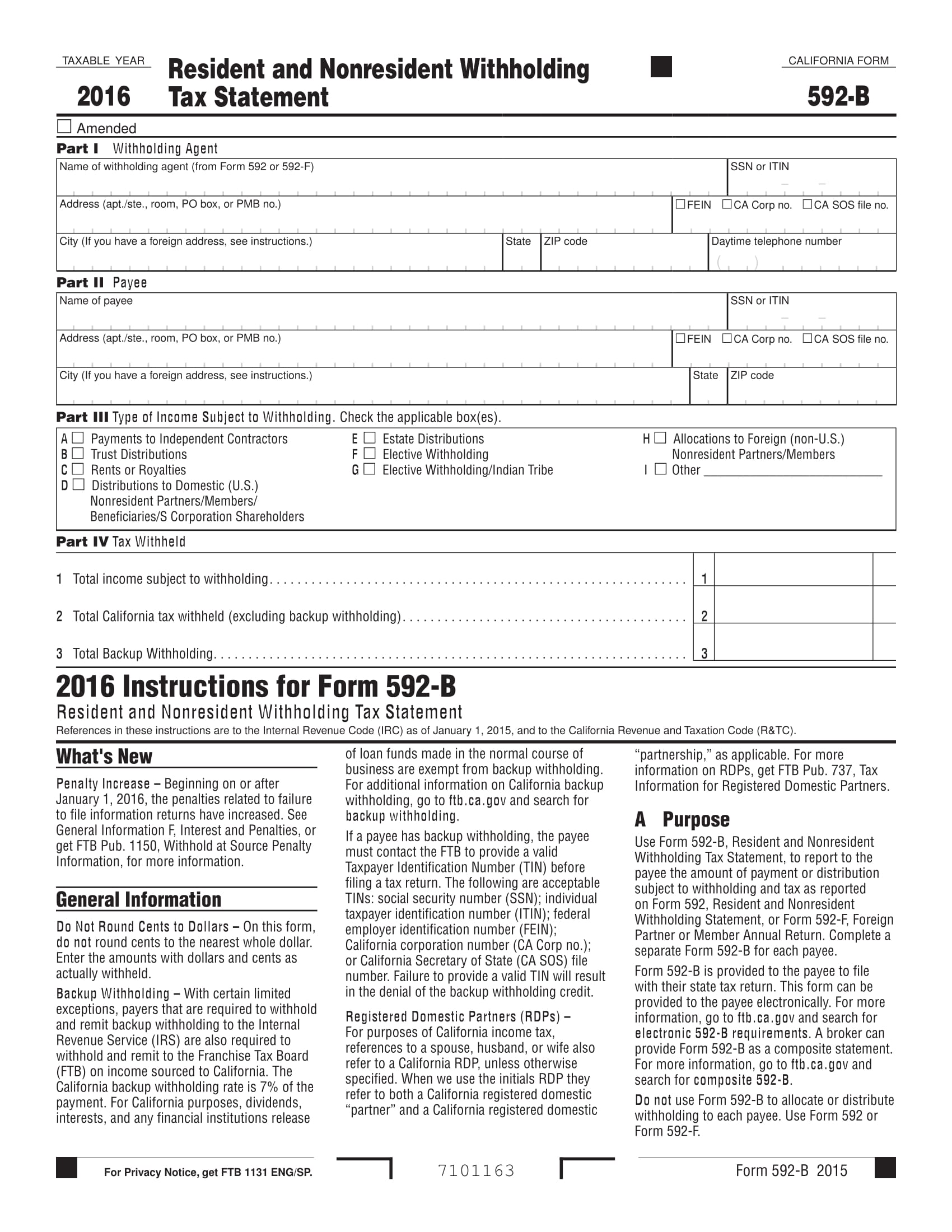

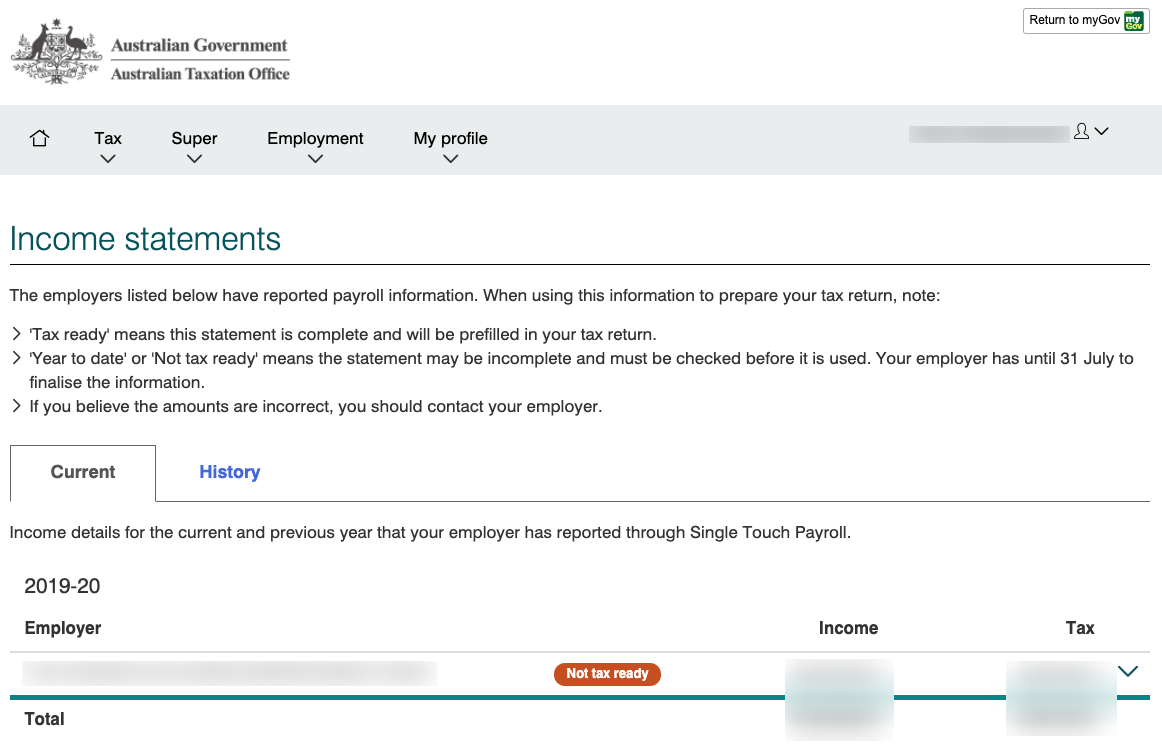

Tax Statement Not Tax Ready If you lodge before the statement is Tax ready you may have to amend your tax return We will send a notification to your myGov inbox when all of your income statements are Tax ready You will need to speak to your employer if after 31 July your income statement is not Tax ready in ATO online services

My income statement is not reday yet so as my tax ready so could I lodge my tax return anyway considering is September already If your income statement shows as Not tax ready you will see a red box with Required next to your employer s name To complete your tax return you should wait until the information is Tax ready However if you choose to use information from an un finalised income statement to lodge your tax return you will need to

Tax Statement Not Tax Ready

Tax Statement Not Tax Ready

https://images-na.ssl-images-amazon.com/images/S/compressed.photo.goodreads.com/books/1617525123i/57621926.jpg

The Best Self Employed Tax Deductions And Credits In 2022

https://static.helloskip.com/blog/2022/03/Untitled-design--11-.png

Tax Free Of Charge Creative Commons Handwriting Image

https://www.thebluediamondgallery.com/handwriting/images/tax.jpg

To complete your tax return you should wait until the information is Tax ready Your employer has until 31 July to finalise your information by making a finalisation declaration in their STP enabled solution From 1 July your STP income statement information will be pre filled into myTax even if your employer hasn t finalised it yet Good Afternoon Upon logging into My Gov my income statement from a former employer is not yet marked as tax ready indicating the end of year STP lodgement requirements have not been completed Given the date to complete this for large employers was 14 July what is the process to escalate this with the ATO Many thanks

Before you can lodge your 2019 20 tax return your employer must have marked your information as tax ready Check your MyGov account Income statements are now categorised into tax ready not tax ready and year to date Your income statement will usually be marked as Tax ready by your employer other available information will pre fill to your tax return for you Pre fill information can save you time and help you get your tax return right

Download Tax Statement Not Tax Ready

More picture related to Tax Statement Not Tax Ready

https://c.pxhere.com/images/38/2b/139c5771ccf68374d3fc7581ece3-1444833.jpg!d

Trendy Tax Statement 14835631 Vector Art At Vecteezy

https://static.vecteezy.com/system/resources/previews/014/835/631/original/trendy-tax-statement-vector.jpg

How To Check The Monthly Income Tax Statement

https://s3-ap-south-1.amazonaws.com/ind-cdn.freshdesk.com/data/helpdesk/attachments/production/84027066251/original/uprWN-CbIGnyARQmaSsFmD_bYN9QjhmliQ.png?1677140881

Your income statement is not tax ready You shouldn t lodge your tax return yet because your income statement is not tax ready We will notify you when your employer finalises your income statement which should generally be by 1 August You should wait to lodge your tax return My mum s income statement is not tax ready what can we do Tax UPDATE Thanks to everyone who responded We have since checked my mum s final payslip for the financial year and her income statement which still says not tax ready and the figures do not match

Authorised by the Australian Government Canberra We acknowledge the Traditional Owners and Custodians of Country throughout Australia and their continuing connection to land waters and community We pay our respect to them and their cultures and Elders past and present Loading We will make it clear to them that their income statement is not tax ready If they choose to use the un finalised information they will need to acknowledge that you may finalise their income statement with different amounts they may need to amend their tax return and pay additional tax Employees with more than one employer

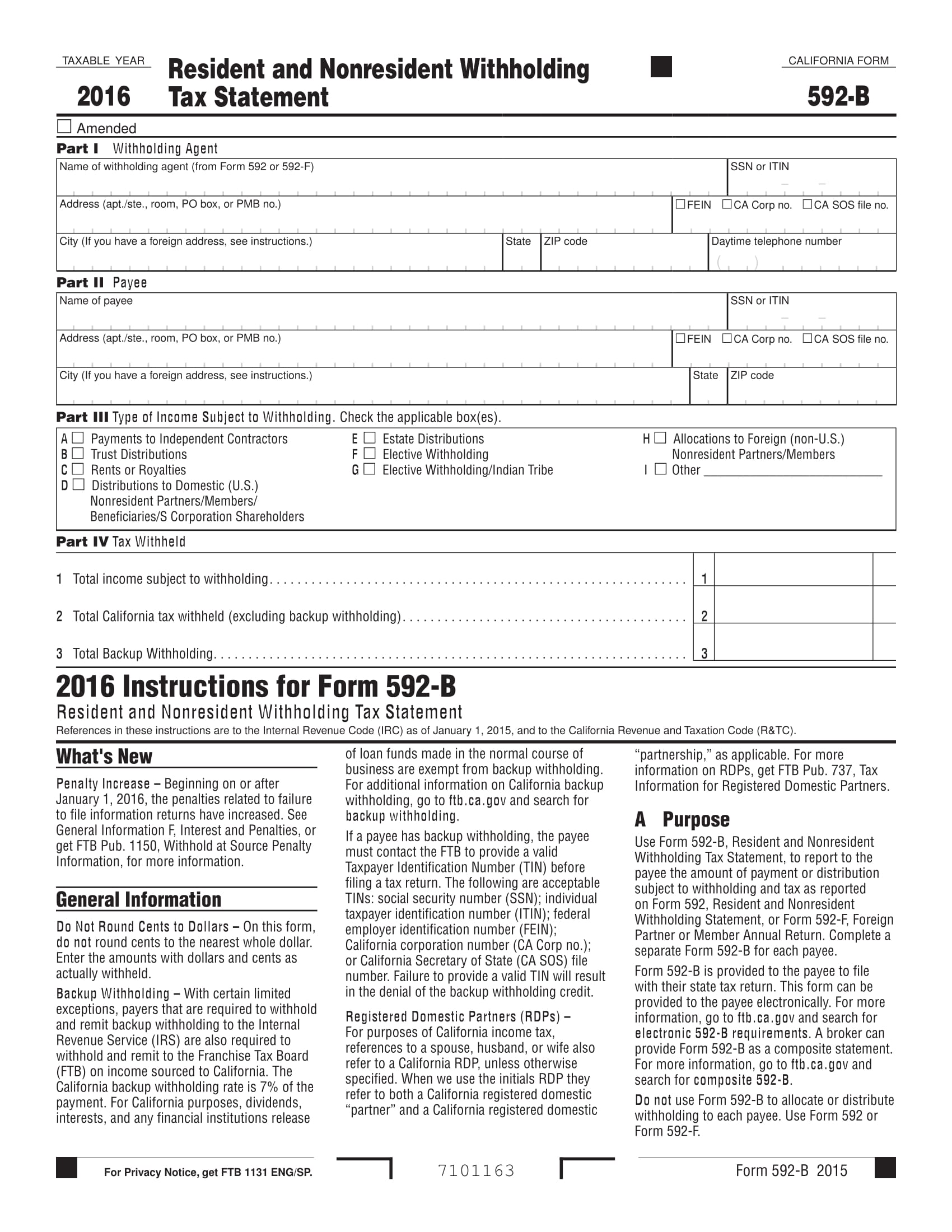

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

https://images.sampleforms.com/wp-content/uploads/2017/10/Withholding-Tax-Statement-Form-1.jpg

Tax Reduction Company Inc

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100064489757770

https://www.ato.gov.au/individuals-and-families/...

If you lodge before the statement is Tax ready you may have to amend your tax return We will send a notification to your myGov inbox when all of your income statements are Tax ready You will need to speak to your employer if after 31 July your income statement is not Tax ready in ATO online services

https://community.ato.gov.au/s/question/a0J9s0000001H48

My income statement is not reday yet so as my tax ready so could I lodge my tax return anyway considering is September already

Is Your Income Statement tax Ready Taxpro

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Why Is My Tax Return Refund So Low This Year What Can I Claim And Why

Introducing CoinJar Tax Statements

How To Access My Income Statement payment Summary Group Certificate

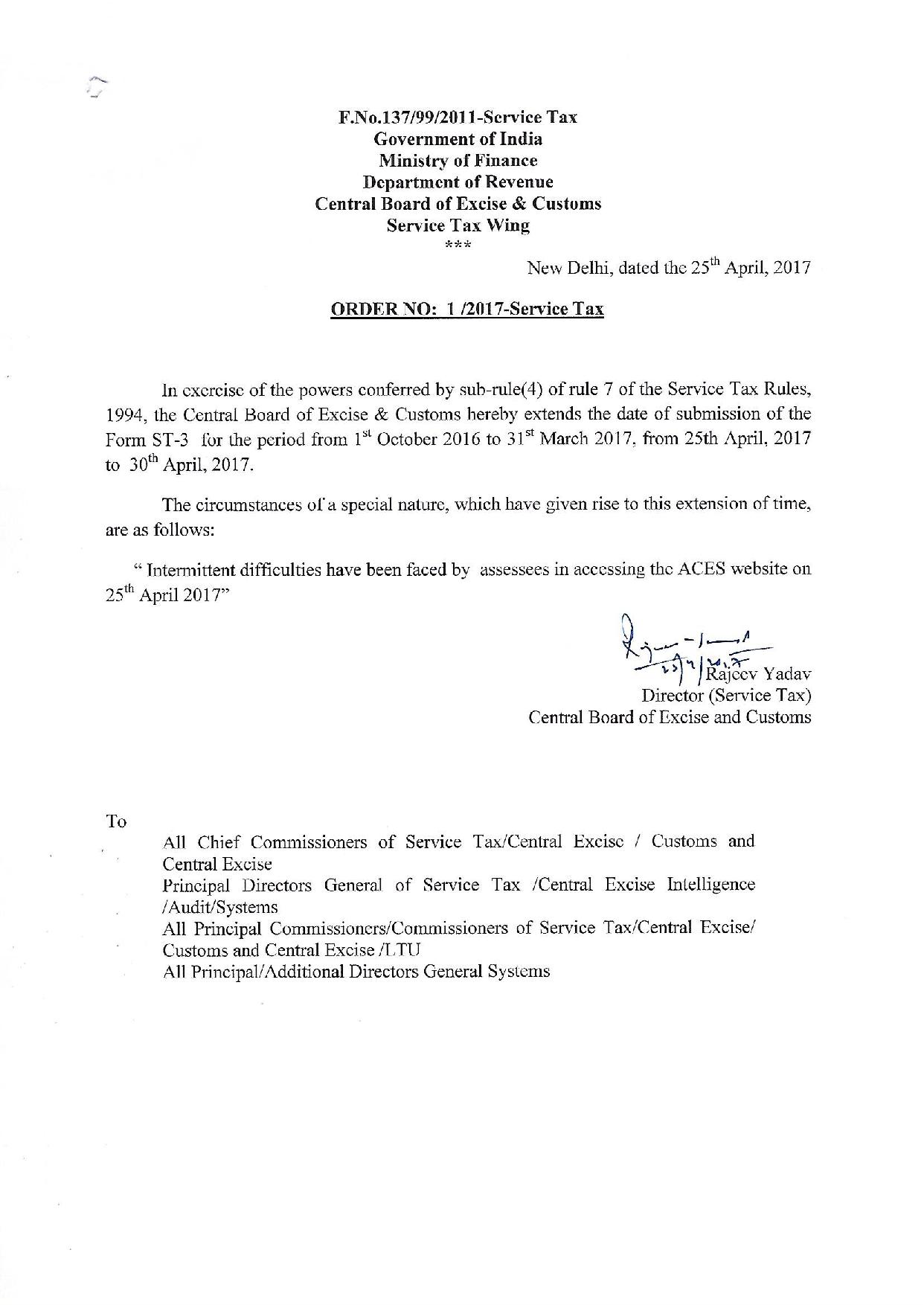

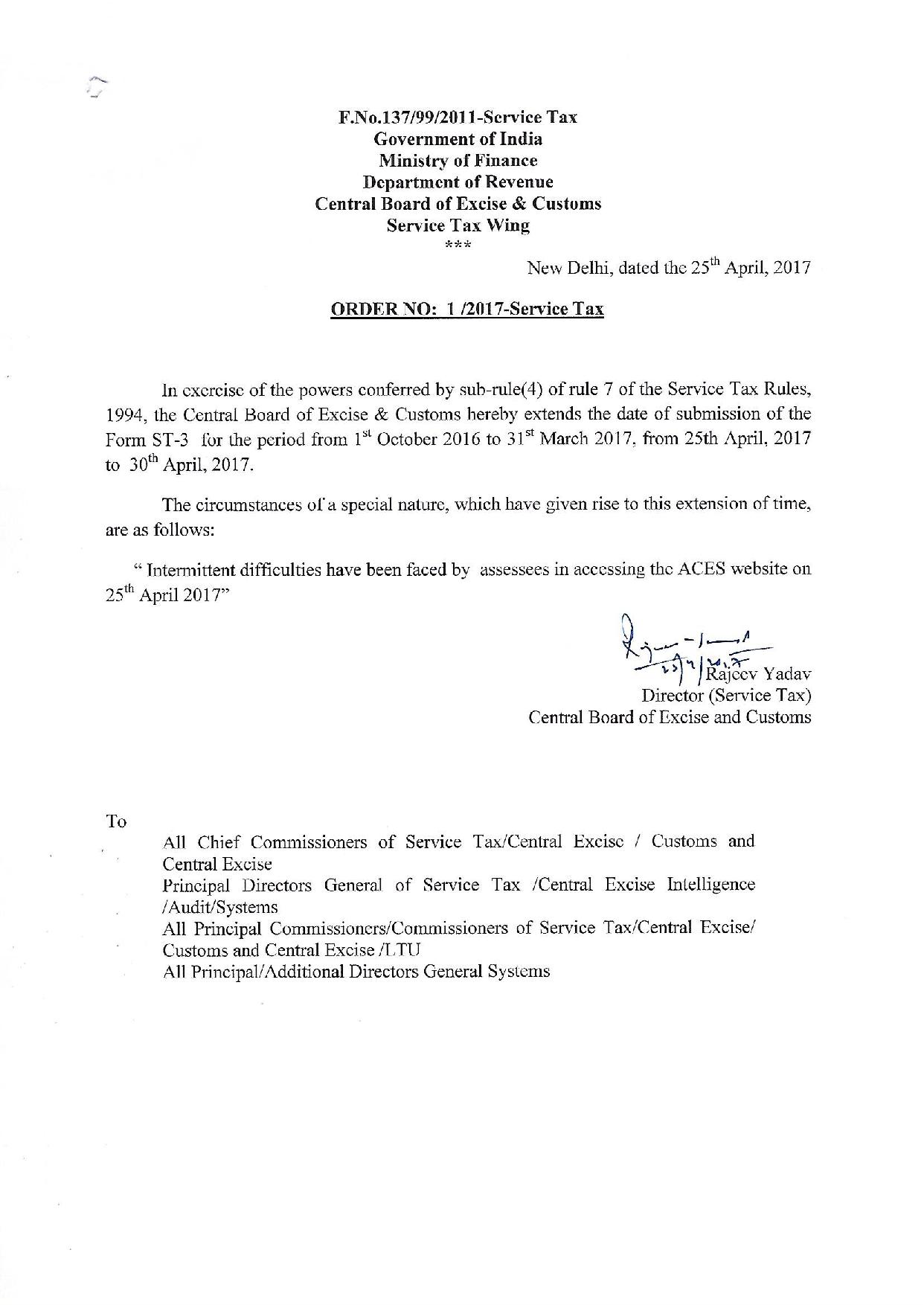

LAST DATE FOR FILLING SERVICE TAX RETURN FOR H2 OF FY 2016 17 RITUL

LAST DATE FOR FILLING SERVICE TAX RETURN FOR H2 OF FY 2016 17 RITUL

Tax Settings Bahawalpur

Tax Return Legal Image

Tax Policy And The Family Cornerstone

Tax Statement Not Tax Ready - By Hydralisk Brisk Your income statement is not tax ready If you are confident in the accuracy of the information displayed you can select Yes below If you are unsure contact your payer to confirm the correct amounts to be included in your tax return You can edit the dollar amounts to ensure your tax return is correct