Tax Return Us Tourist Requirements for a refund include presenting original receipts meeting minimum purchase amounts making purchases within 30 days of departure and taking the items out of the

April 7 2023 Tips Is There a Tax Free Program in the USA According to the U S Customs and Border Protection department the United States Government doesn t USA Electronic filing e file Taxpayers with an AGI Adjusted Gross Income within a specified threshold can electronically file their tax return for free using Free File

Tax Return Us Tourist

Tax Return Us Tourist

https://www.greenbacktaxservices.com/wp-content/uploads/2020/06/Late-Tax-Return-Custom.jpeg

CONTENTdm

https://digital.tcl.sc.edu/digital/api/singleitem/image/idn/55/default.jpg

Jugar Prematuro Lev ntate Informaci n Impuesto Sobre La Renta Sede

https://w7.pngwing.com/pngs/453/780/png-transparent-form-1040-irs-tax-forms-internal-revenue-service-tax-return-tax-information-reporting-text-material-income-tax.png

If you are a U S citizen or legal permanent resident green card holder traveling or living outside the United States please register with the State Department s Smart Traveler Loading Sorry to interrupt CSS Error

1 I m a U S citizen living and working outside of the United States for many years Do I still need to file a U S tax return 2 I pay income tax in a foreign country Do I still have to Certain states Texas Louisiana allow the tourists to claim the tax refund on taxable items and US citizens can claim a refund if they travel outside the US within 30 days State and

Download Tax Return Us Tourist

More picture related to Tax Return Us Tourist

US Tax Return Swiss Payroll Tax Services

https://www.spts.ch/wp-content/uploads/2018/07/US-TAX-Final-615384_1920.jpg

Pre printed US Tax Declaration Forms Income Tax Return USA Stock

https://c8.alamy.com/comp/B0925D/pre-printed-us-tax-declaration-forms-income-tax-return-usa-B0925D.jpg

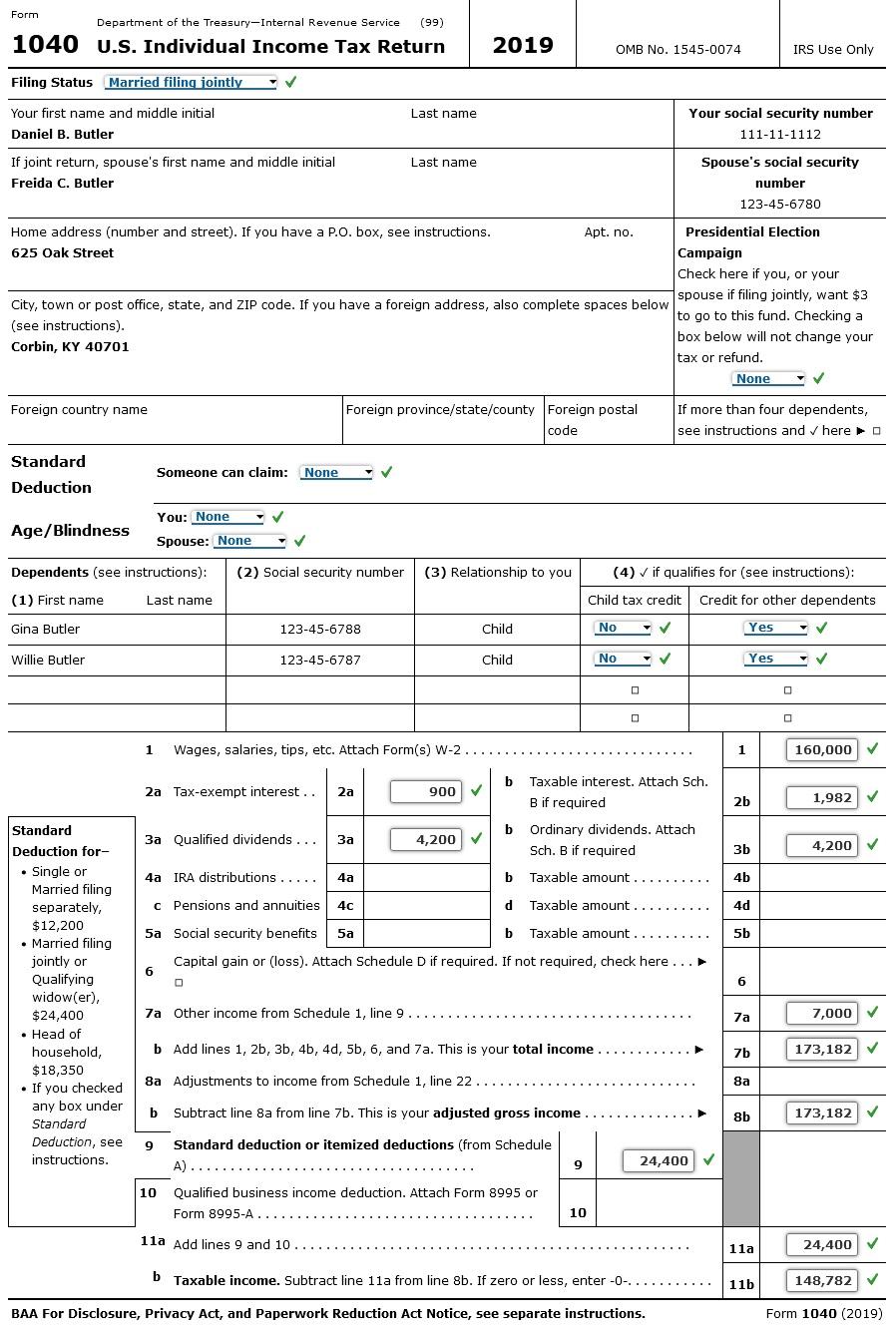

Solved 6 1 Final Project Practice Tax Return TRP 04 57 Chegg

https://media.cheggcdn.com/media/668/66867a19-e5a4-4fa2-8f43-6f200546bff2/phpdJZjcm

To see the sales tax rate of a particular state see tax rates Please note the tax rates table does not include city or county sales taxes Tax Refunds The U S Government does not With a more modest tax refund visitors can still plan an awesome trip either domestically or abroad The lowest tax refund is typically in Maine where the average taxpayer saw a

US citizens and permanent residents must file tax returns with the IRS no matter where they live or earn their money US tax obligations for expatriates If you re an American Visitors to the USA may be liable for U S taxes if they stay longer than the tax rules permit A review of the relevant rules may avoid serious tax liability

Did You Know That You Have To Pay Tourist Tax For Every Day Of Your

https://images.news18.com/tamil/uploads/2023/03/travel-tax-1-167956019816x9.jpg

Checking Your Tax Return Article The United States Army

https://www.army.mil/e2/c/images/2014/02/06/330792/original.jpg

https://www.stilt.com/taxes/tax-refund-usa

Requirements for a refund include presenting original receipts meeting minimum purchase amounts making purchases within 30 days of departure and taking the items out of the

https://justtravelusa.com/tax-free-usa

April 7 2023 Tips Is There a Tax Free Program in the USA According to the U S Customs and Border Protection department the United States Government doesn t

Tourist Development Tax Return Form Printable Pdf Download

Did You Know That You Have To Pay Tourist Tax For Every Day Of Your

Reforming Federal Income Tax The Regulatory Review

4 Crucial Things Expats Need To Know About The US Tax Return UK

How To Use Your Tax Return Wisely Washington Real Estate Northwest

Americans Citizens both Citizens And Permanent Residents Required To

Americans Citizens both Citizens And Permanent Residents Required To

Learn How To Fill The Form 1120 U S Corporation Income Tax Return

How To Find Taxable Income On Tax Return

Money Concepts

Tax Return Us Tourist - Loading Sorry to interrupt CSS Error