Taxability Of State Tax Refunds Verkko 6 helmik 2023 nbsp 0183 32 Generally refunds of state taxes paid by individuals are only federally taxable to the extent a federal benefit was claimed for paying state taxes

Verkko 3 helmik 2023 nbsp 0183 32 IRS Statement Taxability of State Payments Feb 3 2023 The IRS is aware of questions involving special tax refunds or payments made by states in Verkko 29 maalisk 2019 nbsp 0183 32 The IRS issued guidance on the tax treatment of state and local refunds now that taxpayers are limited to a 10 000 deduction on their individual tax

Taxability Of State Tax Refunds

Taxability Of State Tax Refunds

https://www.the-sun.com/wp-content/uploads/sites/6/2022/02/taxrefund-1jpg-JS702393863.jpg?w=1560

Cutler Co Latest News Are State Tax Refunds And Rebates Federally

https://cutlercpas.com/wp-content/uploads/2023/02/0x0.jpg

Massachusetts Residents Enjoy A Bonus State Refund November 2022

https://patterson-solutions.com/wp-content/uploads/2022/09/MA-Form-1_half-page_tax-refunds.jpg

Verkko 15 maalisk 2023 nbsp 0183 32 If you deducted your state and local income taxes last year and also received a state refund last year then your state tax refund that you received from Verkko 10 helmik 2023 nbsp 0183 32 IRS issues guidance on state tax payments to help taxpayers IR 2023 23 Feb 10 2023 WASHINGTON The Internal Revenue Service provided

Verkko 14 helmik 2023 nbsp 0183 32 For the remaining four states Georgian Massachusetts South Carolina and Virginia the payments could be taxable if the taxpayer itemized their deductions in 2021 and received Verkko 11 helmik 2023 nbsp 0183 32 The Internal Revenue Service provided details clarifying whether special state tax payments issued by 21 states in 2022 are taxable The IRS has determined that in the interest of sound tax

Download Taxability Of State Tax Refunds

More picture related to Taxability Of State Tax Refunds

Tax Refunds 1 1B In Unclaimed Money Awaits Tax Returns

https://www.gannett-cdn.com/-mm-/c854498003ddfe79bd56377d5c65f844b5eb72ce/c=0-444-2398-1799&r=x1683&c=3200x1680/local/-/media/2018/03/08/DetroitFreeP/DetroitFreePress/636561017843565093-tax-refund.jpg

Taxable Refunds Credits Or Offsets Of State And Local Income Taxes

https://i.ytimg.com/vi/O0FErGyvHzY/maxresdefault.jpg

Are State Tax Refunds Taxable Taxation Portal

https://taxationportal.com/wp-content/uploads/2022/01/Taxes.jpg

Verkko 30 elok 2023 nbsp 0183 32 The IRS has announced guidance on the federal tax status of refunds of state or local taxes and certain other payments by state or local governments to Verkko 30 elok 2023 nbsp 0183 32 IRS issues guidance on state tax payments IR 2023 158 Aug 30 2023 WASHINGTON The IRS today provided guidance PDF on the federal tax status of

Verkko Refund Reported The state revenue agency will send you a Form 1099G Certain Government Payments by Jan 31 of the year following the year in which you received Verkko 13 helmik 2023 nbsp 0183 32 IRS guidance on state tax refunds general welfare and disaster relief payments The IRS provided details clarifying the federal tax status involving special

IRS Guidance On Federal Taxability Of State Refunds Remains Problematic

https://imageio.forbes.com/specials-images/imageserve/63eb8eaf836a97338e2ed0f6/0x0.jpg?format=jpg&height=900&width=1600&fit=bounds

Summary Of Taxability And Practical Questions Taxability Of Differen

https://d1avenlh0i1xmr.cloudfront.net/medium/23949cd2-0282-40c1-b2bb-517f9c4ba59aslide2.jpg

https://www.forbes.com/sites/ambergray-fenner/2023/02/06/are-stat…

Verkko 6 helmik 2023 nbsp 0183 32 Generally refunds of state taxes paid by individuals are only federally taxable to the extent a federal benefit was claimed for paying state taxes

https://www.irs.gov/newsroom/irs-statement-taxability-of-state-pay…

Verkko 3 helmik 2023 nbsp 0183 32 IRS Statement Taxability of State Payments Feb 3 2023 The IRS is aware of questions involving special tax refunds or payments made by states in

Taxes 2019 Why Is My Refund Smaller This Year

IRS Guidance On Federal Taxability Of State Refunds Remains Problematic

The IRS Is Sending Tax Refund Interest Checks Out To Millions Of

State And Local Tax Refund Worksheet

Is There A Delay In NC Tax Refunds Wfmynews2

Why Remote Work Might Complicate Your 2020 Taxes Remote Work Tax Work

Why Remote Work Might Complicate Your 2020 Taxes Remote Work Tax Work

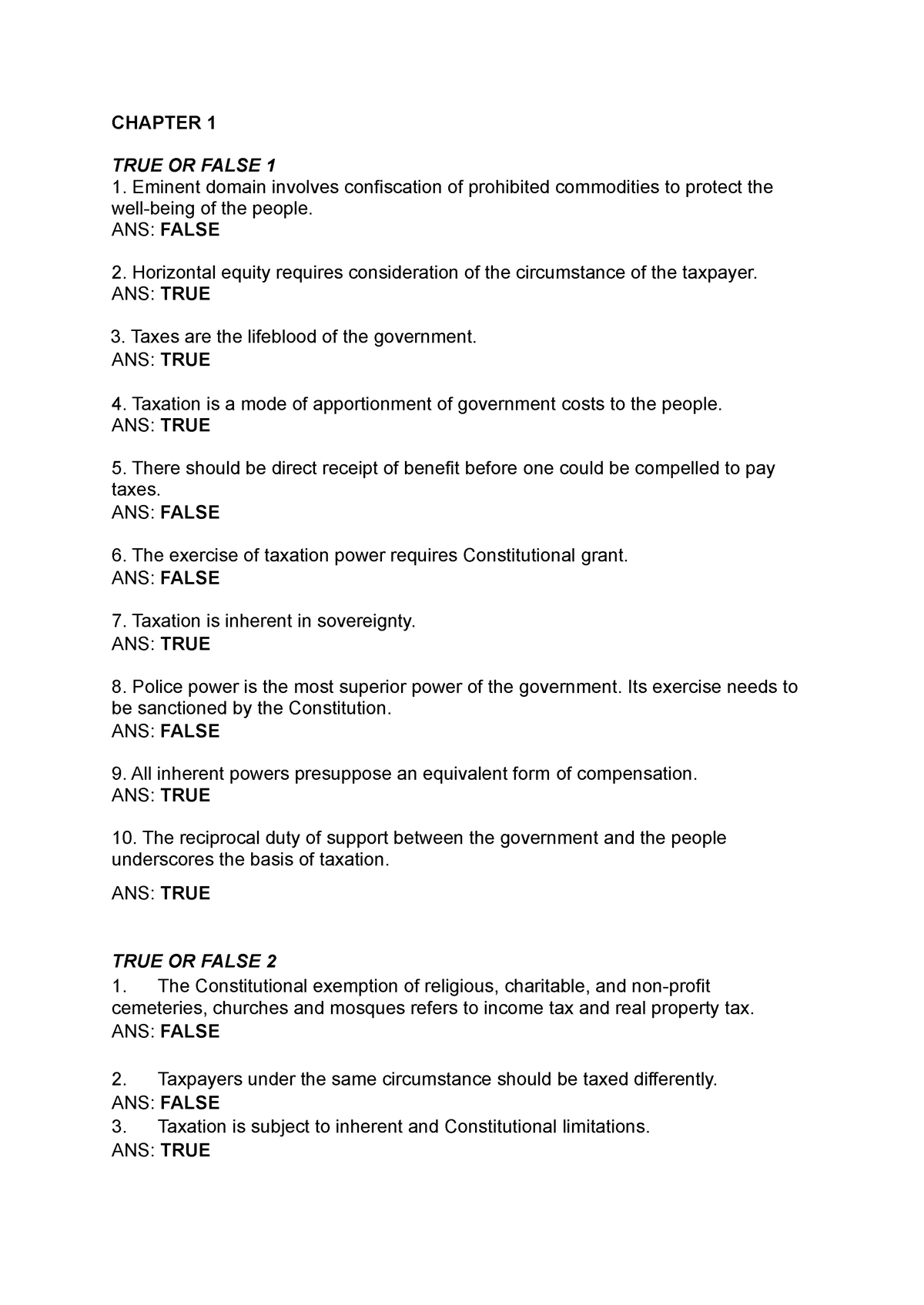

Hello TAX Income Taxation True Or False CHAPTER 1 TRUE OR FALSE 1

Tax Services In Dallas TX All Encompassing Planning

IRS Finally Offers Guidance On Taxability Of State Refunds And Payments

Taxability Of State Tax Refunds - Verkko Taxable Refunds Credits or Offsets of State or Local Income Taxes If you receive a refund of or credit for state or local income taxes in a year after the year in which