Tax Write Off If You Work From Home One of the bigger tax deductions you can take if you work from home as an independent contractor is the home office deduction To take this deduction you ll need to figure out the percentage of your home used for

How the deduction works There are two ways that eligible taxpayers can calculate the home office deduction In the simplified version you can take 5 per square foot of your home office If you re a regular employee working from home you can t deduct any of your related expenses on your tax return In the past you could claim an itemized deduction for

Tax Write Off If You Work From Home

Tax Write Off If You Work From Home

https://i.ytimg.com/vi/yHDEmiJpInQ/maxresdefault.jpg

10 Ways To Stay Social If You Work From Home The Frugal Millionaire

https://i2.wp.com/www.thefrugalmillionaireblog.com/wp-content/uploads/2015/11/social.jpg?resize=904%2C1024&ssl=1

Top 6 Tax Deductions That May Have Slipped Your Mind

https://accountantsdirect.com.au/wp-content/uploads/s2-1-2.jpg

If I m an employee and my job is fully remote and I have working from home can I deduct my work from home expenses Although there has been an increase in employees working at home since coronavirus under You ll be able to deduct a percentage of eligible expenses based on the size of your workspace If your home office is 10 of your home s total square footage then you can deduct 10 of

If you worked from home in 2022 you may be wondering if you qualify for the home office deduction which offers a tax break for part of your home expenses Remote work You can claim the deduction whether you re a homeowner or a renter and you can use the deduction for any type of home where you reside a single family home an apartment a condo or a

Download Tax Write Off If You Work From Home

More picture related to Tax Write Off If You Work From Home

If You Work From Home Here Are 11 Tax Deductions You Need To Know

https://i.pinimg.com/originals/60/cf/e1/60cfe14e0d40b945224a28b6cbabf436.png

Is Your Employer Spying On You As You Work From Home

https://www.thetimes.co.uk/imageserver/image//methode/sundaytimes/prod/web/bin/6f9226ca-43be-11eb-94fc-c2faf7d2563a.jpg?crop=1100%2C1100%2C0%2C0

A Simple Explanation Of Home Office Tax Deductions CHC Blog

https://www.chconsulting.co.za/wp-content/uploads/2022/06/A-simple-explanation-of-Home-Office-Tax-Deductions-South-Africa-2021.jpg

Home Office Deduction Tax Topic 509 Business Use of Home Form 8829 PDF Publication 587 If you use part of your home exclusively and regularly for conducting The home office deduction calculated on Form 8829 is available to both homeowners and renters There are certain expenses taxpayers can deduct These may

The home office deduction is one of the most popular work from home tax deductions Once you understand how to calculate record and report home office expenses you can benefit from If you work from home you need to know how to qualify for the home office deduction pay self employment taxes and understand which business expenses you can take

An Info Poster With The Words 10 Taxes You Can Write Off When You Work

https://i.pinimg.com/736x/09/3a/2b/093a2ba9f154a2cb359274242adab1b5.jpg

Working At Home Don t Overlook These Deductions

https://secureservercdn.net/198.71.233.237/f0d.478.myftpupload.com/wp-content/uploads/2021/03/Original-on-Transparent.png

https://www.ramseysolutions.com/taxes/…

One of the bigger tax deductions you can take if you work from home as an independent contractor is the home office deduction To take this deduction you ll need to figure out the percentage of your home used for

https://www.cnbc.com/2021/12/03/who …

How the deduction works There are two ways that eligible taxpayers can calculate the home office deduction In the simplified version you can take 5 per square foot of your home office

2023 Tax Return Working From Home Deductions Changes Tax Digital

An Info Poster With The Words 10 Taxes You Can Write Off When You Work

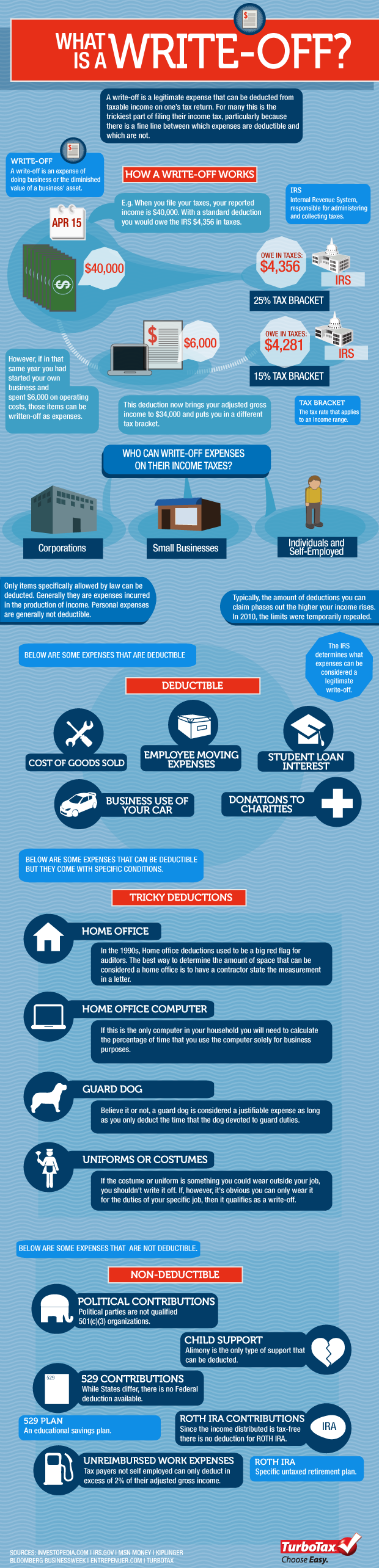

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

Still Working From Home Use These Memes To Describe The Experience

Australian Taxation Office On LinkedIn Working From Home Expenses

10 Companies That Will Let You Work From Home And Are Hiring Now

10 Companies That Will Let You Work From Home And Are Hiring Now

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

Can You Claim Your Elderly Parents On Your Taxes The TurboTax Blog

Five Things You Need To Know About Taxes If You Work From Home Moving

Tax Write Off If You Work From Home - Unfortunately for remote workers the shift to work from home whether forced or optional doesn t qualify for a tax write off of their workspace as a home office But for self