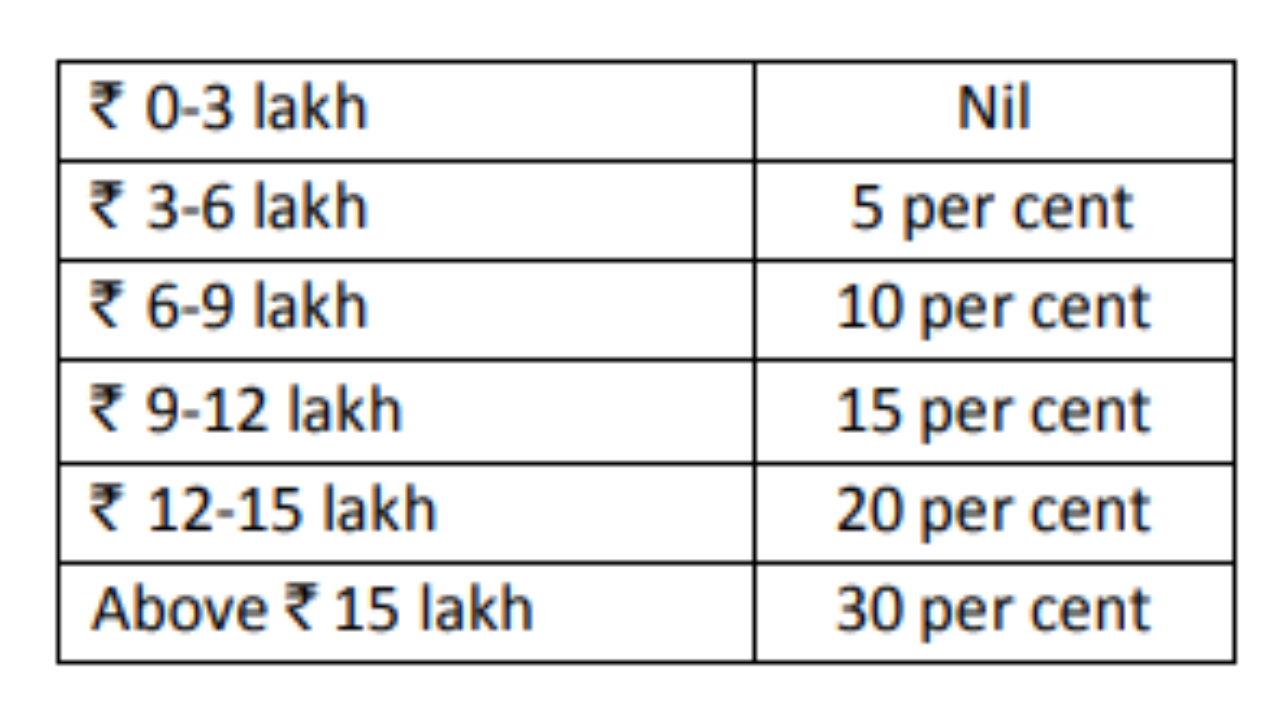

Tax Slabs And Rebate Web 2 f 233 vr 2023 nbsp 0183 32 Budget 2023 tweaked the income tax slabs under the new tax regime The maximum exemption limit will be Rs 3 lakh and for every additional Rs 3 lakh income the

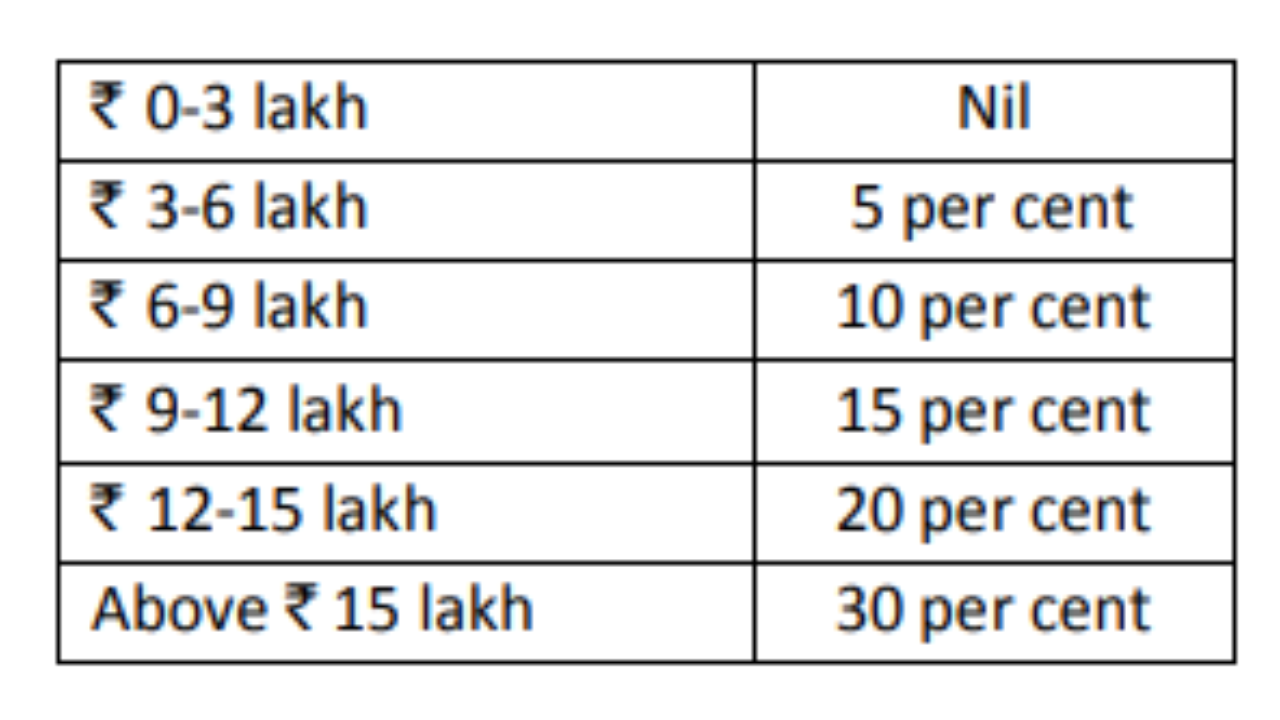

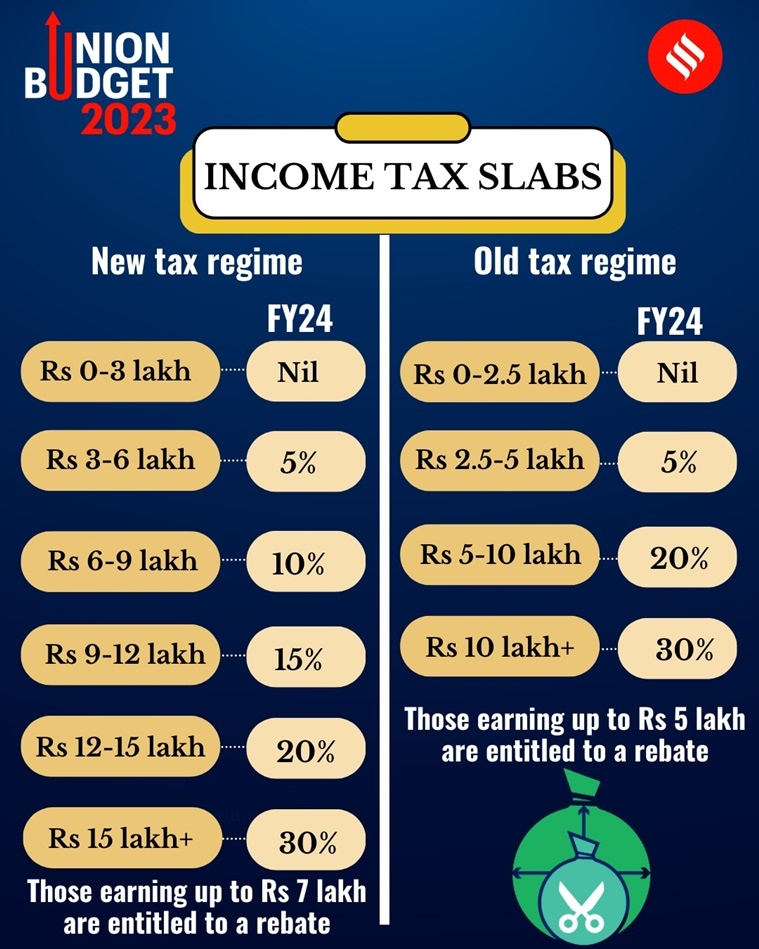

Web 1 f 233 vr 2023 nbsp 0183 32 The new income tax slabs under the new tax regime are Rs 0 3 lakh Nil Rs 3 6 lakh 5 per cent Rs 6 9 lakh 10 per cent Rs 9 Web 4 f 233 vr 2023 nbsp 0183 32 The tax rebate under Section 87A hiked to taxable income level of Rs 7 lakh from Rs 5 lakh The amount of tax rebate has doubled

Tax Slabs And Rebate

Tax Slabs And Rebate

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

https://static.tnn.in/photo/msid-101208384/101208384.jpg

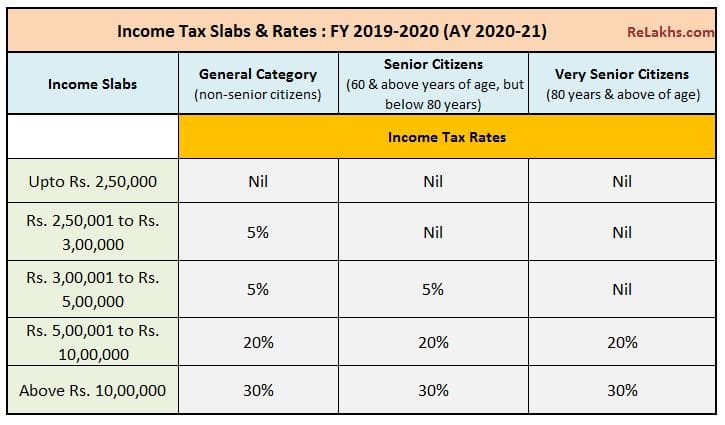

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

https://4.bp.blogspot.com/-ygld82QNGGs/Xd_7fFpO9WI/AAAAAAAAJBU/w2H37lRhli4Tk4pgjN-Ra8So_O_t_RJ-wCK4BGAYYCw/s1600/slab_rate_%25281%2529-20190201043639.png

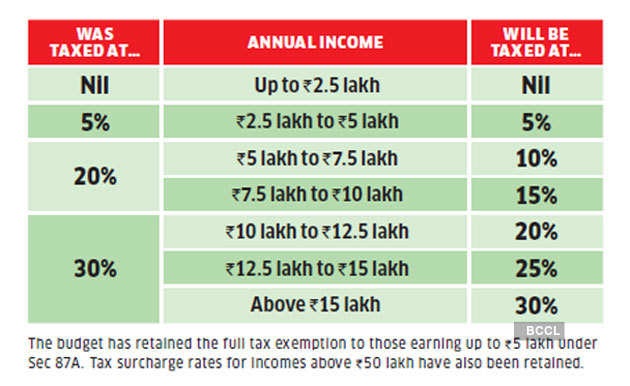

Web 29 mars 2019 nbsp 0183 32 New Income Tax Slabs For FY 2022 23 AY 2023 24 as per Budget 2023 As per the Union Budget 2023 a few key changes Web 1 f 233 vr 2023 nbsp 0183 32 Put simply only those with an annual income of up to Rs 7 lakh under the new tax regime will benefit from the proposal as they will get a 100 per cent rebate on their tax liability On the other hand those with

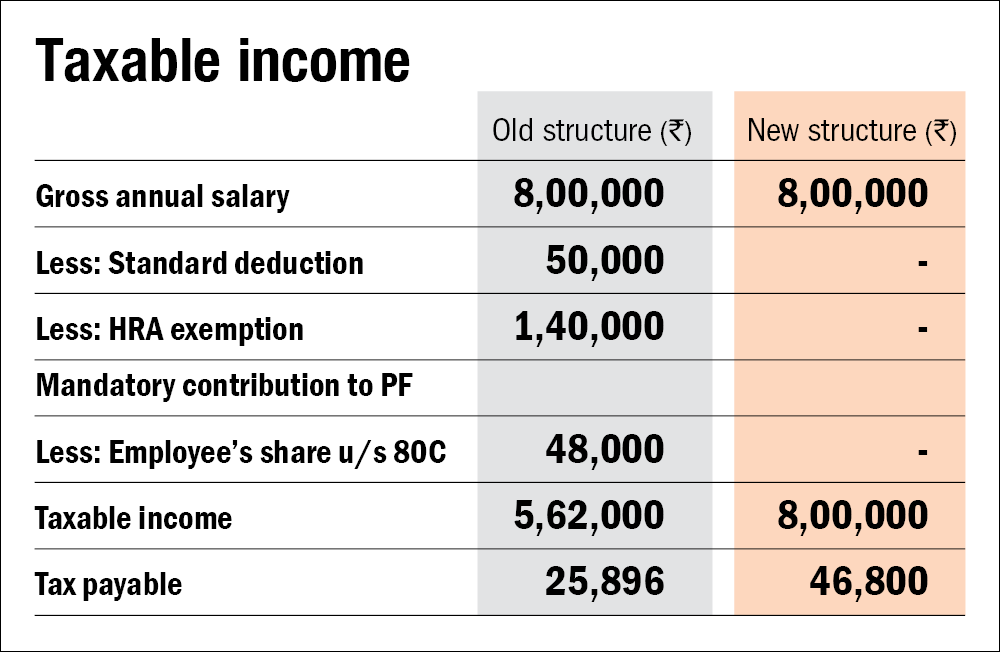

Web 1 ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following Web 31 janv 2023 nbsp 0183 32 The salaried class hopes for an income tax rebate from the Budget every year It is expected that the Budget may alter tax slabs to make the new income tax regime more attractive Notably the income

Download Tax Slabs And Rebate

More picture related to Tax Slabs And Rebate

Income Tax Slab Rate For New Tax Regime Fy 2020 21 Gambaran

https://i2.wp.com/www.askbanking.com/wp-content/uploads/2020/04/income-tax-slabs.jpg?fit=660%2C440&ssl=1

What Are The New Income Slabs Under The New Tax Regime

https://images.indianexpress.com/2023/02/tax-slabs-759.jpg

Income Tax Slab Rates Income Tax In India Public Finance Gambaran

https://www.valueresearchonline.com/content-assets/images/47951_the_new_tax_slabs-table-1__w660__.png

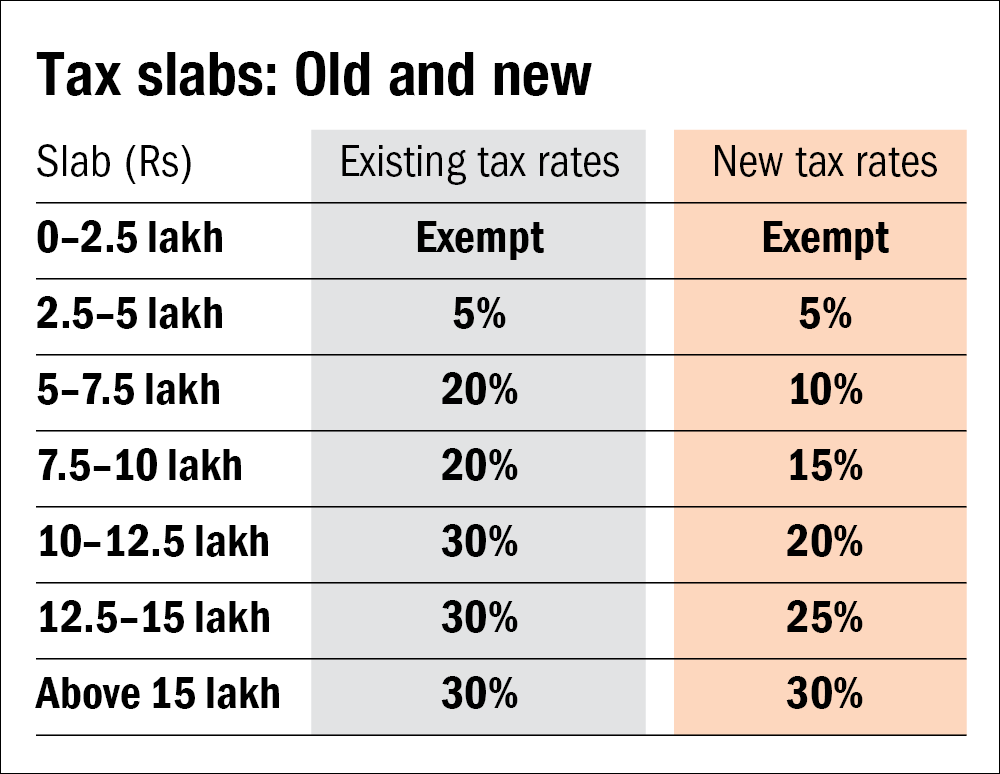

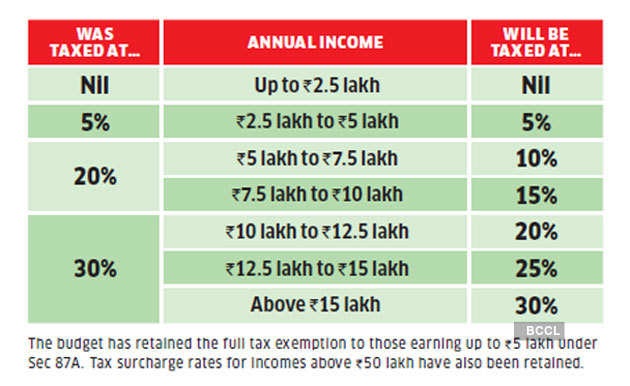

Web Currently there are two different Income Tax regimes Under both the new regime and the old regime taxpayers can avail of tax benefits The finance minister announced that Web 7 f 233 vr 2023 nbsp 0183 32 The Finance Minister has proposed to make the new tax regime more attractive by increasing the rebate limit from Rs 5 lakh to Rs 7 lakh and easing the tax

Web 3 f 233 vr 2023 nbsp 0183 32 Changes in Income Tax slabs It was proposed to change the tax structure in the new regime by reducing the number of slabs to five from six income categories and increasing the tax exemption limit to 3 lakh Web 16 juil 2023 nbsp 0183 32 New Income Tax Slab Rates for FY 2023 24 The 2023 2024 Income Tax Slab underwent significant changes with the implementation of the new income tax

New Income Tax Slabs Will You Gain By Switching To New Regime 10 02

https://img.etimg.com/photo/msid-74024695/new-tax-slabs.jpg

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

https://economictimes.indiatimes.com/wealth/tax/income-tax-budget-2023...

Web 2 f 233 vr 2023 nbsp 0183 32 Budget 2023 tweaked the income tax slabs under the new tax regime The maximum exemption limit will be Rs 3 lakh and for every additional Rs 3 lakh income the

https://indianexpress.com/article/explained/ev…

Web 1 f 233 vr 2023 nbsp 0183 32 The new income tax slabs under the new tax regime are Rs 0 3 lakh Nil Rs 3 6 lakh 5 per cent Rs 6 9 lakh 10 per cent Rs 9

New Income Tax Slab Rates Vs Old Rates Which One Is Better

New Income Tax Slabs Will You Gain By Switching To New Regime 10 02

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

Income Tax Slabs For Ay20 21 Which Itr Option Is Better For You Here

Choosing Between The Old And New Tax Slabs Value Research

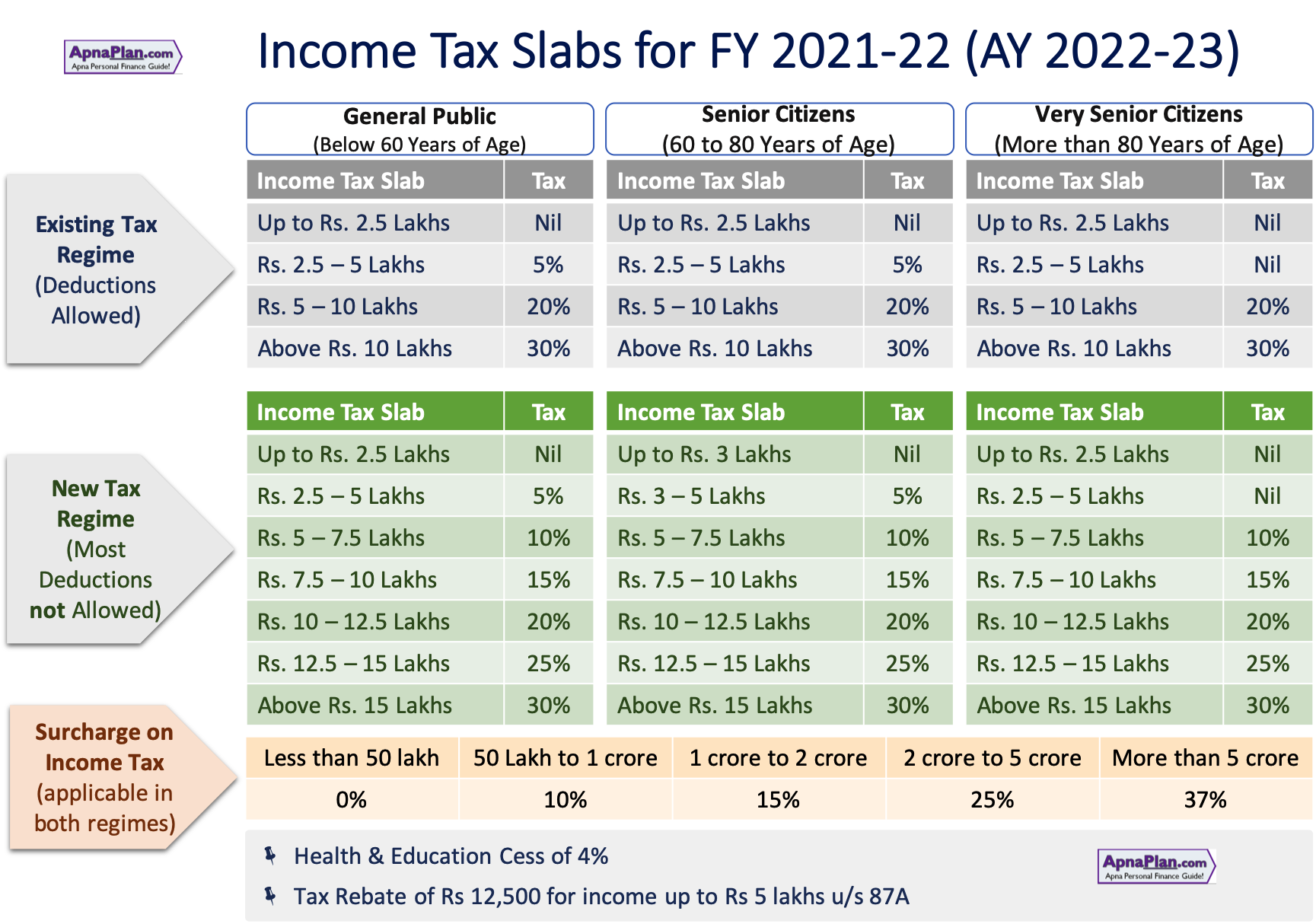

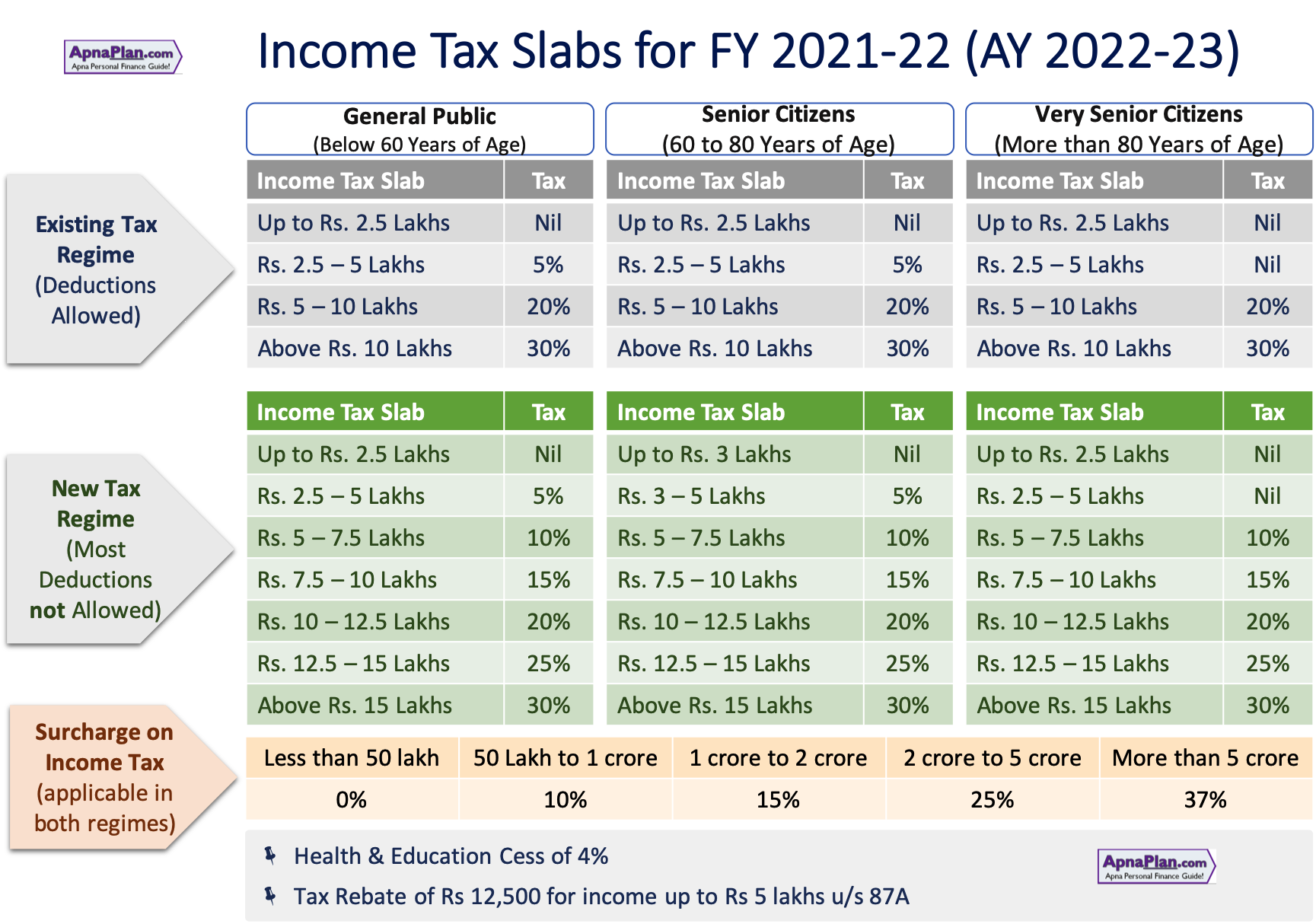

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Standard Deduction For 2021 22 Standard Deduction 2021

FY 2014 15 Income Tax Returns Filing New ITR Forms

Tax Slabs And Rebate - Web 31 janv 2023 nbsp 0183 32 The salaried class hopes for an income tax rebate from the Budget every year It is expected that the Budget may alter tax slabs to make the new income tax regime more attractive Notably the income