Tax Saving Fixed Deposit Hdfc If you are in the highest tax bracket of 30 and put Rs 1 5 lakh in the tax saving FD you can save up to Rs 46350 Rs 45 000 in tax plus Rs 1350 in cess How much can I invest in the five year tax saving FD You can invest anywhere between Rs 100 and Rs 1 5 lakh in a financial year in the Fixed Deposit What is the tenure of this FD

Tools Calculators Fixed Deposit Calculator View Fixed Deposit Interest rates View TDS rates APPLY ONLINE Chat With Eva Check out the fees you need to pay and the charges for maintaining your Regular Fixed Deposit at HDFC Bank Be aware of minimum balance other maintenance charges HDFC Bank offers Tax Saver FD Scheme of 5 years tenure at an interest rate of 7 00 p a for regular citizens and 7 50 p a for senior citizens Depositors can claim tax deductions on fixed deposits under Section 80C of the Income Tax Act in a financial year HDFC Bank Tax Saving FD Highlights Looking for Higher FD rates

Tax Saving Fixed Deposit Hdfc

Tax Saving Fixed Deposit Hdfc

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/07/hdfc-bank-fd-interest-rates.jpg

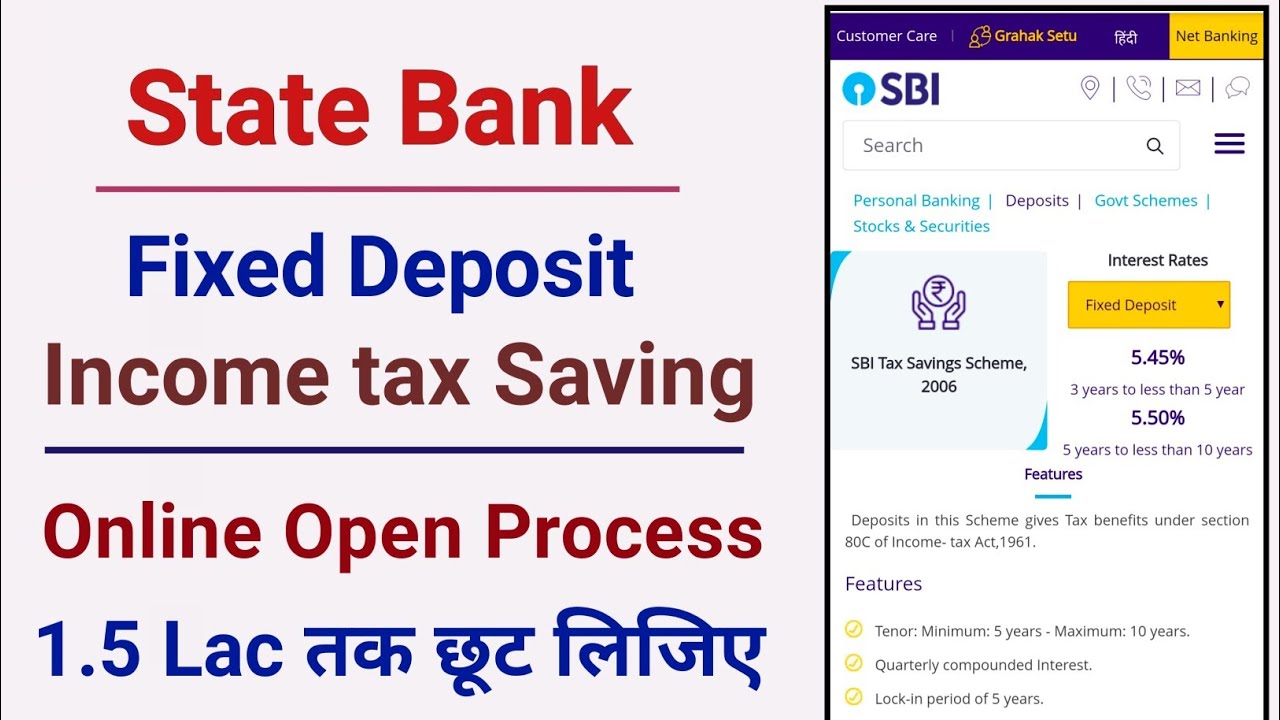

SBI Tax Saving Fixed Deposit Scheme IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2019/03/SBI-Tax-Saving-Fixed-Deposit-Scheme.jpg

Best Tax Saving FD Under Section 80C Interest Rates Eligibility

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/01/tax-saving-fd.jpg

The minimum amount for a tax saving FD is Rs 100 and multiples of Rs One hundred are permitted The maximum sum permitted for a fiscal year is Rs 1 5 Lakhs The lock in term is five years from the deposit date In the case of joint deposits the tax deduction will be provided only to the deposit s first FD holder HDFC 5 Year Tax Saving FD HDFC Tax Saving FD Investing in a fixed deposit is probably the safest form of investment compared to other investment vehicles including stocks and bonds to name a few There are certain FD schemes that let you enjoy tax benefits on the investment amount and the HDFC 5 Year Tax Saving Fixed Deposit is

With an investment in an HDFC Tax Saving FD you can save income tax under section 80C of the Income Tax Act 1961 Section 80C allows a tax deduction of Rs 1 5 lakhs for an investment in a tax saving fixed deposit The HDFC Tax Saving FD has a lock in period unlike other fixed deposits of 5 years A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor can claim a deduction of a maximum of Rs 1 5 lakh per annum by investing in a tax saving fixed deposit account Some of its features are A lock in period of 5 years

Download Tax Saving Fixed Deposit Hdfc

More picture related to Tax Saving Fixed Deposit Hdfc

Tax Saving Fixed Deposit SBI HDFC Or ICICI Bank Who Is Giving

https://www.rightsofemployees.com/wp-content/uploads/2020/08/transparent-tax-system-aims-to-prevent-dishonest.jpg

How To Close break Fixed Deposit Online In HDFC BANK HDFC BANK FD

https://i.ytimg.com/vi/N9D5gjssfF8/maxresdefault.jpg

Tax Saver Fixed Deposit Top 10 Tax Saving FDs In India

https://www.taxscan.in/wp-content/uploads/2022/12/Tax-Saver-Fixed-Deposit-Tax-Saver-Fixed-Deposit-Tax-Tax-Saving-Saving-Top-10-Tax-Saving-FDs-in-India-Taxscan.jpg

Apply Online Fixed Deposit FD HDFC Bank Ltd offers a wide range of FD schemes at a competitive interest rates with attractive and assured returns Visit us at HDFC Bank Ltd to know more about FD interest rate and other benefits HDFC Tax Saving FD Taxes The taxes over the tax saving fixed deposit scheme are as follows An individual can invest up to Rs 1 5 lakhs which is tax deductible as per Section 80C The money earned by an individual as an interest income on investing their money is considered a source of income and hence taxable

1 Online Mode To book your HDFC Bank tax saving FD follow these steps Step 1 Visit the official website of HDFC Bank and log in to your NetBanking account Step 2 Navigate to the Transact option and select Open Fixed Deposits Step 3 Select the bank branch of your choice and enter all the relevant details Investing in a tax saving Fixed Deposit FD with a bank stands out as a highly favored choice among investors seeking to leverage the benefits of Section 80C within the ambit of the Income Tax Act Many individuals opt for this investment avenue for tax saving purposes due to its perceived lower risk when compared to equities It s

Upto 6 5 Interest On Tax saving Fixed Deposits From These Top 5 Banks

https://www.bizzbuzz.news/h-upload/2021/03/24/990852-money1.jpg

Download FD Certificate From HDFC Bank Download HDFC Fixed Deposit

https://i.ytimg.com/vi/bPcFOuT_hZo/maxresdefault.jpg

https://www.hdfcbank.com/.../what-is-a-tax-saving-fd

If you are in the highest tax bracket of 30 and put Rs 1 5 lakh in the tax saving FD you can save up to Rs 46350 Rs 45 000 in tax plus Rs 1350 in cess How much can I invest in the five year tax saving FD You can invest anywhere between Rs 100 and Rs 1 5 lakh in a financial year in the Fixed Deposit What is the tenure of this FD

https://www.hdfcbank.com/personal/save/deposits/...

Tools Calculators Fixed Deposit Calculator View Fixed Deposit Interest rates View TDS rates APPLY ONLINE Chat With Eva Check out the fees you need to pay and the charges for maintaining your Regular Fixed Deposit at HDFC Bank Be aware of minimum balance other maintenance charges

PDF Bank Of India Cash Deposit Slip PDF Download Bank Form PDF

Upto 6 5 Interest On Tax saving Fixed Deposits From These Top 5 Banks

Sbi Tax Saver Fixed Deposit How To Open Tax Saver Fd In Sbi Online

Tax Saving FD Tax Saving FD Interest Rates In 2021 I Paisabazaar

HDFC FD Interest Rates 2019 HDFC Bank Fixed Deposit Rates

Tax Saving Fixed Deposits FD Guide Plus Best Interest Rates TODAY

Tax Saving Fixed Deposits FD Guide Plus Best Interest Rates TODAY

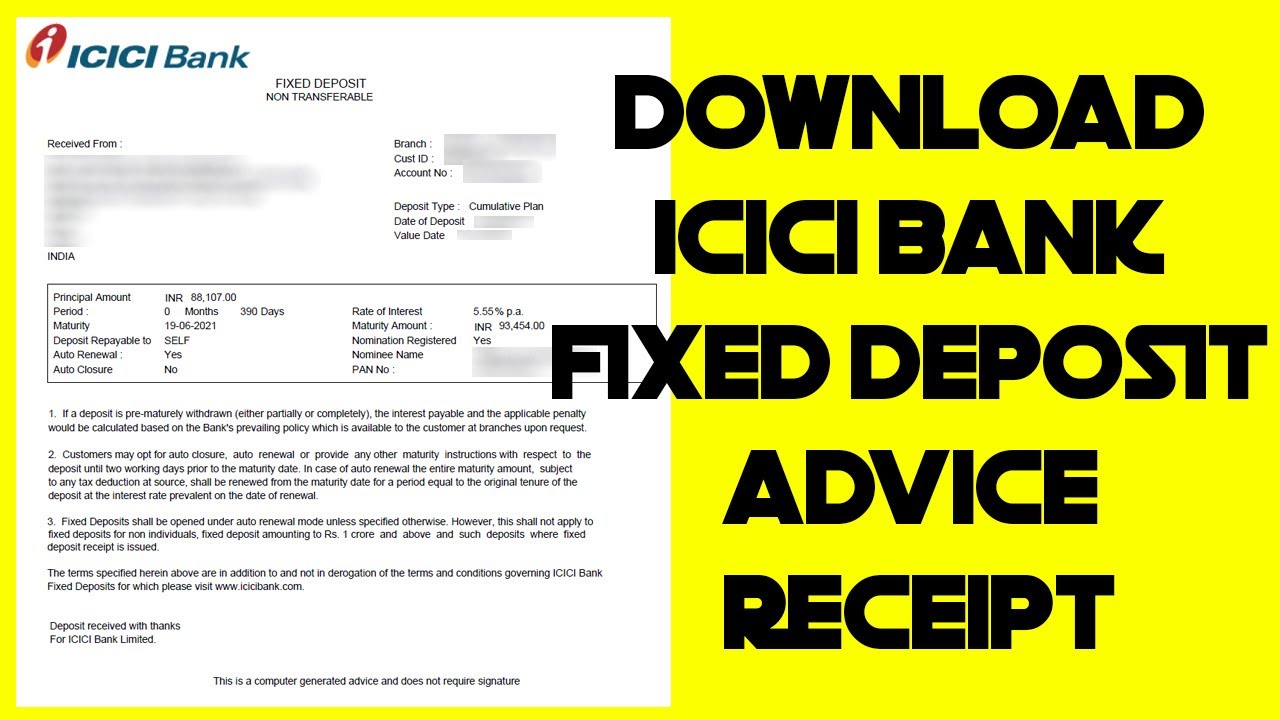

How To Download ICICI Bank FD Advice Receipt FD Certificate From

All You Need To Know About Investing In A Tax Saving Fixed Deposit

Tax Saving Fixed Deposits SBI ICICI HDFC Or Axis Find Out Which

Tax Saving Fixed Deposit Hdfc - According to HDFC Bank the first holder of the fixed deposit FD will only be eligible for the income tax benefit of up to Rs 1 5 lakh under Section 80C in case of joint deposits On the tax savings fixed deposits FD HDFC Bank offers an interest rate of 7 25 per cent and 7 75 per cent per annum for normal citizens and senior citizens