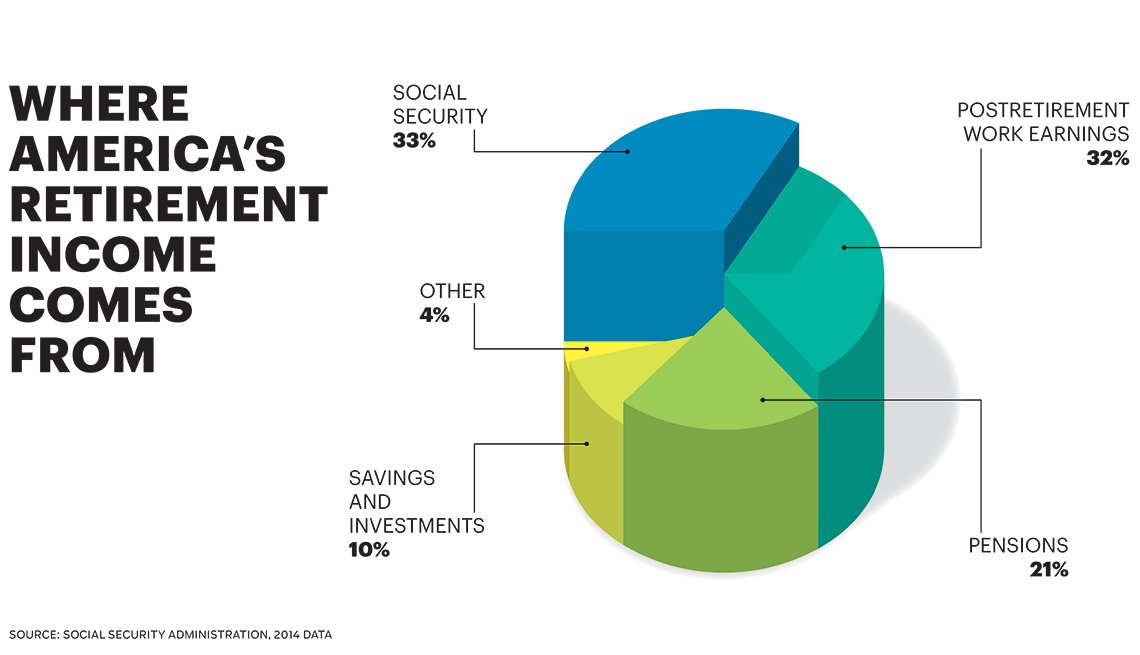

Tax Withholding Retirement Plan Distribution Applicable state tax withholding for retirement plan distributions This table provides the state requirements as of April 2024 States may change their requirements at any time

Here s how federal tax withholding generally works for some common sources of retirement income state withholding may also apply Traditional SEP and SIMPLE IRAs Unless you specify otherwise your You can take distributions from your IRA including your SEP IRA or SIMPLE IRA at any time There is no need to show a hardship to take a distribution However your

Tax Withholding Retirement Plan Distribution

Tax Withholding Retirement Plan Distribution

https://www.washfinancial.com/wp-content/uploads/2018/06/Image.jpg

Free Retirement Plan Contribution Limits Campaign Advisorexpressions

https://advisorexpressions.com/wp-content/uploads/2022/01/AE-2022-FB-Posts_2022ContributionLimits2.jpg

La State Withholding Tax Form WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/08/a-list-of-income-tax-rates-for-each-state-5.png

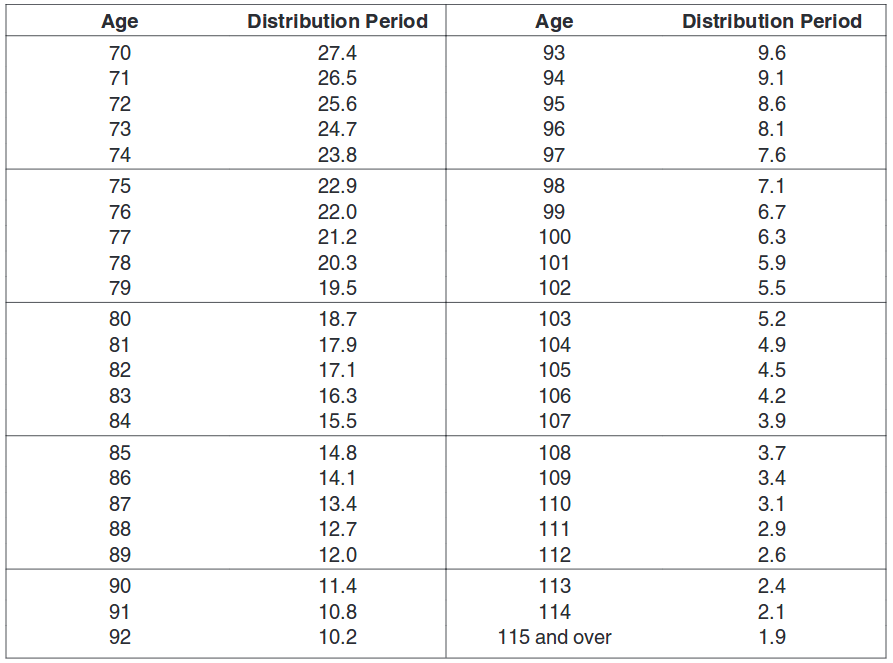

Generally pension and annuity payments are subject to Federal income tax withholding The withholding rules apply to the taxable part of payments or distributions from an Find out about required minimum distributions on your retirement plan under Internal Revenue Code sections 401 a 9 408 a 6 and 408 b 3 and how much and when to

If you withdraw from your 401 k before the age of 59 5 also known as an early distribution you will have to pay a 10 penalty on the early withdrawal You may be able to avoid the 20 tax if you roll over The taxes you owe on your 401 k distributions at retirement depend on whether your funds are in a traditional 401 k or a Roth 401 k There are other factors at play too

Download Tax Withholding Retirement Plan Distribution

More picture related to Tax Withholding Retirement Plan Distribution

Understanding Your Retirement Plan Distribution Options

https://s3.studylib.net/store/data/008171268_1-b3b2ddc1cf785f80a9a5199a92d1f47f-768x994.png

How To Make IRS Payments For Your Taxes Tax Defense Network

https://www.taxdefensenetwork.com/wp-content/uploads/2018/08/How-to-Make-IRS-Payments-for-Your-Taxes_Credit-Cards.jpg

Weekly Tax Table Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/07/weekly-tax-table-2016-17-hqb-accountants-auditors-advisors.jpg

401 k 403 b and other qualified workplace retirement plans Generally most withdrawals are subject to 20 withholding However withdrawals made to satisfy your annual required minimum distributions RMDs are subject to 10 withholding which for high income retirees may be far too low Federal income tax withholding applies to payments of Nonperiodic Payments and Eligible Rollover Distributions of which most traditional including SEP and SIMPLE IRA distributions are categorized

When you take a distribution from your 401 k your retirement plan will send you a Form 1099 R This tax form shows how much you withdrew overall and the federal and state taxes withheld from the distribution if When you withdraw money from your IRA or employer sponsored retirement plan your state may require you to have income tax withheld from your distribution Your

IRS Addresses CARES Act Relief For Retirement Plan Distributions And

https://www.seilersingleton.com/wp-content/uploads/2020/05/2020-06-01-Retirement-Plan-1024x683.jpg

App Of Retirement Plan Figma Community

https://s3-alpha.figma.com/hub/file/2808205398/c0fe6066-566a-48a1-a28d-84ba981746ea-cover.png

https://personal.vanguard.com/pdf/sarpsc.pdf

Applicable state tax withholding for retirement plan distributions This table provides the state requirements as of April 2024 States may change their requirements at any time

https://www.schwab.com/.../tax-withho…

Here s how federal tax withholding generally works for some common sources of retirement income state withholding may also apply Traditional SEP and SIMPLE IRAs Unless you specify otherwise your

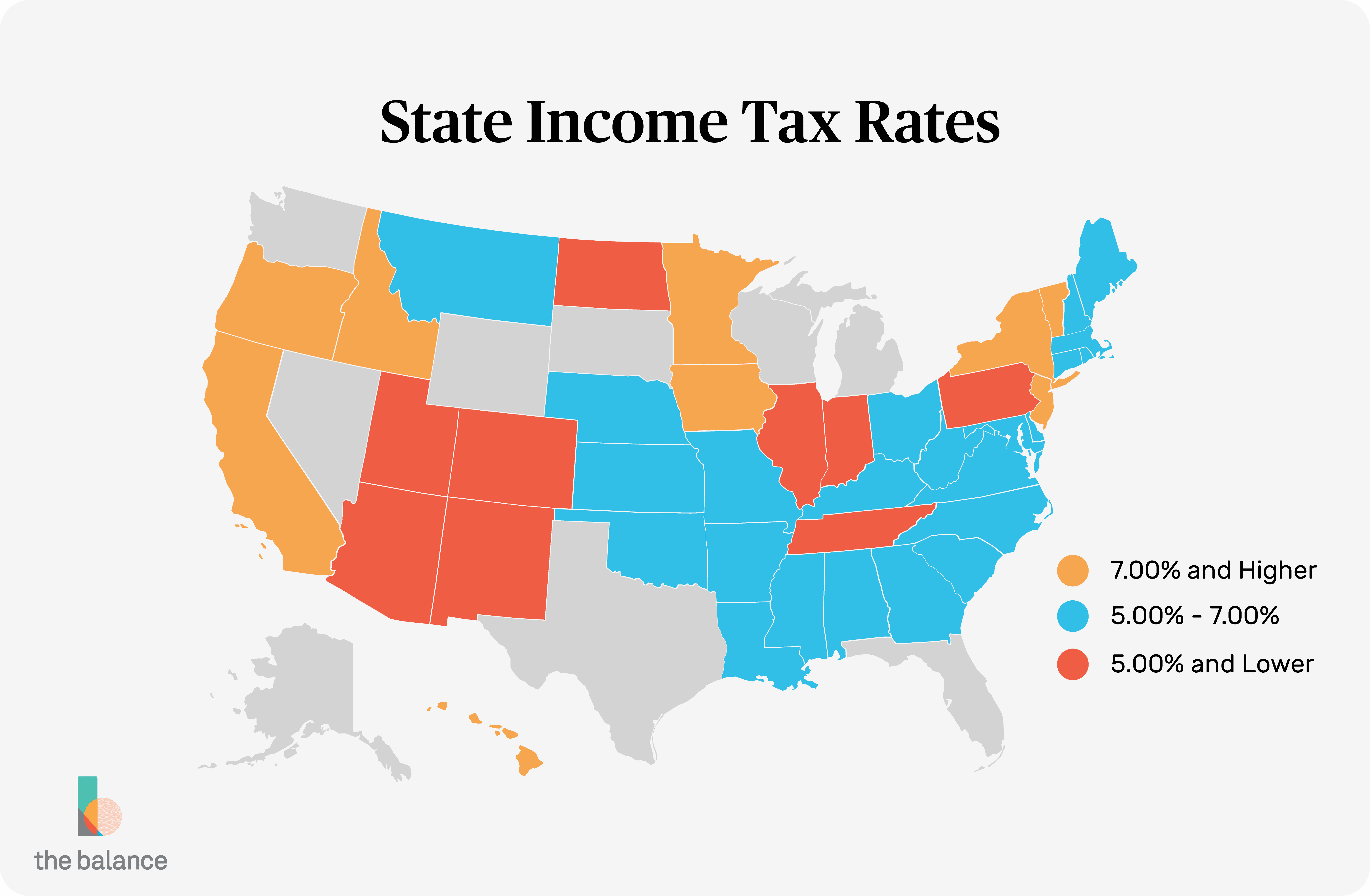

Retirement Plan Contribution And Distribution Summary For Persons Age

IRS Addresses CARES Act Relief For Retirement Plan Distributions And

5 Crucial Retirement Years For Your Money Ktvb

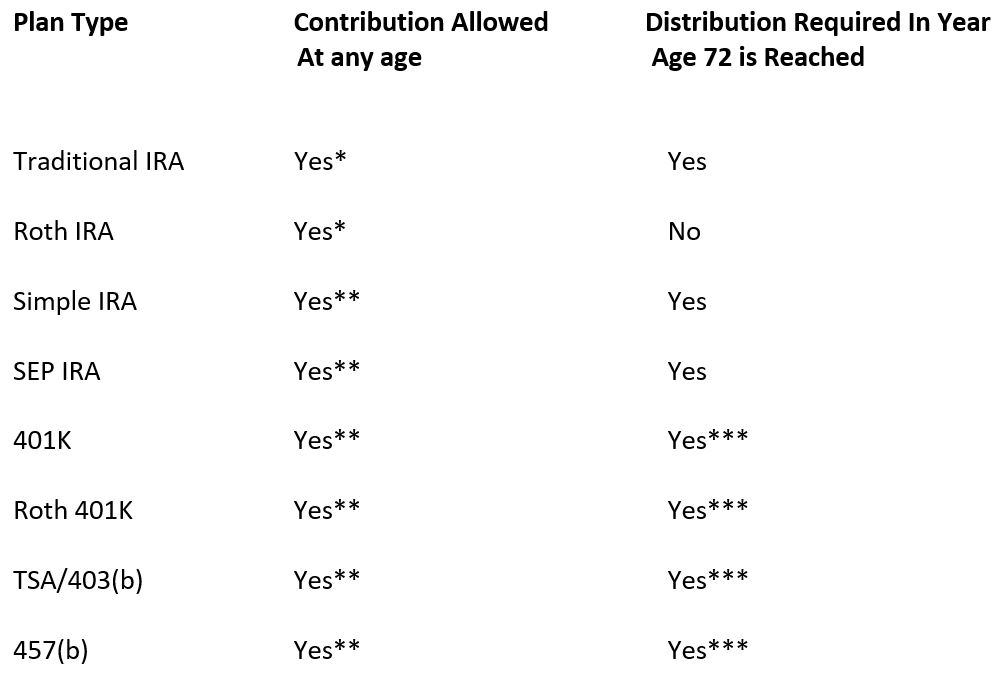

What Is A Form W 2 What Is The Purpose Of A 1099 Wagepoint

Minimum Retirement Plan Distributions

Pay Less Retirement Taxes

Pay Less Retirement Taxes

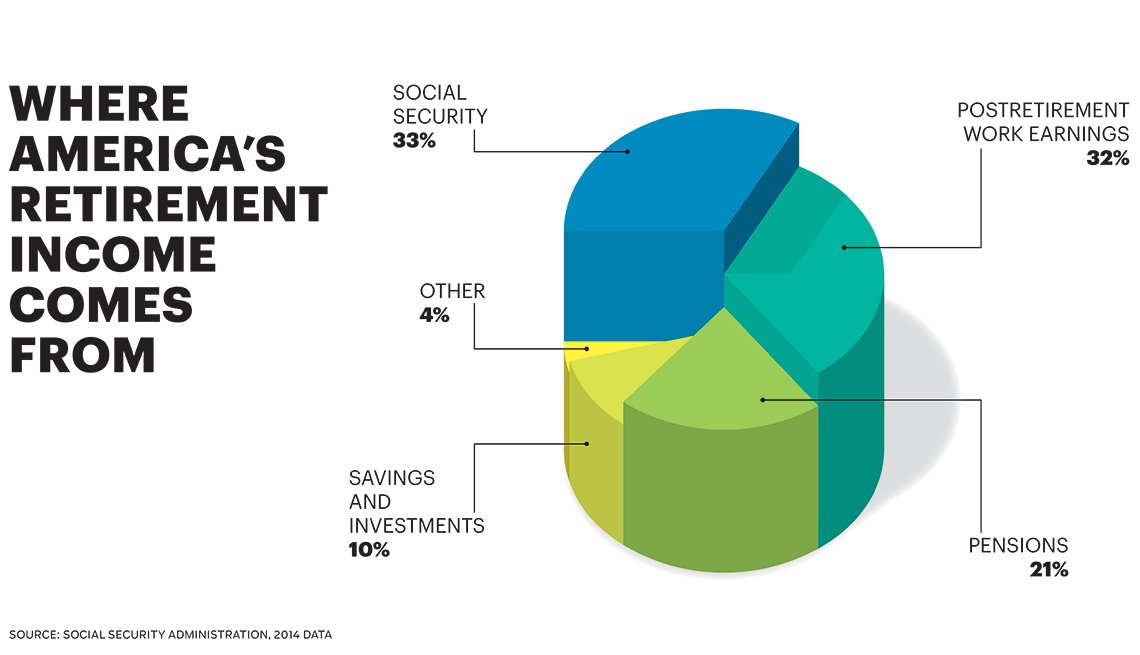

Guide To Aging On A Financial Budget Aging

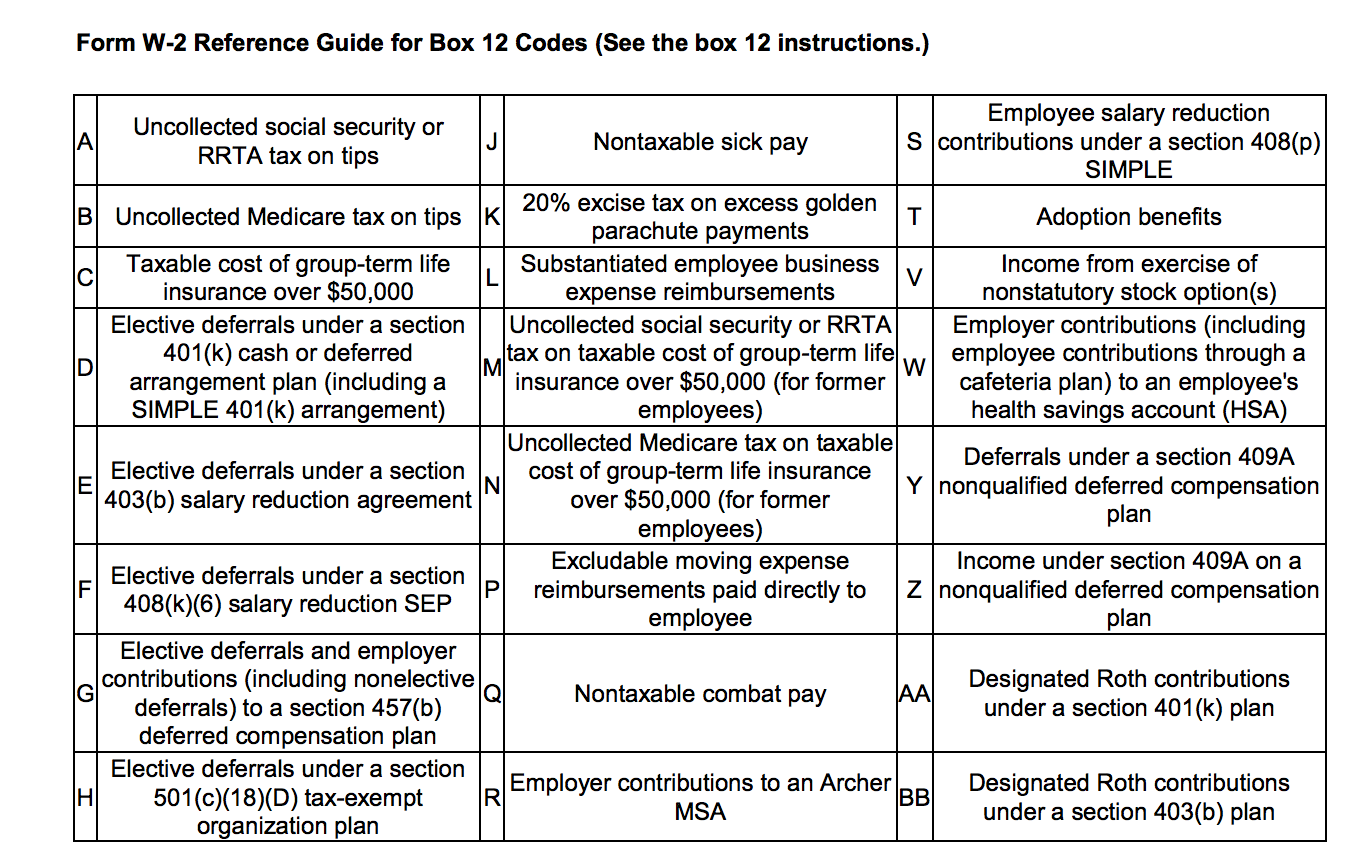

State Taxes Can Add Up Wealth Management

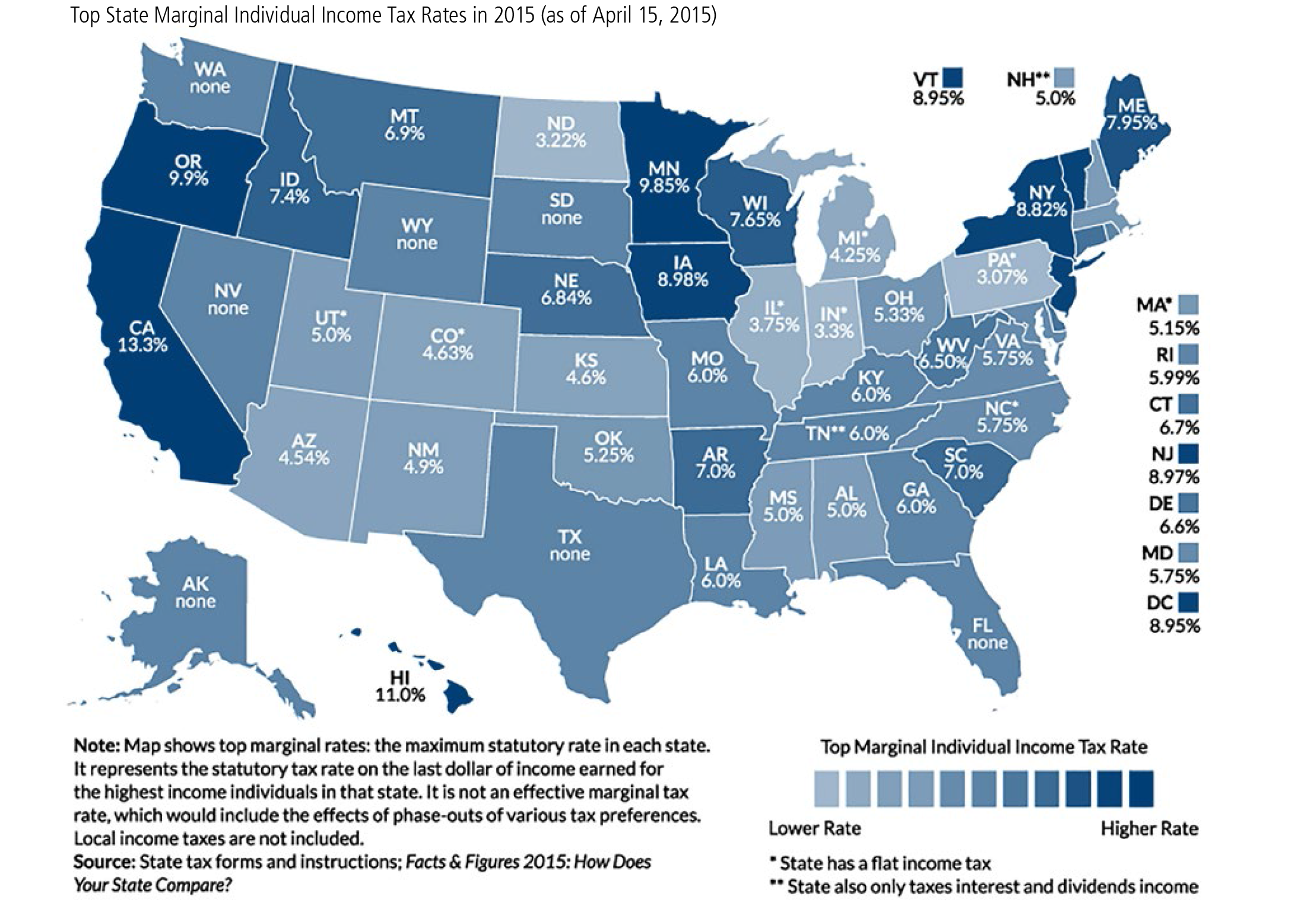

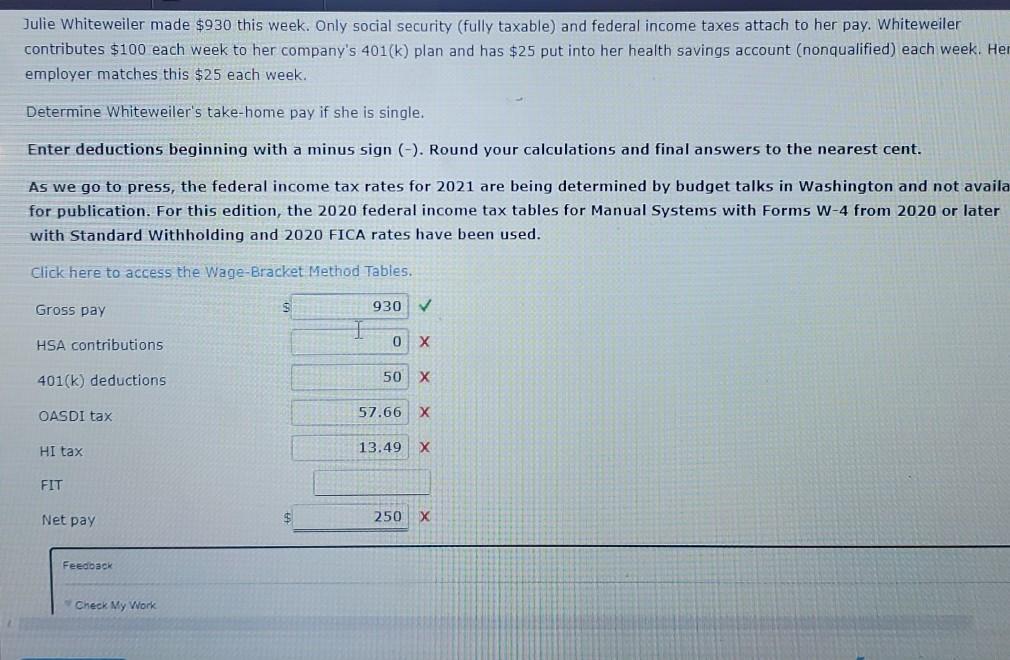

Solved Julie Whiteweiler Made 930 This Week Only Social Chegg

Tax Withholding Retirement Plan Distribution - Find out about required minimum distributions on your retirement plan under Internal Revenue Code sections 401 a 9 408 a 6 and 408 b 3 and how much and when to