Tax Return Student Loan Tell HMRC about a student or postgraduate loan in your tax return English Cymraeg If you complete a Self Assessment tax return you must use it to tell

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a

Tax Return Student Loan

Tax Return Student Loan

https://i.pinimg.com/originals/bc/2d/0d/bc2d0decaa44747c10c1ea6b2bd2d332.jpg

Houston Bookkeepers Tip The 4 Ways To Pay For College And How They

https://houstonbookkeeper.net/wp-content/uploads/2016/03/Houston-tax-return-student-loan1.jpg

Simplifying The Cares Act For Student Loans intercession4ag

https://i.pinimg.com/originals/aa/af/ef/aaafef429da6662ed73a35d17c428d08.jpg

1098 E Tax Form U S Department of Education 1098 E Student Loan Interest Statement If you made federal student loan payments in 2022 you may be eligible to Feb 8 2024 at 9 53 a m Getty Images You may be eligible for a tax reduction based on your student loan interest Key Takeaways If you took out an educational loan for

Key Takeaways If you include student loan interest in you tax deductions you can lower your tax bill Up to 2 500 of student loan interest can be tax deductible each year The student loan interest deduction is a tax break for college students or parents who took on debt to pay for their school It allows you to deduct up to 2 500 in

Download Tax Return Student Loan

More picture related to Tax Return Student Loan

How To Get 10 000 Student Loan Payment Refund After Paying Off Your

https://i.ytimg.com/vi/ZxgntWqIZhc/maxresdefault.jpg

How To Use Your Tax Return Effectively To Reduce Student Loan Payments

https://i.pinimg.com/originals/2a/7e/7a/2a7e7ac89cf46ee0ad4621a38a4cff24.jpg

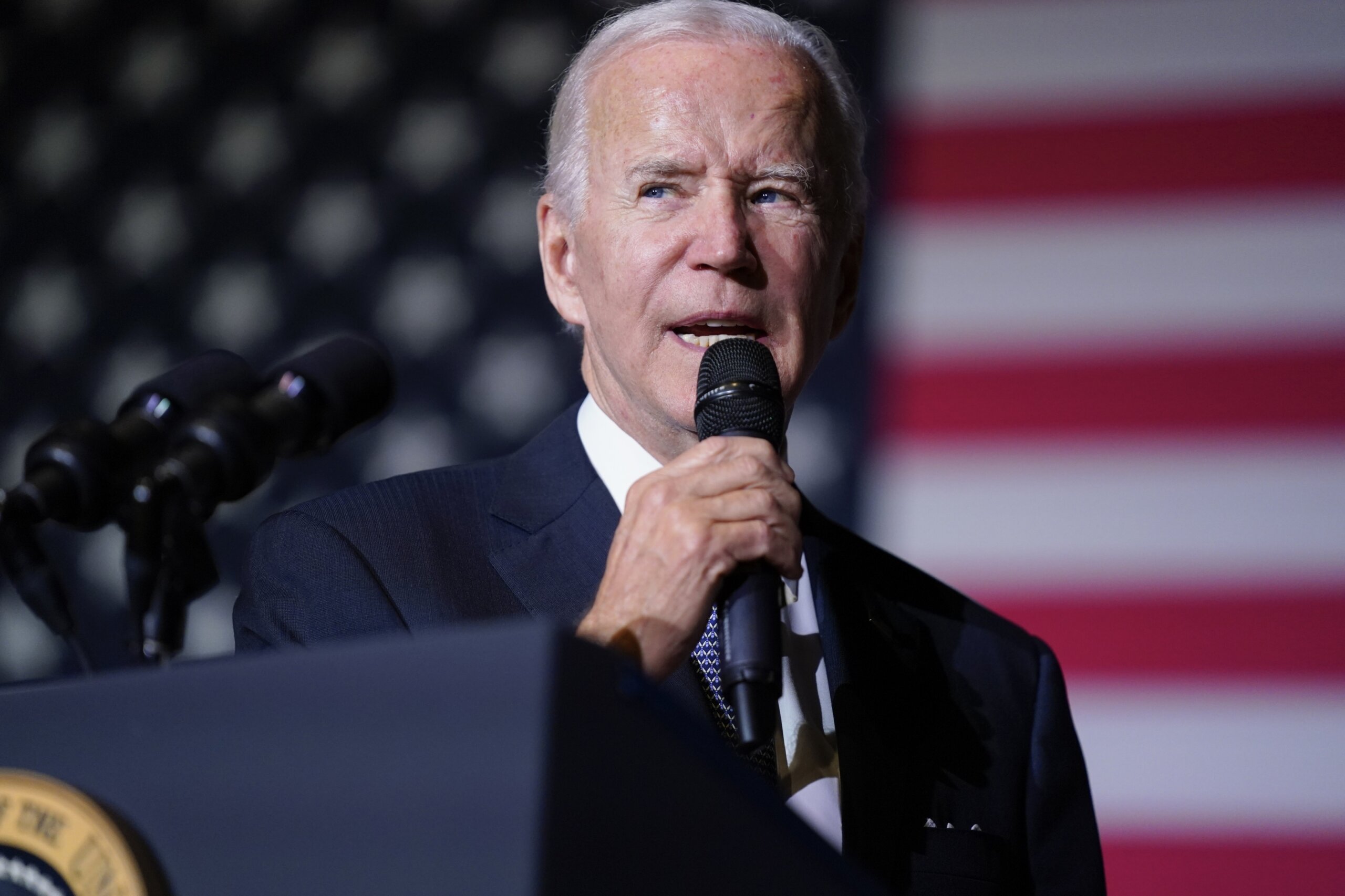

How To Qualify For Student Loan Tax Break Despite Payment Pause

https://image.cnbcfm.com/api/v1/image/107185937-1675099533332-gettyimages-1451131632-dsc09474-edit.jpeg?v=1675175401&w=1920&h=1080

When you use student loan funds to finance your education if you are eligible the IRS allows you to claim qualifying Student loans can impact your federal income tax return in several ways from reducing your taxable income to losing your refund depending on your situation

You are a single filer with an income below 65 000 or a modified adjusted gross income of less than 80 000 Benefits of the Student Loan Deduction There are The amount of student loan interest you can deduct decreases as your income rises For example as a single filer you can only claim the full interest amount

CAN YOU GET A MORTGAGE LOAN WITH STUDENT DEBT Toronto Real Estate

https://images.unsplash.com/photo-1544717305-2782549b5136?ixid=Mnw0MTQ1MnwwfDF8c2VhcmNofDV8fFNUVURFTlR8ZW58MHx8fHwxNjc3NTk5MDM5&ixlib=rb-4.0.3&q=80&w=1280

Five Grown up Ways To Spend Your Tax Return

https://apexadvice.com.au/wp-content/uploads/sites/137/2023/09/202309-5-ways-to-spend-tax-return-copy.jpeg

https://www. gov.uk /guidance/tell-hmrc-about-a...

Tell HMRC about a student or postgraduate loan in your tax return English Cymraeg If you complete a Self Assessment tax return you must use it to tell

https://www. forbes.com /advisor/taxes/student-loan...

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a

Tax Accounting Services Lee s Tax Service

CAN YOU GET A MORTGAGE LOAN WITH STUDENT DEBT Toronto Real Estate

Where To Enter Student Loan Interest On Tax Return Student Gen

Getting Married With Student Loan Debt Here s What You Need To Know

EXPLAINER Where Does The Student Loan Debt Plan Stand WTOP News

4 Smart Investments Using Your Tax Return

4 Smart Investments Using Your Tax Return

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Draht Verantwortlicher F r Das Sportspiel Vermuten States Of Jersey

50K Debt Free Student Loan Chart Student Loan Payoff Progress Chart

VA Loan Requirements Will I Be Penalized For Paying Off My Loan Early

Tax Return Student Loan - Yes you will be able to deduct qualifying student loan interest payments for the 2023 tax year when you file your tax return in 2024 However note that most federal student