Tax Return Vs Refund A tax refund is a state or federal reimbursement to a taxpayer who overpaid the taxes that they owed for the year often by having too much withheld from their paychecks

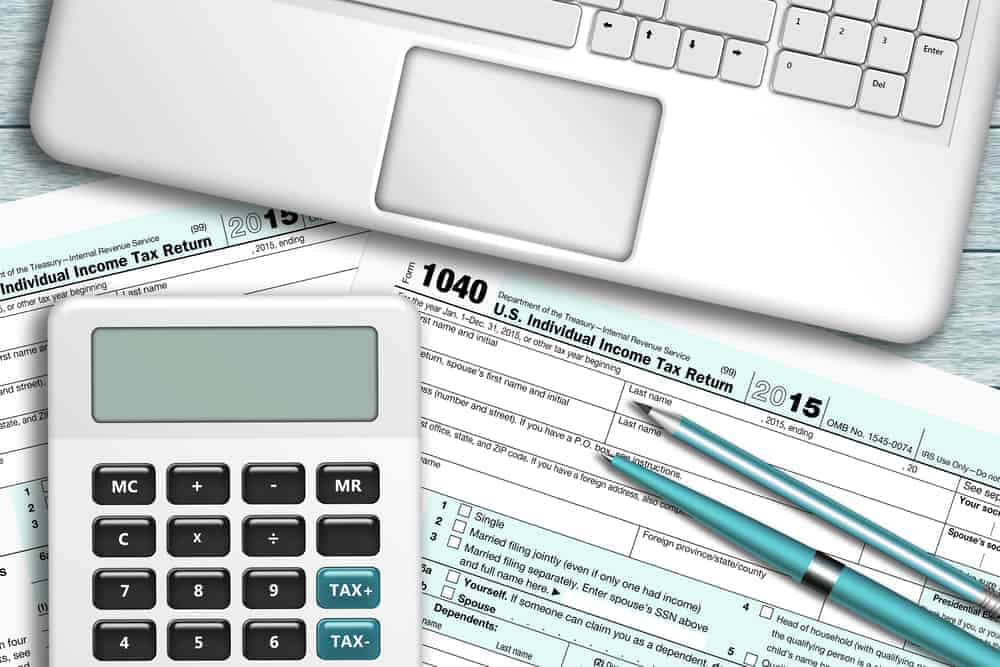

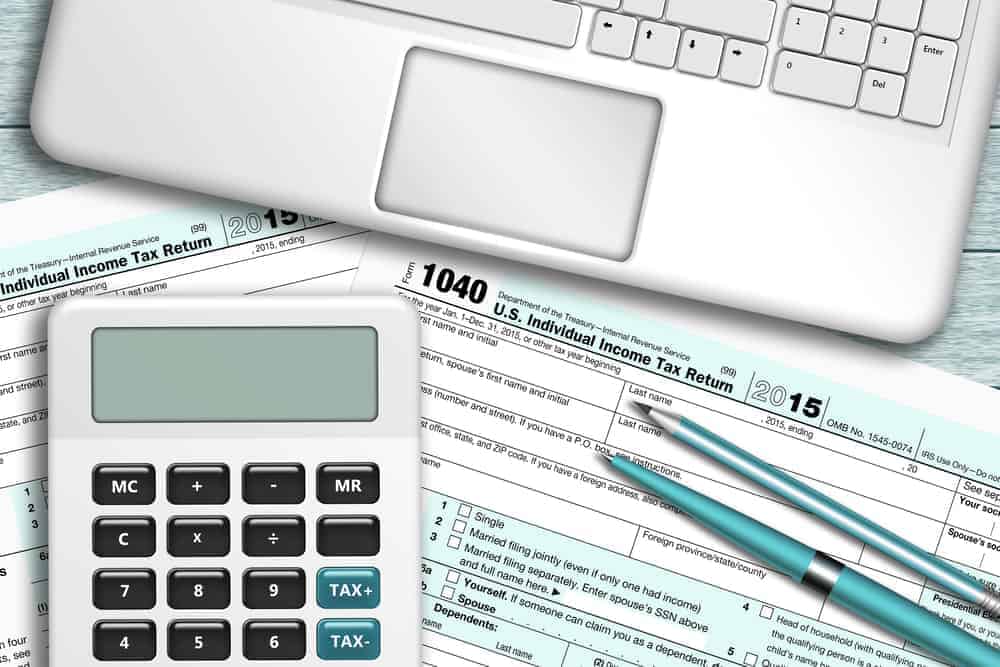

Tax Return vs Tax Refund Your tax return is a calculation of what you owe the IRS or what the IRS owes you Your tax refund is a payment made to you by the IRS because you overpaid over the course of the year or were eligible for one or more refundable tax credits You can request a tax refund from the government by filing an annual tax return This document reports how much money you earn expenses and other important tax information It will help you to calculate how many taxes you owe schedule tax payments and request a refund when you have overpaid

Tax Return Vs Refund

Tax Return Vs Refund

https://www.lessdebtmorewine.com/wp-content/uploads/2022/02/Depositphotos_95123388_S-1.jpg

Chargeback Vs Refund Heartland

https://cdn-gss.dataweavers.io/-/media/project/gpn/heartland/heartland/dry-fly-blogs/chargeback-vs-refund.jpg?rev=1fcb25a30735483bb3cfe53836e66890

Chargeback Vs Refund Differences And How To Handle Them

https://ccbill.com/wp-content/uploads/chargeback-vs-refund.jpg

While often used interchangeably they carry distinct meanings 1 Tax Return A tax return is the annual document filed with the Internal Revenue Service IRS by individuals and businesses It details income deductions and credits aiming to determine tax owed or refunded Typically due on April 15th deadlines may extend for specific groups Tax returns allow taxpayers to calculate their tax liability schedule tax payments or request refunds for the overpayment of taxes In most countries tax returns must be filed annually

Federal tax returns collect information about personal or businesses income and help filers determine how much they may owe or receive as a refund A refund in the context of taxes is reimbursement for an overpayment of taxes by a government taxing authority In a wider context businesses and merchants issue refunds to customers who are

Download Tax Return Vs Refund

More picture related to Tax Return Vs Refund

Chargeback Vs Refund Differences And How To Handle Them

https://ccbill.com/wp-content/uploads/fraud-cases.jpg

Chargeback Vs Refund What s The Difference Which Is Better

https://paymentcloudinc.com/blog/wp-content/uploads/2022/05/chargeback-no-refund-policy-1-1536x1021.jpg

Chargeback Vs Refund What s The Difference YouTube

https://i.ytimg.com/vi/9e8QpZ0lys8/maxresdefault.jpg

Wondering if you ll get a tax refund how long you ll have to wait and how to maximize it Find all the answers right here A refund just means you withheld too much from your paycheck while an additional tax liability means you didn t withhold enough What s in a refund As exciting as refunds are they re really just the federal government returning the extra amount you paid

[desc-10] [desc-11]

Ep 2 Standard Deductions In Personal Tax Return Vs Schedule C YouTube

https://i.ytimg.com/vi/tf2kZR6kS0o/maxresdefault.jpg

Chargeback Vs Refund Differences And How To Handle Them

https://ccbill.com/wp-content/uploads/chargeback-vs-refund-definitions.jpg

https://www.investopedia.com/terms/t/tax-refund.asp

A tax refund is a state or federal reimbursement to a taxpayer who overpaid the taxes that they owed for the year often by having too much withheld from their paychecks

https://www.thebalancemoney.com/what-is-a-tax-return-5114242

Tax Return vs Tax Refund Your tax return is a calculation of what you owe the IRS or what the IRS owes you Your tax refund is a payment made to you by the IRS because you overpaid over the course of the year or were eligible for one or more refundable tax credits

Chargeback Vs Refund How They Differ And How To Deal With Them

Ep 2 Standard Deductions In Personal Tax Return Vs Schedule C YouTube

Chargeback Vs Refund Differences And How To Handle Them

Chargeback Vs Refund Know The Difference

Chargeback Vs Refund Which One Is The Correct One

Return Vs Refund When To Use Each One In Writing

Return Vs Refund When To Use Each One In Writing

Chargeback Vs Refund Differences And How To Handle Them

Tax Return Vs Tax Refund Here s How They re Different Coupon Matrix

Chargeback Vs Refund What s The Difference Which Is Better

Tax Return Vs Refund - Tax returns allow taxpayers to calculate their tax liability schedule tax payments or request refunds for the overpayment of taxes In most countries tax returns must be filed annually