Taxable Benefits In Kind Uk How does having a benefit in kind affect your take home pay Taxable perks can reduce your take home pay so are they worth

HMRC oversees the tax treatment of all benefits in kind and provides guidelines on how different benefits should be valued and reported It s the employer s If you re intending to payroll benefits and expenses you must register them with HMRC using the payrolling employees taxable benefits and expenses online

Taxable Benefits In Kind Uk

Taxable Benefits In Kind Uk

https://blog.vantagecircle.com/content/images/2022/01/taxable_benefits.png

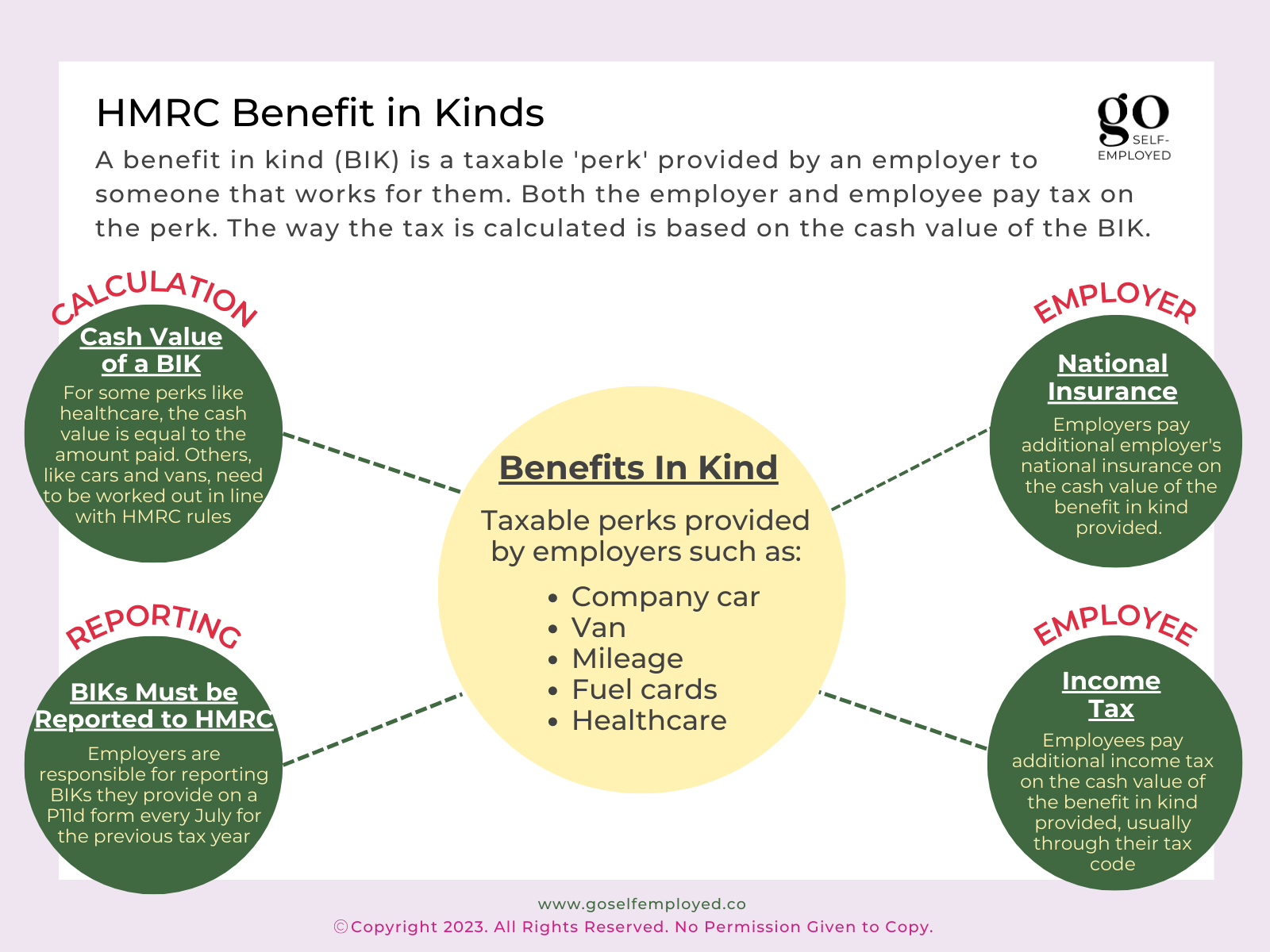

What Are HMRC Benefit In Kinds

https://goselfemployed.co/wp-content/uploads/2023/01/benefit-in-kinds.png

Taxable Vs Nontaxable Fringe Benefits Hourly Inc

https://assets-global.website-files.com/5e6aa7798a5728055c457ebb/610db3408091a50fded87ae4_hero-taxable vs free tax fringe.jpg

Learn what a benefit in kind is how BIK is taxed and get insights on navigating benefit in kind tax implications in the UK and enhancing employee If your employer provides you with a taxable benefit such as use of a company car the taxable benefit must be valued For most types of benefit in kind the law sets out how you should work out the value

What company benefits you pay tax on including company cars low interest loans and accommodation and what company benefits are tax free such as childcare Benefit in kind tax or BIK tax is a complex topic and there are several obligations you need to meet as a UK employer when it comes to offering BIKs to your employees In this post we ll explain what

Download Taxable Benefits In Kind Uk

More picture related to Taxable Benefits In Kind Uk

Understanding Taxable Benefits In Canada Insightful Financial

https://insightfulfinancial.ca/wp-content/uploads/2023/09/understanding-taxable-benefits.png

Taxable Benefits In Kind

https://d2hpwsdp0ihr0w.cloudfront.net/sessions/895059ba-b0f8-4543-9e3b-acc500f5588a/809d0721-1d7a-4e82-b132-acc500fb56be_et/thumbs/slide103240.jpg

How Much Tax Do You Pay On Benefits in kind Oxford Accountant

https://www.ridgefieldconsulting.co.uk/wp-content/uploads/2020/04/Tax-on-Benefits-In-Kind.jpg

Benefits in kind or BiKs for short are non cash goods and services which employers sometimes provide to employees and directors on top of their wages or salary You might also hear them called P11D It s therefore important for you to know which benefits in kind are taxable and which are tax free If your employees make use of taxable benefits in kind you

As an employee receiving a Benefit in Kind you are liable to pay income tax on the taxable benefit in kind considering its value which means its cash equivalent as determined by As an employee who receives a BIK you will be charged income tax To calculate how much you need to apply your personal income tax rate band 20 for

Tax Free Benefits And Expenses Fiander Tovell

https://irp.cdn-website.com/md/unsplash/dms3rep/multi/photo-1511376868136-742c0de8c9a8.jpg

Are Benefits In Kind Taxable

https://506424.fs1.hubspotusercontent-na1.net/hubfs/506424/Imported_Blog_Media/58200181_m-2.jpg#keepProtocol

https://www.uktaxcalculators.co.uk/tax-guid…

How does having a benefit in kind affect your take home pay Taxable perks can reduce your take home pay so are they worth

https://accountsandlegal.co.uk/tax-advice/benefits...

HMRC oversees the tax treatment of all benefits in kind and provides guidelines on how different benefits should be valued and reported It s the employer s

Government Papers Benefits In Kind Statistics Reward And Employee

Tax Free Benefits And Expenses Fiander Tovell

12 Non Taxable Compensation Of Government Employees 12 Non taxable

Benefit In Kind What Is It And Is It Taxable Cronin Co

The Ultimate Guide To Benefits In Kind Shield GEO

How To Payroll Benefits In Kind TBL Accountants

How To Payroll Benefits In Kind TBL Accountants

What Are Benefits In Kind Taxoo

HMRC Taxable Benefits In Kind And Expense Payments Headlinemoney

Chart That Tells A Story Taxable Benefits In Kind

Taxable Benefits In Kind Uk - If your employer provides you with a taxable benefit such as use of a company car the taxable benefit must be valued For most types of benefit in kind the law sets out how you should work out the value