Tax Saving Options In Canada 1 Take advantage of your Registered Retirement Savings Plan RRSP Maximizing your RRSP contributions for the year reduces your taxes whether you work for an employer or yourself Your RRSP contributions qualify you for larger tax deductions In turn these deductions pare down your tax payable in the year that you claim them

Tax advantaged savings plans are a smart way to save for retirement and lower your tax bill A Retirement Savings Plan RSP will allow you to shelter your savings from tax while a Tax Free Savings Account TFSA lets you withdraw money without penalty Check your RSP deduction limit on your most recent Notice of Assessment from the CRA To reduce income tax Canadians can claim home office expenses The temporary flat rate work from home expense claim method applied for taxes from 2020 to 2022 However the rules have

Tax Saving Options In Canada

Tax Saving Options In Canada

https://img.indiafilings.com/learn/wp-content/uploads/2021/11/12003509/TAX-SAVING-1.png

How To Reduce Tax In India Societynotice10

https://financialexpresswpcontent.s3.amazonaws.com/uploads/2020/03/tax-saving-table.jpg

Tax Saving Options For Those In The 30 Tax Bracket Wealthzi

https://www.wealthzi.com/wp-content/uploads/2020/09/3-1.jpg

CIBC TFSA Tax Advantage Savings Account There are more perks to this account than just the security of investing with a big brick and mortar bank You can start your TFSA with as little as 25 A Tax Free Savings Account is a new way for residents of Canada over the age of 18 to set money aside tax free throughout their lifetime

The Tax Free Savings Account TFSA was introduced by the Government of Canada in 2009 to help Canadians save and invest their money tax free throughout their lifetime Strategies Tax Saving Tips For Canadian Taxpayers By Andrew Beattie Updated May 06 2021 Reviewed by Lea D Uradu Fact checked by Suzanne Kvilhaug Taxes are a bane for just about everyone

Download Tax Saving Options In Canada

More picture related to Tax Saving Options In Canada

Here Are 5 Tax saving Investment Options With Guaranteed Returns

https://akm-img-a-in.tosshub.com/businesstoday/images/photo_gallery/202102/tax-saving-investment-options-660_250221111752.jpg

Women s Day Top Tax Saving Options The Financial Express

https://www.financialexpress.com/wp-content/uploads/2023/03/cropped-tax-saving-options.jpg

Best Tax Saving Options Comparison Of Interest Rates On Tax Saving

https://img.etimg.com/thumb/msid-81599488,width-1070,height-580,imgsize-168572,overlay-etwealth/photo.jpg

Other Tangerine TFSA investment options include Tax Free GICs available in 90 day to 5 year terms and investment accounts and portfolios Canadian Tire Tax Free High Interest Savings Best Tax Free Savings Accounts In Canada For 2024 We ve compared 11 tax free savings accounts at 39 nationally available banks and credit unions to find some of the best options available See

1 Max out We all know Registered Retirement Savings Plans RRSPs are a valuable tool to help save for retirement but maximizing your contributions is also a great way to reduce your taxable income Contributions are deducted from your income when you file your tax return TFSAs savings account are a great option to grow your everyday savings but not the only ones available to Canadians High Interest Savings Accounts HISAs Most high Interest Savings Accounts HISAs offer interest over 1 00 Unlike the TFSA income tax is charged on interest earned as it is a non registered account

Tax Savings Options That You Should Know

https://www.worldmeeting2015.org/wp-content/uploads/2020/03/tax-saving-image-660_040419061647.jpg

Tax Saving Options Beyond Section 80C Swarit Advisors

https://swaritadvisors.com/learning/wp-content/uploads/2019/02/Tax-Saving.png

https://hardbacon.ca/.../pay-less-income-tax-in-canada

1 Take advantage of your Registered Retirement Savings Plan RRSP Maximizing your RRSP contributions for the year reduces your taxes whether you work for an employer or yourself Your RRSP contributions qualify you for larger tax deductions In turn these deductions pare down your tax payable in the year that you claim them

https://www.scotiabank.com/ca/en/small-business/...

Tax advantaged savings plans are a smart way to save for retirement and lower your tax bill A Retirement Savings Plan RSP will allow you to shelter your savings from tax while a Tax Free Savings Account TFSA lets you withdraw money without penalty Check your RSP deduction limit on your most recent Notice of Assessment from the CRA

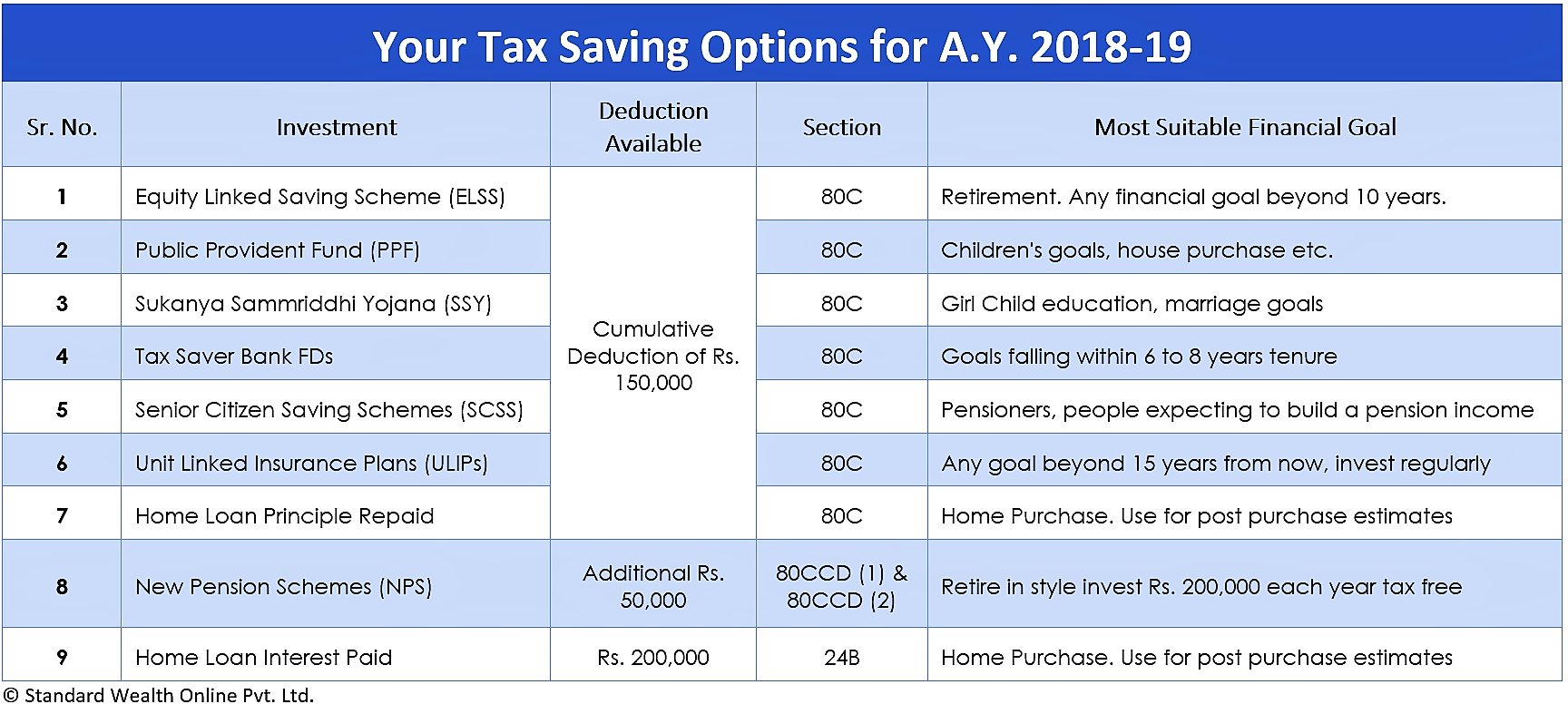

Tax Saving Options For AY 2018 19 For Last Quarter Investors TheSWO

Tax Savings Options That You Should Know

Best Tax Saving Investment Scheme ELSSs Wealth4india

Fundviser

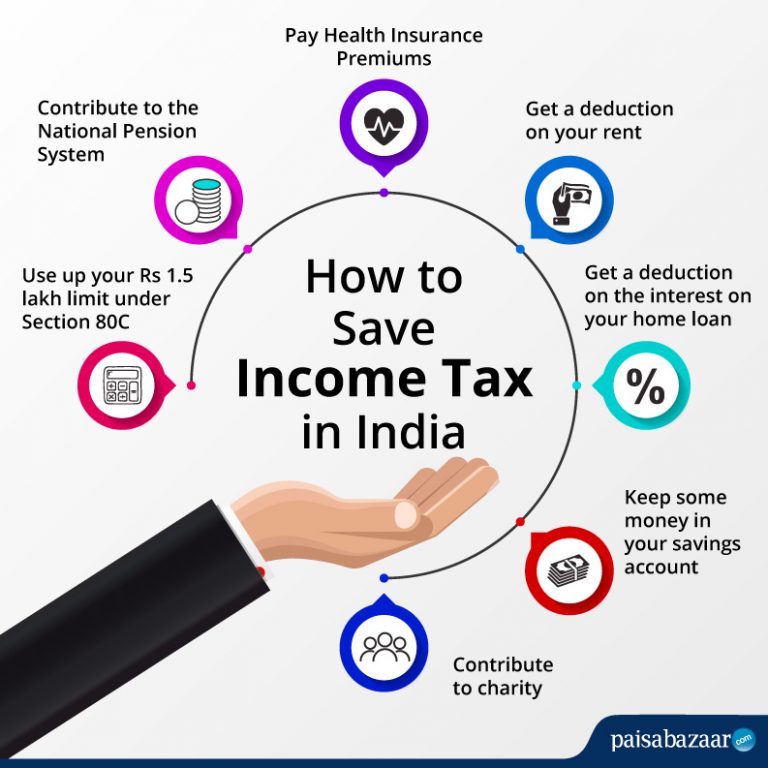

How To Save Income Tax On Salary Tax Saving Schemes Paisabazaar

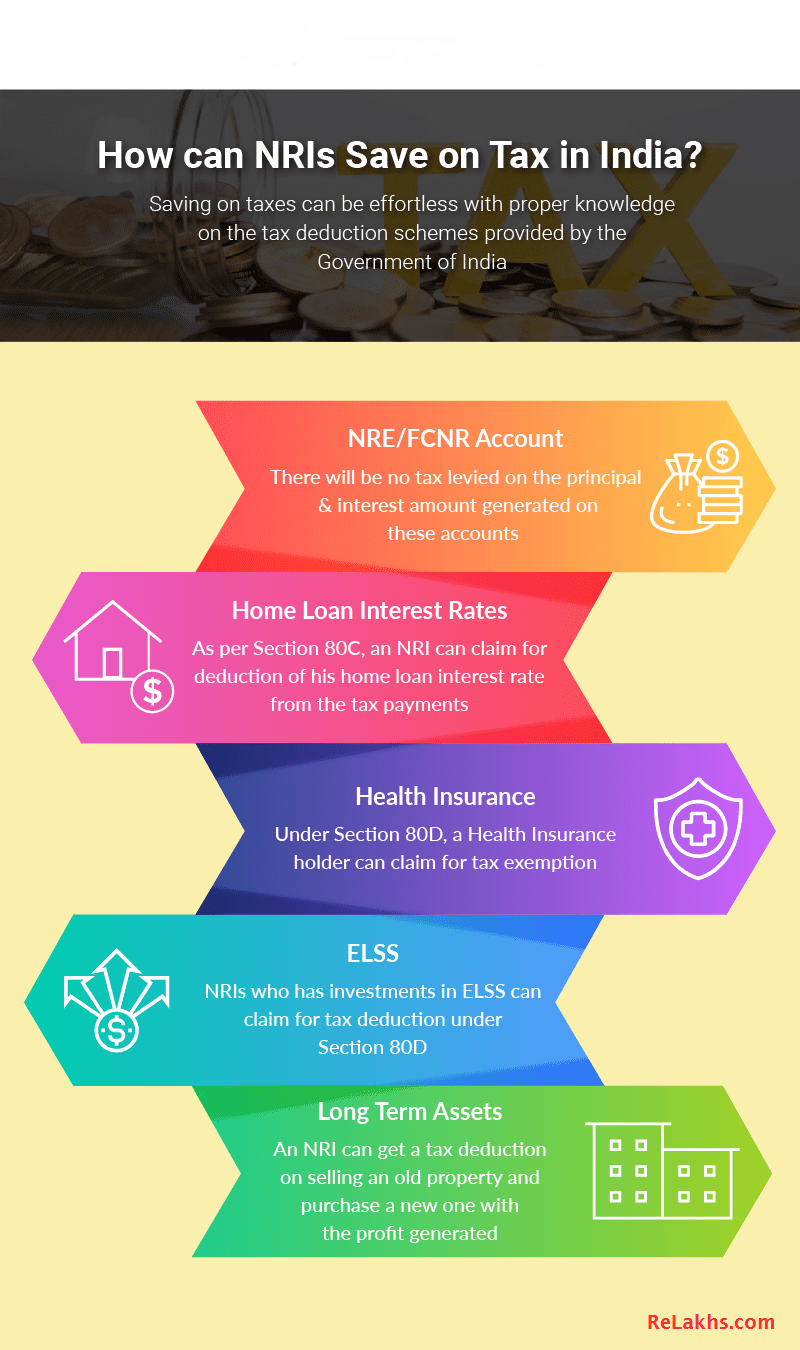

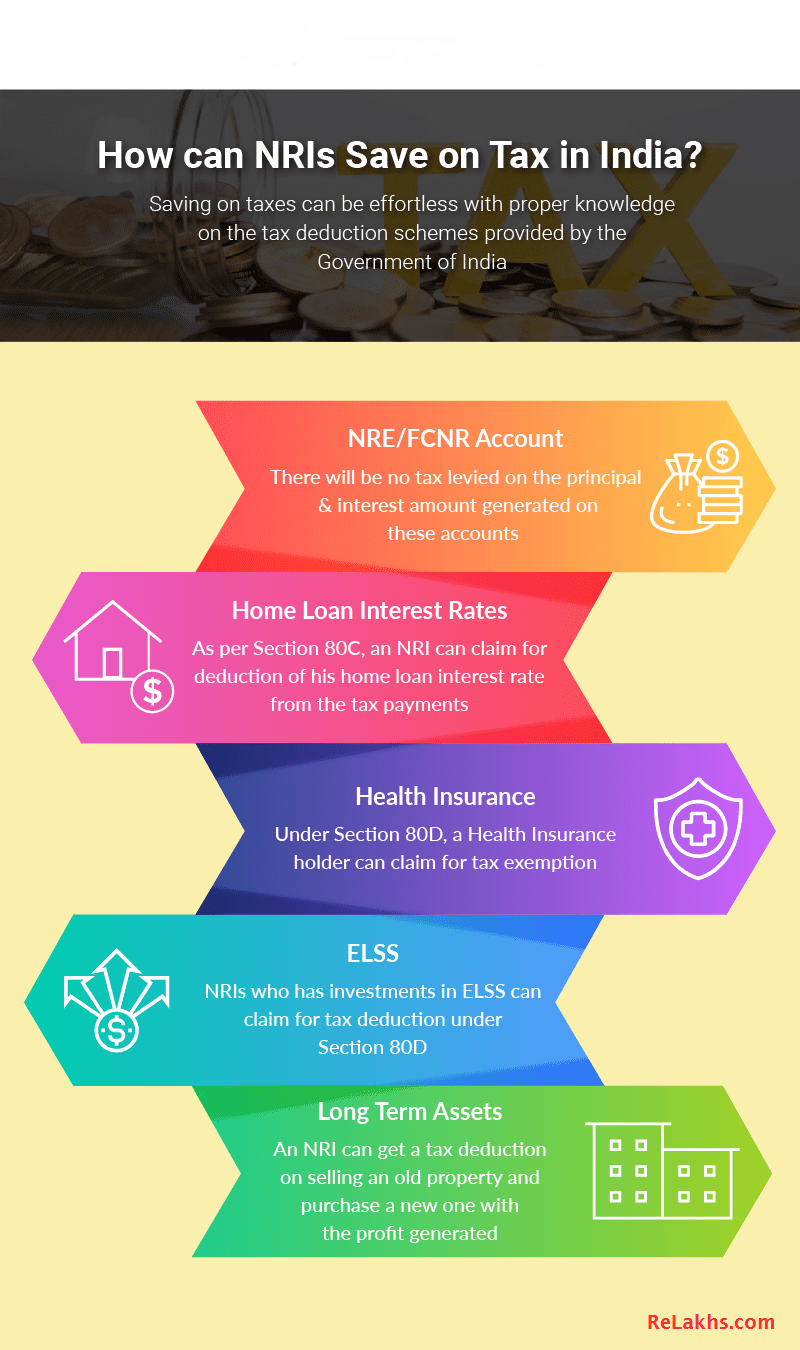

Best NRI Tax Saving Options 2023 2024 How NRIs Can Save On Tax

Best NRI Tax Saving Options 2023 2024 How NRIs Can Save On Tax

5 Tax Saving Options For FY 19 20 Blog guru

Income TAX Documents Tax Saving Options

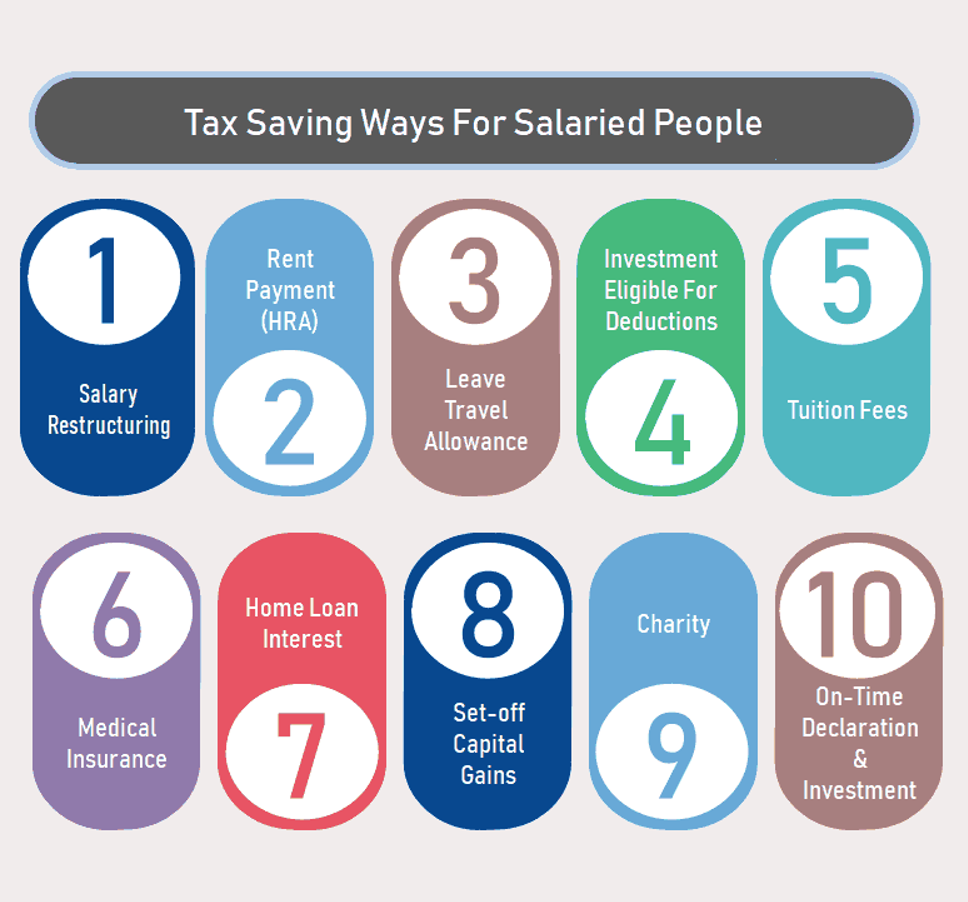

Tax Saving Options For Salaried 2022 23 Myfinopedia

Tax Saving Options In Canada - Strategies Tax Saving Tips For Canadian Taxpayers By Andrew Beattie Updated May 06 2021 Reviewed by Lea D Uradu Fact checked by Suzanne Kvilhaug Taxes are a bane for just about everyone