Tax Return Private School Tuition Private school tuition is not tax deductible but you may be able to leverage some tax benefits if you re saving in a tax advantaged account or claiming tax breaks at the state level Also remember that

If your child attends a K 12 private school there is no federal tax deduction or credit you qualify for that will help pay for tuition not even school uniforms However once your child graduates and attends The IRS does not allow deductions on federal income tax returns for private school tuition at the high school and middle school levels College education has

Tax Return Private School Tuition

Tax Return Private School Tuition

https://www.thinkimpact.com/wp-content/uploads/private-school-tuition.webp

Is Private School Tuition Tax Deductible EdChoice

https://www.edchoice.org/wp-content/uploads/2016/04/Private-School-Tuition-Tax-Deductible-Main-1.jpg

How Do I Claim Tuition On My Tax Return Can My Parents Or Spouse Claim

https://torontoaccountant.ca/wp-content/uploads/2013/03/iStock_000005137369Small-822x411.jpg

Generally the cost of tuition for private school for elementary and secondary school students is not tax deductible There are non refundable tuition and education tax Withdrawals made for private school tuition are tax free on a federal level but you should note that states actually oversee 529 plans

If you receive a tuition reduction for education below the graduate level including primary and secondary school it is a qualified tuition reduction and therefore tax free only if your relationship to the educational However you can claim a tax credit for private school if you pay for your children s college tuition If your children are young you could consider opening an educational savings

Download Tax Return Private School Tuition

More picture related to Tax Return Private School Tuition

Bigger Private School Tuition Tax Break Now Available To Louisiana

https://img.particlenews.com/img/id/4ZfKeP_0nQrQzZU00?type=thumbnail_1600x1200

Arizona Private School Tax Credit 2019

https://beachfleischman.com/wp-content/uploads/2018/11/feat_20181105-az-tax-credit-alert.jpg

Tax Deductions And Tax Breaks For Private Schools

https://i.pinimg.com/736x/84/04/f0/8404f098d0f0301d7cb0b4fbfd3dff82.jpg

This Article contains provisions that restrict the taxing rights of the country of temporary presence i e the country of study This means that in most cases the country of study If your child is attending a private K 12 school because they have special education needs you may be able to get a tax break on the tuition The deduction requires a physician s referral

Private school tuition is subject to its own tax ramifications so knowing the tax rules may help you save Learn more about private school tax breaks and deductions No the cost of private school K 12 doesn t qualify for any education deductions or credits on your federal return A few states allow deductions for K 12

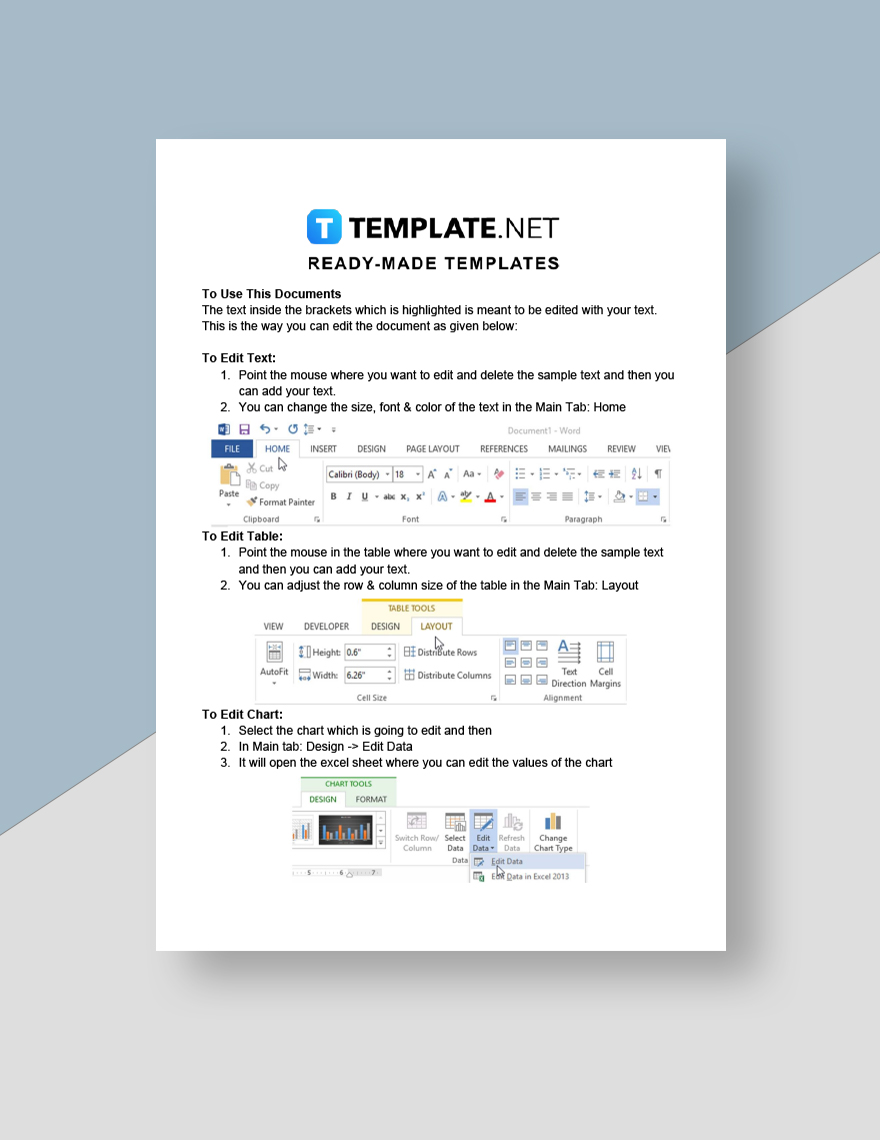

School Tuition Receipt Template Download In Word Google Docs Excel

https://images.template.net/50465/School-Tuition-Receipt-1.jpg

Tax Benefits On Tuition Fees School Fees Education Allowances

https://www.alerttax.in/wp-content/uploads/2017/02/Tax-Benefits-on-Tuition-Fees-School-Fees-Education-Allowances.png

https://smartasset.com/taxes/is-private-scho…

Private school tuition is not tax deductible but you may be able to leverage some tax benefits if you re saving in a tax advantaged account or claiming tax breaks at the state level Also remember that

https://money.howstuffworks.com/personal …

If your child attends a K 12 private school there is no federal tax deduction or credit you qualify for that will help pay for tuition not even school uniforms However once your child graduates and attends

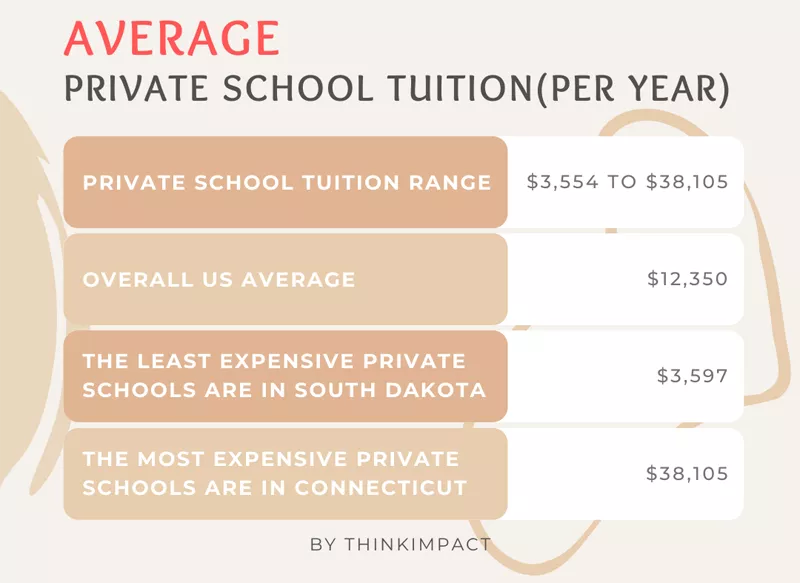

Average Private School Tuition 77 Data Statistics For 2023

School Tuition Receipt Template Download In Word Google Docs Excel

Private School Tax Deductions And Credits

5 Ways To Save For Private School Tuition Bankrate

Tax Saving Investment Office Time Tuition Fees Tax Credits

Is Private School Tuition Tax Deductible

Is Private School Tuition Tax Deductible

Private School Tuition Contract Template In Google Docs Word Pages

Which Education And Tuition Tax Credits Am I Eligible For

If You Have Any Questions About How The Expansion Of The Section 529

Tax Return Private School Tuition - You can file and edit tax return data in MyTax or using a paper form How to check your tax return How to file information for your tax return Finland does usually not impose