Tax Withholding On Retirement Plan Distributions 401 k 403 b and other qualified workplace retirement plans Plan providers typically withhold 20 on taxable distributions unless the withdrawal is made to satisfy the annual required minimum

You can take distributions from your IRA including your SEP IRA or SIMPLE IRA at any time There is no need to show a hardship to take a distribution However your The withholding rules apply to the taxable part of payments or distributions from an employer pension annuity profit sharing stock bonus or other deferred

Tax Withholding On Retirement Plan Distributions

Tax Withholding On Retirement Plan Distributions

https://cdn.newsday.com/ace/c:NmJjZWFhMzctYmQ0Zi00:YzNmMjZj/landscape/1280

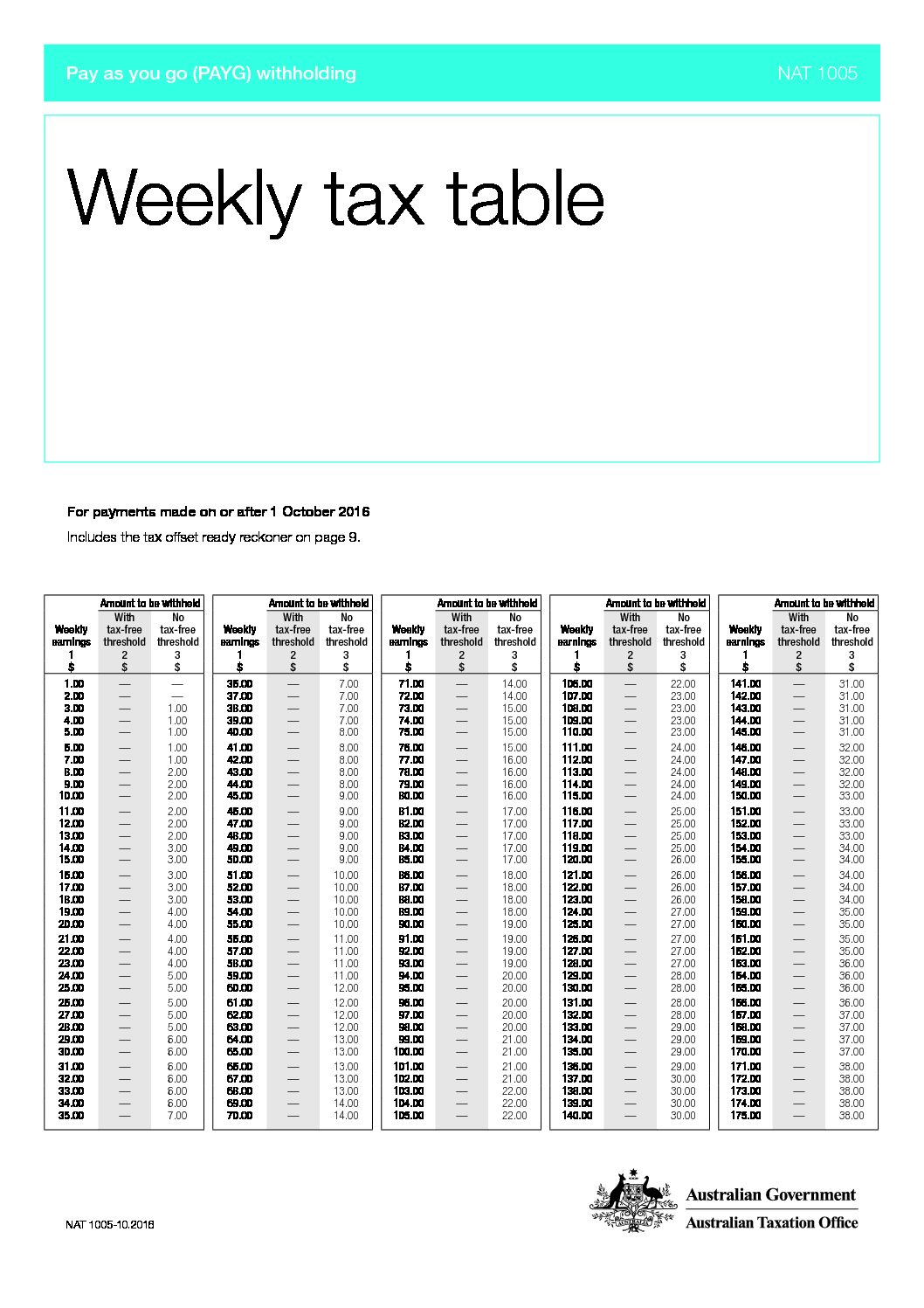

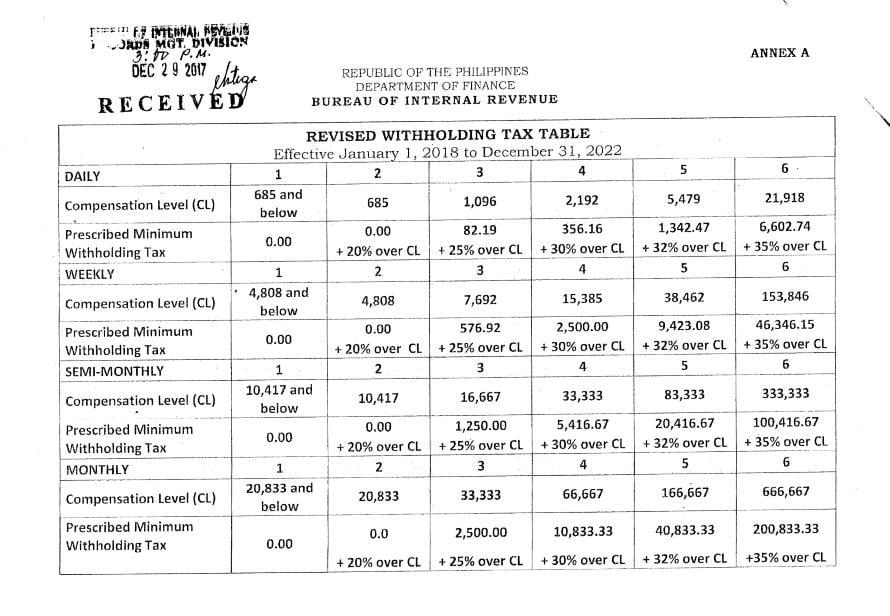

Weekly Tax Table Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/07/weekly-tax-table-2016-17-hqb-accountants-auditors-advisors.jpg

Tax Withholding Estimator 2022 ConaireRainn

https://lh4.googleusercontent.com/WVxGbD58MusXZ3PD0th6xXrCi4gNzdme5Q0yBhQfXb5RxjT451dk5P-OwcZ038MfJtF2T11rYqrE6BjEemhd6cb1z4uEJGoH0uk9ScDK6rJGYI6-PFUIjaJC8VdOGC4M_dPqaPzk

You must generally withhold 30 from a plan distribution paid to a foreign payee unless you can reliably associate the payment with valid documentation that Traditionally 401 k distributions are taxed as ordinary income However the tax burden you ll incur varies by the type of account you have a traditional 401 k or a Roth 401 k and by

Withdrawals from traditional IRA and 401 k accounts are taxable Withdrawals from Roth IRAs and Roth 401 k s are generally not taxable Retirement account withdrawals can bump you into a When you reach age 72 you are required to start taking distributions from traditional IRA accounts and other qualified retirement plans such as a 401 k These distributions are included as taxable

Download Tax Withholding On Retirement Plan Distributions

More picture related to Tax Withholding On Retirement Plan Distributions

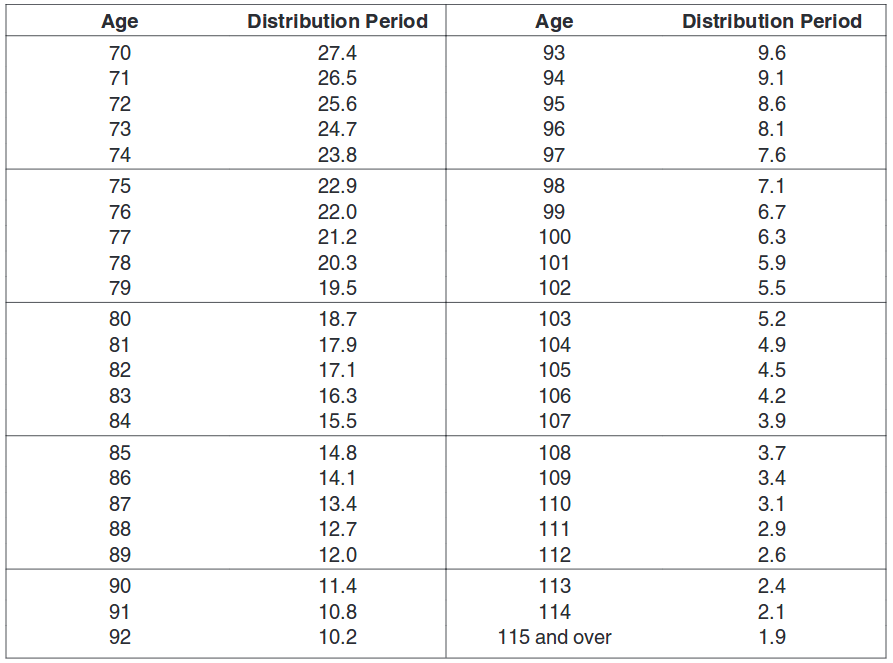

Minimum Retirement Plan Distributions

https://www.calcxml.com/articles/images/p590b-table3.png

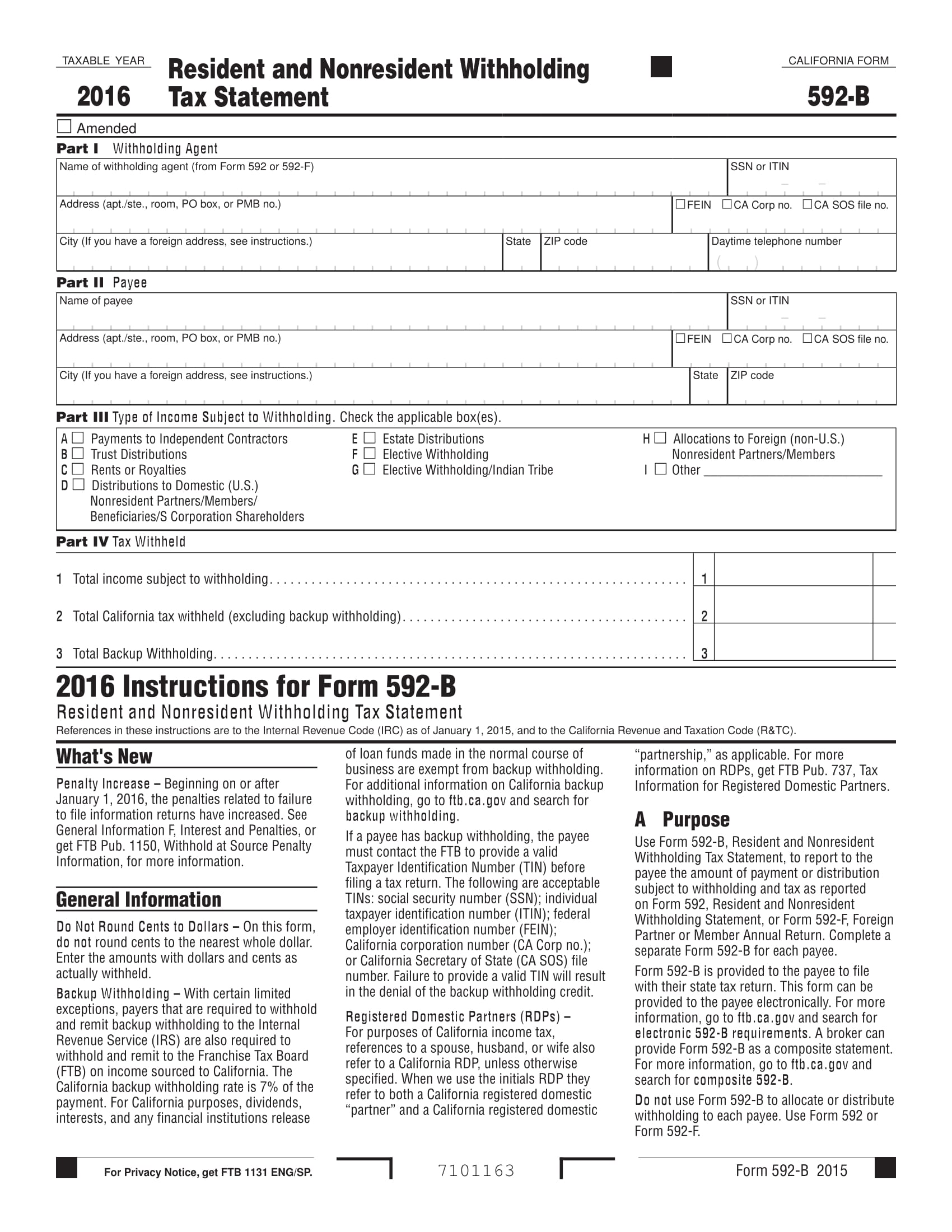

Withholding On Retirement Benefits PDF Tax Exemption Pension

https://imgv2-2-f.scribdassets.com/img/document/435477031/original/1b120be30b/1660616570?v=1

Rules For Withholding Taxes On Retirement Plan Distributions

https://i.pinimg.com/originals/40/a3/04/40a30429d5153b12ee1de4dda1aaa733.jpg

Sometimes the answer is zero you owe no taxes In other cases you owe income tax on the money you withdraw You can even owe an additional penalty if you withdraw funds before age 59 On the Applicable state tax withholding for retirement plan distributions This table provides the state requirements as of April 2024 States may change their requirements at any time

Federal withholding from retirement plan distribution payments is classified as a 945 tax withholding and must be reported on Form 945 Benetech does not prepare Form 945 to Distributions from your 401 k plan are taxable unless the amounts are rolled over as described below in the section titled Rollovers from your 401 k plan If you receive a

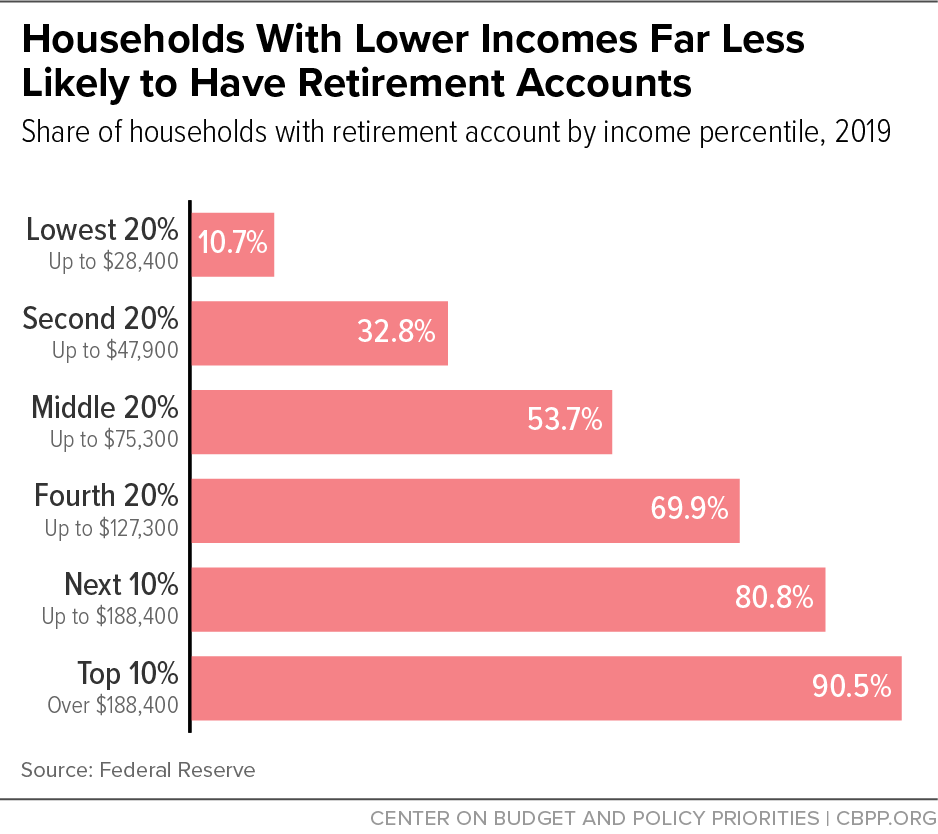

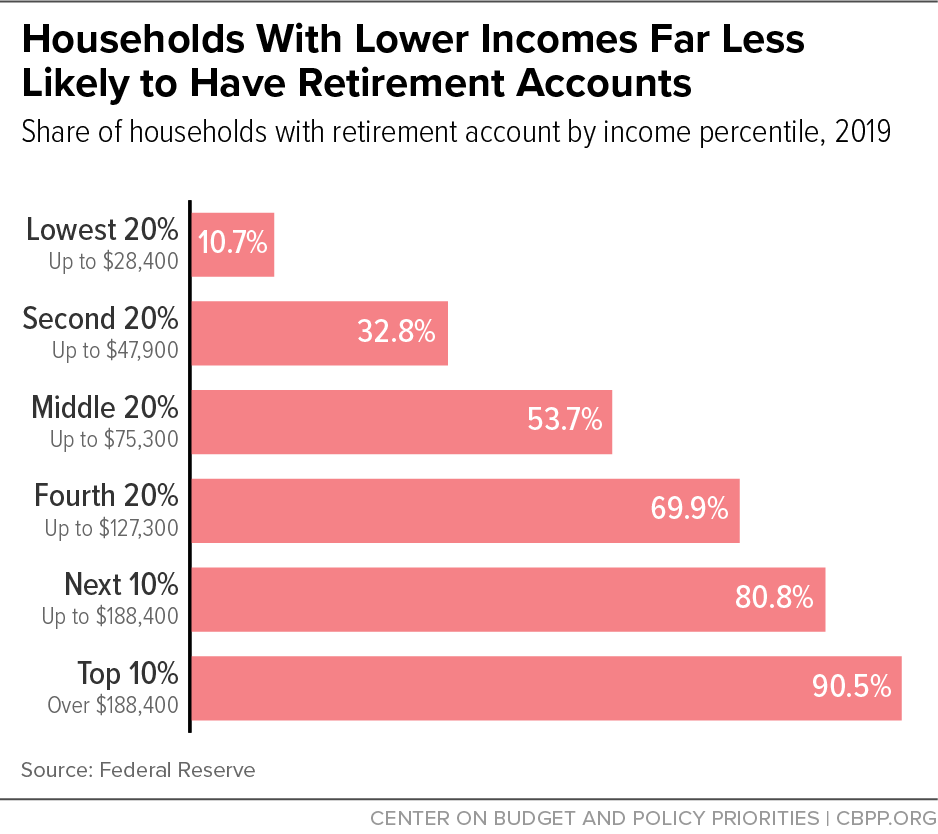

House Bill Would Further Skew Benefits Of Tax Favored Retirement

https://www.cbpp.org/sites/default/files/styles/report_580_high_dpi/public/2022-04/4-29-22tax_f1.png?itok=BgCY47eU

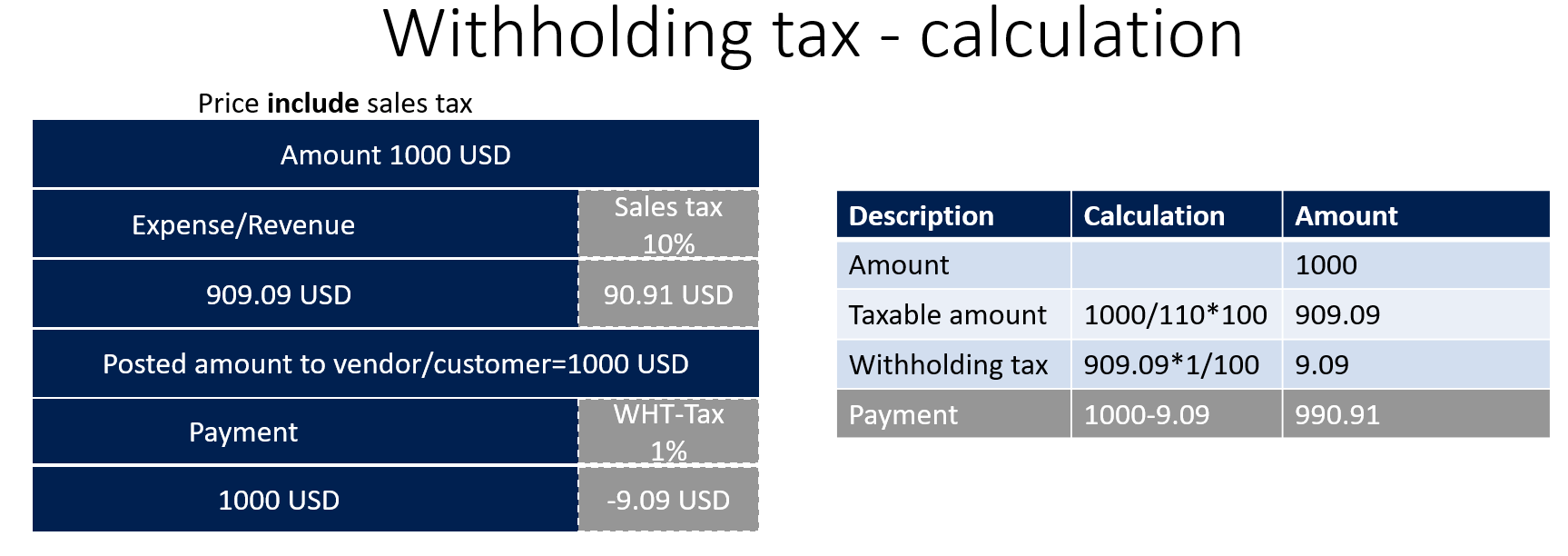

Understanding Withholding Tax Microsoft Dynamics 365 Enterprise

https://www.oreilly.com/api/v2/epubs/9781788839297/files/assets/64b061e6-7c28-4b0a-9600-30c2ccd4bbbf.png

https://www.schwab.com/.../tax-withho…

401 k 403 b and other qualified workplace retirement plans Plan providers typically withhold 20 on taxable distributions unless the withdrawal is made to satisfy the annual required minimum

https://www.irs.gov/retirement-plans/retirement...

You can take distributions from your IRA including your SEP IRA or SIMPLE IRA at any time There is no need to show a hardship to take a distribution However your

Retirement Benefits Get Your Hands On Them Sooner

House Bill Would Further Skew Benefits Of Tax Favored Retirement

Pay Less Retirement Taxes

COVID 19 CARES Act Financial Planning Series 5 Retirement Plan

How CARES Act Affects Employee Retirement Plan Distributions

Retirement Savings Planner Tsp Lokasintemplates

Retirement Savings Planner Tsp Lokasintemplates

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Neat What Is Non Standard 1099 r A Chronological Report About Tigers

Bonus Tax Rate 2018 Museumruim1op10 nl

Tax Withholding On Retirement Plan Distributions - You must generally withhold 30 from a plan distribution paid to a foreign payee unless you can reliably associate the payment with valid documentation that