Tax Student Loan Interest Paid Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You

You can deduct the interest you pay on your student loans Deducting student interest lowers your adjusted gross income AGI which can help you qualify Enter the eligible amount of interest paid on your student loans on line 31900 of your return Claim the corresponding provincial or territorial non refundable tax credit on line 58520

Tax Student Loan Interest Paid

Tax Student Loan Interest Paid

https://img.money.com/2021/01/Student_Loan_Tax_Deduction.jpg?quality=85

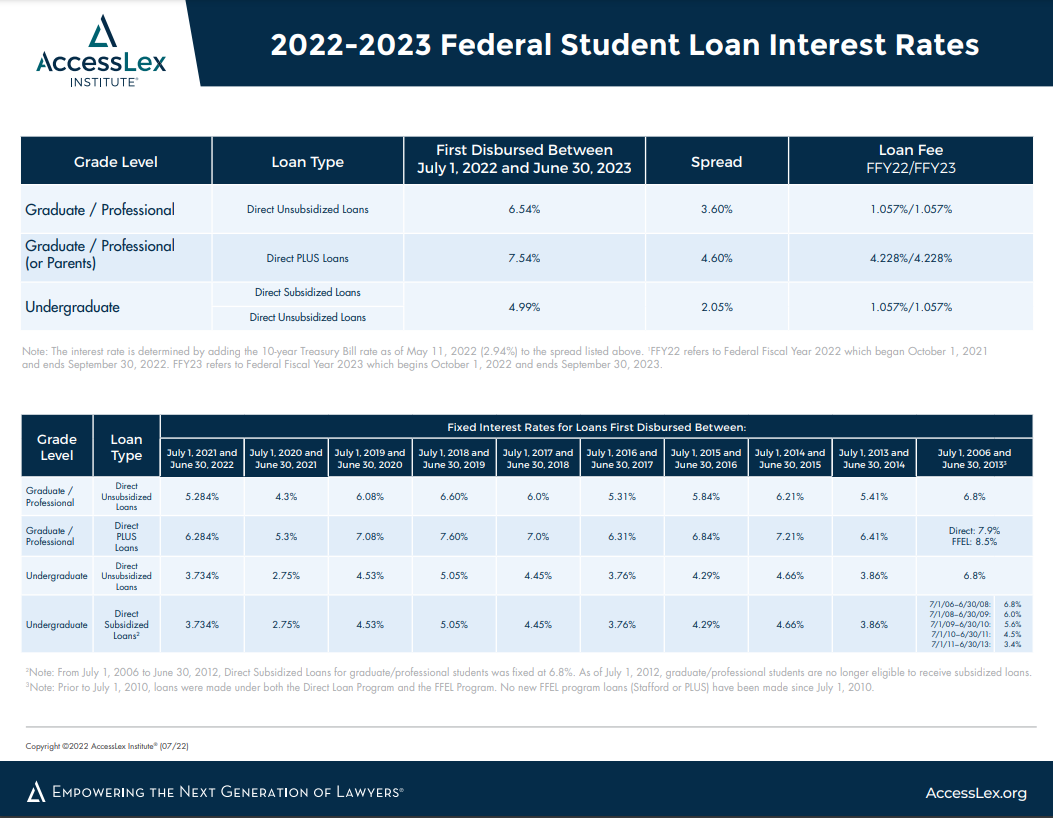

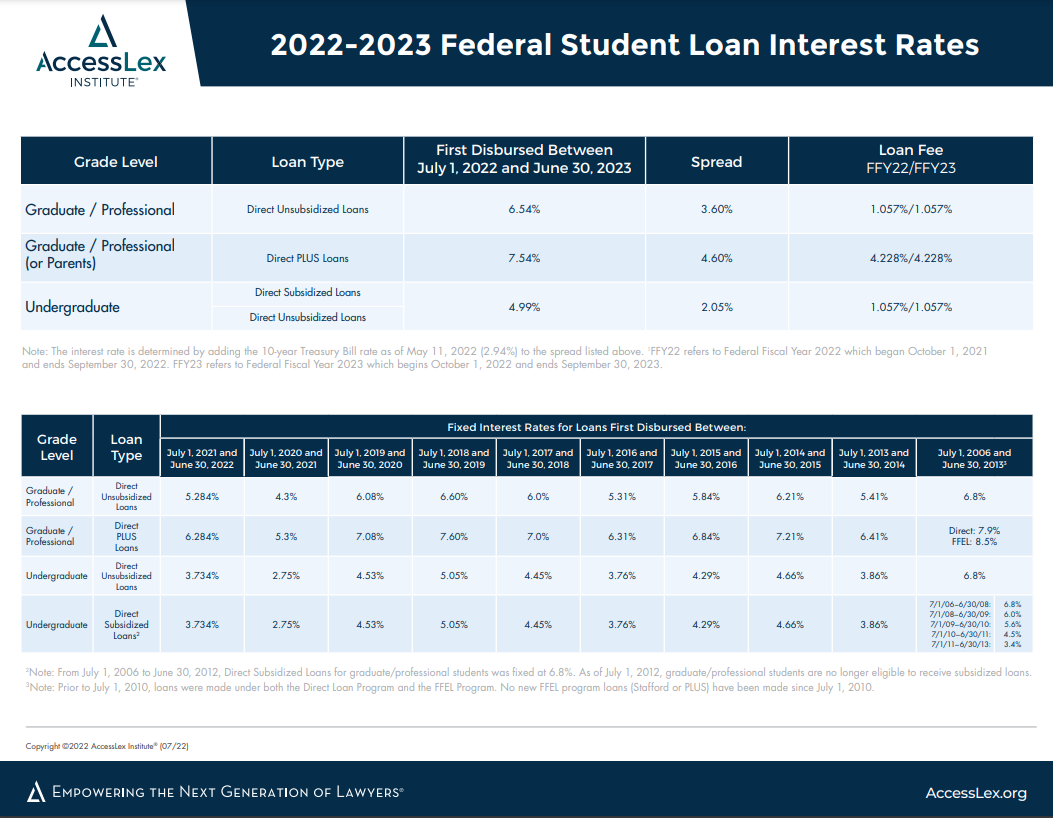

Federal Student Loan Interest Rates AccessLex

https://www.accesslex.org/sites/default/files/inline-images/Federal Student Loan Interest Rates_2022 2023.png

Understanding Student Loans INFOGRAPHIC Via Nerd Wallet Student Loans

https://i.pinimg.com/736x/23/9e/c6/239ec6850d61bc6850f949e1745b8e97--student-loan-debt-student-debt-relief.jpg

The student loan interest deduction allows borrowers to deduct up to 2 500 of the interest they paid during the tax year on a qualified student loan To be eligible for the full 2 500 deduction in the How to repay Make extra repayments Getting a refund When your student loan gets written off or cancelled Update your employment details How much you repay depends

How much can you deduct for student loan interest in 2023 See if you can qualify with our student loan interest tax deduction calculator Up to 2 500 of student loan interest paid each year can be claimed as a deduction on Schedule 1 of the Form 1040 For 2023 the break begins to phase out for

Download Tax Student Loan Interest Paid

More picture related to Tax Student Loan Interest Paid

Student Loan Interest Deduction 2013 PriorTax Blog

https://www.blog.priortax.com/wp-content/uploads/2014/02/Student-Loan-Interest-Deduction-2013-1024x576.jpg

Certificate Courses Student Loans Higher Education Expand Goo

https://i.pinimg.com/originals/77/3c/34/773c34226e31586700a3c5640808a657.jpg

Tax Tip 2016 Deduct Student Loan Interest Paid By Your Parents YouTube

https://i.ytimg.com/vi/Xm7hicMUeKc/maxresdefault.jpg

Up to 2 500 in interest you ve paid on your student loans can be deducted on your income tax return You ll get a Form 1098 E for this if you ve paid at least 600 The interest you pay on an education loan is entirely tax free as you can claim tax deductions against it However this is applicable only for the interest amount actually

Post 2012 student loans are charging 7 9 interest MoneySavingExpert explains how interest and repayment really works and if you should pay yours off Taxes and Interest You re required to repay your student loans with interest Interest is calculated as a percentage of the amount you borrowed You may be able to deduct

Learn How The Student Loan Interest Deduction Works

https://d3tc5xafqqxqk8.cloudfront.net/wp-content/uploads/2020/05/08174241/image2.png

SC Set To Tax Student Loan Forgiveness

http://s3.amazonaws.com/lewiscountypress-pictures-production/cc/production/pictures/1301/tax_student_loan_article_show_carosel.jpg

https://www.irs.gov/taxtopics/tc456

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You

https://www.forbes.com/advisor/taxes/student-loans-taxes

You can deduct the interest you pay on your student loans Deducting student interest lowers your adjusted gross income AGI which can help you qualify

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

Learn How The Student Loan Interest Deduction Works

Student loan interest equation example Funding Cloud Nine

Why You Should Prepare For Student Loan Payments To Resume even If

16 Best Private Student Loans Of March 2021 NerdWallet Student

39 Mortgage Insurance Premiums Deduction Worksheet Worksheet Master

39 Mortgage Insurance Premiums Deduction Worksheet Worksheet Master

Federal Student Aid Changes Announced From Department Of Education

Student Loan Interest Deduction Who Qualifies And How To Claim It

How Can You Find Out If You Paid Taxes On Student Loans

Tax Student Loan Interest Paid - If you made interest rate payments on your student loans during the tax year you could deduct up to 2 500 in interest paid If you happen to qualify for the 22 tax