Tax Treatment Of Accrued Market Discount The tax treatment of accrued market discount depends on whether the bond is a taxable or tax exempt instrument For taxable bonds the accrued market

Accrued market discount is the expected gain on a discount bond until maturity Learn how it is taxed as income and how to choose between ratable accrual and constant yield The taxation of accrued market discounts depends on the type of debt instrument and the taxpayer s accounting method Generally accrued market discounts are taxed as

Tax Treatment Of Accrued Market Discount

Tax Treatment Of Accrued Market Discount

https://images.prismic.io/baker-tilly-www/ZmQ3NGI4N2EtZWRjZi00Y2M0LWEzOTgtYWM4ZmM5YjM1NTYy_buildings-architecture-background-istock_000037138764medium.jpg?auto=compress,format&rect=0,143,600,315&w=1200&h=630

Ratable Accrual Method AwesomeFinTech Blog

https://www.awesomefintech.com/term/cards/ratable-accrual-method/card_2.png

Accrued Interest What It Is And How It s Calculated

https://www.annuity.org/wp-content/uploads/How-to-Calculate-Accrued-Interest-1.jpg

Market discount on a tax exempt bond is not tax exempt If you bought the bond after April 30 1993 you can choose to accrue the market discount over the period you own the Unlike OID market discount is not subject to taxation annually Accreted market discount only becomes taxable in the year the bond is sold or redeemed Also unlike OID market

For discount bonds purchased in the secondary market You have two options Elect to recognize a portion of the discount each year as taxable income just as you would with If the debtor makes a partial payment of principal on market discount debt the taxpayer holding the debt first treats the payment as accrued market discount to the extent it was

Download Tax Treatment Of Accrued Market Discount

More picture related to Tax Treatment Of Accrued Market Discount

Accrued Market Discount Should Not Be Zero R TurboTax

https://64.media.tumblr.com/753e20a5e0663b0f1c1e3436f2c97792/6bbb268f01aca57e-7e/s1280x1920/7022305e9a0bc02ee15d18871717c9617de57a52.jpg

What Is Accrued Market Discount Accrued Market Discount Finance

https://i.ytimg.com/vi/pjXv5_KEIqo/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZSgxMA8=&rs=AOn4CLDlg3PwEPsEGRAcpOaHMi1uu7oePg

/display-stock-market-numbers-and-graph-517963238-9b334840de544431b47550b342889970.jpg)

Accrued Market Discount Definition

https://www.investopedia.com/thmb/RvARwX62OSUuixVBf8cwVTT-ACg=/2105x1424/filters:fill(auto,1)/display-stock-market-numbers-and-graph-517963238-9b334840de544431b47550b342889970.jpg

The discount bond method is used if the bond does not qualify for the coupon bond method e g the bond is issued at a discount The discount method essentially requires the For purposes of paragraph 1 a person disposing of any market discount bond in any transaction other than a sale exchange or involuntary conversion shall be treated as

The accrued market discount is then treated as ordinary interest on Schedule B and is also added to the basis thus only taxed as ordinary interest The D code is present on For tax purposes the accrued market discount is usually treated as income Investors have choices in managing this income they can either accrue the market discount annually

Tax Treatment Of Accrued Interest Or Profit Payable To Bank Or

https://ancgroup.biz/wp-content/uploads/2023/03/protect-company-finances-and-tax-optimization-company-investment-represented-by-dollar-SBI-301985369-1024x683.jpg

Accrued Market Discount YouTube

https://i.ytimg.com/vi/86KNqvCoiNg/maxresdefault.jpg

https://fastercapital.com/content/The-Tax...

The tax treatment of accrued market discount depends on whether the bond is a taxable or tax exempt instrument For taxable bonds the accrued market

https://www.investopedia.com/terms/a/accruedmarketdiscount.asp

Accrued market discount is the expected gain on a discount bond until maturity Learn how it is taxed as income and how to choose between ratable accrual and constant yield

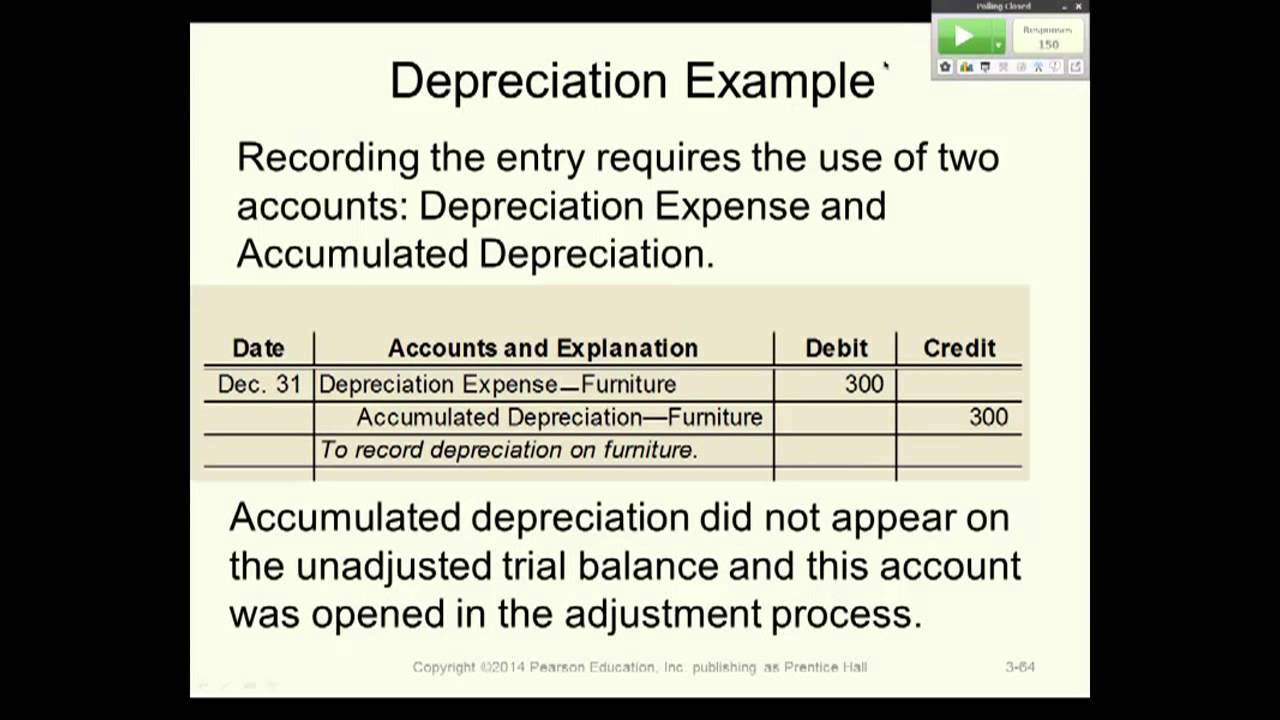

The Adjusting Process And Related Entries Principlesofaccounting

Tax Treatment Of Accrued Interest Or Profit Payable To Bank Or

Accrued Income Definition Accounting Treatment Accountant Skills

Intro To Financial Accounting Adjusting Entries Unearned accrued

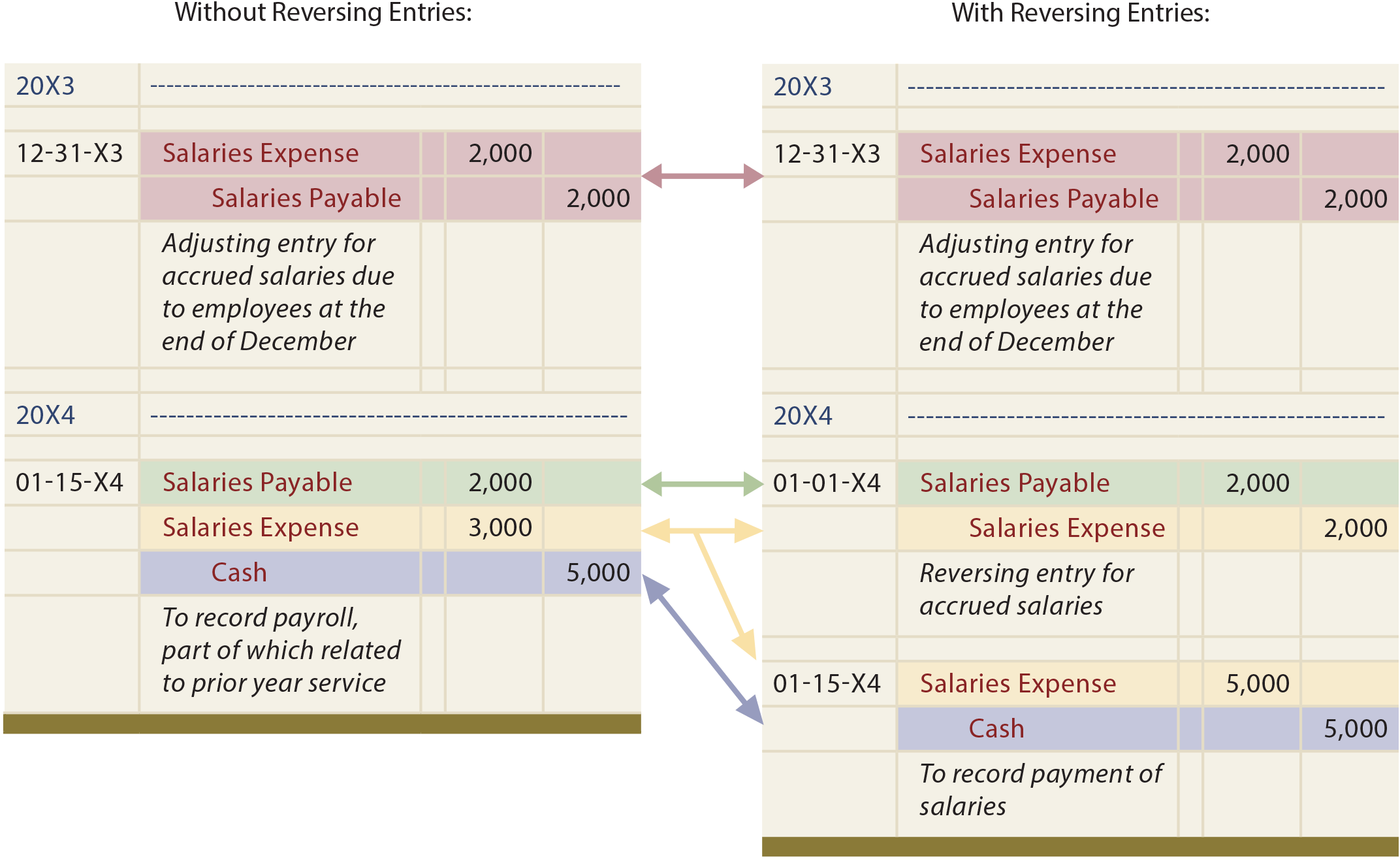

Reversing Entries Principlesofaccounting

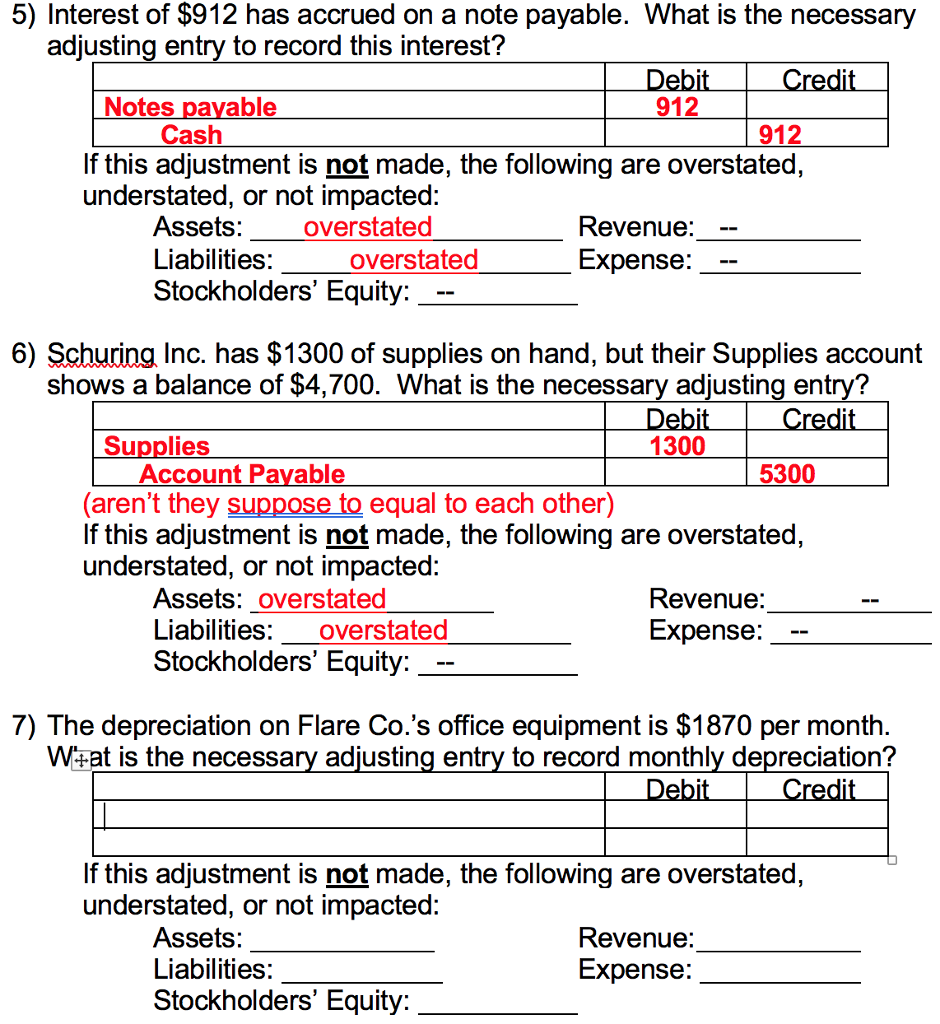

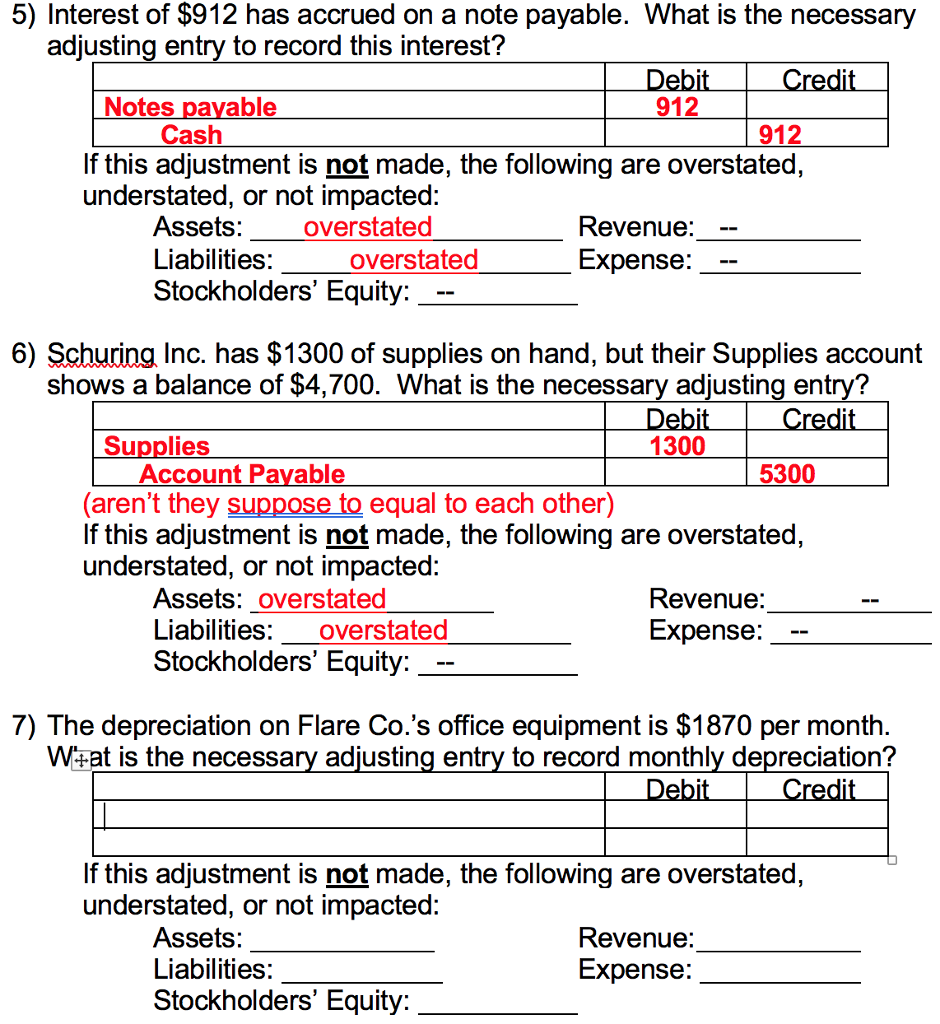

Solved 5 Interest Of 912 Has Accrued On A Note Payable Chegg

Solved 5 Interest Of 912 Has Accrued On A Note Payable Chegg

4 Types Of Provident Fund And Tax Treatment Of Provident Fund

Premium On Bonds Payable Journal Entry Bonds Issued At A Premium

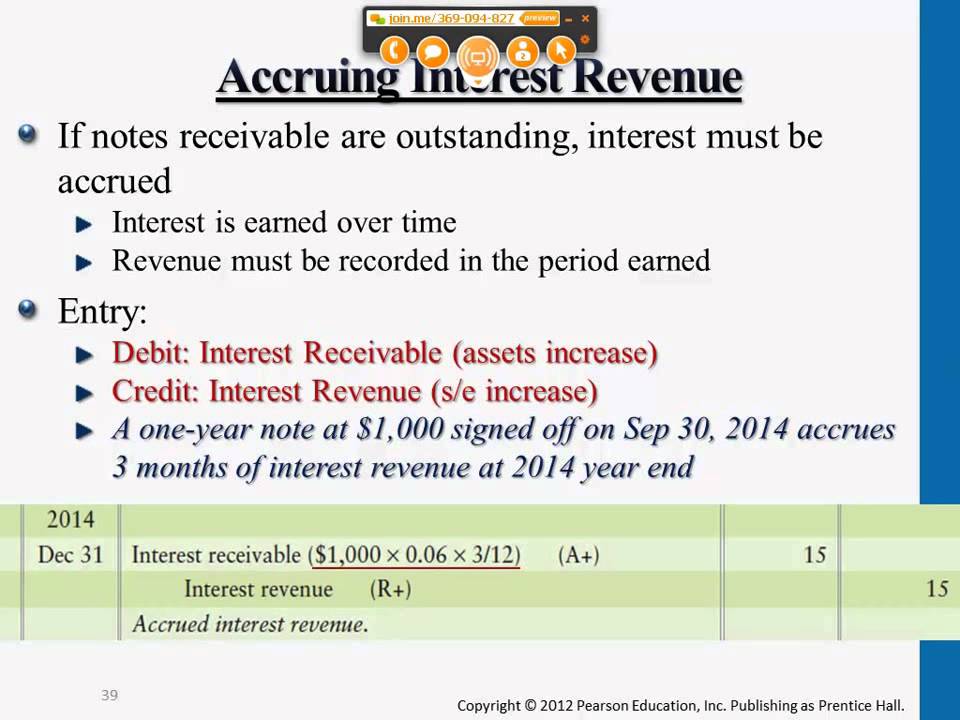

Accruing Interest Revenue Professor Victoria Chiu YouTube

Tax Treatment Of Accrued Market Discount - In general a capital gain from the disposition of a market discount bond is treated as interest income to the extent of accrued market discount as of the date of disposition