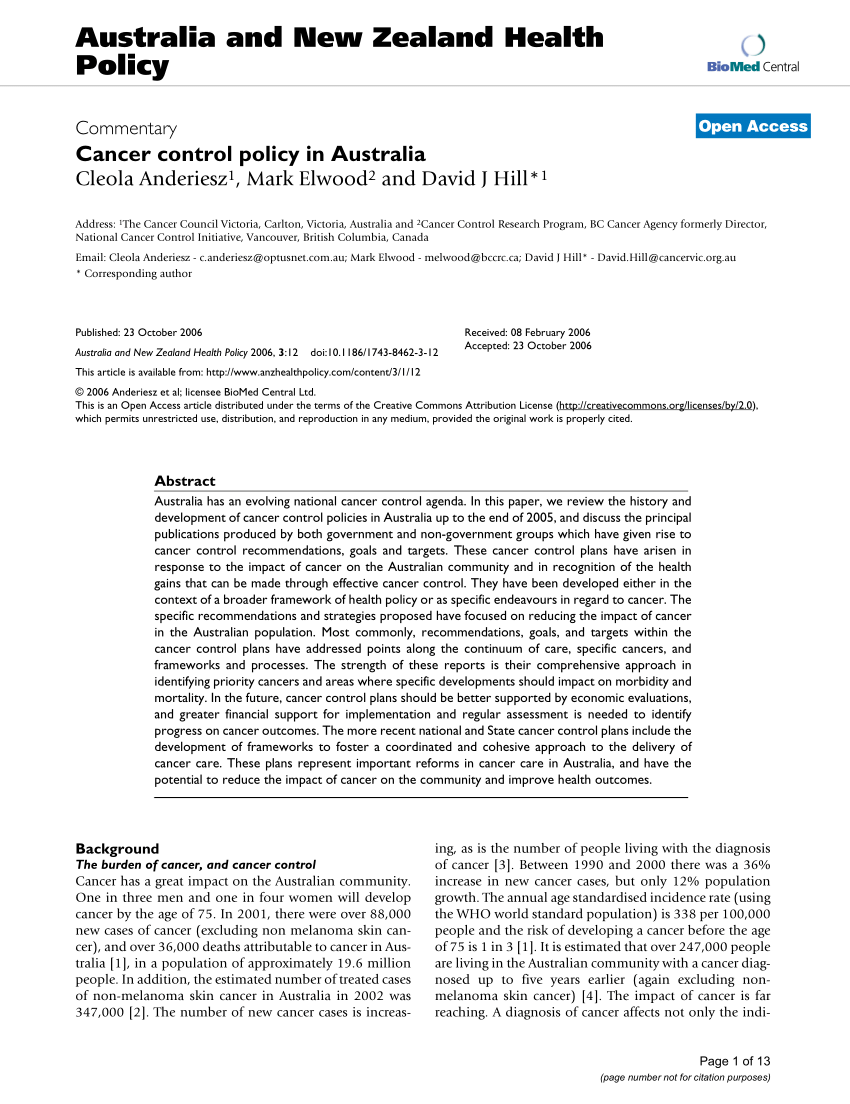

Ecommerce Return Policy Examples Templates 2024

https://www.tidio.com/wp-content/uploads/return-policy-ecommerce-1.png

Return Policy All Returns Exchanges Must Have Receipt Sign Signs

https://i.pinimg.com/originals/ae/63/69/ae636942344f624089812f28e4304dcc.jpg

Taxation Law And Policy

https://law.unimelb.edu.au/__data/assets/image/0005/4072829/varieties/medium.jpg

If you earned Australian income between 1 July 2023 and 30 June 2024 you may need to lodge a tax return If you re doing your own tax you have until 31 October 2024 to Australian tax returns for the tax year beginning 1 July and ending 30 June of the following year are generally due on 31 October after the end of the tax year 1

Using myTax you can lodge your tax return on a computer smartphone or tablet The benefits include We can pre fill most information from your employers This guide will explain the basics of the Australian tax system and tax return process to help you successfully lodge your return In Australia individual taxpayers are

Order Return Policy Vector In Gradient Design 6867399 Vector Art At

https://static.vecteezy.com/system/resources/previews/006/867/399/non_2x/order-return-policy-in-gradient-design-vector.jpg

Publication Details

https://iorder.com.au/upload/image/publications/ex_2679-6.2022_full.jpg

https://www.ato.gov.au/individuals-and-families/...

Your tax return covers the income year from 1 July to 30 June If you need to complete a tax return you must lodge it or engage with a tax agent by 31 October

https://www.ato.gov.au/individuals-and-families/...

Your tax return must be lodged or you must engage a tax agent by 31 October When you lodge online with myTax or use a tax agent we pre fill your tax

Table 2 From Public Policy In Australia And The Politicisation Of The

Order Return Policy Vector In Gradient Design 6867399 Vector Art At

PDF Cancer Control Policy In Australia

Return Policy Definition Templates And Examples IONOS CA

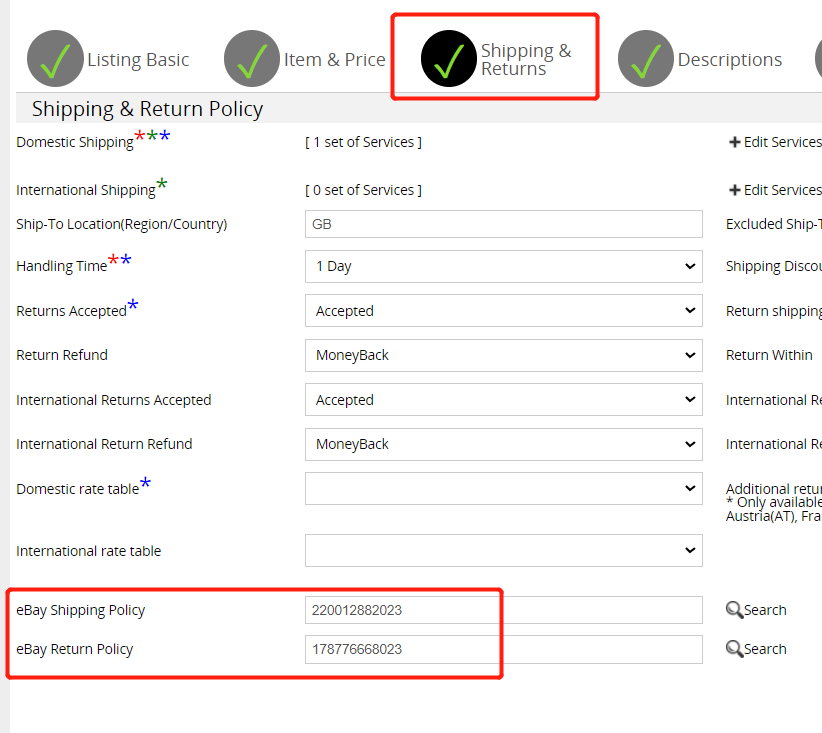

Error You ve Provided An Invalid Shipping Policy Return Policy

CVS Return Policy 10 Things You Need To Know About CVS Return Policy

CVS Return Policy 10 Things You Need To Know About CVS Return Policy

Return Exchange Policy Posh New York

Publication Details

Savers Return Policy 2024 Helpful Tips Methods Involved

Tax Return Policy In Australia - Learn more about fulfilling your tax obligations in Australia Get to know the requirements tax calculation benefits of lodging your tax returns with H R Block