Tax Saving Options For Senior Citizens Senior citizens can save taxes by understanding capital gains taxes maximizing contributions to retirement accounts considering Roth IRA conversions utilizing tax efficient charitable giving employing portfolio tax strategies and contributing to

If you invest in the maximum tenure of the 5 year lock in tax saving FD you can avail tax deduction of up to Rs 1 5 lakh under Section 80C of the Income Tax Act 1961 A few aspects to consider before investing in the Senior Citizens FD scheme are that interest rates are subject to change and can be revised by your bank without prior notice For senior citizens section 80 TTB provides deductions up to Rs 50 000 on all interest incomes How to Plan Your Tax Saving Investments for the Year The best time to start planning your tax saving investments is at the beginning of the financial year Most taxpayers procrastinate till the last quarter of the year resulting in hurried decisions

Tax Saving Options For Senior Citizens

Tax Saving Options For Senior Citizens

https://img.indiafilings.com/learn/wp-content/uploads/2021/11/12003509/TAX-SAVING-1.png

Tax Credit Or Tax Deduction Which Is More Helpful For Tax Savings And

https://i.pinimg.com/originals/ff/c2/2c/ffc22c3cacdd92bd70a97183067c7a7a.jpg

Tax Saving Investment Plans For Senior Citizens Motilal Oswal Mutual Fund

https://www.motilaloswalamc.com/insights/wp-content/uploads/2023/05/Tax-Saving-Investments-for-Senior-Citizens.jpg

Tax Planning to minimize your taxes in retirement will help you avoid running out of money as you age We share 6 strategies to increase your tax free retirement income To limit your tax liability after retirement it is imperative that you research the best tax saving options Here are some of the ways senior citizens can lower their tax liability Do keep in mind that these tax benefits are

Under Section 80TTB of the IT Act an interest income up to Rs 50 000 for senior citizens during a financial year is completely tax free You can also consider investing in the Post Office Monthly Income Scheme POMIS which offers a regular monthly income Some tax saving options other than 80C include deductions for health insurance premiums paid for yourself or family u s 80D deduction for interest on education loan u s 80E and deduction for house loan interest u s 24

Download Tax Saving Options For Senior Citizens

More picture related to Tax Saving Options For Senior Citizens

Safe Investment Options For Senior Citizens MFOnline

https://mfportfolio.in/resources/images/blogs/Senior-Citizens-Pensioners/retirement-investment-options.jpg

10 Smart Tax Saving Options Other Than 80C Save Your Money Anupam

https://anupamroongta.com/wp-content/uploads/2021/07/tax-saving-options-for-senior-citizens.png

5 Tax Saving Options For Salaried Employees Zaggle Save Employee

https://www.zagglesave.com/blog/wp-content/uploads/2022/03/Zaggle-Save-Blog-1-2048x1195.jpg

The Senior Citizens Savings Scheme SCSS allows senior citizens in India to invest up to Rs 30 lakhs providing a safe and tax saving stream of income The scheme features a government backed retirement benefits program with a fixed 8 2 interest rate Eligibility criteria include age requirements and specific investment conditions For retirees over age 65 it s more important than ever to take full advantage of every available tax break That s especially true if you re on a fixed income After all some retirees have

Find out the income tax slab rates for senior citizens for the financial year 2024 25 Learn about the applicable tax brackets exemptions and deductions to effectively plan your taxes and maximize savings Here are ways senior citizens can save on taxes By tax filing 1 Higher Tax Exemption Limit Senior citizens aged 60 80 enjoy a higher exemption limit of Rs 3 lakh compared to Rs 2 5 lakh

5 Best Investment Options For Senior Citizens In India

https://www.tflguide.com/wp-content/uploads/2022/01/Benefits-of-Investing-in-Senior-Citizen-Saving-Scheme.jpg

Health Insurance Options For Senior Citizens Gofolic

http://www.gofolic.org.uk/wp-content/uploads/2020/02/Aid-For-Senior-Citizens-scaled.jpg

https://greatsenioryears.com/smart-guide-how-to...

Senior citizens can save taxes by understanding capital gains taxes maximizing contributions to retirement accounts considering Roth IRA conversions utilizing tax efficient charitable giving employing portfolio tax strategies and contributing to

https://www.etmoney.com/learn/saving-schemes/the...

If you invest in the maximum tenure of the 5 year lock in tax saving FD you can avail tax deduction of up to Rs 1 5 lakh under Section 80C of the Income Tax Act 1961 A few aspects to consider before investing in the Senior Citizens FD scheme are that interest rates are subject to change and can be revised by your bank without prior notice

Finance Blog Mint2Save Reliable Investment Options For Senior

5 Best Investment Options For Senior Citizens In India

Income Tax Saving Options For Senior Citizens Check These Four

Tax Savings Options That You Should Know

Tax Saving Options For Those In The 30 Tax Bracket Wealthzi

Best Tax Saving Options Comparison Of Interest Rates On Tax Saving

Best Tax Saving Options Comparison Of Interest Rates On Tax Saving

Women s Day Top Tax Saving Options The Financial Express

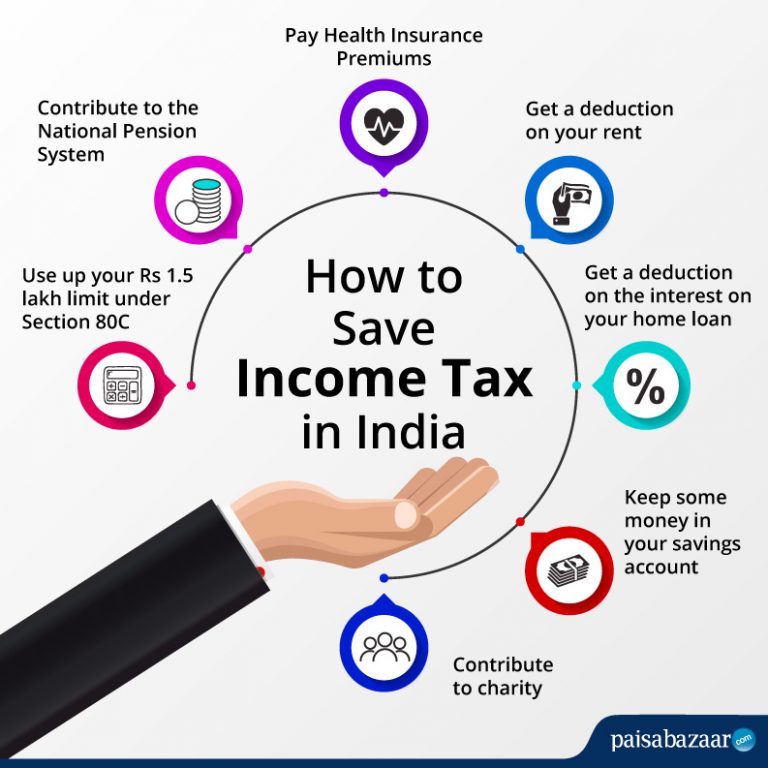

How To Save Income Tax On Salary Tax Saving Schemes Paisabazaar

Best Saving Scheme Options For Senior Citizens Financesjungle

Tax Saving Options For Senior Citizens - Under Section 80TTB of the IT Act an interest income up to Rs 50 000 for senior citizens during a financial year is completely tax free You can also consider investing in the Post Office Monthly Income Scheme POMIS which offers a regular monthly income